Alan M. Klein is a Partner in the Corporate Department at Simpson Thacher & Bartlett LLP. The following post is based on a Simpson Thacher memorandum.

Shareholder activism, which has increasingly occupied headlines in recent years, continued along its sharp growth trajectory in 2013. The number of activists, as well as the amount of capital backing them, has increased substantially, as has the sophistication and effectiveness of their tactics.

In addition, last year was particularly noteworthy for the role shareholder activism played in the M&A sector, including a number of high-profile attacks on announced business combination transactions. In November 2013, we hosted a conference to discuss the rise of shareholder activism as it relates to M&A activity. We gathered a number of industry-leading experts to discuss significant recent developments and emerging trends and to explore tactics and responses from a company and an activist perspective. The panel discussions at this conference provided a number of interesting insights, observations and data points, and several of the key themes and highlights are outlined below.

Continued Growth of Shareholder Activism

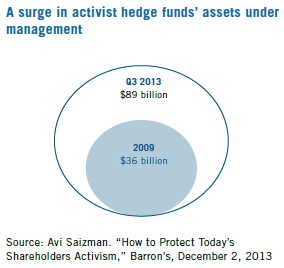

As of the end of the 3rd quarter of 2013, various estimates indicate that activist funds have $80+ billion in assets under management. In addition to the growth in capital under management, there has been a proliferation of new players in recent years. The expectation among conference participants was that both new and old players will be increasingly aggressive in order to promote their “brand” in what has become a progressively competitive asset class. In addition, the stigma historically associated with being an activist fund has significantly diminished and institutional investors and pension funds now regularly and openly engage in and support activism and invest in activist funds.

Activism Reaching Larger Companies and Using an Increasingly Sophisticated Playbook

Shareholder activists are increasingly willing to target large cap companies, and the targets of activist campaigns are not limited to underperforming companies. In addition, activist investors have become significantly more sophisticated in their analyses and critiques of target companies, as well as more varied in their proposals for changes in target company strategies. In the past year, for example, there are a number of examples of activist funds hiring headhunters to increase the quality of their board candidates, using outside investment banks or consultants to prepare detailed “white papers” and effectively using various forms of media in furtherance of their campaigns.

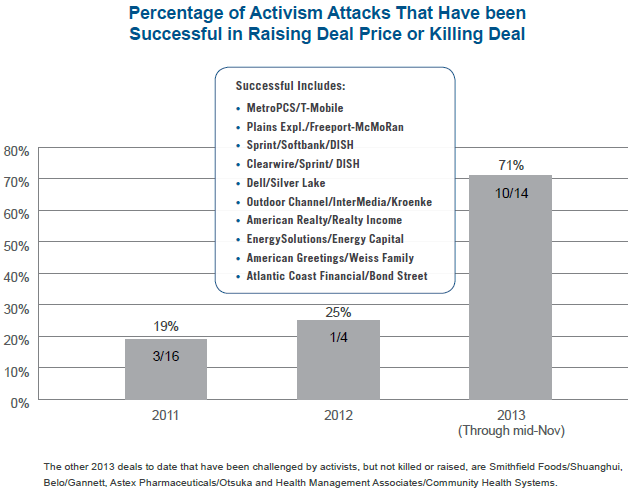

Rise in Successful Activist Attacks on Announced Deals

A key element of the M&A landscape throughout 2013 was the number and “success” of activism attacks on announced M&A transactions. The Dell buyout transaction probably garnered the most headlines, but there were a number of high-profile attacks throughout 2013 in which an activist fund publicly opposed an announced deal unless the buyer agreed to increase the purchase price (so-called “bumpitrage”). Most notably, over two thirds of activist attacks on announced deals through mid-November 2013 were successful in raising the deal price or terminating the transaction.

The implications of this development remain to be seen, including whether it results in a potential chilling effect on M&A or enhanced shareholder value and how it affects the behavior of, and agreements put in place by, buyers and sellers in M&A transactions.

Activist Designees in the Boardroom

The rise in overall shareholder activism campaigns coupled with the increased propensity of target companies to settle has resulted in a growing number of activist designees on company boards. These changes to board composition often have resulted in boards considering, or re-considering, the strategic direction and alternatives for the target company. They also have caused companies and their advisors to grapple with certain collateral issues. Such issues include the ability of activist director-designees to share confidential information with the sponsoring activist fund and possible payments by the activist fund to its designee directors. [1] We expect issues such as these to continue to be a focus in the coming year and to result in litigation.

Preparing for Shareholder Activism

Preparation must be part of a company’s usual routine these days. This includes regular engagement and dialogue with the company’s significant shareholders and a periodic (and critical) self-assessment at both the senior executive and board levels. Companies and their boards and advisors also should be ever-mindful of the potential for activism in connection with any significant corporate transaction, including a possible M&A transaction. For example, carefully planned and ongoing use of the media, which has long been a key component of announcing a business combination transaction, is more important than ever in contributing to the success of an announced transaction.

Endnotes:

[1] One particular topic that the conference participants discussed in this regard was the possible use of bylaw provisions to disqualify director nominees who receive third-party compensation, such as the type proposed to be paid by Elliott Management Corp. to its director-designees in connection with its proxy fight with Hess Corp. We note that on January 13, 2014, Institutional Shareholder Services (ISS) issued FAQs in which it indicated that it may consider a board’s unilateral adoption of such bylaw provisions as a material failure of governance that would lead it to recommend voting against directors and boards adopting such a bylaw. For additional information, please click here to see the Firm’s memorandum on this topic.

(go back)

Print

Print