The following post comes to us from George B. Paulin, chairman and chief executive officer of Frederick W. Cook & Co., Inc., and head of the firm’s Los Angeles office. This post is based on an FW Cook alert letter.

Say on Pay Continues to Shape the Executive Pay Landscape

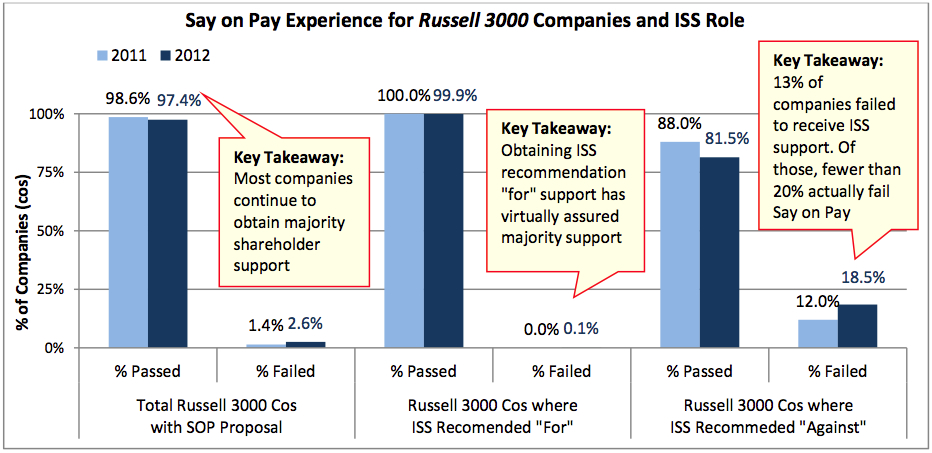

An overwhelming 97% of Russell 3000 companies that conducted a Say on Pay (SOP) vote in 2012 received majority shareholder support. [1] While support levels rival those for management proposals to ratify auditors, companies do not take SOP vote outcomes for granted. Rather, the prospects for low shareholder support for SOP proposals have caused most companies to devote a tremendous amount of time, resources, and consideration to the administration and disclosure of executive compensation programs. This paper serves to highlight the key issues compensation committees faced in 2012 and the implications for action in 2013 and beyond.

Market observations through two years under SOP:

- Most companies continue to obtain majority shareholder support for their SOP proposals

- For companies that passed in 2012, the average shareholder support was 92%

- The number of failing companies increased 52% year-over-year (38 in 2011; 58 in 2012)

- 2011 success did not guarantee positive 2012 results, even in the absence of changes in pay program design or pay levels (underscores emphasis on company performance and changes to proxy advisory firm methodologies)

- Failure to receive support from proxy advisors, such as Institutional Shareholder Services (ISS)

and Glass Lewis, may not result in failed SOP votes, but significantly impacts shareholder support levels, e.g., generally greater than 20% - The influence of proxy advisory firms and SOP voting has motivated filers to adopt more homogenous pay plans (e.g., increased prevalence of long-term incentive programs based on relative TSR performance), narrowed the range of compensation practices, and dramatically reduced the number of companies offering pay practices viewed by proxy advisors as “problematic.”

Proxy Advisors Influence over Say on Pay

Many institutional investors, representing a high concentration of voting power at most public companies, subscribe to proxy advisory firms such as ISS and Glass Lewis. The voting practices of these institutional investors are significantly influenced by the recommendation of the proxy advisory firms as investors seek the convenience and comfort of a structured analytical approach to evaluating SOP (and other) proposals.

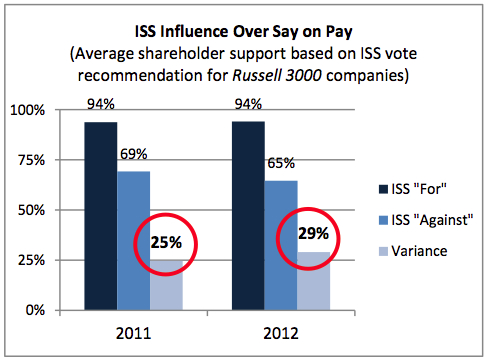

Anecdotal experience suggests that ISS influence over SOP voting ranges between 20% and 30%. To test this hypothesis, we examined the SOP support rates for Russell 3000 companies in 2011 and 2012. Estimates of ISS influence were derived by subtracting the average support rate of companies that received ISS support from the average support rate of companies that failed to receive ISS support, which suggested 25% to 29% ISS influence in 2011 and 2012, respectively.

To account for the varying support rates based on a company’s investor base, we also examined 343 Russell 3000 companies that (1) conducted SOP votes in both 2011 and 2012, and (2) received a different ISS vote recommendation for the 2012 vote than they received for the 2011 vote. After accounting for outliers, we found that companies received an average of 28% lower shareholder support when ISS recommended “against” the companies’ SOP proposal as opposed to years when ISS recommended “for” the proposal. While results vary by company depending on the makeup of institutional investors and their adherence to ISS’ recommendations, this analysis is indicative of the typical impact associated with ISS recommendations.

Implications for 2013 and beyond:

While ISS and Glass Lewis do not directly vote, proxy advisor influence may be sufficient to move the needle below the 70% support threshold, which is generally accepted to reflect a meaningful level of shareholder concern. The actual level of proxy advisor influence may be tempered by direct outreach efforts with key institutional shareholders. We encourage companies to be aware of the level of influence proxy advisors may have over their SOP vote outcomes, and assess support levels in preparation for their upcoming SOP vote.

- Understand the makeup of your largest investors and their reliance on proxy advisory recommendations (most proxy solicitors keep track of institutional investor voting practices)

- Understand how your pay programs stack up against proxy advisory best practices to anticipate shareholder receptivity/support

- Understand proxy advisory pay for performance methodology and how this may impact their recommendations relative to your SOP proposal

- Review pay programs for fit in support of the company’s strategy and culture

- Confirm your plans suit the stated purpose of the company and its shareholders

- Review disclosures to ensure they are easy to read and clearly articulate the company’s business purpose in support of pay strategy and specific actions, particularly if a pay practice or level of pay may be viewed negatively by the proxy advisory groups.

Continued Evolution of Proxy Advisor Policies

As expected, both ISS and Glass Lewis announced changes to their policies in 2012 and 2013, but underlying principles are largely intact. Three of the most prominent changes include:

Governance Scoring (QuickScore):

In February 2013, ISS announced plans to replace their Governance Risk Indicators (GRId) model with QuickScore. [2] GRId, introduced in 2010 to replace ISS’ Corporate Governance Quotient (CGQ), was intended to serve as a tool for institutional investors to assess the governance-related risk at portfolio companies (risk categories: Audit, Board Structure, Compensation, and Shareholder rights). Unlike GRId, QuickScore emphasizes a quantitative approach over a qualitative approach. Each company’s “score” will be ranked against one of two comparison groups: (1) largest 500 U.S. companies by market capitalization, or (2) the next largest 2,500 companies. ISS has not released specific scoring criteria and is not expected to do so – this requires companies to engage directly with ISS to simulate their scores.

Peer Group Methodology:

The most notable change to proxy advisor policies in 2012 was related to peer group selection criteria. Peer group development serves as a critical component of both ISS’ and Glass Lewis’ pay for performance test, which drives each proxy advisors’ SOP vote recommendation.

ISS [3] : ISS’ new model incorporates a target company’s self-selected peers, but the model continues to rely heavily on two factors: (1) company size, and (2) industry classification. The major change for ISS was to acknowledge that companies may compete for executive talent outside of its GICS [4] industry grouping. To address this change, ISS may now include companies in multiple industries based on review of a target company’s self-selected peer group, assuming it meets ISS’ prescribed size criteria (based on market capitalization, and revenues or assets size).

Glass Lewis [5] : In collaboration with Equilar, Glass Lewis completely redesigned their approach to peer group selection. The new model is based on a mathematical algorithm that selects peers based on interrelationships between a target company, companies in its self-selected peer group, their self-selected peers, and other companies that may consider the target company a peer. Of particular note, the Glass Lewis approach does not take into consideration the traditional “company size” criteria, which challenges the traditional paradigm that executive pay levels must be correlated to company size.

Pay and Performance Test:

Both ISS and Glass Lewis retooled their proprietary pay and performance tests in 2012. These quantitative tests serve as the primary driver of their SOP vote recommendations. [5*]

ISS: Consists of three tests: (1) Relative Degree of Alignment (RDA) examines CEO pay and TSR relative to a company’s peer group over one and three years, (2) Multiple of Median (MOM) measures the multiple of CEO total pay to the peer group median, (3) Pay-TSR Alignment (PTA) evaluates CEO pay on an absolute basis against TSR over a five-year period. This analysis tests the difference between the trend in annual pay changes and the trend in annualized TSR during the period.

Glass Lewis: Computes the company’s relative performance percentile ranking and compares it to its CEO’s and other NEO’s pay percentile ranking relative to the peer group. The difference in these two percentiles is used to determine the pay for performance grade, and assigns a letter grade A, B, C, D, or F. Ironically perfect alignment between pay and performance results in a grade of “C.” A grade of “A” or “B” requires a company’s compensation rank to fall below its performance rank. Performance is measured against peers using total shareholder return (TSR), change in operating cash flow, earnings per share growth, return on equity and return on assets.

Implications for 2013 and beyond:

Changes to peer group selection methodologies by both ISS and Glass Lewis should enhance the overall relevance of the pay and performance analysis for many filers. This is not to say that some industries and certain filers will not continue to struggle with the appropriateness of these comparisons. Additionally, because of the changes in methodology from year to year, it is challenging for filers to get a baseline understanding of how their pay programs compare to the market as defined by the large proxy advisory firms. This reinforces the importance for companies to develop pay programs intended to support their business and strategic goals, as opposed to trying to satisfy the ever-changing views of proxy advisory firms.

Defining “Pay” in Pay for Performance

Both ISS and Glass Lewis methodologies rely on compensation information found in the Summary Compensation Table. Because the SEC rules require filers to disclose a combination of grant date values for long-term equity-based awards and actual payments for annual and long-term cash awards, some argue there is a disconnect in the timing of the compensation disclosures and the pay for performance analysis performed by the proxy advisory firms. In response to this fact, we observed in 2012 an increase in the number of companies exploring alternative approaches to defining compensation in their proxy disclosures to better demonstrate pay and performance alignment. In many cases, these disclosures are helpful to establish a relationship that may otherwise not be apparent from standard Summary Compensation Table (SCT) disclosure or to rebut proxy advisor findings of a pay and performance disconnect. Total pay, as defined in the SCT, has been criticized by some for presenting a mismatch of target pay opportunity and actual pay realized. Specifically, SCT disclosure combines:

| SCT Elements | Securities and Exchange Commission (SEC) Reporting Requirements |

| Realized Pay Elements |

|

| Target Pay Elements (ASC 718) |

|

| Incremental Change in Non-Compensatory Benefits |

|

The principle issue in measuring the relationship between a company’s pay and performance with SCT data lies in the measurement of equity-based awards, which happens to be the single highest weighted element of direct compensation [6] for executives at most public companies. SEC disclosure rules mandate a grant date fair value approach for SCT reporting that illustrates what an executive “could” earn based on target performance. Critics contend that actual or realized pay is the more appropriate measure for equity-based awards as it takes into account the value based on the shareholders’ actual experience. Two alternative pay measures have emerged to account for this issue, and their prevalence is growing in proxy disclosures:

Realized Pay [7] : Realized pay is synonymous to earned pay or take-home pay. Realized pay generally measures the value of earned equity awards at the time they vest as opposed to time of grant. For performance-based awards, realized pay not only considers the stock price at the end of the performance period, but also the actual number of shares earned based on the performance plan design. Stock option gains are valued at the time of exercise.

Realizable Pay [8]: Realizable pay accounts for realized pay but also takes into account the value of outstanding equity awards, those that are granted but not yet vested. Realizable pay generally assesses the value of outstanding equity awards based on the target number of awards granted at current stock prices. In 2012, both ISS and Glass Lewis announced formulation of realizable pay analyses to supplement their pay and performance tests. One of the key differences between the proxy advisors’ approach to realizable pay is the valuation of outstanding stock options. Glass Lewis measures the options’ intrinsic value, while ISS recalculates a Black-Scholes value based on its proprietary option-pricing methodology. [8*]

Implications for 2013 and beyond:

We expect to continue to see companies conducting realized or realizable pay analyses in support of their pay and performance alignment. The definition of realized or realizable pay need not be consistent with proxy advisor definitions, but companies should anticipate the likely reaction of proxy advisor pay for performance tests and be prepared to communicate the business rationale behind pay changes amid TSR performance. From a proxy disclosure perspective, the SEC requires that any supplemental pay disclosures are properly referenced to avoid confusing readers as to the purpose of the supplemental data (i.e., not intended to replace or supersede information in the Summary Compensation Table).

Shareholder Engagement

One of the more significant recent developments in executive compensation has been the increase in shareholder engagement. In 2012, we observed an increase in the number of companies reporting that pay program design has been influenced, either directly or indirectly, by shareholder feedback. Most of the companies that conducted direct shareholder engagement did so as a result of an “against” recommendation from ISS or Glass Lewis, or as a result of low shareholder support for their SOP results; some have been more proactive in reaching out to shareholders to solicit feedback.

Anecdotal experience suggests that direct investor outreach can be an enlightening experience for filers. Companies that have engaged with shareholders on a proactive basis often learn about the priorities of their investors, without the filter of proxy advisory standards.

Some companies are finding that their institutional investors do not have the bandwidth to entertain discussions on the issues of corporate governance and executive pay, particularly during the busy proxy season. Limited time and resources have been historically linked as contributing factors to the proliferation and reliance on proxy advisors. For those investors that do rely on proxy advisors, addressing proxy advisor concerns is consistent with addressing investor concerns.

Implications for 2013 and beyond:

Shareholder engagement is no longer reserved solely for companies that have failed to receive SOP support from proxy advisors. While the degree of engagement efforts will vary on individual circumstances, we anticipate that more companies will look to develop an ongoing dialogue with their investors on hot button topics related to executive pay and seek direct feedback on program design. Direct shareholder engagement considerations include:

- Identify your largest institutional investors and the individuals at those firms who determine voting policies related to executive compensation (your proxy solicitor may help you get started)

- Understand their voting history (e.g., did they support your Say on Pay vote last year, if not, why?) and voting policies (e.g., what are their compensation hot buttons, do they follow recommendations of proxy advisors, and if so, which ones?)

- Keep in mind that shareholder communications, written or verbal, may be construed as additional solicitation materials under SEC rules and trigger securities filings (discuss with legal counsel)

- Be proactive. Don’t wait for a negative recommendation from proxy advisors to develop dialogue on the subject of executive compensation

- Start early. Investors are more likely to be receptive to discussions with companies with which they have an ongoing relationship than those that demand time only when facing a failed SOP vote recommendation from ISS during the busy proxy season.

Litigation Related to Executive and Non-Employee Director Compensation

2012 saw an increase in the number of lawsuits related to executive compensation. These lawsuits were brought on a number of topics such as SOP and compensation-related disclosures, Internal Revenue Code Section 162(m) compliance, and incentive plan designs motivating excessive risk. In many of these lawsuits the plaintiffs’ attorneys allege a breach of fiduciary duty on the part of directors for seeking shareholder approval on the basis of misleading, incomplete or incorrect information.

These lawsuits have specifically targeted SOP proposals and shareholder proposals requesting amendment of incentive plans, including proposals to increase the number of shares available for incentive plans. Most of these cases are filed shortly after a company files its definitive proxy statement and seek to enjoin the company from conducting its annual shareholder’s meeting until the deficiency in proxy disclosure has been corrected. Alleged deficient disclosures have been related to the following topics:

| Say on Pay Proposal Related Topics | Equity Plan Proposal Related Topics |

|

|

While not as prevalent, more lawsuits are emerging related to the following:

Internal Revenue Code Section 162(m): Section 162(m) of the Code generally limits tax deductibility of compensation paid by a public company to its chief executive officer and its next three most highly paid executive officers, except the chief financial officer, to $1 million, subject to an exemption for qualified performance-based compensation. We observe a number of cases alleging a breach of fiduciary responsibility on the part of directors for awarding compensation that is not tax deductible under 162(m) and thus wasting corporate assets. In other cases, the defendants are alleged to have violated SEC securities law by reporting misleading or insufficient information in regards to the applicability of 162(m) on a company’s pay program, or that reported pay does not meet the technical requirements under 162(m).

Equity Compensation to Directors: Historically, equity plan documents have not included limits on the level of awards made to directors. Directors’ responsibilities, including the act of setting their own compensation, have typically been protected under the business judgment rule; however, one case in 2012 is challenging this presumption. In, Seinfeld v. Slager, a Delaware Chancery Court refused to dismiss a claim that directors breached their fiduciary duty by granting themselves equity awards under a shareholder-approved plan due to insufficient limits on the amount of pay that could be awarded to directors. As such, the directors were “self- interested” and not entitled to the business judgment rule. Instead, defendants had to establish that their pay was fair to the company at trial under the more onerous “entire fairness standard.” To address this situation, Committees may wish to consider whether equity plans should be amended to include reasonable limits on awards to directors.

Implication for 2013 and beyond:

To date, a number of the aforementioned lawsuits have been settled with a combination of attorney’s fees paid and supplemental disclosures filed by companies seeking to avoid delaying their annual meetings. In other examples, most recently at Symantec Corp. and Apple Inc., courts have denied the plaintiff’s case for an injunction. It is unclear which companies are more likely to be targeted for these lawsuits. Particularly troublesome is the fact that disclosure for many of the targeted companies met all technical and regulatory securities laws, complied with SEC reporting guidelines, and was generally consistent with customary proxy language.

At this point, we suggest committees prepare for this potential risk by examining areas historically targeted with its outside counsel and compensation consultant, understand the potential consequences of a lawsuit, and ensure that proxy disclosure is accurate, transparent and fully compliant with all applicable requirements to present a compelling defense if challenged.

Regulatory Developments

Legislators had their hands full in 2012 with election year politics, with the result that there was no new substantive legislation aimed at executive compensation. Regulators on the other hand kept busy implementing provisions under the Dodd-Frank Act. According to the SEC website, the SEC has adopted more than three-fourths of the ninety-plus provisions under the Dodd Frank Act that require SEC rulemaking. One of these provisions included stock exchange listing requirements on compensation committee and committee advisor independence, which was approved by the SEC on January 17, 2013.

| Compensation committee member independence standards must consider… | Committee advisor, including consultants and law firms, independence standards must consider… |

|

|

Of the remaining compensation-related open items under Dodd-Frank, no actions are expected to be effective before the Spring 2014 proxy season, as the SEC is currently deadlocked with two Republican and two Democratic members, with no chair to break ties as the long-serving SEC Chairman, Mary Schapiro, retired in December 2012 and President Barack Obama’s nominee, Mary Jo White, has yet to be confirmed. Outstanding compensation-related Dodd Frank items of note:

- Additional proxy disclosure items: o Pay for performance graph

- Description of companies’ policies prohibiting hedging and speculative trading in company stock by employees and outside directors

- Ratio of median pay for all employees to the CEO’s pay

- If enacted, the median employee pay may be based on a “sample” of employees to address concerns regarding administrative burden

- Clawback or recoupment policies:

- Adoption of policy that requires recoupment of incentive compensation in the event of certain financial restatements related to intentional or unintentional management missteps, for the amount that otherwise would not have been paid

- Three-year look-back period from the time a restatement is required

- Covers current and former executive officers

- Adoption of policy that requires recoupment of incentive compensation in the event of certain financial restatements related to intentional or unintentional management missteps, for the amount that otherwise would not have been paid

Implications for 2013 and beyond: Finalized SEC independence requirements will have little impact for most committees that maintain independent compensation committees and advisors. Committees will need to continue to disclose in the proxy the role of their compensation advisors in determining or recommending executive or non-employee director compensation, and whether the resulting work raises any conflicts of interest. If it does, the proxy must disclose the nature of the conflict and how it is being addressed. We expect to see an increase in the number of companies, including those that have previously waited for finalization of Dodd-Frank rulemaking, adopting clawback and formal hedging/pledging policies to align with competitive market and sound governance practices.

Endnotes:

[1] 2012 Say on Pay voting results for companies in the Russell 3000 index as discussed in this paragraph, or otherwise in this paper, reflect results for the period January 21, 2012 through January 20, 2013, as reported by the Institutional Shareholder Services (ISS) Governance Analytics database. 2011 Say on Pay results reflect the period January 21, 2011 through January 20, 2012.

(go back)

[2] See Alert Letter “Institutional Shareholder Services Announces New Governance QuickScore Model” dated January 30, 2013 posted on our website at www.fwcook.com for additional details.

(go back)

[3] See Alert Letters “2012 Glass Lewis Policy Updated” dated July 20, 2012 and “ISS Releases 2013 Policy Updates” dated November 19, 2012 posted on our website at www.fwcook.com for additional details.

(go back)

[4] Global Industry Classification Standard (GICS), developed by Morgan Stanley Capital International (MSCI) and Standard & Poor’s, assigns each company to a sub-industry, and to a corresponding industry, industry group and sector, according to the definition of its principal business activity.

(go back)

[5] See Alert Letters “2012 Glass Lewis Policy Updated” dated July 20, 2012 and “ISS Releases 2013 Policy Updates” dated November 19, 2012 posted on our website at www.fwcook.com for additional details.

(go back)

[6] Direct compensation elements include base salary, bonus, and other incentive compensation (i.e., equity).

(go back)

[7] See Alert Letter “Realized Pay – New Approach for Measuring Pay” dated November 6, 2012 posted on our website at www.fwcook.com for additional details.

(go back)

[8] ISS’ proprietary Black-Scholes calculation has been publicly contended on account of being inconsistent with ASC 718 accounting rules as reported by companies and often leads to increased values.

(go back)

Print

Print