The following post comes to us from Lisa A. Alfaro, partner at Gibson, Dunn & Crutcher LLP, and is based on a Gibson Dunn publication; the full publication, including international implications, is available here.

Significant FCPA developments continued apace during the first six months of 2013. After a relative downtick in 2012, the first half of 2013 saw criminal enforcement of the statute return to the robust levels of recent years. With approximately 60 devoted prosecutors and enforcement attorneys, whose efforts are frequently supplemented by their colleagues in the U.S. Attorneys’ and regional enforcement offices across the country, the Government’s efforts to enforce the statute have never been stronger.

This client update provides an overview of the Foreign Corrupt Practices Act (“FCPA”) as well as domestic and international cross-border anti-corruption enforcement, litigation, and policy developments from the first half of 2013. There is much for us to report—the last six months witnessed a series of judicial decisions that further define the FCPA’s scope, a plethora of enforcement actions, Corporate America’s response to the U.S. government’s Resource Guide to the U.S. Foreign Corrupt Practices Act, and increasingly vigorous anti-corruption enforcement and legislative activities from around the world.

FCPA Overview

The FCPA’s anti-bribery provisions make it illegal to corruptly offer or provide money or anything of value to officials of foreign governments or foreign political parties with the intent to obtain or retain business. These provisions apply to “issuers,” “domestic concerns,” and “agents” acting on behalf of issuers and domestic concerns, as well as to “any person” that violates the FCPA while in the territory of the United States. The term “issuer” covers any business entity that is registered under 15 U.S.C. § 78l or that is required to file reports under 15 U.S.C. § 78o(d). In this context, foreign issuers whose American Depository Receipts (“ADRs”) are listed on a U.S. exchange are “issuers” for purposes of the FCPA. The term “domestic concern” is even broader and includes any U.S. citizen, national, or resident, as well as any business entity that is organized under the laws of a U.S. state or that has its principal place of business in the United States.

In addition to the anti-bribery provisions, the FCPA’s books-and-records provision requires issuers to make and keep accurate books, records, and accounts, which, in reasonable detail, accurately and fairly reflect the issuer’s transactions and disposition of assets. Finally, the FCPA’s internal controls provision requires that issuers devise and maintain reasonable internal accounting controls aimed at preventing and detecting FCPA violations. Prosecutors and regulators frequently invoke these latter two sections – collectively known as the accounting provisions – when they cannot establish the elements for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. Because there is no requirement that a false record or deficient control be linked to an improper payment, even a payment that does not constitute a violation of the anti-bribery provisions can lead to prosecution under the accounting provisions if inaccurately recorded or attributable to an internal controls deficiency.

2013 Mid-Year FCPA Enforcement Statistics

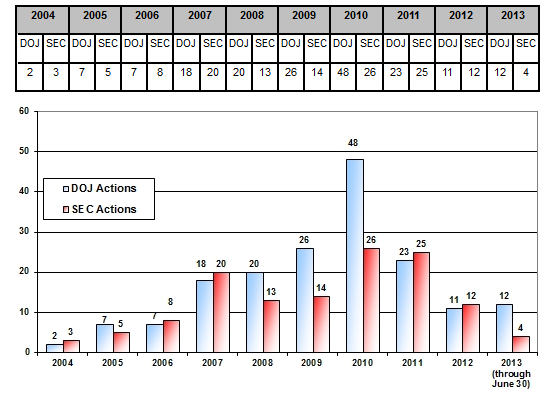

The following table and graph detail the number of FCPA enforcement actions initiated by the U.S. Department of Justice (“DOJ”) and the U.S. Securities and Exchange Commission (“SEC”) during each of the past ten years.

2013 FCPA Enforcement Actions (Through June 30)

Corporate Enforcement Actions

Koninklijke Philips Electronics N.V.

On April 5, 2013, the SEC filed a settled administrative cease-and-desist proceeding against Koninklijke Philips Electronics N.V. (“Philips”), a Netherlands-based healthcare and lighting company that trades on the New York Stock Exchange. According to the SEC’s Order, from 1999 to 2007, and in connection with at least 30 transactions, employees of Philips’ Polish subsidiary “made improper payments to public officials of Polish healthcare facilities to increase the likelihood that public tenders for the sale of medical equipment would be awarded to Philips.” Without admitting or denying the alleged books-and-records and internal controls violations, Philips agreed to disgorge $3,120,597 in profits and pay prejudgment interest of $1,394,581.

The SEC alleged that the misconduct first came to Philips’ attention in August 2007, when Polish officials arrested two employees of the Polish subsidiary. A subsequent internal audit did not uncover the alleged improper payments, purportedly because they had been falsely characterized and accounted for as legitimate expenses in Philips’ books and records. But when Polish authorities later indicted 23 individuals, including three former employees of the Polish subsidiary and 16 healthcare officials, Philips undertook a further review that uncovered the allegedly improper payments.

Philips voluntarily disclosed the relevant conduct to DOJ and the SEC and undertook significant remedial measures, including terminating and disciplining responsible employees, retaining multiple professional service firms to investigate the irregularities, and designing an enhanced compliance program. In recognition of the company’s cooperation, the SEC declined to impose a civil penalty. There is no indication as to whether DOJ intends to take enforcement action in this matter.

Parker Drilling Company

On April 16, 2013, Parker Drilling Company, a global drilling services and project management company headquartered in Houston, settled FCPA charges with DOJ and the SEC. The charges arise from the long-running Nigerian customs investigation, in connection with which seven companies resolved FCPA charges in November 2010, as reported in our 2010 Year-End FCPA Update.

According to the charging documents, executives of Parker Drilling authorized $1.25 million in improper payments to a third-party intermediary retained to assist the company in resolving customs disputes, while knowing that the third party intended to use the funds to “entertain” Nigerian officials involved in resolving the disputes. These payments allegedly led to Parker Drilling receiving more than $3 million in reductions to previously assessed customs fines.

To resolve the criminal FCPA bribery charges, Parker Drilling entered into a three-year deferred prosecution agreement (“DPA”) and paid an $11,760,000 fine. In connection with the civil settlement with the SEC, which alleges FCPA bribery, books-and-records, and internal controls violations, Parker Drilling agreed to disgorge the $3,050,000 in penalty reductions it allegedly received as a result of the conduct and further paid $1,040,000 in prejudgment interest. Parker Drilling was not required to retain an independent compliance monitor as part of these settlements, but instead will self-monitor its implementation of an enhanced compliance program and report annually to DOJ for the three-year term of the DPA.

Ralph Lauren Corporation

On April 22, 2013, the SEC announced its first ever FCPA-related non-prosecution agreement (“NPA”) in resolving its investigation of New York-based apparel company Ralph Lauren Corporation (“RLC”). DOJ simultaneously announced that it too had entered into an NPA with RLC. In connection with the NPAs, RLC agreed to pay an $882,000 fine to DOJ and to disgorge $593,000 in profits and pay $141,845 in prejudgment interest to the SEC.

According to the NPAs, a manager of RLC’s Argentinian subsidiary made $593,000 in payments to a customs broker over a four-year period while knowing that the customs broker was passing some or all of that amount on to government customs officials to secure the importation of RLC products. The manager also allegedly provided improper gifts to Argentinian officials, including expensive perfume, dresses, and handbags. RLC uncovered the alleged improper payments in 2010, after employees of the Argentinian subsidiary raised concerns about the customs broker in response to the posting of a new corporate FCPA policy. RLC thereafter initiated an internal investigation and made a voluntary disclosure to DOJ and the SEC within two weeks of discovering the allegedly improper payments. RLC also undertook significant remedial actions, including winding down its operations in Argentina and conducting a worldwide FCPA compliance review that “identified no further violations.”

SEC officials have touted the RLC settlement as a significant demonstration of the benefits accorded to companies that responsibly handle corruption allegations. For example, FCPA Unit Chief Kara N. Brockmeyer stated, “Ralph Lauren’s level of self-policing along with its self-reporting and cooperation led to this resolution.” At the same time, this resolution has prompted discussion within the FCPA’s corporate bar regarding the evidence establishing a jurisdictional basis for reaching parent company RLC for the anti-bribery allegations.

Total, S.A.

On May 29, 2013, DOJ and the SEC announced a joint FCPA settlement with French oil and gas company Total, S.A. In one of the largest combined monetary resolutions in the statute’s history, Total, an ADR-issuer in the United States, agreed to pay a $245.2 million fine to DOJ and to disgorge $153 million in profits to the SEC, for a total payment of more than $398 million. Simultaneously, French anti-corruption authorities announced that they are recommending that Total, a senior executive, and two Iranian businessmen stand trial on related charges before a Paris criminal tribunal.

According to the U.S. settlements, between 1995 and 2004, Total utilized intermediaries to make approximately $60 million in improper payments to the Chairman of a wholly owned subsidiary of the National Iranian Oil Company to obtain the rights to develop two significant oil and gas fields in Iran. Total allegedly mischaracterized the unlawful payments as “business development expenses” paid through what purported to be legitimate consulting agreements with the intermediaries. The DOJ resolution took the form of a three-count criminal information charging conspiracy to violate the FCPA’s anti-bribery provision, as well as substantive books-and-records and internal controls violations, which information will be stayed during the three-year term of a DPA. The SEC settlement consists of an administrative cease-and-desist order alleging violations of the FCPA’s anti-bribery, books-and-records, and internal controls provisions. Total is required by both settlements to retain, for a three-year period, an independent compliance monitor, who shall be a “French national or French law or accounting firm [] with demonstrated ability in helping companies comply with the FCPA.”

Acting Assistant Attorney General Mythili Raman noted in DOJ’s press release announcing the settlement that this case represents “the first coordinated action by French and U.S. law enforcement in a major foreign bribery case” and evidences that the two countries “are working more closely today than ever before to combat corporate corruption.” But the DPA itself reveals some of the challenges of French-U.S. law enforcement coordination, qualifying what is usually a boilerplate obligation to cooperate with U.S. authorities post-settlement with notations that any such cooperation must be consistent with French data protection, labor, and blocking statutes. Another interesting bi-continental dynamic is that Total is contesting the French charges, releasing a statement that “Total and [the senior executive] will argue that the behavior that they are accused of was completely legal under French law.”

Individual Enforcement Actions

BizJet Executives

On April 5, 2013, DOJ announced the unsealing of criminal FCPA charges against four former executives of BizJet International Sales and Support, Inc. (“BizJet”), the Tulsa-based aircraft maintenance, repair, and overhaul services company that settled its own FCPA charges in March 2012, as reported in our 2012 Mid-Year FCPA Update. According to the indictment, between 2004 and 2010 the four charged individuals—Peter DuBois, Jald Jensen, Bernd Kowalewski, and Neal Uhl—conspired to bribe officials of various Latin American governments to secure contracts for BizJet from government air fleets in Brazil, Mexico, and Panama.

DuBois and Uhl each pleaded guilty and received the same sentence of five years’ probation, including eight months of home detention. DOJ filed 5K1.1 motions to reduce each of these their sentences based on their “substantial cooperation,” which for DuBois included working in an undercover capacity to secretly record phone calls with other former BizJet executives. The recommended sentencing ranges for DuBois and Uhl were 108-120 months and 60 months, respectively. DuBois also was subject to nearly $160,000 in criminal and administrative forfeiture orders, representing the alleged personal proceeds from his crime, and Uhl received a $10,000 criminal fine. Kowalewski and Jensen are not before the Court and, according to DOJ, are believed to be residing abroad.

Frederic Cilins

On April 15, 2013, DOJ announced the arrest of Frederic Cilins, a French citizen, for allegedly obstructing an FCPA-related grand jury investigation pending in the Southern District of New York into whether an Israeli mining company offered bribes to secure valuable concession rights in the Republic of Guinea. Cilins has not (yet) been charged with an FCPA violation. The affidavit supporting the criminal complaint alleges that Cilins arranged several meetings in Jacksonville, Florida with the widow of former Guinean President Lansana Conté. At these meetings, Cilins allegedly offered the widow $1 million to destroy contractual documents that purportedly evidence Cilins’ prior offer to pay Guinean officials millions of dollars to influence the award of the concession rights to the Israeli mining company and to sign an affidavit falsely attesting, among other things, that no such contractual documents existed. Cilins allegedly furthered offered the widow an additional $5 million if the Israeli mining company retained its interest in the Guinean concession. Unbeknownst to Cilins, the widow was cooperating with the Federal Bureau of Investigation (“FBI”) and secretly recorded the meetings and several related phone calls.

Cilins has pleaded not guilty to all charges and is being held without bail after the Court found that Cilins is “a serious risk of flight and there are no conditions that can assure his appearance in court.” Of interest, Cilins recently filed a motion to compel production of the original contractual documents that purportedly evidence the underlying bribery, stating in his motion that “[i]t is Mr. Cilins’ defense that these documents are not genuine contracts, but rather these are false ‘contracts’ created to extort monies from [the Israeli mining company], Mr. Cilins, and others. In response, the Government contends that the originals sought by Cilins are not within its possession, custody, or control and, in any event, are not material to its obstruction case. The motion remains pending.

Alstom Executives

In yet another U.S. prosecution with French connections, on April 16, 2013, DOJ announced criminal FCPA charges against Frederic Pierucci and David Rothschild, both former executives of the U.S. subsidiary of “a French power and transportation company” that has been reported widely in the press as Alstom, S.A. The charges were unsealed shortly after Pierucci, a French national who is still employed by parent company Alstom, was arrested as he stepped off a plane at JFK Airport. Rothschild had previously pleaded guilty, in November 2012, to a single count of conspiring to violate the FCPA, but the proceedings were kept under seal until Pierucci’s arrest. Then, on May 1, 2013, DOJ announced a superseding indictment charging a third former executive of the Alstom U.S. subsidiary, William Pomponi. Pomponi and Pierucci are each charged with both substantive and conspiracy-related FCPA bribery and money laundering charges.

According to the charging documents, Pierucci, Pomponi, and Rothschild participated—together with multiple unnamed employees of Alstom and a Japanese consortium partner (an entity that settled its own FCPA charges in connection with a different investigation in January 2012)—in a corrupt scheme to bribe Indonesian government officials to obtain a $118 million equipment and services contract at the Taharan power plant. In late 2002, the participants allegedly hired an intermediary to bribe a member of the Indonesian parliament. In late 2003, unsatisfied with the efficacy of the first intermediary’s efforts, the participants allegedly hired a second intermediary to bribe two officials at Indonesia’s state-owned electric company.

The cases against Pierucci and Pomponi are pending in the U.S. District Court for the District of Connecticut, with a February 2014 trial date. Pomponi, a U.S. citizen who surrendered after his indictment, is free on bond. Pierucci is still being held in custody. Rothschild is also free pending his sentencing date, which has not yet been scheduled. Typically, an individual who pleads guilty and cooperates in an ongoing investigation is not sentenced until the resolution of charges against his or her co-defendants.

Employees of Direct Access Partners LLC

On May 7, 2013, DOJ announced the arrests of Tomas Alberto Clarke Bethancourt and Jose Alejandro Hurtado, employees of New York broker-dealer Direct Access Partners LLC (“DAP”), and Maria de Los Angeles Gonzalez de Hernandez, a senior official of Venezuelan’s state economic development bank, Banco de Desarrollo Económico y Social de Venezuela (“BANDES”). Clarke Bethancourt and Hurtado were each charged with substantive and conspiracy FCPA bribery, Travel Act, and money laundering violations. Hernandez was charged with substantive and conspiracy Travel Act and money laundering violations. All three were arrested in Miami, Florida when the BANDES official, who is a resident of Caracas, Venezuela, came to visit the two broker-dealer employees. Then, on June 12, FBI agents arrested a managing partner of DAP, Ernesto Lujan, on substantive and conspiracy FCPA bribery, Travel Act, and money laundering charges.

According to the charging documents, the DAP employees paid the BANDES official at least $5 million in kickbacks between 2008 and 2010, in return for her directing more than $66 million of BANDES’ financial trading business to DAP. DOJ alleges that much of this trading activity, including round trip trades of bank bonds that DAP bought from BANDES and then sold back on the same day, was conducted solely to generate business for DAP and provided no discernible benefit to BANDES. The DAP employees allegedly pocketed millions of dollars in commissions from these trades, out of which they paid a portion to the BANDES official. The payments were allegedly funneled through a complex web of Swiss and Panamanian bank accounts and DOJ has additionally filed a civil forfeiture complaint against a number of these accounts and real estate properties allegedly purchased with the corrupt proceeds.

This case reportedly arises out of an SEC broker-dealer examination of DAP, which we believe is the first examination to result in FCPA charges. (Gibson Dunn first reported on a Financial Industry Regulatory Authority letter designating FCPA compliance as a focal point for broker-dealer examinations in its 2009 Mid-Year FCPA Update.) Perhaps not coincidently, in her testimony before Congress in support of the SEC’s Fiscal Year 2014 budget request, SEC Chairwoman Mary Jo White named the hiring of 250 additional examiners as one of the Commission’s “top priorities.” The SEC also has filed non-FCPA fraud charges against the DAP employees listed above, plus two others, including Hurtado’s wife.

DAP has reportedly closed its doors in the wake of the DOJ/SEC investigations. Announcing the criminal arrests, Acting Assistant Attorney General Raman remarked, “[A]t the end of the day, the real dividends bribe payers reap are criminal charges.”

Not Quite FCPA Enforcement Actions

The early months of 2013 saw some debate within the FCPA community as to what constitutes an FCPA enforcement action. Because the FCPA’s books-and-records and internal controls provisions apply broadly to a wide variety of accounting misconduct that has no connection to foreign bribery, there can be shades of gray in determining whether cases should truly be counted in the FCPA enforcement statistics.

The chief catalyst of this debate was the SEC’s settled enforcement actions against Keyuan Petrochemicals, Inc. and its former chief financial officer, Aichun Li, jointly announced on February 28, 2013. Among other things, the defendants were charged with books-and-records and internal controls violations for allegedly maintaining an off-book cash account from which the company distributed untaxed executive bonuses, paid for various corporate travel and entertainment expenses, and funded “gifts to Chinese government officials,” including “red envelopes” distributed around the Chinese New Year. The SEC contended that the off-balance sheet cash account was not subject to adequate internal controls and caused the company’s disclosed financial accounts to be misstated. To resolve the SEC’s charges, Keyuan and Li agreed to pay civil penalties of $1 million and $25,000, respectively, and Li consented to a two-year bar from appearing before the Commission as an accountant.

According to press reports, an SEC spokeswoman answered the Keyuan debate by stating that the Commission does not consider this to be an FCPA case, although she declined to comment on how the SEC makes these classifications. Another recent case raising similar questions, but which SEC personnel also have confirmed was not an FCPA enforcement action, is the September 2012 complaint filed against Subramanian Krishnan, the former chief financial officer of Digi International Inc. Among other things, the SEC charged Krishnan with allegedly approving improper travel and entertainment expenditures and “cash payments” that “were not supported by documentation or explanation” in China, thereby causing the falsification of Digi’s books and records and circumventing Digi’s system of internal controls. The SEC’s August 2012 resolution with Oracle Corporation, reported in our 2012 Year-End FCPA Update, adds to the confusion because it is classified as an FCPA enforcement action based on allegations that an Indian subsidiary “parked” a portion of sales proceeds in an off-book account that its distributers used to make payments to various third parties. The SEC alleged that the Indian subsidiary “creat[ed] the potential for bribery or embezzlement,” but the SEC did not allege any actual corrupt payments.

2013 Mid-Year Check-In on Enforcement Litigation

Bourke Runs Out of Appeals; Reports to Prison

For years we have been reporting on the FCPA investigation, then trial, then appeals of Frederic Bourke, co-founder of luxury handbag designer Dooney & Bourke. The legal process finally wound its way toward a close when, on April 15, 2013, the U.S. Supreme Court denied Bourke’s petition for certiorari, which among other things sought review of the Second Circuit’s endorsement of the “ostrich” jury instruction used at Bourke’s trial. In May 2013, the Second Circuit rejected a petition for rehearing en banc in a separate challenge brought by Bourke seeking a retrial based on newly discovered evidence. U.S. District Court Judge Shira Scheindlin ordered Bourke, who had been out on bail since his 2009 convictions on conspiracy to violate the FCPA and the Travel Act and making false statements to FBI agents, to report to a federal penitentiary in suburban Denver to begin serving his one-year sentence.

2013 Mid-Year FCPA Sentencing / Judgment Docket

The following table catalogues recent sentences imposed upon individuals convicted of FCPA offenses in prior years, as well as judgments entered in prior-year FCPA civil enforcement actions brought by the SEC.

| Defendant | Sentence / Judgment | Resolution Date | Original Charging Date | Court (Judge) |

| Paul Novak | 15 months’ incarceration$1 million criminal fine | 05/03/2013 | 01/17/2008 | S.D. Tex. (Lake) |

| Thomas Farrell | Time served | 04/25/2013 | 03/10/2003 | S.D.N.Y. (Scheindlin) |

| Uriel Sharef | $275,000 civil penalty Injunction | 04/15/2013 | 12/20/2011 | S.D.N.Y. (Scheindlin) |

| Clayton Lewis | Time served (6 days) | 04/04/2013 | 07/31/2003 | S.D.N.Y. (Buchwald) |

| Flavio Ricotti | Time served (~ 11 months) | 03/22/2013 | 04/08/2009 | C.D. Cal (Selna) |

| Mario Covino | 3 months’ home detention$7,500 criminal fine | 03/11/2013 | 12/17/2008 | C.D. Cal. (Selna) |

| Richard Morlok | 3 months’ home detention$5,000 criminal fine | 03/11/2013 | 01/07/2009 | C.D. Cal. (Selna) |

| Hans Bodmer | Time served (~ 5 months)$500,000 criminal fine | 03/07/2013 | 08/05/2003 | S.D.N.Y. (Scheindlin) |

FCPA Civil Enforcement Litigation

SEC v. Elek Straub, et al.

In our 2011 Year-End FCPA Update, we first reported on a December 2011 civil complaint filed by the SEC against three former executives of Magyar Telekom, Plc.—Andras Balogh, Tamas Morvai, and Elek Straub—alleging that the defendants made improper payments to Macedonian and Montenegrin officials and then caused those payments to be inaccurately reflected in Magyar’s books and records. The defendants subsequently moved to dismiss the charges, arguing first that the SEC’s complaint failed to state a claim, second that U.S. courts do not have personal jurisdiction over them, and third that the SEC’s charges were untimely under the applicable five-year statute of limitations. On February 8, 2013, the Honorable Richard J. Sullivan of the U.S. District Court for the Southern District of New York denied the defendants’ motion in its entirety.

Defendants’ Rule 12(b)(6) failure-to-state-a-claim argument hinged on two issues, whether the complaint adequately alleged that: (1) the defendants “ma[de] use of … any means or instrumentality of interstate commerce corruptly in furtherance of” the alleged bribe payments, as required by 15 U.S.C. § 78dd-1(a); and (2) the recipients of the payments were “foreign officials” under 15 U.S.C. § 78dd-1(f)(1)(A).

With respect to the former argument, Judge Sullivan held that the SEC had adequately alleged the jurisdictional nexus of an FCPA violation by claiming that e-mails exchanged by the defendants attaching copies of documents relevant to the corrupt scheme were “routed through and/or stored on network servers within the United States,” even though the defendants were physically located outside the United States when they sent and received these e-mails. Judge Sullivan also held that the FCPA’s “corruptly” element does not modify the jurisdictional requirement, and thus the defendants need not have known that their allegedly corrupt e-mails would cross into U.S. cyberspace.

It is important to note here that the SEC’s complaint alleges that the Magyar Telekom defendants were “officers, directors, employees, or agents of Magyar Telekom, a United States issuer,” which subjected them to jurisdiction under 15 U.S.C. § 78dd-1. Had these foreign defendants not been directly associated with an issuer – for instance, if they had been employees of a foreign subsidiary of a U.S. issuer – they would likely have been subject to the comparatively stricter jurisdictional requirements of 15 U.S.C. § 78dd-3, which requires that the corrupt act or use of the U.S. mails or other means of interstate commerce take place “while in the territory of the United States.” It was for this reason that the Honorable Richard J. Leon dismissed FCPA 78dd-3 charges against foreign defendant Pankesh Patel, as described in our 2011 Mid-Year FCPA Update, where he mailed a package containing an allegedly corrupt purchase agreement from the United Kingdom to the United States.

With respect to the latter, foreign official, argument, Judge Sullivan held that the FCPA does not require the Government to allege the specific identify of the foreign official who received the corrupt payment in question. Judge Sullivan cited the December 2012 ruling of the Honorable Keith P. Ellison of the U.S. District Court for the Southern District of Texas in the Ruehlen litigation, discussed in our 2012 Year-End FCPA Update, which came to the same conclusion. Judge Sullivan did not mention the conflicting decision of the Honorable Lynn N. Hughes, also of the Southern District of Texas Bench, which held that a defendant cannot be convicted under the FCPA for “promising to pay unless you have [evidence of] a particular promise to a particular person for a particular benefit.”

On the jurisdictional front, defendants argued that, as foreign nationals who did not enter the United States during the period of the alleged scheme, they lacked sufficient “minimum contacts” with the United States to support the court’s exercise of personal jurisdiction over them. But Judge Sullivan ruled that the court’s exercise of personal jurisdiction at this early stage in the litigation met with due process requirements because the alleged misconduct “was designed to violate United States securities regulations and was thus necessarily directed toward the United States.” By allegedly signing false management representation and sub-representation letters to Magyar Telekom’s auditors, while knowing that the company’s ADRs were traded on a U.S. exchange and that prospective purchasers of securities would be influenced by false financial filings, Judge Sullivan had “little trouble inferring” that the defendants’ intent, even if not their primary intent, was to “cause a tangible injury in the United States.” Judge Sullivan also found that the exercise of personal jurisdiction was “fair” and “reasonable” because although it might not be “convenient” for the defendants (who had not recently set foot in the United States, much less a U.S. courtroom) to defend this action, they failed to make “a particular showing that the burden on them would be ‘severe’ or ‘gravely difficult.'” Judge Sullivan also noted that “if the SEC could not enforce the FCPA against Defendants in federal courts in the United States, Defendants could potentially evade liability altogether.”

Finally, Judge Sullivan also rejected defendants’ statute-of-limitations defense. Defendants argued that the SEC failed to bring suit within five years of the alleged violation, as required by 28 U.S.C. § 2462. Judge Sullivan, however, held that the statute began to run not from when the alleged act was committed, but rather from when the defendants were present in the United States (which the defendants have not been since the commission of the alleged scheme).

The individual defendants have moved the district court to certify an interlocutory appeal to the U.S. Court of Appeals for the Second Circuit on the three legal issues discussed above. Among other authorities, the defendants cite the U.S. Supreme Court’s recent decision in Gabelli v. SEC, a non-FCPA case that rejected the broad “discovery rule” asserted by the SEC and held that the five-year statute of limitations set forth in 28 U.S.C. § 2462 runs from the time the alleged act was committed, not when the SEC discovers the violation. The defendants’ motion is pending.

SEC v. Herbert Steffen, et al.

In a separate case proceeding on a similar track but ending in a very different place, in December 2011 the SEC filed civil charges in the U.S. District Court for the Southern District of New York against seven former Siemens AG representatives. The SEC’s complaint alleged a $100 million bribery scheme to secure a $1 billion national identity card contract with the Argentine government. Like the Magyar Telekom defendants, one of the Siemens defendants, Herbert Steffen, filed a motion to dismiss on personal jurisdiction grounds. But Stefen’s motion, assigned to Judge Scheindlin, fared significantly better. On February 19, 2013, just 11 days after her Southern District colleague rejected the Magyar Telekom defendants’ motion, Judge Scheindlin granted Steffen’s motion to dismiss for lack of personal jurisdiction.

Like the defendants in Straub, Steffen was a foreign citizen and former senior executive of a foreign company that publicly traded on a U.S. stock exchange. Steffen was alleged to have “pressured” another Siemens executive to authorize bribes and to have participated in at least one phone call in furtherance of the bribery scheme with a co-defendant who was then located in the United States. Coupled with allegations that Steffen’s co-defendants held numerous meetings in the United States, utilized U.S. banks, and that one target of the bribery scheme was an arbitration proceeding held in Washington, D.C., the personal jurisdiction case against Steffen appeared to be even stronger than that against the Magyar Telekom defendants.

But the key distinguisher that led Judge Scheindlin to find a lack of minimum contacts between Steffen and the United States, while simultaneously endorsing Judge Sullivan’s opposite decision in Straub, was the absence of any role that Steffen played in the falsification of the issuer’s financial statements. Unlike the Magyar Telekom defendants, the SEC did not allege that Steffen played a role in covering up the bribery scheme by, for example, making false certifications to the auditors. So while acknowledging that it is “well-established” that “signing or directly manipulating financial statements to cover up illegal foreign action, with knowledge that those statements will be relied upon by United States investors,” is sufficient to establish U.S. jurisdiction over a foreign defendant, Judge Scheindlin stated that this exercise “is in need of a limiting principle.” She concluded, “Absent any alleged role in the cover ups themselves, let alone any role in preparing false financial statements the exercise of jurisdiction here exceeds the limits of due process …” Judge Scheindlin also found that the exercise of personal jurisdiction over Steffen would not be “reasonable,” even if permissible under due process standards, in light of his lack of ties to the United States, advanced age, poor proficiency in English, and the United States’ “diminished interest in adjudicating the matter” in light of the fact that Steffen had already reached a settlement with German authorities in connection with the alleged bribery scheme.

Interestingly, the SEC appears not to have sought appellate review of Judge Scheindlin’s decision.

SEC v. Ruehlen, et al.

In our 2012 Year-End FCPA Update, we discussed Judge Ellison’s December 2012 order granting, in part, motions to dismiss FCPA charges against Gibson Dunn client James J. Ruehlen and his co-defendant, Mark A. Jackson. In light of this decision, the SEC filed an amended complaint in January 2013. Defendants promptly renewed their motion to dismiss on statute-of-limitations grounds. But when the SEC proposed a second amended complaint in the wake of the Supreme Court’s Gabelli decision, the parties agreed that the narrower relief sought by the SEC in the new complaint, which asserts that civil penalties should be imposed only for certain violations that accrued on or after May 12, 2006, mooted the motion to dismiss. Ruehlen and Jackson have since answered the complaint and the litigation is proceeding with a trial date currently set for April 2014.

otions to Appear Specially in Criminal Prosecutions

The Straub and Steffen cases discussed above each involve foreign defendants challenging civil FCPA cases, through counsel, from the relative comfort of their home countries. But the legal avenues for challenging criminal cases from abroad, without physically being brought before the court, are different and more challenging. (Indeed, a criminal indictment against Steffen in the U.S. District Court for the Southern District of New York remains even after Judge Scheindlin’s ruling to dismiss the civil case.) The first six months of 2013 saw two foreign defendants in FCPA-related cases attempt, without success, to challenge their indictments from abroad.

The first case involves a 2010 money laundering indictment of Juthamas and Jittisopa Siriwan, the alleged foreign official recipient and her daughter from the foreign bribery scheme that led to the FCPA convictions of husband-and-wife film producers Gerald and Patricia Green in 2009. As reported in our 2012 Year-End FCPA Update, the Siriwans, who remain in their home country of Thailand, filed a motion to dismiss their indictment in January 2012. Although the Honorable George H. Wu of the U.S. District Court for the Central District of California allowed them (over DOJ’s objection) to make a special appearance through counsel to challenge the indictment, he declined to resolve the motion pending Thailand’s decision on whether to grant DOJ’s request to extradite the Siriwans. At a March 2013, Judge Wu again deferred the issue to give the Thais additional time to act on the case. The next hearing in currently set for March 2014.

The second case involves the FCPA prosecution of Han Yong Kim, who as described in our 2009 Year-End FCPA Update is one of six former executives and representatives of Control Components, Inc. indicted in April 2009. Kim is a foreign national and citizen of South Korea and has at all times since the indictment resided there. His counsel, in seeking to make a special appearance before the Honorable James V. Selna (also of the U.S. District Court for the Central District of California) to challenge the indictment, therefore bristled at DOJ’s repeated characterization of Kim as a “fugitive.” But on June 11, 2013, Judge Selna, for the second time, rejected Kim’s motion on the grounds of the “alien disentitlement” doctrine and principles of mutuality, both of which effectively flow from the perceived inequity of entertaining a motion from a defendant who declines to submit to the Court’s jurisdiction. Although, according to Kim’s motion, there is little risk of South Korea extraditing Kim, the outstanding indictment and accompanying Interpol “Red Notice” will continue to place significant restraints upon Kim’s ability to travel internationally.

IBM and the FCPA Settlement That Won’t Settle

As reported in our 2012 Year-End FCPA Update, the March 2011 settlement between the SEC and International Business Machines Corp. (“IBM”) has received significantly more judicial scrutiny than is typical of negotiated FCPA resolutions. Counting himself among a “growing number of district judges in the country who have grown increasingly concerned about … just simply signing off on consent decrees,” D.C. District Court Judge Leon refused to “rubber stamp” the settlement. After a contentious hearing in December 2012, in which Judge Leon insisted (principally through his interactions with SEC counsel) that IBM either submit regular reports to the Court on its suspected violations of the FCPA (including non-corruption related violations of the books-and-records provision) or provide hard evidence as why this would be too burdensome, the parties appeared in court again on February 4, 2013.

At the February 4 hearing, Judge Leon relaxed the scope of his proposed reporting requirement from all accounting inaccuracies to those reasonably likely to be connected to violations of the anti-bribery law, or those that could show the company’s books and records to be fraudulent. Judge Leon also remained resolute that IBM report any future instances in which it was subject to open investigations by federal government agencies. He was unswayed by IBM’s concerns that filing such information in court, even under seal, could result in its being leaked to the public. Judge Leon noted that this matter is “important” because “corporate America is watching.” The matter remains pending, with the settlement still unapproved.

U.S. Government Forfeiture Actions

In our 2012 Year-End FCPA Update, we reported on an in remforfeiture action brought by DOJ as part of its Kleptocracy Asset Recovery Initiative against property owned by Diepreye Solomon Peter Alamieyeseigha, a former Governor of Bayelsa State in Nigeria. On May 31, 2013, the U.S. District Court for the District of Maryland executed a forfeiture judgment against the Rockville, Maryland home in question, which is worth more than $700,000 and allegedly was purchased with proceeds traceable to Alamieyeseigha’s corrupt conduct. Said Acting Assistant Attorney General Raman of the judgment, “Foreign officials who think they can use the United States as a stash-house are sorely mistaken. Through the Kleptocracy Initiative, we stand with the victims of foreign official corruption as we seek to forfeit the proceeds of corrupt leaders’ illegal activities.”

FCPA-Related Private Civil Litigation

Selected Shareholder Derivative Suits

Although courts have consistently dismissed FCPA-related derivative actions, the plaintiffs’ bar continues to look for a foothold in this area.

In one recent example, on February 1, 2013, the U.S. District Court for the District of Nevada dismissed a consolidated shareholder derivative action against Wynn Resorts, LTD. As we reported in our 2012 Mid-Year FCPA Update, this lawsuit is but one front in a high-profile dispute between Wynn and one of its former directors, Kazuo Okada, the latter of whom was dismissed after an independent investigation concluded that he paid more than $110,000 in bribes to gaming regulators in the Philippines. The Honorable James C. Mahan found that the plaintiffs failed to make a pre-suit demand on the Board and that the futility exception to making such a demand did not apply because plaintiffs failed to allege sufficient facts either to show that a majority of the Board lacked independence or to raise a reasonable doubt that the Board’s decision was anything other than a valid exercise of business judgment. Judge Mahan’s dismissal was without prejudice, allowing plaintiffs the opportunity to file an amended complaint, which plaintiffs did on April 8, 2013. The amended complaint remains pending.

In another recent judicial victory for Wynn over Okada, on February 15, 2013, Judge Mahan denied Okada’s motion for a preliminary injunction enjoining Wynn from holding a special meeting of its shareholders to vote on Okada’s removal as a director of Wynn. This motion was part of a lawsuit Okada brought in January 2013 alleging that a definitive proxy statement Wynn filed with the SEC in connection with the proposed meeting contained false and misleading statements about Okada. After Judge Mahan refused to issue the preliminary injunction, but before the shareholders’ vote, Okada resigned from Wynn’s Board.

Another example of a dismissed shareholder derivative suit is that against Hewlett-Packard Co. (“HP”). On May 6, 2013, the Honorable Edward J. Davila of the U.S. District Court for the Northern District of California dismissed with prejudice the two-year-old lawsuit that alleged that HP’s directors breached their fiduciary duties to the company in connection with certain business and litigation matters, including by allegedly “declining to stop and prevent HP’s illegal payment of bribes after receiving reports of such illegal activity and ‘red flags’ indicating such widespread illegality.” In this case, derivative plaintiffs did make a pre-suit demand on the Board, but Judge Davila found that HP’s directors were reasonable in refusing to bring the litigation requested in the demand where they hired counsel to investigate the allegations and made an informed decision in the “good faith belief that their action was in the best interest of the corporation.” The derivative plaintiffs have noted an appeal to the Ninth Circuit.

Yet a third example concerns the derivative lawsuit brought by shareholders of Parker Drilling Co. On March 11, 2013, in a one-page per curiam order, the U.S. Court of Appeals for the Fifth Circuit affirmed the decision of the lower court discussed in our 2012 Year-End FCPA Update, which found that the derivative plaintiff shareholder, who did not make a pre-suit demand on the company’s Board, failed to produce futility evidence demonstrating that the Board would have rejected his demand.

Lawsuits Brought by Business Partners

On June 7, 2013, the Fifth Circuit upheld the lower court’s dismissal of a civil Racketeer Influenced and Corrupt Organizations Act (“RICO”) lawsuit brought by oil and gas developer Jack J. Grynberg against BP plc and Statoil ASA. This dispute, discussed in several of our prior updates, enjoys a tortured, decade-long history of arbitration, state, and federal court litigation over the share of payments due each of these former business partners for the development of the Greater Kashagan Oil Field in Kazakhstan. Grynberg claimed that his share of the proceeds was impermissibly diminished when his corporate partners allegedly made a $175 million payment to the Kazakh Government that they characterized as a “signature bonus,” but he characterized as a bribe that violated the FCPA and RICO Act. The Fifth Circuit agreed with the lower court’s finding that Grynberg’s claim was barred by a decision in arbitration that even if his corruption allegations were true, there was no evidence that Grynberg was injured by the alleged bribes.

Lawsuits Brought by Foreign Sovereigns

For several years we have been following a 2008 RICO lawsuit brought by the Kingdom of Bahrain’s state-owned aluminum smelter, Aluminum Bahrain (“Alba”), against Alcoa, Inc. and a third-party intermediary allegedly used by Alcoa to make corrupt payments to senior Alba officials to induce them to pay inflated prices for Alcoa products. In 2012, the Honorable Donetta W. Ambrose of the U.S. District Court for the Western of Pennsylvania denied defendants’ motion to dismiss. Subsequently, Alcoa reached an $85 million settlement with Alba. The third-party intermediary, Victor Dahdaleh, has chosen to fight and, with Chief Judge Ambrose’s certification, filed an interlocutory appeal to the Third Circuit challenging the lower court’s exercise of personal jurisdiction over him. On January 25, 2013, the Third Circuit denied that decision in a one-page per curiam order. Another issue percolating in the civil lawsuit is Dahdaleh’s request to stay discovery while his criminal trial arising from the same alleged facts proceeds in the United Kingdom. Chief Judge Ambrose originally granted Dahdaleh a stay until June 2013, but with his U.K. trial now continued until November he has moved to extend that stay.

Another RICO lawsuit brought in a U.S. court by a foreign sovereign alleging corporate corruption of its government officials, which we also have been following since 2008, is that brought by the Republic of Iraq in the U.S. District Court for the Southern District of New York against nearly 100 companies and corporate executives. The Iraqi Government alleged that the defendants engaged in a corrupt conspiracy with the Saddam Hussein regime to divert funds that were to be used for its citizens under the U.N.-sponsored Oil-for-Food Program. On February 6, 2013, in a comprehensive, 49-page opinion, the Honorable Sidney H. Stein granted defendants’ long-pending consolidated motion to dismiss. Rejecting Iraq’s attempt to disassociate itself from the corrupt actions of its own prior government, Judge Stein concluded that the conduct at issue fell “within the default rule that a regime’s governmental conduct redounds to the sovereign.” Further, the Court held that the RICO Act does not apply extraterritorially and that “the FCPA offers no private right of action.” Iraq has noted an appeal to the Second Circuit.

Employee Dodd-Frank Whistleblower Lawsuits

Most practitioners would agree that we have seen only the tip of the iceberg that will be employee whistleblower lawsuits brought pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank”). On January 15, 2013, that tip crept outward when former compliance officer Meng-Lin Liu brought suit against Siemens AG. Liu, a citizen of Taiwan who worked for Siemens’ wholly-owned Chinese subsidiary, Siemens China Ltd., alleges that he was wrongfully terminated after reporting alleged attempts by local business leaders to evade the controls put in place as part of Siemens’ 2008 FCPA settlement. Siemens has moved to dismiss the complaint, arguing that Dodd-Frank does not cover a wholly foreign fact pattern such as this, where a Taiwanese citizen, working for a Chinese subsidiary of a German business, became suspicious of transactions in China, Hong Kong, and North Korea, and reported his concerns to his supervisors in China and Germany. Oral argument on the motion to dismiss is presently set for August 21.

Employee Defamation Actions

On June 25, 2013, the Texas First District Court of Appeals handed down a decision that should give pause to every corporation (and its counsel) cooperating with the Government in any criminal investigation. Over a strongly-worded dissent, two-thirds of the three-judge panel reversed a trial court decision that Shell Oil Co. had an “absolute privilege” immunizing it from a defamation lawsuit brought by a former employee implicated in the investigation.

In 2009, Shell tendered a written report to DOJ presenting the findings of its internal investigation into the company’s interactions with Nigerian customs officials. This was part of the joint DOJ/SEC freight forwarding investigation that, as reported in our 2010 Year-End FCPA Update, resulted in Shell and numerous other oil and oil services firms (including Parker Drilling this year, as discussed above) settling FCPA charges. In its report, Shell characterized project manager Robert Writt as a major player who “engag[ed] in unethical conduct” in approving certain payments to third parties and provided inconsistent statements to company investigators. Writt was fired and brought suit against Shell for wrongful termination and defamation. The trial court granted summary judgment to Shell on the defamation claim, finding that Shell’s statements to DOJ were subject to an “absolute privilege” under Texas law. The wrongful termination claim was tried to a jury, which also found for Shell.

Underlying the Court of Appeals decision was a finding that the report tendered to DOJ was not made during a legislative or judicial proceeding, a necessary condition for the “absolute privilege” to apply. According great weight to the fact that DOJ did not file charges against Shell until 20 months after the report was submitted, Justice Terry Jennings writing for the Court found that these pre-charge interactions did not qualify as a “judicial proceeding.” Rather, the communications constituted statements made in the “public interest,” which enjoy only a “qualified” privilege. The key difference between the two privileges, under Texas law, is that the “absolute” privilege provides immunity from suit under all circumstances whereas the “qualified” privilege protects the speaker for false statements only provided the false statements are made without malice.

In rejecting the trial court’s “absolute privilege” finding, the Court of Appeals held that such a holding could have the “very dangerous effect of actually discouraging parties from being truthful with law-enforcement agencies and instead encourage them to deflect blame to others without fear of consequence.” But in his dissent, Justice Harvey Brown noted that “[a]bsent an absolute privilege, the threat of [civil] liability may deter a company from fully cooperating in an FCPA investigation.” Because corporate respondeat superior liability by its very nature requires a company to attribute fault to its employees to accept responsibility itself, the risk of defamation actions for candid admissions “creates a disincentive for companies to conduct their own investigations, to make frank assessments of fault, and to communicate findings to the DOJ.” Denying the absolute privilege here thus bears the risk of chilling the free flow of information to DOJ and thereby impairing DOJ’s ability to conduct FCPA investigations. A company faced with a DOJ inquiry, as Shell was, will now be faced with the following quandary: “provide inculpatory statements regarding actions taken on its behalf by its employees, recognizing that it is exposed to a defamation claim,” or “face criminal prosecution or penalization for a failure to comply and cooperate adequately with the DOJ’s investigation.”

In addition to these policy reasons, Justice Brown would also have found that as a matter of law Shell’s communications were “made in contemplation of a judicial proceeding” or, alternatively, that DOJ’s investigation was itself a “quasi-judicial proceeding,” either of which would have qualified Shell for absolute immunity. Shell’s petition for rehearing en banc has been denied, but we expect to see a request for review by the Texas Supreme Court in the coming months.

2013 Mid-Year Legislative And Policy Developments

House Bill Would Prevent Allocation of Certain Defense Spending to FCPA Defendants

Legislation working its way through Congress could have a significant impact on government contractors that recently entered into or expect in the future to enter into FCPA resolutions with either DOJ or the SEC. The House and Senate have each been working on a bill to appropriate Fiscal Year 2014 funding for certain Department of Defense military construction projects. On June 4, 2013, Representative Alan Grayson (D-FL) offered an amendment (House Amendment 89) to the House version of the bill (H.R. 2216) that would prevent funds allocated under the bill from being used for contracts with companies that, within the preceding three years, have been “convicted or had a civil judgment rendered against them” for, among other things, “bribery.” The amendment also applies to companies whose principals have had a conviction or civil judgment rendered against them within the preceding three years. The bill, including Rep. Grayson’s amendment, has passed the House and is now before the Senate.

Although the bill is still subject to the conference process before becoming law, and even if it becomes law would apply only to certain government funding, this legislative action reflects an increasingly aggressive stance by the federal government against those implicated in criminal and other enforcement cases, including by circumventing the standard suspension and debarment process.

Industry Weighs in on the FCPA Resource Guide

As discussed in our 2012 Year-End FCPA Update and Decoding FCPA Enforcement client alert, on November 14, 2012, DOJ and the SEC jointly issued the much-anticipated Resource Guide to the U.S. Foreign Corrupt Practices Act (“FCPA Resource Guide”).

On February 19, 2013, a coalition of 31 business organizations headlined by the U.S. Chamber of Commerce submitted a letter in response to DOJ and the SEC. The letter expresses appreciation for the agencies’ “tremendous effort” to provide a “single central source of information” that clarifies “a range of issues regarding the enforcement of the FCPA.” But the letter also identifies “several areas of continuing concern for businesses seeking in good faith to comply with the FCPA.” These areas, which largely track the Chamber’s proposed statutory reforms reported in our 2011 Year-End FCPA Update, include:

- adding an affirmative corporate compliance defense;

- clarifying the definition of “foreign official” and “instrumentality”;

- limiting the liability of U.S. multinational companies for the acts of foreign subsidiaries;

- limiting successor liability for the prior acts of an acquired company;

- requiring corporate knowledge as a prerequisite for establishing corporate criminal liability; and

- increased visibility into declination decisions.

Despite what appears to be an increase in the number of reported declinations in the months following publication of the FCPA Resource Guide, publicly available information concerning these declinations remains spotty. Nevertheless, public filings suggest that in each of the eight declinations announced to date in 2013, the company in question voluntarily disclosed the matter to government agencies. These declinations are an encouraging sign that DOJ and the SEC are making good on their long-standing pledge to provide meaningful credit to companies who self-report suspected violations and take prompt remedial actions.

FCPA Speaker’s Corner

Senior officials from DOJ and the SEC were active on the speaking circuit during the first half of 2013. A few of the more insightful statements pertaining to FCPA enforcement are summarized below:

- DOJ Acting Assistant Attorney General Mythili Raman on cross-border cooperation: “Through our increased work on prosecutions with our foreign counterparts and our participation in various multi-lateral fora like the OECD and United Nations, it is safe to say that we are cooperating with foreign law enforcement on foreign bribery cases more closely today than at any time in history.” (June 17, 2013, Global Anti-Corruption Congress, “Keynote Address”)

- SEC Chairwoman Mary Jo White on revisions to the SEC’s “neither admit, nor deny” policy: “I have reviewed the policy and the practice, and we are going to in certain cases be seeking admissions going forward. Public accountability in particular kinds of cases can be quite important, and if you don’t get them, you litigate them. What kinds of cases are those? To some degree it turns on how much harm has been done to investors, how egregious the fraud is. But again, I emphasize how important the ‘no admit, no deny’ protocol also will remain for the majority of cases.” (June 23, 2013, The Wall Street Journal, “Where the SEC Action Will Be”)

- DOJ Deputy Assistant Attorney General Denis J. McInerney on whether DOJ’s use of DPAs and NPAs demonstrates ambivalence toward corporate criminal liability: “I’m not ambivalent in the least. It’s an appropriate thing to have. As a result of it, and the enforcement of it over the last ten, twenty years, we have seen a complete radical change in how the corporate world behaves in a very positive way. It’s a good thing. And continued aggressive enforcement of it, that is also incentivizing companies to do the right thing, is exactly where we should be and where we are.” (May 3, 2013, Corporate Crime Reporter Conference, “Neither Admit Nor Deny: Corporate Crime in the Age of Deferred Prosecutions, Consent Decrees, Whistleblowers & Monitors”)

- SEC Enforcement Co-Director George S. Canellos on the Ralph Lauren Corporation NPA: “The NPA in this matter makes clear that we will confer substantial and tangible benefits on companies that respond appropriately to violations and cooperate fully with the SEC.” (April 22, 2013, “SEC Announces Non-Prosecution Agreement With Ralph Lauren Corporation Involving FCPA Misconduct”)

- DOJ Fraud Section Chief Jeffrey H. Knox on corporate compliance programs: “[I]n many cases where companies come in with an FCPA violation or other issues but they have strong compliance programs at the time that, for no lack of trying, just didn’t detect criminal conduct, they often walk out the door with declinations. … [But] where you have a … compliance program [that is only strong] on paper, you had some execution on it, but only to a point and the sales team prevails. What should the policy be as a prosecutor? From our perspective, the compliance team is part of the company, but so is the sales team. So is the management team. If you fail to comply through the end, you won’t get as much credit for it. And you shouldn’t.” (February 12, 2013, Ethics Resource Center, “Improving Corporate Conduct Through Pro-Compliance Enforcement Practice: A One-Day Summit”)

- DOJ FCPA Unit Chief Charles E. Durosson industry sweeps: “[T]he bottom line is, if we’re doing our jobs right, SEC and DOJ, we’re going to be following those leads to lead us to the next case, and maybe that’s going to be your client.” (March 7, 2013, American Bar Association, “27th Annual National Institute on White Collar Crime”)

- DOJ FCPA Unit Chief Charles E. Duross on his unit’s caseload: “We have more prosecutors today than we ever have. More agents today than we ever have. We have a greater caseload today than we ever have.” (March 7, 2013, American Bar Association, “27th Annual National Institute on White Collar Crime”)

- SEC FCPA Unit Chief Kara N. Brockmeyer on the view that compliance programs should uncover potential problems: “If your compliance program is telling you, ‘We don’t seem to have any problems,’ maybe that’s one flag that you might want to take a look at.” (May 22, 2013, Compliance Week 2013, “FCPA Guidance, Right From the Source”)

Governmental Personnel Changes

The past six months have seen significant personnel changes in senior leadership positions at the SEC and DOJ.

On April 8, 2013, the Senate confirmed Mary Jo White as the new Chairwoman of the SEC. Chairwoman White’s storied career is well known and will clearly augment the Commission’s enforcement expertise. Further bolstering this team, Chairwoman White appointed two extremely talented and able co-heads of the SEC’s Enforcement Division, George S. Canellos and Andrew J. Ceresney.

On March 1, 2013, Attorney General Eric H. Holder, Jr. appointed Mythili Raman as the Acting Assistant Attorney General for DOJ’s Criminal Division. Ms. Raman is a highly-regarded career prosecutor who has already staked out the FCPA as a DOJ enforcement priority. Other changes to senior leadership positions within DOJ’s Criminal Division, all of whom are internal promotions, include John D. Buretta stepping up to the Principal Deputy Assistant Attorney General position, Denis J. McInerney taking Buretta’s spot as Deputy Assistant Attorney General, and Jeffrey H. Knox taking the helm of the over 100-prosecutor Fraud Section, which houses the FCPA Unit. Each of these DOJ officials has a quite successful stint as an Assistant U.S. Attorney in either the Southern or Eastern District of New York in his or her background. Lastly, the current leadership team of three assistant chiefs supporting continuing Fraud Section Deputy Chief and head of the FCPA Unit Charles E. Duross are Jason A. Jones, James M. Koukios, and Matthew S. Queler. This very experienced and talented group of former assistant U.S. Attorneys, alumni of the Brooklyn, Miami, and Newark offices, respectively, presents a formidable DOJ team.

Print

Print