The following post comes to us from Luigi L. De Ghenghi and Andrew S. Fei, attorneys in the Financial Institutions Group at Davis Polk & Wardwell LLP, and is based on a Davis Polk client memorandum; the full publication, including diagrams, tables, and flowcharts, is available here.

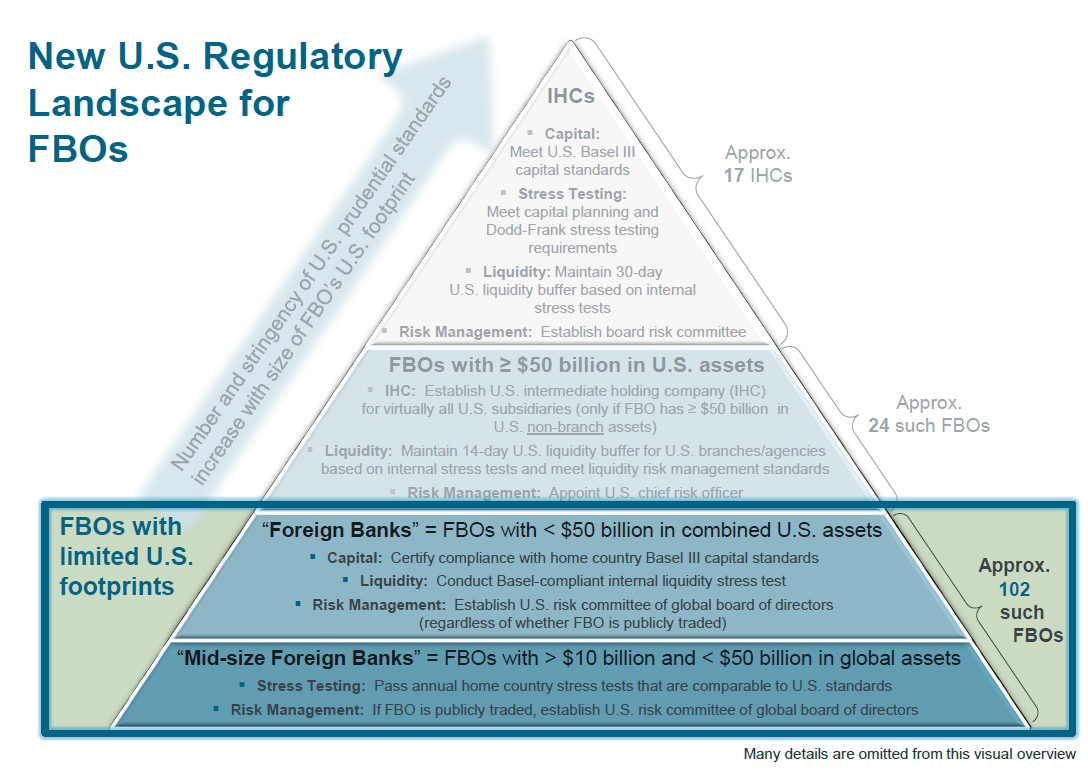

The Federal Reserve has issued a final rule adopting a tiered approach for applying Dodd-Frank enhanced prudential standards to foreign banking organizations (“FBOs”). Under the tiered approach the most burdensome requirements (e.g., the requirement to establish a top-tier U.S. intermediate holding company) will only apply to FBOs with large U.S. operations, whereas fewer requirements will apply to FBOs with limited U.S. footprints.

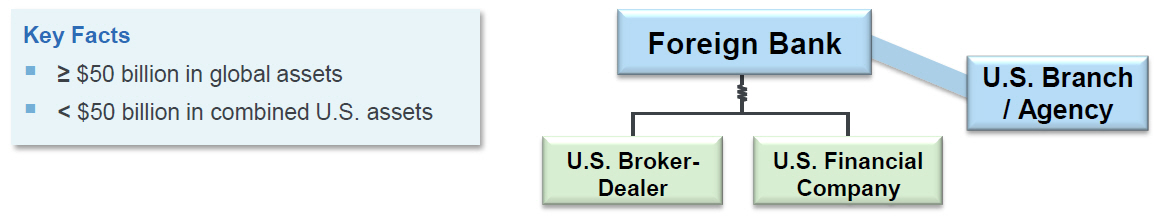

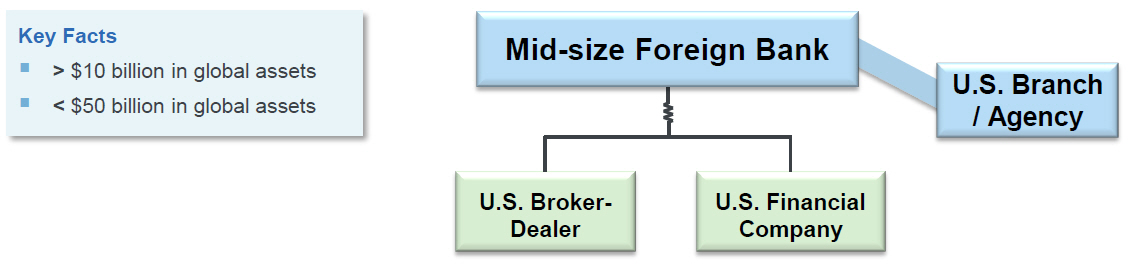

We have summarized below the Dodd-Frank enhanced prudential standards that will apply to the following FBOs with limited U.S. footprints:

- FBOs with $50 billion or more in global assets but less than $50 billion in U.S. assets (“Foreign Banks”); and

- FBOs with between $10 billion and $50 billion in global assets (“Mid-size Foreign Banks”).

The general compliance date of the Dodd-Frank enhanced prudential standards final rule is July 1, 2016.

Overview of New Requirements for a Foreign Bank

- U.S. Risk Committee: A Foreign Bank must establish a U.S. risk committee of its global board of directors that meets certain requirements.

- Consequences for non-compliance: Federal Reserve may impose requirements, conditions or restrictions relating to the activities or business operations of the Foreign Bank’s combined U.S. operations (i.e., U.S. branches/agencies and U.S. subsidiaries).

- Internal Liquidity Stress Test: A Foreign Bank must report the results of an internal liquidity stress test that meets the Basel Committee’s principles for liquidity risk management and incorporates multiple stress test horizons.

- Consequences for non-compliance: Combined U.S. operations must maintain net due to or net due from funding position with non-U.S. affiliates of 25% or less of third-party liabilities of combined U.S. operations on a daily basis.

- Home Country Capital Certification: A Foreign Bank must certify that it meets home country capital standards that are consistent with the Basel capital framework, including Basel III.

- Consequences for non-compliance: Federal Reserve may impose requirements, conditions or restrictions, including risk-based or leverage capital requirements, relating to the activities or business operations of the Foreign Bank’s combined U.S. operations.

- Home Country Capital Stress Test: A Foreign Bank must be subject to and pass annual home country capital stress tests that are comparable to U.S. standards, including requirements for governance and controls of stress testing practices by management and board of directors.

- Consequences for non-compliance: 105% U.S. asset maintenance (eligible assets as percentage of average quarterly liabilities requirement for U.S. branches/agencies and the Foreign Bank must conduct annual stress test of U.S. subsidiaries and report results to the Federal Reserve.

- Single Counterparty Credit Limits: To be finalized by the Federal Reserve at a later date.

- Early Remediation Framework: To be finalized by the Federal Reserve at a later date.

Overview of New Requirements for a Mid-size Foreign Bank

- U.S. Risk Committee

- If publicly traded, a Mid-size Foreign Bank must establish a U.S. risk committee of its global board of directors that meets certain requirements.

- Consequences for non-compliance: Federal Reserve may impose requirements, conditions or restrictions relating to the activities or business operations of the publicly traded Mid-size Foreign Bank’s combined U.S. operations.

- A non-publicly traded Mid-size Foreign Bank is not required to establish a U.S. risk committee.

- If publicly traded, a Mid-size Foreign Bank must establish a U.S. risk committee of its global board of directors that meets certain requirements.

- Home Country Capital Stress Test: A Mid-size Foreign Bank (regardless of whether it is publicly traded) must be subject to and pass annual home country capital stress tests that are comparable to U.S. standards, including requirements for governance and controls of stress testing practices by management and board of directors.

- Consequences for non-compliance: 105% U.S. asset maintenance (eligible assets as percentage of average quarterly liabilities) requirement for U.S. branches/agencies and the Mid-size Foreign Bank must conduct annual stress test of U.S. subsidiaries and report results to the Federal Reserve.

The full visual memorandum, which uses diagrams, tables and flowcharts to illustrate the Dodd-Frank enhanced prudential standards that will apply to foreign banks with limited U.S. footprints, is available here.

Print

Print