The following post comes to us from Nada Mora, Senior Economist at the Federal Reserve Bank of Kansas City, and Viral Acharya, Professor of Finance at NYU.

In our paper, A Crisis of Banks as Liquidity Providers, forthcoming in the Journal of Finance, we investigate whether the onset of the 2007-09 crisis was, in effect, a crisis of banks as liquidity providers, which may have led to reductions in credit and increased the fragility of the financial system. The starting point of our analysis is the widely accepted notion that banks have a natural advantage in providing liquidity to businesses through credit lines and other commitments established during normal times. By combining deposit taking and commitment lending, banks conserve on liquid asset buffers to meet both liquidity demands, provided deposit withdrawals and commitment drawdowns are not too highly correlated. Evidence from previous crises supports this view. In fact, banks experienced plenty of deposit inflows to meet the higher and synchronized drawdowns that occurred during episodes of market stress (Gatev and Strahan (2006)). The reason is that depositors sought a safe haven due to deposit insurance as well as due to the regular occurrence of crises outside the banking system (e.g., the fall of 1998 following the Russian default and LTCM hedge fund failure; the 2001 Enron accounting crisis).

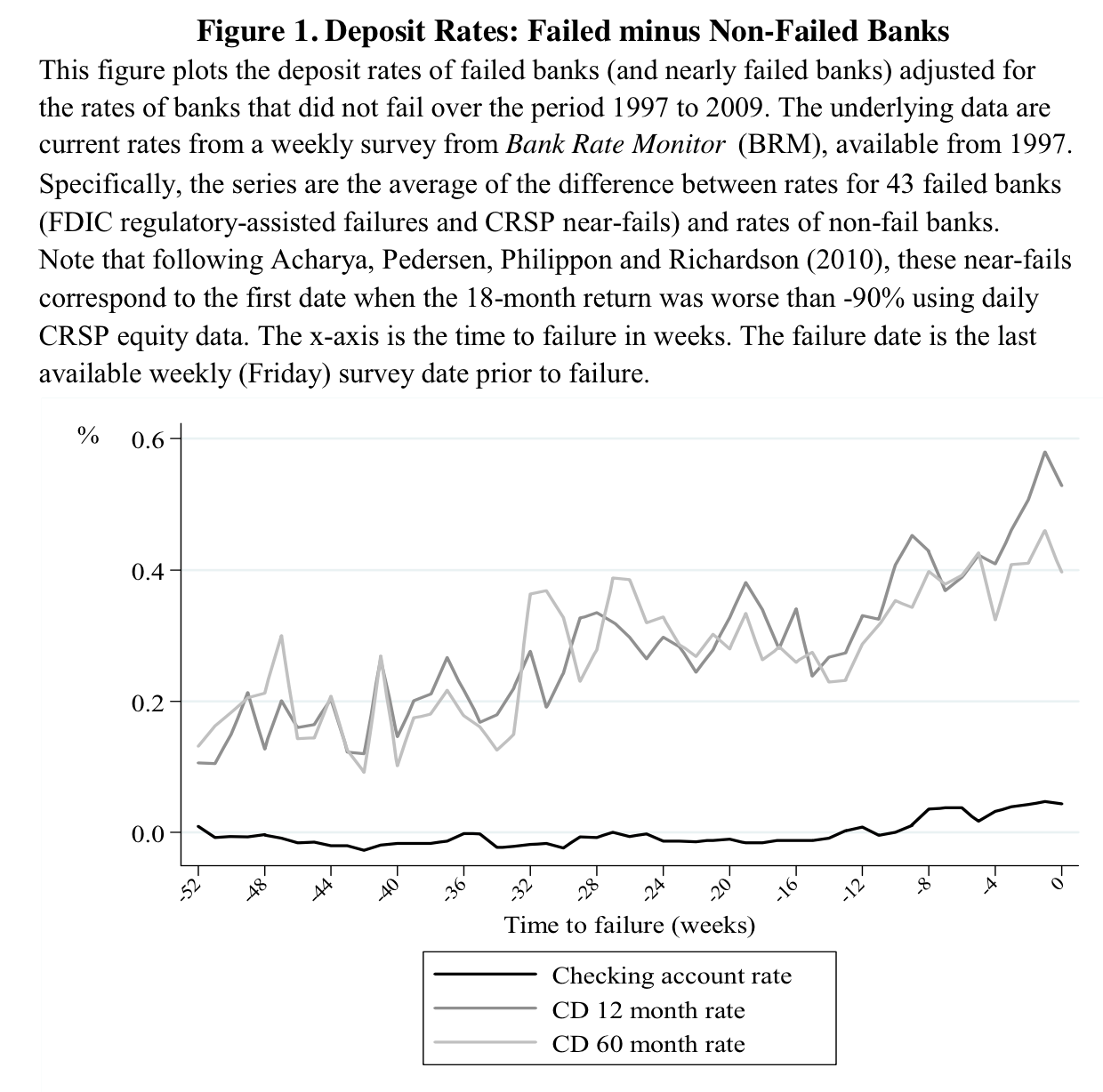

In 2007 to 2009, however, the banking system was itself at the center of the financial crisis. Questions were raised about the solvency of the banking system as a whole, which was exposed to toxic credit instruments as documented by Acharya, Schnabl, and Suarez (2013), Brunnermeier (2009), and Diamond and Rajan (2009). As the solvency risk of a bank increases, it might seek to attract deposits by offering higher rates such as the case of Washington Mutual during the crisis. Figure 1 shows this to be the case more generally by drawing on weekly survey evidence of deposit rates offered by failed banks as measured by the difference from the rates of banks that did not fail, over a one year period prior to failure, for failures occurring during the 1997 to 2009 period (concentrated within the crisis). For ease of comparison, the x-axis is the time to failure, where failure also covers cases of near-fails based on stock return performance. As is evident, weak institutions offered substantially higher CD rates in the run-up to failure.

This rise in deposit rates reflected possible stress on deposit funding of banks. In particular, not all deposit liabilities were insured, especially at the onset of the crisis when over 62% of deposits were uninsured. Did banks manage to retain their deposit base in wake of the funding stress? And did they manage to meet their credit demands in the form of undrawn credit lines and commitments to firms?

Our main result is that the onset of the crisis was a crisis of banks as liquidity providers in the aggregate; and not just of the weakest banks that later failed. In particular, there was aggregate deposit funding pressure in relation to increased loan demand and drawdowns throughout the first year of the crisis until the government interventions in the fall of 2008. The mechanism whereby the banking system as a whole provides backup liquidity to the market by experiencing sustained deposit inflows broke down from the ABCP “freeze” starting August 9, 2007 (as documented in Acharya, Schnabl, and Suarez (2013)), until just before the Lehman failure on September 15, 2008. Core deposits increased by only $90 billion up until end-2008Q2 (an increase which did not exceed core deposit inflows in a comparable period just before the crisis). Core deposits eventually increased in the banking system as a whole by close to $800 billion by early 2009, but only starting in 2008Q3 when they grew by $272 billion in just one quarter. Importantly, prior to Lehman’s failure, lending growth outpaced core deposit funding growth, that is, at the aggregate level, the banking system recorded a loan-to-deposit shortfall throughout the first year of the crisis.

We argue that the weakness in the aggregate deposit funding position of banks and its sharp reversal following Lehman’s failure is explained by investor perception of greater risk in bank deposits relative to instruments offering similar liquidity and payments services. Because most deposits were over the deposit insurance limit at the outset, investors preferred to hold assets with more explicit government backing than bank debt. Among the instruments with government backing that investors sought were Federal Home Loan Bank discount notes (analyzed in Ashcraft, Bech, and Frame (2010)) and Treasury securities (directly and indirectly through money market mutual funds specializing in government securities). The funding inflow into government funds exceeded that into “prime” funds beginning in August 2007, and accelerated in the aftermath of Lehman’s failure, Reserve Primary Fund’s “breaking the buck”, and the sharp outflow from prime funds. Concurrently, the government backed the depository system more explicitly through an increase in insurance limits from $100,000 to $250,000 and the full insurance of noninterest bearing accounts, among other measures. Therefore, explicit government backing appears to have been the key factor explaining the aggregate funding shifts.

To understand the microeconomics of these aggregate effects on the banking sector, we analyze the liquidity provision role of banks at the individual bank level. Our results show that the aggregate liquidity shock at the onset of the crisis particularly hit banks at greater risk of credit line drawdowns. These banks were vulnerable to liquidity risk because liquidity tensions coincided on both sides of their balance sheet in the crisis. Drawing on evidence from quarterly Call Reports and CD rates from a weekly proprietary survey, we find that a bank exposed to high commitments increased deposit rates significantly more than one exposed to low commitments (whether exposure is measured by potential or effective drawdowns). But crucially, despite scrambling for deposits by raising rates, commitments-exposed banks experienced weaker deposit growth, including of core deposits that are commonly considered a stable source of funding, and were forced to cut back on new credit originations.

While banks honored their existing credit lines drawn by firms beginning in August 2007 (extensive firm-level evidence is provided by Ivashina and Scharfstein (2010), Campello et al (2011), and Berrospide et al (2012)), this liquidity provision by banks was possible only because of explicit, large support from the government and government-sponsored agencies such as FHLB advances and Federal Reserve liquidity facilities. For example, advances from the FHLBs covered 65% of non-deposit borrowing growth at commitments-exposed banks during the first year, and the widening shortfall between their on-balance sheet loans and deposits was closed halfway with government-sponsored borrowing. Equally importantly, we document that unlike previous crises, banks did not expand total loans and credit lines. In this sense, the role of banks as liquidity providers was itself in crisis during the crisis from 2007 to 2008.

We conduct several tests to rule out the alternative hypothesis that commitments-exposed banks were simply those with greater solvency problems, and thus, expected to be disciplined by depositors. The results indicate that solvency problems, such as real estate related exposure, were independent risk factors, whose effect persisted into the latter part of the crisis. In contrast, the funding pressure on commitments-exposed banks coincided with the shifts in aggregate deposit funding. We show nonetheless that liquidity risk interacts with solvency risk as predicted by theory. Commitments-exposed banks with weaker fundamentals were more vulnerable to the onset of the crisis than equally exposed banks but with stronger fundamentals.

The full paper is available for download here.

Print

Print