The following post comes to us from Sullivan & Cromwell LLP, and is based on a Sullivan & Cromwell publication by William Y. Chua, Kung-Wei Liu, and Kenny Chiu.

China Natural Resources, Inc. (“CHNR”), a natural resources company based in the People’s Republic of China (the “PRC”) with shares listed on the NASDAQ Capital Market, recently completed the spin-off (the “Spin-Off”) and listing by introduction (the “Listing by Introduction”) on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”) of its wholly-owned subsidiary, Feishang Anthracite Resources Limited (“Feishang Anthracite”), which operated CHNR’s coal mining and related businesses prior to the Spin-Off. [1] S&C represented CHNR and Feishang Anthracite in connection with the Spin-Off and Listing by Introduction, which is the first-of-its-kind where a U.S.-listed company successfully spun off and listed shares of its businesses on the Hong Kong Stock Exchange, including advising on the U.S. and Hong Kong legal issues that arose in connection with this transaction.

Transaction Overview

In connection with the Spin-Off, the ordinary shares of Feishang Anthracite were distributed on a pro rata basis to holders of record of the common shares of CHNR (the “Distribution”). In particular, holders of CHNR common shares (“CHNR Shareholders”) received five Feishang Anthracite ordinary shares for each CHNR common share held on the record date. CHNR Shareholders did not pay any consideration for the Feishang Anthracite ordinary shares that they received in the Distribution. No CHNR Shareholder approval was required for the Spin-Off or Distribution.

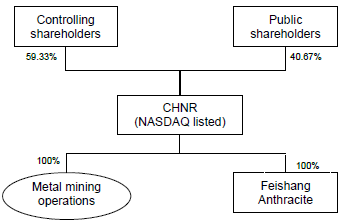

Corporate structure pre-Spin-Off/Listing by Introduction

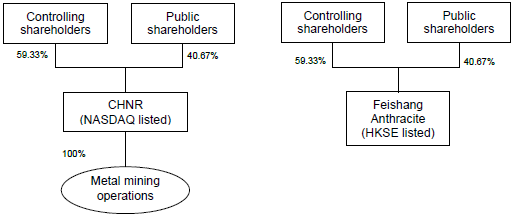

Corporate structure post-Spin-Off/Listing by Introduction

Considerations under the U.S. Federal Securities Laws

The Spin-Off raised a number of key considerations under the U.S. federal securities laws, including the following:

Registration under the Securities Act of 1933

A key threshold question revolved around whether a spin-off transaction would be subject to registration under the Securities Act of 1933, as amended (the “Securities Act”). In particular, the conditions and requirements set forth in Staff Legal Bulletin No. 4 (“SLB 4”) issued by the Securities and Exchange Commission (the “SEC”) needed to be carefully analyzed and considered in the context of the Spin-Off. [2]

Disclosure requirements under the Exchange Act

Under SLB 4, adequate information relating to the entity being spun off must be provided to the parent company’s shareholders and the trading markets. Where both the parent company and the spun-off entity are non-U.S. companies, which is the case for CHNR and Feishang Anthracite, the parent company would prepare an information statement that substantially complies with Regulation 14A or Regulation 14C. In addition, depending on the specific facts and circumstances, the spun-off entity may also be required to register its securities under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). [3] In the case of Feishang Anthracite, the information statement included: (i) the listing document which was also submitted to the Hong Kong Stock Exchange; and (ii) additional disclosure required under SLB 4 as well as the Exchange Act. As a result, the information statement met the relevant requirements under the Hong Kong Listing Rules, SLB 4 and the Exchange Act.

Confidential treatment for foreign private issuers

Foreign private issuers listed in the United States should consider requesting confidential treatment in connection with a spin-off transaction where the need to deal with, as well as harmonize, the differing regulatory requirements of multiple jurisdictions is expected to arise. In the case of Feishang Anthracite, which had to register its ordinary shares under the Exchange Act, the ability to obtain confidential review of its registration statement by the SEC staff [4] was very helpful in ensuring that any differing or potentially conflicting regulatory requirements could be addressed in an appropriate manner. Moreover, by obtaining confidential treatment, the 60-day period for automatic effectiveness of a registration statement filed under Section 12(g) of the Exchange Act does not commence until the registration statement has been publicly filed. This has the added benefit of helping harmonize any transaction timing differences that may arise when multiple regulatory regimes are implicated.

Hong Kong Listing Considerations

In connection with the Listing by Introduction, the key considerations under the listing rules of the Hong Kong Stock Exchange (the “HK Listing Rules”) included the following:

Waiver from Rule 8.05 of the HK Listing Rules

Under Rule 8.05 of the HK Listing Rules, the spun-off entity must satisfy certain financial tests, including the profit test, the market capitalization/revenue/cash flow test and the market capitalization/revenue test. In its listing application, Feishang Anthracite applied for a waiver from strict compliance with Rule 8.05 that is available to qualified mineral companies. Such waiver is granted by the Hong Kong Stock Exchange at its sole discretion. As a result, the granting of the waiver will depend to a significant extent on the persuasiveness of the waiver application. Among other factors, the spun-off entity should demonstrate that its management has sufficient management experience and expertise and that there is a clear path to commercial production as well as profitability where the mining businesses are still at pilot run or construction stages.

Competing businesses of controlling shareholders

Rule 8.10 of the HK Listing Rules requires detailed disclosure regarding any business of the controlling shareholder that competes with those of the spun-off entity. The disclosure should address, among other things, the reasons for not including such competing business in the spun-off entity, a description of the competing business and its management and facts demonstrating that the spun-off entity is able to carry on its business independently of the competing business. In addition, under certain circumstances, contractual arrangements as well as related undertakings would need to be devised and structured among the controlling shareholder and the spun-off entity in order to address the Hong Kong Stock Exchange’s concern over arrangements to manage conflicts of interest and delineation of businesses between the spun-off entity and other businesses under the common control of the controlling shareholder.

Other Considerations

The Spin-Off and Listing by Introduction also raised other important disclosure and other issues, including:

- disclosure of the mining consultant’s report that is required to be included in the listing document under the HK Listing Rules (also referred to as the “competent person’s report” under the HK Listing Rules) and issues relating to compliance with SEC Industry Guide 7;

- dealing with issues arising as a result of the financial statements included in the spun-off entity’s registration statement in connection with the Spin-Off being prepared under the applicable U.S. auditing and accounting standards, while the financial statements used for purposes of the Listing by Introduction were prepared under the applicable Hong Kong financial reporting standards;

- appropriate treatment of certain pro forma financial information prepared in accordance with the requirements of the HK Listing Rules and harmonization with the requirements of Article 11 of Regulation S-X under the Exchange Act;

- disclosure of certain non-GAAP financial measures included in the listing document submitted to the Hong Kong Stock Exchange and the appropriate reconciliations in accordance with Regulation G under the Exchange Act; and

- structuring the mechanics and procedures for the Distribution, including addressing the differing requirements of NASDAQ, The Depository Trust Company and the share registrars of the applicable non-U.S. jurisdictions, the Cayman Islands and the British Virgin Islands.

Endnotes:

[1] Sullivan & Cromwell represented China Natural Resources, Inc., the parent company, and Feishang Anthracite Resources Limited, the spun-off entity, and was the architect behind the spin-off/listing by introduction structure.

(go back)

[2] The relevant conditions as stipulated under SLB 4 are: (i) no consideration provided to the parent company for the subsidiary shares; (ii) spin-off must be pro rata to the parent shareholders; (iii) the spun-off entity shares must be registered under the Exchange Act, and adequate information about the spin-off and the spun-off entity must be made public; (iv) there must be a valid business purpose for the spin-off; and (v) “restricted securities” that are spun off must have been held by the parent company for at least two years.

(go back)

[3] SLB 4 also provides that there may be situations where the spun-off securities would not have to be registered under the Exchange Act (for example, the Rule 12g3-2(a) or 12g3-2(b) exemption from registration may be available). The SEC will consider requests for “no-action” positions from non-U.S. companies that do not intend to register the spun-off securities under the Exchange Act.

(go back)

[4] Under the current policy of the SEC staff, confidential review of initial registration statements of foreign private issuers is available only under limited circumstances, including situations where a foreign private issuer is listed or is concurrently listing its securities on a non-U.S. securities exchange, or a foreign private issuer is able to demonstrate that the public filing of an initial registration statement would conflict with the laws of an applicable foreign jurisdiction.

(go back)

Print

Print