The following post comes to us from Michael Patterson, Principal, Financial Services at Ernst & Young LLP, and is based on an Ernst & Young publication.

We recently conducted a survey of broker-dealer compliance officers to gather perspectives and practices around new regulatory initiatives and amendments that will likely have a material impact on financial institutions: the Dodd-Frank Act and FINRA’s know-your customer (KYC) and suitability rules.

We thought it would be useful to understand how firms and their compliance functions are responding.

The survey consisted of 12 questions focused on 4 specific initiatives:

- 1. The uniform fiduciary standard under Dodd-Frank Title IX

- 2. Regulation of the over-the-counter (OTC) derivatives markets under Dodd-Frank Title VII

- 3. The Volcker Rule regulating proprietary trading under Dodd-Frank Title VI

- 4. FINRA’s new KYC and suitability rules (FINRA Rules 2090 and 2111)

Survey respondents

Responses were gathered between 20 March and 3 May 2011 from 42 individuals, generally representing large, global broker-dealers. Respondents replied anonymously.

Survey highlights

- Most survey respondents considered the impact of the Dodd-Frank and FINRA initiatives on their compliance program to be extensive.

- Development of new technology tools for supervision and compliance with new rules will require substantial budget allocations in 2011 and continuing into fiscal year 2012. This applies to new monitoring requirements for Dodd-Frank and FINRA rules, as well as overall risk monitoring.

- Half of the respondents indicated that they will be hiring additional compliance staff. We believe that:

- Those with a thorough understanding of the compliance function and with strong product knowledge will be in demand.

- Those with experience in developing compliance programs overseeing OTC derivatives implementation are expected to be especially in demand.

- Responding to regulatory inquiries was rated as a significant operational challenge, one that is expected to increase as exams will likely become more frequent and rigorous.

Survey analysis: challenges with regulations

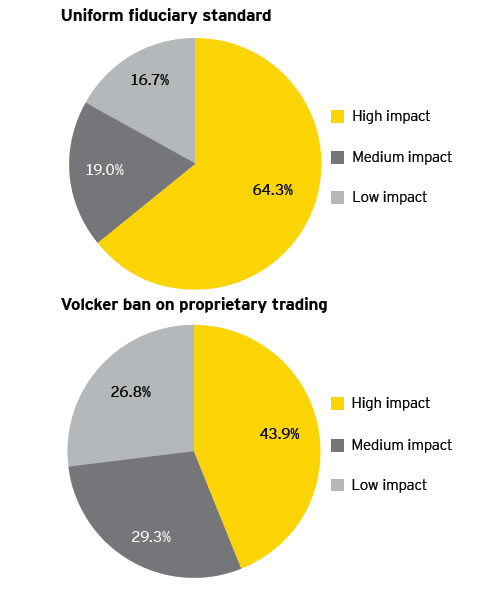

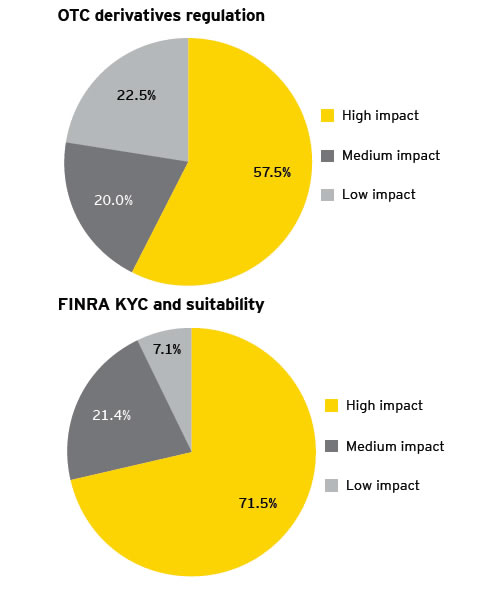

1. Indicate the level of impact to your broker-dealer presented by each of the following Dodd-Frank and FINRA initiatives:

- Uniform fiduciary standard

- Volcker ban on proprietary trading

- Over-the-counter (OTC) derivatives regulation

- FINRA know your customer (KYC) and suitability

Uniform fiduciary standard and the FINRA know-your customer (KYC) and suitability rules receive high impact responses

Although respondents considered all four initiatives to have a high degree of impact, the uniform fiduciary standard and the FINRA KYC and suitability rules received the greatest percentage of high impact responses.

Volcker rules not yet written

The Volcker rules have not been written yet, and the extent of requirements under those rules is still unknown, especially for those firms that have spun off large portions of their proprietary trading businesses in anticipation of the rules.

OTC derivatives rules not yet finalized

It should be noted that:

- the OTC derivatives rules have not been finalized yet; and

- they will only affect broker-dealers that are swap dealers or major swap participants, which accounts for only a portion of our survey respondents.

New compliance date for FINRA KYC and suitability: 9 July 2012

Interestingly, at the time of the survey, firms were actively engaged in considering what changes were required in firm processes, practices, supervision, compliance and such in response to the new FINRA rules because their original compliance date was quickly approaching. That date has since been extended to 9 July 2012.

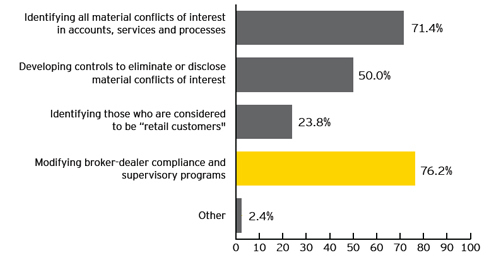

2. With respect to the uniform fiduciary standard, which of the activities below pose a challenge to your broker-dealer?

Recent regulatory activity indicates that conflicts of interest and disclosures will continue as a major area of attention.

Respondents indicated that the top two activities posing a challenge in responding to the uniform fiduciary standard changes are:

- identifying material conflicts; and

- modifying broker-dealer compliance and supervisory programs.

Correctly identifying material conflicts is crucial to the success of supervision and compliance programs and controls.

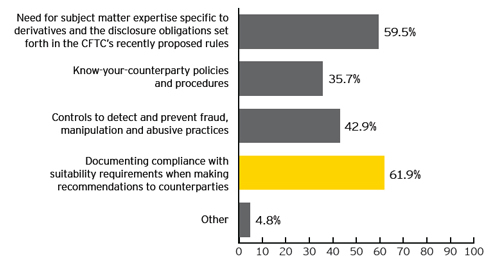

3. With respect to OTC derivatives regulation, which of the activities below pose a challenge to your broker-dealer?

Customer suitability remains a pervasive concern of regulators across industry sectors and asset classes.

Top two challenges

Respondents indicated the top two challenges for Dodd-Frank OTC derivatives are:

- the need for subject matter expertise specific to derivatives and the disclosure obligations set forth in the CFTC’s recently proposed rules; and

- documenting compliance with suitability requirements when making recommendations to counterparties.

Clearly, implementing the proposed rules will require substantial subject matter expertise in order to evaluate, assess, determine gaps and implement specific rule changes. The rule changes proposed by the SEC and CFTC will impact multiple areas across the organization.

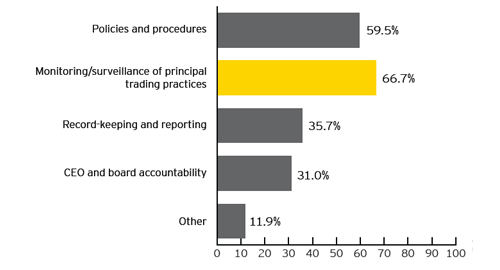

4. With respect to the Volcker ban on proprietary trading, which of the activities below pose a challenge to your broker-dealer?

Likely demand by regulators for monitoring and surveillance data

If the rules incorporate the Financial Stability Oversight Council’s (FSOC) guidance, there will likely be a great demand by regulators for monitoring and surveillance data.

The responses indicated that the top challenge for the Volcker Rule is the monitoring and surveillance of principal trading activity.

At this time, the associated rules have not yet been drafted, which is causing some confusion, especially around what is defined as proprietary trading and how it differs from trading in a principal capacity. Further, regulatory expectations and requirements are not yet known, which complicates efforts to identify necessary changes.

More clarity as to the rules and expectations will drive compliance programs and supporting technology requirements, including monitoring routines for this type of trading activity.

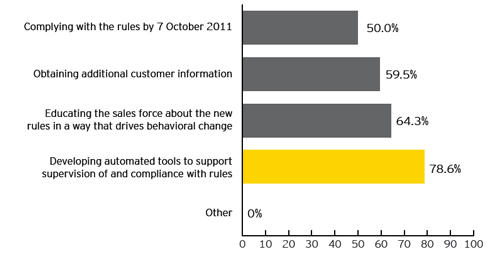

5. With respect to FINRA KYC and suitability, which of the activities below pose a challenge to your broker-dealer?

Development of automated tools poses a challenge

The impact of these rules is widespread, affecting almost all aspects of a firm’s business and compliance processes.

The majority of respondents indicated that developing automated tools to support supervision and compliance programs poses a challenge although all topics were seen as challenging, with each activity eliciting a response of 50% or more.

It is likely that the degree of challenge posed by these activities was heightened by the original compliance date of 7 October 2011. That has since been extended to 9 July 2012.

Survey analysis: technology challenges

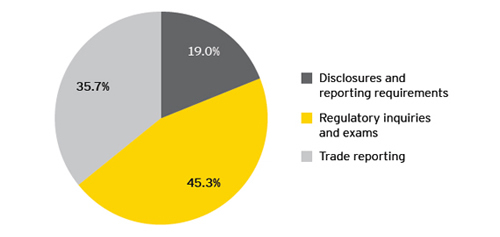

1. Of the following topics, choose the option that presents the most significant operational challenge to your broker-dealer.

Demands from regulators will increase

Based on the responses to this question, we believe that demands from regulators will continue to increase.

Regulatory inquiries and exams are presenting the most significant operational challenge. This is most likely attributable to firms having to re-deploy resources to address these tasks while still conducting business as usual.

Other likely reasons include the frequency of inquiries and exams, extensive document requests and the lack of technology solutions to identify or locate the requisite data efficiently and effectively.

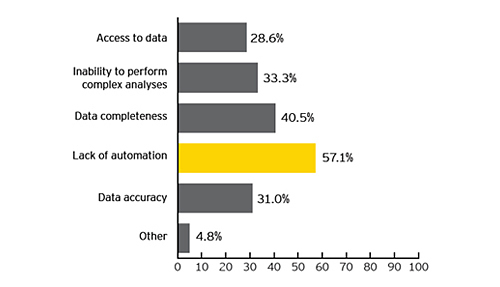

2. Which of the activities below pose the most significant technology challenge to your broker-dealer?

3. Automation is a significant technology challenge

Given the results, our view is that automation will receive substantial budget and funding in 2012 plans.

It appears that staff must devote a substantial amount of time to performing manual tasks, which most likely reduces productivity and prevents them from focusing on key business issues.

The lack of automation is the most significant technology challenge for almost 60% of respondents. Data completeness also poses a challenge for more than 40% of respondents. Combined, these result in the inability to perform complex analyses, as indicated by more than 30% of respondents.

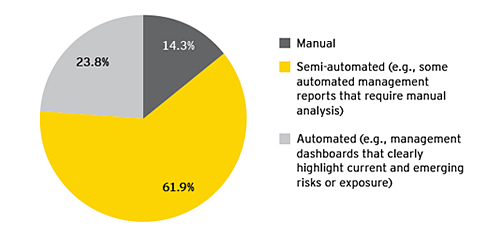

4. Which best describes your firm’s processes for identifying current and emerging risk or exposure?

More effective automation needed

Most regulators indicate that they are increasing their internal capability to collect and analyze firm data, MIS and other information and to perform their own analytics, which will guide the selection and scope of exams.

Although more than 80% of respondents indicated that they have either a semi-automated or automated process in place for identifying current and emerging risk or exposure, more than 75% of respondents indicated that they are performing manual analyses of reports.

These responses coincide with the technology challenges cited in the previous question and highlight the need for more effective automation to help increase firms’ productivity and efficiency.

Survey analysis: operational and budgetary concerns

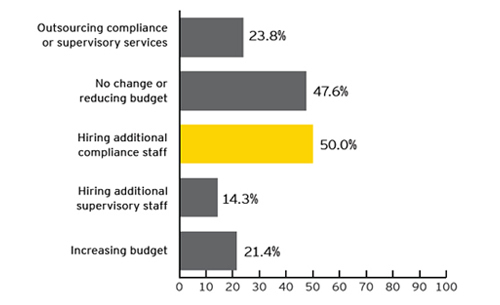

1. Does your compliance function anticipate any of the following in 2011?

Additional compliance staff to be hired

Half of respondents indicated that they will be hiring additional compliance staff.

Although 50% of respondents anticipate hiring additional compliance staff, and nearly 15% anticipate hiring additional supervisory staff, almost 50% of respondents anticipate no change or a reduction in budget for 2011.

This apparent anomaly may arise from the fact that more than 20% of respondents anticipate outsourcing some or all compliance and supervisory services, which presumably will lead to cost savings.

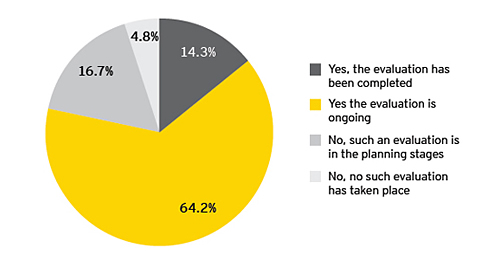

2. Has a formal assessment of business lines and products been conducted by or for your firm?

Formal assessments underway

The majority of respondents have begun to conduct formal assessments of business lines and products in anticipation of increased regulation and oversight.

Firms should continue to perform these evaluations and consider staffing needs, both in terms of numbers and qualifications, as well as addressing data requirements and enhancing technology to stay ahead of the curve.

Compliance programs will need to adapt in order to respond to new initiatives such as Dodd-Frank and FINRA’s KYC and suitability rules.

Additionally, focus needs to be given to enhancing technology-based tools and the data that supports them so that these programs can become increasingly more efficient and effective.

Print

Print