The following post comes to us from David J. Greene, partner focusing on investment fund formation, structuring, and related transactions at Latham & Watkins LLP, and is based on a Latham client alert by Mr. Greene, Amy Rigdon, Barton Clark, and Nabil Sabki.

US federal laws and regulations, as well as the rules of self-regulatory organizations, impose numerous yearly reporting and compliance obligations on private equity firms. While these obligations include many routine and ongoing obligations, new and emerging regulatory developments also impact private equity firms’ compliance operations. This post provides a round-up of certain annual or periodic investment advisory compliance-related requirements that apply to many private equity firms. In addition, this post highlights material regulatory developments in 2014 as well as a number of expectations regarding areas of regulatory focus for 2015.

A complete review of a private equity firm’s compliance obligations is beyond the scope of this post, as operational aspects unique to a particular private equity firm may imply additional regulatory obligations, or different timelines for compliance.

Annual Compliance Reviews

Investment advisers registered under the Investment Advisers Act of 1940, as amended (the Advisers Act), are required to review compliance programs annually for adequacy and effectiveness. These annual compliance reviews can be expected to be a focal point of SEC inspections. Chief Compliance Officers (CCOs) of private equity firms should consider whether their compliance documentation appropriately addresses applicable compliance requirements, including the following:

- Collect annual certifications from all “supervised persons,” certifying that each has read and understood the compliance policies and procedures, and collect an annual personal securities holding report from each “access person”

- Update, maintain and deliver to clients, as applicable, Form ADV Part 2B (the brochure supplement) by all registered investments advisers

- Distribute annual privacy notice to natural-person clients or investors

- Obtain annual re-certifications of “bad actor” status pursuant to Securities Act Rule 506(d) [1]

- File SEC Form D on or before the anniversary of any previous Form D filing

- Amend blue sky filings, as applicable

- Complete Department of Labor filings for ERISA benefit-plan clients or investors, as applicable

- Confirm and comply with any contractual obligations in counterparty agreements, side letters, credit facilities, and other documents that require periodic notice, reporting, or similar requirements

In addition, CCOs should consider any compliance matters that arose during the previous year, any changes in the investment manager’s or its affiliates’ business activities, and any changes in applicable law that may require a revision to the compliance program. Documentation of these activities must be kept for a period of five years. CCOs should also coordinate, in conjunction with an investment adviser’s senior management, an overall review of the investment adviser’s compliance program, and adopt any appropriate revisions to the program.

Regulatory Filings Checklist [2]

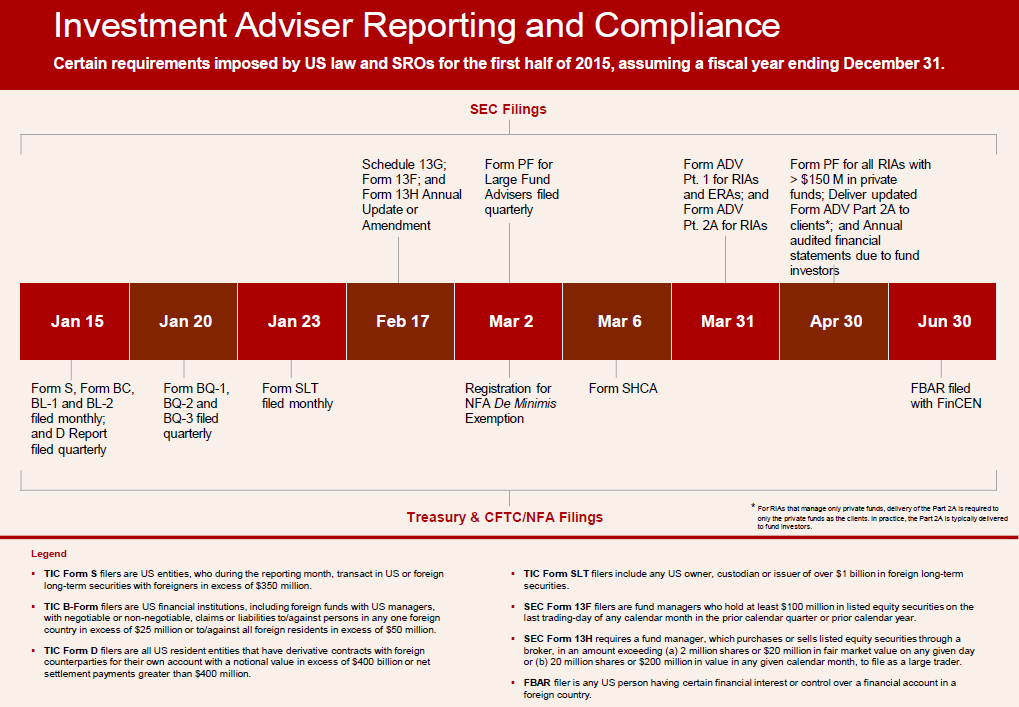

The following checklist provides a summary chronological listing of certain U.S. Securities and Exchange Commission, U.S. Commodities Futures Trading Commission, National Futures Association and U.S. Department of the Treasury reporting obligations for the first half of 2015. Many of the deadlines assume a fiscal year end of December 31.

Notable Developments in 2014

Regulators have renewed their focus on internal controls and books and records compliance. In particular, the SEC continues its ongoing “broken windows” campaign targeting minor violations. The campaign’s aim is to demonstrate that the SEC’s enforcement program will pursue all types of violations of the federal securities laws, big and small, and not tolerate small infractions because “even the smallest infractions have victims, and … the smallest infractions are very often just the first step toward bigger ones down the road.” (From SEC Chair Mary Jo White’s speech at the Securities Enforcement Forum on Oct. 9, 2013). The following are brief summaries of notable developments relevant to investment managers and investment funds as well as hyperlinks to more detailed information.

- Increased Transparency: Disclosures of Conflicts of Interest, Fees and Expenses—The SEC strongly recommended increased transparency in a speech by Andrew Bowden, the Office of Compliance Inspections and Examinations (OCIE) Director, entitled Spreading Sunshine in Private Equity. More particularly, through its enforcement and inspection efforts in 2014, the SEC continued to focus on private equity disclosures to investors, particularly related to conflicts of interest. The SEC’s areas of concentration have included disclosures related to affiliated party transactions, referral fees, finder’s fees and other compensation agreements. Additionally, the SEC has scrutinized investment funds that accelerate portfolio company monitoring fees or shift costs from the investment manager to its investors in the middle of a fund’s life. Finally, the SEC has highlighted private equity firms’ use of and payments to consultants or “operating partners,” (i.e., individuals or organizations that provide some specialized experience or services in connection with portfolio companies) as an area for improved disclosures. Especially sensitive are allocations of portfolio company expenses between related private equity funds as well as the allocation of an adviser’s expenses to the private equity fund. (Please see Latham Client Alert, Private Equity Fund Managers: Takeaways From The SEC’s Past Year in Enforcement for more on SEC enforcement in 2014.) Ultimately, private equity firms should seek to conduct the operations of their funds (particularly related to conflicts of interest and expense sharing) in accordance with their governing documents, including the fund’s offering documentation on which investors made their investment decisions in respect of the fund. Private equity firms should also consider updating their Form ADV brochure as needed to provide disclosure of current practices.

- Asset Valuation Practices—Private equity firms’ valuation practices were another increasing area of concern for the SEC. The SEC’s focus included lenient valuation practices (particularly if an investment manager uses unrealized portfolio gains to compute incentive fees), differences in valuations used in fundraising activities as compared to ongoing reporting, and transparency efforts. It should be expected that valuation policies and practices will continue to be an area of focus in SEC examinations, both as to consistent and accurate implantation and investor disclosure. As a result, we believe private equity firms should carefully review their historical performance presentations for consistency with valuation policies as well as the accuracy of disclosure. In this regard, the SEC also announced in an Annual Staff Report that it is using data provided in Form PFs to ferret out aberrational returns relative to certain benchmarks for further investigation.

- New Focus on Cybersecurity Preparedness, Regulation S-P—The SEC’s OCIE is assessing cybersecurity preparedness during routine and non-routine examinations. In a risk alert published in April 2014, the SEC provided a sample list of information that its examiners would want to review. The list demonstrates the SEC’s concern regarding an investment manager’s ability to protect the safety and confidentiality of customer information. The risk alert recommended that investment managers adopt policies and procedures addressing administrative, technical and physical safeguards for protecting customer records. Less than a year later, on February 3, 2015, the OCIE released the results of its initial examination sweep, which revealed that most managers have adopted cybersecurity policies and procedures. The OCIE is now evaluating the adequacy of the policies and procedures discovered during the sweep. The speed with which the SEC has moved on cybersecurity demonstrates how important the SEC considers the issue.

- The Testimonial Rule and Social Media—In March 2014, the SEC released new rules and updated guidance for registered investment advisers using social media. Statements posted on social media may come under scrutiny if they pertain to investment-related commentary or discuss an investor’s experience with the investment adviser. In this regard, the SEC is principally concerned with those statements that are deceptive, misleading or fraudulent. In certain circumstances, online statements by an investment adviser are exempted. The following types of online statements will not be considered testimonial: (i) listing friends or contacts on the adviser’s social media site, so long as it is not implied that those listed are current or former clients or those listed experienced favorable results, (ii) citing or “sharing” fan pages and third-party commentary pages, as long as the investment adviser cannot control how the commentary is presented and allows for commentary to be updated in real-time and (iii) directing clients to social media sites containing third-party commentary. Investment advisers may not compensate clients for posting commentary on a site about the investment adviser, or instruct the adviser’s own supervised persons to submit testimonials about the adviser to a site.

- Delay of the Volcker Rule—In December 2014, the Board of Governors of the Federal Reserve System issued an order extending the conformance period under the Volcker Rule until July 21, 2016 for covered funds created prior to December 31, 2013. The deadline will likely be further extended until July 21, 2017 for these funds. All funds initiated after December 31, 2013 must be in conformance by July 21, 2015. (Please see Latham Client Alert Volcker Rule Conformance Deadline Extended for Certain Funds for a summary of the extension details.) The Volcker Rule generally prohibits banking entities from engaging in proprietary trading and from acquiring or retaining an ownership interest in, sponsoring, or having certain relationships with a hedge fund or private equity fund. (Please see Consensus Interpretation of the Implementation of Parallel Fund Structures Under the Volcker Rule for more information regarding whether a non-US banking entity may invest in a parallel foreign fund organized by a non-bank sponsor that contemporaneously offers a parallel covered fund to, among other persons, US investors within the parameters of the Volcker Rule).

- Implementation of the Directive on Alternative Investment Fund Managers (AIFMD)—Since July 21, 2014, the AIFMD has been in full force and effect in the European Union (EU) member states that have enacted implementing rules. Any private equity firm seeking to market a non-EU alternative investment fund directly or indirectly through an agent in the EU could become subject to the AIFMD. As a threshold question, a private equity firm should identify which investment vehicles would be considered an alternative investment fund. (Please see the Latham-authored article If it “looks” like a fund, if it “sounds” like a fund… for further guidance.)

- Compliance Insight on Conforming SPVs and Escrow Accounts to the Custody Rule, Rule 206(4)-2—The SEC in its Exam Priorities for 2014 stressed the importance of recognizing when an investment manager has custody of assets and compliance with the SEC’s custody rule. The Advisers Act states that when a registered investment adviser has custody (broadly defined) of client funds or securities, the adviser is required to, among other things, undergo an annual surprise examination by an independent public accountant and use a qualified custodian to maintain the clients’ assets and send statements directly to the clients. In lieu of a surprise examination of the assets of a pooled investment fund, the adviser can obtain audited annual financial statements of the fund and provide such statements to investors within 120 days of the fiscal-year end (180 days for a fund of funds). To assist advisers with pooled investment funds, the SEC issued new guidance on applying the Custody Rule to special purpose vehicles (SPVs) and escrow accounts used for investment purposes. When using an SPV to make investments, registered investment advisers should be careful to either treat the SPV as a separate client or rely on the audit exemption and treat the SPV’s assets as assets of the fund for which the manager has indirect custody. For escrow accounts created to hold a portion of a portfolio company’s interest in a negotiated sale, registered investment advisers must meet a five-point test set forth in the guidance to comply with the custody rule.

- Expanded Definition of “Knowledgeable Employee” used in Rule 3c-5 under the Investment Company Act—The SEC, in a No-Action Letter to the Managed Funds Association on February 6, 2014, expanded the definition of knowledgeable employee, making it easier for certain non-executive employees to invest in the employer’s investment fund Importantly, knowledgeable employees are (i) excluded for purposes of determining whether a 3(c)(7) fund is owned exclusively by qualified purchasers and (ii) not required to be counted for purposes of the 100 beneficial owner limitation in a 3(c)(1) fund. The No-Action Letter expanded which employees may be considered “knowledgeable” to include employees who perform a policy-making function regardless of title, employees who head business divisions even if not a part of the investment activities, or employees who participate in investment activities including analytical or risk teams. Additionally, the No-Action Letter acknowledged that an affiliated management person who participates in the activities of covered separate accounts is likely to be as financially knowledgeable and sophisticated as an employee who participates in the investment activities of a fund and, thus, may also constitute a knowledgeable employee. The SEC advised that an investment manager should maintain a written record of its knowledgeable employees and should be able to explain the facts and circumstances that support its conclusion that any particular employee qualifies as a knowledgeable employee.

- Campaign Contributions and the Pay-to-Play Rule, Rule 206(4)-5—On June 20, 2014, the SEC settled its first case under pay-to-play rules for investment advisers. The pay-to-play rule requires a two-year waiting period before a firm could receive advisory fees from public plans after making political contributions to politicians capable of influencing the hiring of an investment adviser by a government entity. The rule does not require that the investment adviser intended to influence the politician or created a quid pro quo arrangement, only that the adviser (or its “covered persons”) made a contribution to a public official or political candidate and subsequently was retained to manage public pension funds or other government assets under the control or influence of such official or candidate.

- Broker-Dealer Activities—The SEC included as one of its examination priorities in 2014 whether investment advisers may be engaged in broker-dealer activities for which registration under the Exchange Act would be required. In particular, the SEC focused on the receipt of transaction-based compensation in connection with the marketing or selling of fund interests, as well as the receipt of transaction-based fees in connection with the purchase or sale of portfolio companies. Private equity firms may wish to review their compensation practices for investor relations and other marketing personnel, as well as their practices for charging monitoring, advisory or transaction fees in respect of portfolio companies. Some of these fees practices may fall within the SEC’s No-Action relief for M&A Brokers. (Please see Latham Client Alert A More Practical Approach to Broker-Dealer Registration for a more detailed discussion.)

What to Expect in 2015

The SEC has prioritized private equity firms for increased scrutiny in 2015, with a particular focus on compliance obligations, marketing materials and performance reporting. Further, the SEC has lowered the bar regarding potentially violative conduct, raising the possibility of enforcement actions.

- Succession Planning for Investment Advisers—The SEC is considering a new rule that would require registered investment advisers to create and maintain “transition plans” or succession plans allowing for the carrying on or winding up of an investment adviser’s business in the event an adviser (or key person) dies or becomes incapacitated. The SEC intends to mitigate both portfolio and operations risks in the asset management industry caused by market stress, a major disruption or when an investment adviser is no longer able to serve its clients. SEC Chair Mary Jo White, in a speech before attendees at a private equity conference, admonished investment advisers to “test and plan for the worst.”

- Focus on Historical Performance Reporting—Private equity fund managers’ historical performance reporting is expected to be an area of concern for the SEC in 2015. Examiners will be probing the internal rates of return disclosed in fund marketing materials, evaluating calculations based on unrealized investments that may impact returns or reviewing net returns that include the sponsor’s capital commitment. The inclusion of the sponsor’s commitment can impact the calculation of net internal rates of return, since the sponsor generally does not pay management fees or carried interest on its committed capital. (Please see Latham-authored article What PE Fund Managers Can Learn From 2014 SEC Enforcement for context on the emphasis of performance reporting transparency.)

- Cherry Picking, Trade Allocations and Principal Transactions—The SEC has identified cherry picking, trade allocations and principal transactions under Section 206(3) of the Advisers Act as an examination focus for 2015. In particular, the SEC is interested in how an investment manager handles written disclosure and obtaining client consent in a principal transaction where the manager is on both sides of the transaction. With regard to trade allocations, private equity firms should take steps to disclose and address conflicts of interest regarding their selection of investments in their various funds. The SEC addressed principal transactions in several enforcement actions in 2014, including in a case involving transactions between an adviser trading on behalf of a hedge fund client and the adviser’s affiliated broker-dealer. [3]

- Wholesale Changes to the Swiss Private Placement Regime—The deadline with which to comply with revisions to the rules governing the marketing and distribution of private funds in Switzerland will expire on March 1, 2015. The Swiss Financial Markets Supervisory Authority (knows as FINMA) has completely revised its private placement rules. By March 1, 2015— subject to very limited exceptions for marketing to licensed and regulated financial institutions e.g., banks and insurance companies—“exempt investors”)— foreign funds wishing to market in Switzerland must appoint a Swiss Representative (a Swiss entity licensed by the Swiss regulator, FINMA) and Swiss Paying Agent (a Swiss bank). These entities will take on the formal responsibility of distributing fund interests and managing payments to and from Swiss investors. A compliant distribution agreement should be executed in this regard. Funds already in the market in Switzerland will need to appoint the required Swiss Paying Agent and Representative before continuing their activities in Switzerland. The Swiss entities appointed will need to review marketing materials before distributing in Switzerland. By and large, however, the new rules are workable, with the Swiss financial industry offering a number of tidy solutions to allow marketing to continue under the new regime.

Wrap Up

In 2014, and continuing into 2015, the SEC remains focused on compliance related to investment funds and investment managers. The issues described above may be raised by the SEC during any routine or non-routine examinations. Investment managers should also anticipate investors inquiring about these issues. Long-standing practices may be exposed to new scrutiny. As a result, investment managers should focus on robust disclosures, compliance and valuation methodologies.

Endnotes:

[1] As widely reported, the SEC amended Rule 506 to prohibit a fund from relying on this exemption from registration, if the fund or any related person covered by the rule has a “disqualifying event.” To comply with this new “bad actor” rule and rely on Rule 506, fund managers must establish procedures and diligence materials designed to reveal disqualifying events for covered persons, which includes certain employees, affiliates and placement agents. Fund managers should distribute and receive back- completed questionnaires or certifications from, among others, officers, investment manager personnel and placement agents. Fund managers should recertify such disclosures annually either by representations and covenants in agreements or by new questionnaires.

(go back)

[2] Does not address filing obligations for registered CPOs or CTAs.

(go back)

[3] SEC Charges Hedge Fund Adviser With Conducting Conflicted Transactions and Retaliating Against Whistleblower (Jun. 16, 2014), http://www.sec.gov/News/PressRelease/Detail/PressRelease/1370542096307#.VNlKn_nF-Ck.

(go back)

Print

Print