Bruce F. Freed is president and a founder of the Center for Political Accountability. This post is based on the CPA’s Annual Mutual Fund Survey; the full report, including a description of the data source and appendix, is available here.

Mutual funds’ support for corporate political disclosure reached a new high in 2013, according to a ten-year analysis by the Center for Political Accountability. Forty large US mutual fund families voted in favor of corporate political spending disclosure an unprecedented 39% of the time, on average.

CPA’s review of mutual fund votes looks at how 40 of the largest U.S. fund families voted on 276 shareholder requests for disclosure of corporate political contributions at U.S. companies over proxy seasons from 2004 to 2013 (covering shareholder meetings from 1 July 2003 to 30 June 2013). Together, these fund families manage around $3.3 trillion in U.S. securities, according to Morningstar® fund data, and control a large portion of the shareholder vote in US securities.

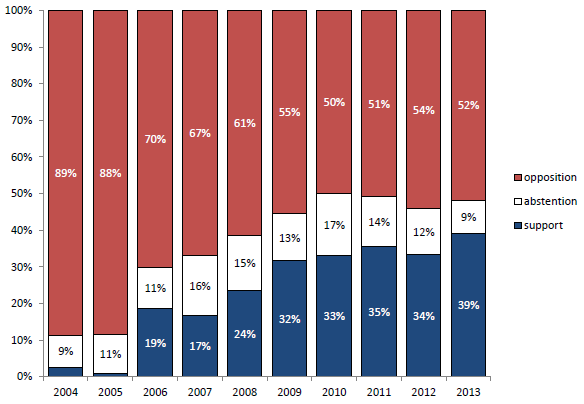

Figure 1: Mutual Fund Voting Trend on Political Contributions Resolutions 2004-2013 [1]

Key Findings:

- 1. In the 2013 proxy season, 40 of the largest mutual fund families supported the 26 shareholder resolutions calling for corporate political spending disclosure, on average, 39 percent of the time. This represents an all-time high: an increase by five percentage points from 2012 and by four percentage points over the previous high of 35 in 2011.

- 2. Abstentions have continued to decline as an average portion of votes cast, and most of these undecided votes appear to have now been cast ‘for’ instead of ‘against’ political contributions disclosure requests. The 40 mutual fund groups abstained 9 percent of the time and opposed these resolutions 52 percent of the time.

- 3. Federated, which had in previous years failed to support all except a single one of the 250 resolutions voted on prior to 2013, this year supported 38 percent of resolutions in 2013.

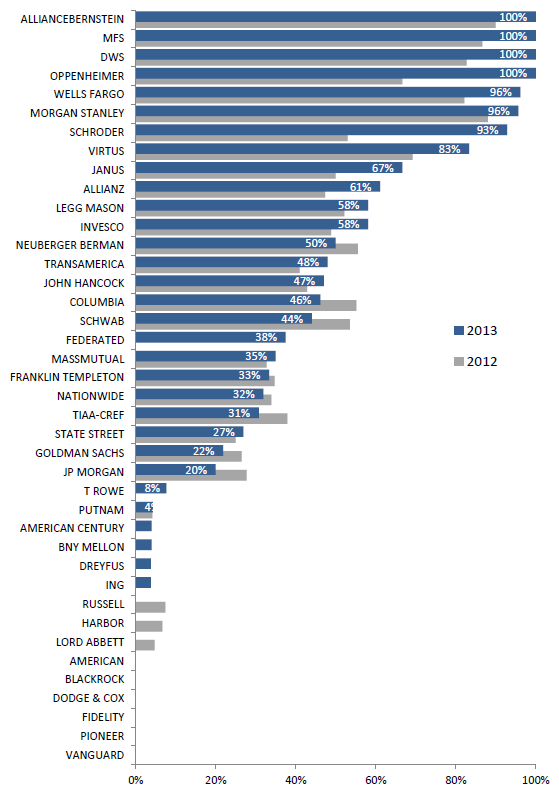

- 4. Eight fund groups supported resolutions more than 80 percent of the time, and four—AllianceBernstein, DWS Investments, MFS (formerly known as Massachusetts Financial Services) and Oppenheimer—supported every one of the resolutions that they voted on. Only once before had a fund family supported 100 percent of political spending disclosure resolutions voted on (MFS in 2010).

- 5. Only nine of the 40 fund groups failed to support a single resolution on corporate political spending disclosure in 2013; 12 fund families failed to cast a vote for in 2012.

- 6. Thirteen of the 40 fund families supported at least 50 percent of political spending disclosure resolutions in the 2013 proxy season. All except one of these increased their support in the 2013 proxy season relative to 2012.

- 7. Two fund groups – Dodge & Cox and Vanguard – have failed to support a single one of the 276 CPA- model political contributions resolutions over the ten-year survey period.

- 8. While the ten-year trend shows declining opposition, at 52 percent in 2013 it remains two percentage points above lowest average support recorded for this group of 40 large mutual funds in 2010. However, 2010 also saw the highest average abstentions for this group—17 percent. It would seem that far more of these abstentions have turned into support than have turned into opposition over subsequent proxy season.

Figure 2: Mutual Fund Families Ranked by 2013 Support for Corporate Political Disclosure Resolutions

This year’s survey considered 65,257 votes cast by large U.S. mutual funds on 276 shareholder-sponsored resolutions voted on during the 2004 to 2013 proxy seasons. [2]

The Resolutions

Appendix I (available here) lists all 26 resolutions based on the CPA model that came to vote in the 2013 proxy season. In 2013, a typical CPA-model resolution asked the company to report on and update semiannually the following:

- 1. Policies and procedures for political contributions and expenditures (both direct and indirect) made with corporate funds.

- 2. Monetary and non-monetary contributions and expenditures (direct and indirect) used to participate or intervene in any political campaign on behalf of (or in opposition to) any candidate for public office, and used in any attempt to influence the general public, or segments thereof, with respect to elections or referenda. The report shall include:

- a. An accounting through an itemized report that includes the identity of the recipient as well as the amount paid to each recipient of the Company’s funds that are used for political contributions or expenditures as described above; and

- b. The title(s) of the person(s) in the Company responsible for the decision(s) to make the political contributions or expenditures.

The 26 resolutions earned an average 31% shareholder support (counting votes cast for and against) and were filed by a range of state-run pension funds, socially responsible asset managers, labor funds, faith-based investors and foundations. The resolution with the highest level of shareholder support in 2013 was filed at CF Industries Holdings Companies (CF), Inc. by New York State Pension Funds. This resolution was voted on by shareholders on May 14, 2013, and earned 66 percent shareholder support. In addition to this, two other resolutions—at Valero Energy (VAL) and Hess Corporation (HES) received over 40 percent shareholder support and an additional eleven received over 30 percent support.

Funds Increasing Support

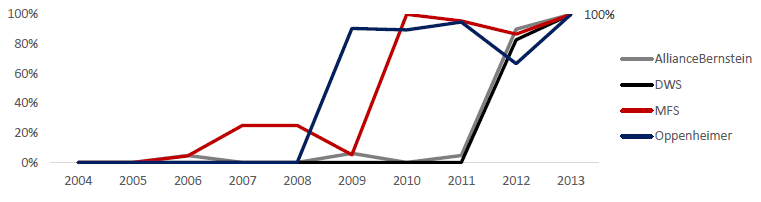

Four funds supported every one of the political spending disclosure resolutions that they voted on in the 2013 proxy season. These include MFS, Oppenheimer, AllianceBernstein, and DWS Investments. In the early part of the period none of the four supported political spending disclosure requests by shareholders. In 2009 Oppenheimer changed its voting pattern, followed by MFS in 2010 and by both AllianceBernstein and DWS in 2012. That all four fund families this year cast all their votes ‘for’ suggests a change in their policy on voting on political spending disclosure shareholder resolutions.

Figure 3: Voting History of Four Mutual Fund Families Supporting All Political Spending Resolutions in 2013

Three of these four funds have in fact recently updated their proxy voting policies with more favorable language on supporting environmental, social, and governance (ESG) issues or corporate political spending resolutions specifically.

MFS updated its proxy voting policy in February 2013 and it says the following:

Generally, MFS will support shareholder proposals that (i) seek to amend a company’s equal employment opportunity policy to prohibit discrimination based on sexual orientation and gender identity; and (ii) request additional disclosure regarding a company’s political contributions (including trade organizations and lobbying activity)(unless the company already provides publicly-available information that is sufficient to enable shareholders to evaluate the potential opportunities and risks that such contributions pose to the company’s operations, sales and capital investments).

Oppenheimer’s proxy voting policy guidelines were updated in March 2013. The policy has a new section called “Social, Political, and Environmental Issues,” and it says that it will “generally ABSTAIN where there could be detrimental impact on share value or where the perceived value if the proposal was adopted is unclear or unsubstantiated.” It also goes on to say that it will only “vote ‘FOR’ a proposal that would clearly”:

Have a discernable positive impact on short-term or long-term share value;

Or

Have a presently indiscernible impact on short or long-term share value but promotes general long-term interests of the company and its shareholders…

AllianceBernstein also recently updated its proxy voting policy with a more favorable language on ESG resolutions. While it previously had stated in its proxy voting policy that it votes on a case-by-case basis on ESG issues, its recently updated proxy voting guidelines says the following:

Shareholder proposals relating to environmental, social (including political) and governance issues often raise complex and controversial issues that may have both a financial and non-financial effect on the company. And while we recognize the effect of certain policies on a company may difficult to quantify, we believe it is clear that they do affect the company’s long-term performance. Our position in evaluating these proposals is founded on the principle that we are a fiduciary. As such, we carefully consider any factors that we believe could affect a company’s long-term investment performance (including ESG issues) in the course of our extensive fundamental, company-specific research and engagement, which we rely on in making our investment and proxy voting decision. Maximizing long- term shareholder value is our overriding concern when evaluating these matters, so we consider the impact of these proposals on the future earnings of the company. In so doing, we will balance the assumed cost to a company of implementing one or more shareholder proposals against the positive effects we believe implementing the proposal may have on long-term shareholder value.

DWS’s proxy voting guidelines remain unchanged from 2010. In it, which has a section on “Social, Environmental, and Political Issues,” it says: “We incorporate social and environmental considerations into both our investment decisions and our proxy voting decisions—particularly if the financial performance of the company could be impacted. In addition, AM has incorporated the Principles for Responsible Investment (PRI) in these Proxy Voting Guidelines.” Then, under a sub-section called “Government/Military,” it says that its “policy is to vote ‘against’ shareholder proposals regarding political contributions and donations.” This sentiment contrasts with their full support of such resolutions in 2013 and near-full support in 2012.

Increasing Support

A total of 13 large fund groups supported at least 50 percent of political spending resolutions in the 2013 proxy season. The 40 fund groups were most supportive of the resolution filed by Trillium Asset Management at Hess Corp. (HES) (voted on May 16, 2012), which earned 46 percent in overall shareholder support. 2013 Resolutions at CF Industries (CF), AutoNation (AN), Yahoo! (YHOO) and Amazon (AMZN) were also strongly supported by mutual fund groups.

Voting Inconsistency

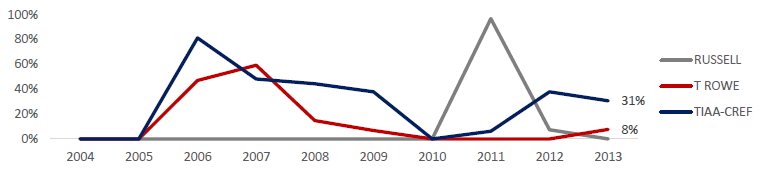

Russell, TIAA-CREF and T Rowe stand out has having inconsistent approaches to voting on shareholder requests for political spending disclosure over the ten year period covered by this survey.

The proxy voting guidelines of both Russell Investments, which failed to support a single political spending resolution in 2013, as well as TIAA-CREF, which only supported 8 of the 26 resolutions that it voted on, would seem to lend support to shareholder requests for political spending disclosure as framed in the CPAs model resolution.

Russell Investments:

Russell generally votes for proposals requesting a company report on or disclose its policies, standards, initiatives, procedures and oversight mechanisms, as well as proposals requesting a company to undertake feasibility studies, related to social, political and environmental issues unless Glass Lewis recommends a vote against the proposal in which case we vote on a case-by-case basis. (p. 13, April 2013)

TIAA-CREF:

TIAA-CREF will generally support reasonable shareholder resolutions seeking disclosure or reports relating to a company’s political expenditures, including board oversight procedures, direct political expenditures, and contributions to third parties for the purpose of influencing election results. (p. 36, 2011)

T. Rowe Price’s proxy voting policies do not make any mention of political contributions, yet do cover issues addressed much less frequently by shareholder proposals (e.g. proxy solicitation expense reimbursement and resolutions calling for reincorporation in a different jurisdiction). Given that such a large number of political spending disclosure resolutions have come to vote over the past 10 years at companies that are generally widely held across fund families’ portfolios, it seems reasonable to anticipate some level of guidance on this issue.

The ‘Big Three’

The three largest fund families in the United States (by assets under management) continue to abstain (Vanguard – 81%, and Fidelity – 100%) or vote against (Vanguard – 19%, and American – 100%) political spending disclosure resolutions. Within the Fidelity family of funds is a set of sub-advised funds managed by Strategic Advisers, Inc. These funds have not been included in the present survey as their votes are cast by non-Fidelity asset managers and diverge over a wide range of voting categories from the rest of the fund group. Strategic Advisers funds tend to support political spending disclosure resolutions around 20-25% of the time from year to year. Fidelity’s own policy on voting on ‘social issues’, remains unchanged from previous years and is to generally abstain.

Likewise, American’s policy (taken from guidelines revised most recently in May, 2013) has not changed from previous years, but provides specific guidance that would seem to lend more support than is actually reflected in their voting record. American Funds’ 2011 proxy voting guidelines state:

“We review shareholder proposals relating to political expenditures on a case-by-case basis. In order to make a voting decision we consider:

- 1) Whether there currently is a policy in place regarding political contributions.

- 2) The level of political contribution oversight by the board and management team.

- 3) The company’s current disclosure practices and whether it has been subject to any previous fines or litigation.

We may vote in favor of a proposal when the current disclosure on political contributions is insufficient or significantly lacking compared to a company’s peers, there are verifiable or credible allegations of funds mismanagement through donations, and there is no explicit board oversight or evidence that board oversight on political expenses is inadequate. We may not support a shareholder proposal if the information requested is already available in another report or the company meets the criteria noted above.”

According to American’s proxy voting record, only two of the 212 political spending disclosure resolutions that it has voted on in the past ten proxy seasons satisfy the criteria articulated above.

Mutual funds looking to update their proxy voting policies with more specific guidance on corporate political disclosure and oversight may draw on Appendix 2 of the Conference Board’s Handbook on Corporate Political Activity, in which sample proxy voting guidelines are provided. In addition, CPA’s one-page summary on the key elements of meaningful corporate political disclosure provides concise guidance to proxy voters as they try to determine where the gaps may lie in a company’s policies and disclosure.

Endnotes:

[1] For this review, CPA counted the numbers of votes cast for, against, and abstained by the mutual funds, not taking into account how many shares the funds voted with for each resolution. Hence, CPA is looking only at the funds’ decision on each resolution, in the three possible options of “for, against, and abstain.”

(go back)

[2] In order not to overweight large companies that tend to be more widely held across fund groups’ portfolios, only unique votes were counted for the survey. Where a single resolution was voted across multiple funds within a single fund family, each holding the corresponding security in their fund portfolios, only one vote is recorded against the corresponding fund family. In the case of inconsistent voting within a fund family, i.e. conflicting votes on a single resolutions, each unique fund family-vote combination is recorded. In total 11,302 unique votes were analyzed.

(go back)

Print

Print

One Comment

Glad to see disclosure votes are rising. I do not understand Fidelity’s 100% non participation.

One Trackback

[…] Bruce Freed blogs. This entry was posted in campaign finance by Rick Hasen. Bookmark the permalink. […]