Kayla Gillan is leader of the Investor Resource Institute at PricewaterhouseCoopers LLP. The following post is based on the Introduction and Overview of a PwC Investor Survey; the complete publication is available here.

Investors are looking at risks differently than in the past. The financial crisis that affected capital markets across the globe demonstrated that companies—and even whole economies—can be rocked to their core when the connections between lending practices, securitization programs, and capital and funding levels are not clearly understood and monitored.

Investors today are expecting that those who manage the businesses that rely on their capital will exercise greater care over this expanded concept of “risk.” Of course, investors also seek steady returns, so risks cannot be eliminated. But this is when disclosure—information that provides necessary nourishment to an efficient market—becomes so important.

In our survey, we asked investors about these issues—what most concerns them, what they expect of corporate directors, and how they view the current quality of corporate disclosures. The message received is clear: Investors want to know more about the risks that companies have identified, and how they are managing them. We also asked investors about a number of governance topics; some investors see these as intrinsically linked to questions about risk oversight, others less so. But for nearly every topic within our survey, investors are looking for more information, not less.

We appreciate the input of those investors—representing over $2 trillion in assets under management—who participated in our survey.

Overview

When PwC launched its Investor Resource Institute in February 2013, one of our first initiatives was to reach out to the investment community to find out what’s uppermost on investors’ minds. A series of small group and one-on-one meetings ultimately led to the development of this survey.

The goal of this survey was twofold. First, because PwC has for many years surveyed CEOs and corporate directors about their views on certain topics, we wanted to complement our knowledge of those areas by learning what investors think. Second, we wanted to learn more about the factors and information that influence investors’ decisions and perspectives so that we can better understand how PwC can add value.

Demographics of responding investors

A diverse mix of institutional investors responded to the survey, 40% of which were government pension funds. About 17% were investment or asset managers, and the remainder represented a variety of other types of organizations. This mix should be recognized when reviewing the following results.

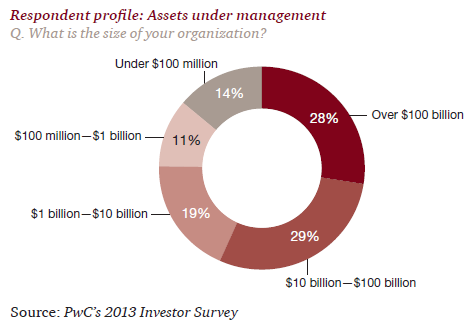

The size of responding investors was more evenly dispersed. In total, responding investors represent assets under management of over $2 trillion.

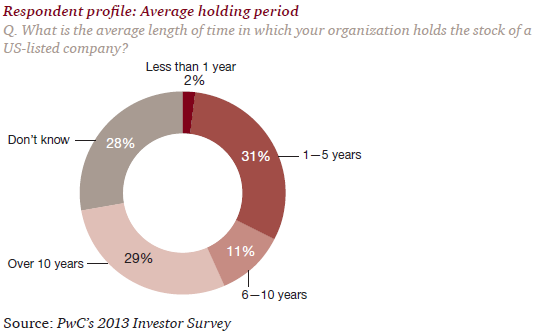

Nearly half of our respondents said their organization holds the stock of a US-listed company for an average of six years or longer. Only 2% said they hold their stock less than one year. Nearly a third of respondents were not sure, indicating either that this statistic is not closely followed by these organizations, or that the person completing the survey was not aware of it.

These demographics offer some insights into the investors represented in this survey. While diverse in terms of size, they are overrepresented by government pension plans. Government pension plans may manage their assets internally, but most use registered investment advisors to manage at least a portion of their US equity. Government pension plans tend to be more engaged in corporate governance and proxy voting matters than some other types of investment organizations.

Print

Print