Subodh Mishra is Executive Director for Communications and Head of Governance Exchange at Institutional Shareholder Services. This post is based on an ISS white paper by Patrick McGurn, Special Counsel and Head of Strategic Research and Analysis, and Edward Kamonjoh, U.S. Head of Strategic Research and Analysis. The complete publication is available here.

Momentum is the buzzword that best describes the 2015 Proxy Season in the U.S. market. Some issues, such as proxy access, hit the ground running and emerged as ballot box juggernauts. Other topics, such as calls for independent board chairs and heightened scrutiny of human rights, stumbled and lost ground. Some new ideas, such as hybrid climate change risk initiatives aimed at impacting board deliberations on compensation and CAPEX, failed to catch fire. Despite the rising proxy access tide, E&S proposals swamped their governance and compensation cousins in the pre-season family reunion headcount. However, big submission numbers failed to translate into growing support. Just one environmental proposal managed to win majority support in the year’s first six months.

Hedge fund activists benefitted from the tailwinds of two consecutive seasons with near 70 percent success rates at meetings, by settling their threatened fights early and often so far in 2015. In an ironic twist, the handful of fights that actually ended in votes this year, including DuPont’s victory over Trian’s Nelson Peltz, favored incumbents and showed that dissident nominees are not always shoo-ins for board seats.

Perennial shareholder proposal campaigns, including those calling for majority voting and annual director elections, nearly disappeared as letter-writing campaigns and other engagement activities took those issues off proxies.

Coming off of the busiest and most contentious “advisory vote” campaign ever, say-on-pay fatigue appeared to set in for both issuers and proxy voters as “say nay” campaigns ebbed and engagement-fueled support grew.

Top 5 Trends for 2015

Access Aplenty

Accounting for upwards of 11 percent of proposal submissions in 2015, and more than 14 percent of shareholder resolutions appearing on proxy ballots to date, proxy access exploded onto the scene this season. This comet-like appearance was ignited by the New York City Comptroller Office’s launch of the Boardroom Accountability Project (BAP). This new campaign accounts for about 65 percent of the almost 120 proxy access shareholder proposal submissions for 2015, according to ISS Voting Analytics data. The vast majority of 2015’s proposals are modeled on the Securities and Exchange Commission’s 2010 proxy access rule (struck down by a Federal court in 2011) and feature a 3-percent-for-three-years ownership requirement and a maximum of 25 percent of board seats proxy access formulation (hereinafter described as “SEC Clones”). The vast majority, roughly 90, of proposal submissions have appeared on ballots.

Earlier in the year, access supporters dodged a potentially fatal blow from the SEC’s no-action process when Chair Mary Jo White overturned a staff interpretation of SEC Rule 14a-8(i)(9) that would have allowed the board at Whole Foods Markets to block a shareholder’s access resolution by placing a management counter-proposal (setting a much higher access hurdle) on the ballot. Other recipients of proxy access proposals had lined up behind Whole Foods by seeking to exclude access shareholder proposals in favor of their own renditions of an access standard. Thus immune from such challenges, after White told Commission lawyers to study the “conflicting” proposal topic during the 2015 season, nearly 50 proposals on ballots drew majority support in the first half of the year.

In the wake of BAP submissions, boards at a dozen companies launched their own access proposals. Boards at five firms convened votes modeled on “near” SEC Clone policies (typically stipulating 3 percent/three years/25 percent of board seats/a 20-shareholder limit on aggregation) in exchange for the withdrawal of proposals by the NYC funds or other proponents or in response to proposals that received majority support last year. Shareholders strongly supported these measures at the five firms, with 89.1 percent support on average—at SLM Corporation, the board’s proposal was favored by 92.2 percent of investors, the highest support level of the five firms, and, most recently, 88 percent of shareholders supported the board proposal at McKesson’s July 29 meeting. Unable to exclude the shareholder proposals thanks to SEC Chair White, boards at seven firms countered investors’ offerings with competing proposals featuring their own more restrictive access models (typically set at 5 percent ownership for 3 years, a cap of 10 to 25 percent of board seats, and nominating group aggregation limits of one to 20 shareholders).

Access shareholder proposals became magnets for support this season. To date, average investor support for the 84 resolutions where vote results are available is 54.4 percent. Forty-nine (or almost 60 percent) of the resolutions have received majority support. Another six resolutions narrowly missed the majority support threshold with at least 49 percent support. In the aggregate, more than 95 percent of access shareholder proposals voted on so far have received at least 30 percent support. Boards at two firms, Citigroup and Apache, endorsed their proponents’ access shareholder proposals, and the board at Republic Services expressed no view on a proposal. Average support for the proposals at these three firms was close to 90 percent.

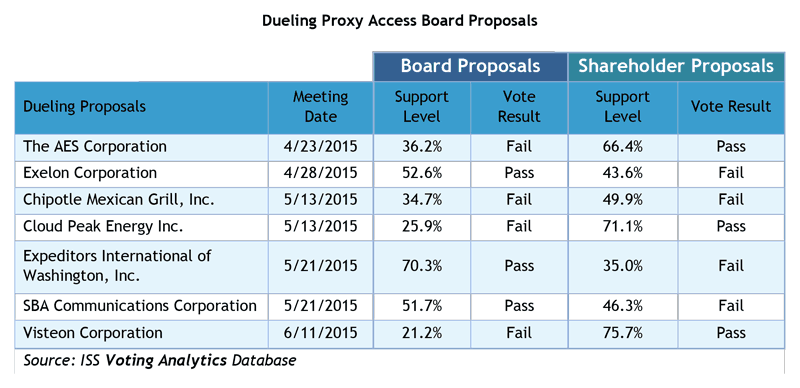

Vote outcomes at companies where competing proposals were at play were mixed. Investors rejected the lion’s share of both the competing board and shareholder-sponsored proposals. Four of the seven dueling board proposals failed to pass muster with shareholders but three succeeded. Conversely, four competing shareholder proposals failed (although by a smaller margin than the failed dueling board proposals) and three passed. Average support for competing board proposals tallied at 41.8 percent, and average support for competing shareholder proposals weighed in at 55.4 percent, or an almost 14 percentage point gap.

At the close of the season, ISS is tracking 41 firms that have adopted, moved to adopt, or made loose commitments to adopt proxy access in 2015 or 2016. These recent adoptions/commitments account for upwards of 70 percent of all the proxy access adoptions since 2003. In the aggregate, roughly 5 percent of firms in the S&P 500 have now adopted or committed to adopt access.

To put this in context, consider the trajectory of the shareholder proposal campaign seeking majority voting rules. Only 7 percent of the S&P 500 firms had a majority vote standard in place in 2004 when the shareholder campaign by the Building Trades Union funds gathered steam. Now, according to ISS QuickScore data, almost 90 percent of S&P 500 firms have a majority vote standard for uncontested director elections. While it took about three years for the majority vote standard campaign shareholder proposals to attain average majority support, the 2015 proxy access campaign broke the average majority support barrier in its inaugural year.

The SEC has promised to issue new guidance on the competing proposal exclusion issue before the onset of the 2016 proxy campaign. Despite this season’s trend, a return of the previous staff interpretation of the Rule 14a-8(i)(9) standard, which allowed issuers to use counter-proposals to block highly dissimilar proposals on the same topic, could stop the access campaign in its tracks.

Settlements Soak Expected Proxy Fight Fireworks

Hedge fund activists entered the 2015 season on an unprecedented roll, with billions in new assets to deploy and multiple freshly-minted entrants rushing in the space. With directors’ resolve weakened by two consecutive seasons of nosebleed-high success rates for activist funds (roughly 70 percent according to data from ISS Special Situations Research), an epidemic of settlement fever broke out as boards inked deals with scores of insurgents before dissident proxy cards were printed and mailed.

These early settlements left many of the usual suspects, including Carl Icahn, Dan Loeb, and Bill Ackman, with plenty of seats on boards, but empty dance-cards at 2015 annual meetings. Trian’s Nelson Peltz settled with two big targets (BNY-Mellon (ISS Governance Quickscore: 3) and PepsiCo (ISS Governance Quickscore: 1)), but he turned down an “anybody-but-a-Trian-principal” board seat deal offered by DuPont (ISS Governance Quickscore: 1). The resulting fight, the largest in U.S. history produced fireworks and cost untold millions, but it ultimately forced no changes in DuPont’s board line-up. Even quirky one-off contests, like Harry Wilson’s DIY run at General Motors (ISS Governance Quickscore: 1) ended with directors’ pre-fight tapouts. Despite the settlement outbreak and the resulting attrition of the biggest players from the arena, contested meetings for the first half of the year still ran ahead of 2014’s volume over the same timeframe, and the median market-cap of targeted firms hit an all-time record at $518 million.

Larger targets, less seasoned dissidents and some downright bizarre fact patterns (did shareholders really need to settle Steve and Elaine Wynn’s on-and-off-and-on-and-off again personal relationship via a contest?) combined to lower activist hedge funds’ batting average to under 50 percent in fights that reached the definitive filing stage. One interesting development to watch—a successful hybrid contested solicitation/vote no campaign by newbie activist H Partners at Tempur Sealy (ISS Governance Quickscore: 2) that led to board invitations for the dissidents and the ouster of the company’s CEO.

Unexpected Ballot Box Headwinds for E&S Proposals

To paraphrase Mark Twain, the death of the shareholder proposal has been greatly exaggerated. Pumped up by the massive proxy access campaign, shareholder proposals stepped out of the wings and onto center stage during the 2015 proxy season. While the proxy access juggernaut drew headlines this season and pushed the total number of shareholder proposals submitted at U.S. firms over the 1,000 mark, E&S issue-oriented proponents managed to hold their lead dog position with respect to total shareholder proposals submitted to U.S. firms. Numbering over 470, resolutions addressing E&S concerns accounted for the largest slice of the shareholder proposal pie with 45 percent of the more than 1,030 proposal submissions this year.

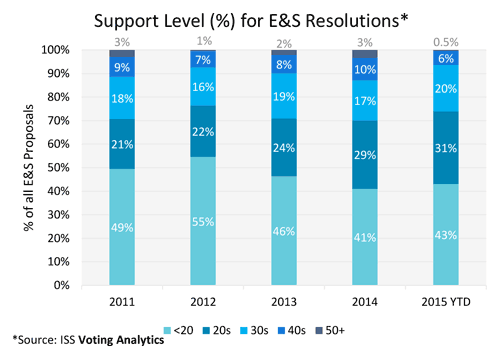

Fueled by a new batch of high-octane climate change proposals designed to appeal to the tastes of bottom-line oriented asset managers, plus a host of perennial resolutions that draw consistent support, including occasional majority votes, E&S backers appeared poised to outstrip their past successes. But, as the dust settled on the field of the 2015 proxy season, while the offerings were plentiful, average support for E&S proposals slipped from 2014’s record-setting levels, and governance topics grabbed the top three spots—proxy access, independent chair, and written consent, respectively—on the list of the most prevalent shareholder proposals on annual meeting ballots.

Perhaps more significantly, E&S offerings have attracted just a single majority vote in first-half-of-year balloting. In contrast, a total of seven E&S proposals received majority support in 2014, and 2013 witnessed four E&S majority votes. The lone proposal to pass requested the publication of a sustainability report at Nabors Industries that includes targets for reducing greenhouse gas (GHG) emissions and water use as well as the linkage between executive compensation and financial and ESG performance. It received 51.5 percent support, up from 43.5 percent support in 2014.

Unpacking the vote results reveals additional leakage in support levels for E&S resolutions this year. The proportion of 2015’s E&S resolutions receiving between 40 and 49 percent support (40s) dropped by 4 percentage points relative to 2014, after several years of steady increases. On the other hand, one-fifth of E&S proposals this season have received support in the 30s—the highest level over the past five years. In the aggregate, however, this uptick has been tempered by the double cold front of a 4 percentage point increase in the proportion of resolutions receiving less than 30 percent support and a 6 percentage point decrease in the proportion of resolutions receiving 30 percent or higher support.

Lost in these numbers, of course, is the E&S proponents’ continuing success in engaging boards in dialogues about their concerns. Such discussions resulted in the withdrawal of about 40 percent of E&S proposals, which is at par with the E&S withdrawal rate in 2014. In stark contrast, less than 10 percent and approximately 16 percent of governance and compensation topic proposals, respectively, have been withdrawn.

The frequency of E&S proposal withdrawals is remarkable. Over the past five years, roughly 800 E&S proposals have been withdrawn, representing almost 40 percent of the over 2,000 submitted. In many respects, proponents consider negotiated settlements in the form of proposal withdrawals a larger measure of success than proposals that receive high votes (30 percent support or higher), given that such settlements result in explicit actions by targeted firms to address concerns raised in resolutions, whereas companies often fail to act on proposals that garner high shareholder support. The combination of high E&S proposal submission rates and the fact that issuers continue agreeing to make changes that result in such high withdrawal rates is palpable evidence that the dialogue on and uptake and support for E&S topics remains vibrant.

Engagement Takes More Action Off Proxy

Longtime governance wonks may have noted the absence of some perennial topics from this year’s list of top shareholder proposals. Resolutions calling for the repeal of classified boards, the adoption of majority voting, and for the elimination of supermajority vote requirements failed to break the list of top proposals and narrowly made it into double digits in terms of total resolutions filed. The dearth of shareholder resolutions on these ballot staples can be attributed to the rise of off proxy activism.

Some investors have found that letter writing campaigns can be just as effective as offering shareholder resolutions as a lever for triggering meaningful engagement with corporate issuers. Some large U.S. pension funds have scored several wins with portfolio firms that have acquiesced to requests for governance reforms, such as director election majority voting standards or greater board diversity, on the heels of letters seeking such reforms. A number of large asset managers have similarly engaged in letter writing campaigns at portfolio firms, which have advanced the dialogue on governance reforms or concerns, including proxy access. Notably, the proxy voting and investment management departments at certain money managers have teamed up to push for certain reforms in their letters to issuers.

Directors, of course, simply might be reading the handwriting on the wall since the letters address popular reforms such as annual elections and majority vote standards. Average support so far in 2015 for these topics is 73 percent and 64 percent, respectively, and, in 2014, 83 percent and 58 percent respectively.

As behind-the-scenes diplomacy continues to evolve as a viable and effective tool in the engagement toolbox, it is expected that fewer proposals on certain topics submitted or appearing on ballots will be recorded in upcoming proxy seasons.

Compensation Spotlight Dims

Compensation issues receded into the background during the 2015 proxy season, as the fifth year of Dodd-Frank mandated management say-on-pay votes (MSoP) proved a charm for most pay panel members. According to ISS Voting Analytics data, average support on MSoP at R3K firms hit 91.6 percent of the votes cast. Nearly 80 percent of the 2,000-plus R3K firms with MSoP on their ballots so far in 2015 topped the 90 percent support line.

Next year, proxy voters might be able to mull over new disclosures related to hedging policies, pay-for-performance, and compensation disparity thanks to a burst of SEC rule-making activity in recent months, with the later likely requiring CEO-to-median-employee pay ratio disclosures by next year. The SEC’s most controversial proposal implementing Dodd-Frank’s tough (“if you didn’t earn it you must return it”) clawback language will not take effect in time for the 2016 season, but pay panels might draw unwelcome attention from investors next season if they undertake stealthy maneuvers to shield future payouts to executives from being reclaimed by switching performance metrics or pay vehicles. 2016 will mark the beginning of round two of the “say when” debate, as boards must consider whether they want to ask shareholders to hold advisory votes more or less often than they do now.

2015’s Five Most Significant Meetings

DuPont: Proxy Contest

Large-cap firm board members undoubtedly took a big breath of relief when a dozen of their peers managed to fend off the 2015 season’s most high-profile hedge fund challenges. Despite numerous attempts by Nelson Peltz’s Trian Fund Management to engage with DuPont on the firm’s value-enhancement strategies, the two sides failed to reach a settlement. The Trian/DuPont spat quickly transmogrified into a drama-laden spectacle. Trian, the company’s fifth largest shareholder, offered up four board candidates to replace some of DuPont’s incumbent directors in order to effectuate its four-pillar plan to unlock value, which included splitting off the company’s low-growth and volatile materials businesses. The prospect of Trian’s polarizing Peltz joining the board and the threat of a “shadow management team” beholden to the hedge fund’s agenda doomed settlement talks.

Pundits expected that at least some of Trian’s nominees would win seats on the board at the firm’s May 13 shareholder meeting, but DuPont was able to fend off Trian’s challenge with all 12 of its nominees prevailing at the ballot box. DuPont’s surprise victory over Trian has been credited to an unprecedented months-long $15-million shareholder outreach campaign that targeted the firm’s largest shareholders, as well as its oft-nonvoting and seldom-tapped retail investor base that is reported to have held one-third of voting shares. Notably, the fight also revealed a potential split in institutional investors’ ranks as some large passive investors bought the company’s arguments that Trian’s plans would come at the cost of DuPont’s long-term investments in research and development. In contrast, many actively managed firms appeared to be more sympathetic to Peltz’s call for change.

DuPont’s triumph over Trian has been viewed by some observers as a watershed moment for boards. It remains to be seen, however, if DuPont’s divide-and-conquer strategy will serve as a compelling blueprint for how to effectively neutralize future high-profile proxy challenges.

Vornado: Board Responsiveness

Vornado’s (ISS Governance Quickscore: 9) multi-year streak as the poster company for unresponsiveness to shareholder mandates continued this year. Having rebuffed shareholder mandates for at least eight years in a row, Vornado has set a record that is likely to remain unbroken in the annals of governance lore in corporate America. Vornado’s track record of shareholder nose-thumbing began in 2007 when a majority of investors voted in favor of a shareholder proposal seeking a majority vote standard for director elections. A majority of investors subsequently expressed support for majority voting every year since then until 2014. A second avenue of unresponsiveness opened in 2010 when a shareholder proposal requesting a switch from a classified to an annually elected board received support from the majority of shares outstanding. Subsequent calls for annual elections have drawn majority support from outstanding shares every year since then through 2014. Vornado’s board scored the unresponsiveness hat trick when directors ignored majority support for a proposal calling for an independent board chair that received majority support in 2013. The board’s losing streak on the topic continued in 2014 and 2015.

In response to the Vornado board’s serial snubs, a majority of shareholders opposed the reelection of all of the firm’s nominees (the board is classified, of course) up for election from 2011 until 2014. At the 2015 meeting, the only two out of three board members drew opposition from the majority of shares cast. In an audacious display of apathy towards shareholders’ concerns, Vornado’s board continued to fail to address the long-standing issues underlying the receipt of majority director withhold votes. In discussions with ISS, the firm reiterated its belief that implementation of the majority supported shareholder proposals is not in the firm’s or shareholders’ best interests at this time.

Nabors: Director Resignations

Nabors Industries (ISS Governance Quickscore: 9) appears to share some of Vornado’s recalcitrant DNA with respect to non-responsiveness to shareholder demands.

Nabors, for example, has responded superciliously to an SEC Clone proxy access proposal supported by a majority of shareholders in each of the four intervening years since 2013, including 2015, when the proposal received 67 percent support—its highest support level yet. In 2014, Nabors’ board adopted a restrictive formulation of access that limits the use of proxy access to a single shareholder owning 5 percent of the stock for three years. In 2015, despite support by more than two-thirds of shares voted, the board elected to maintain the current formulation of access stating, in its 8-K announcing the 2015 vote outcomes, that its Governance and Nominating Committee would consider reducing the 5 percent share ownership requirement in advance of the 2016 shareholder meeting as opposed to in 2017, which was the reevaluation deadline proposed when the firm adopted its proxy access provision in 2014. In so doing, the committee opined that it had “adequately responded to concerns expressed by a majority of shareholders.”

Similarly, Nabors has also failed to adequately respond to a shareholder proposal requesting a majority vote standard that was supported by a majority of investors in 2014 (and 2011). The proposal was submitted at the firm in 2015, but it was subsequently withdrawn after the firm’s proxy materials were printed. Nabors’ response to the 2014 majority supported proposal was not to adopt a true majority vote standard, but, rather, to change the composition of its committees and adopt a policy to publicly announce the board’s rationale for rejecting directors’ resignations tendered pursuant to its plurality voting policy.

Reflecting dissatisfaction with the board’s tepid responses to majority supported shareholder resolutions, in every year since 2013, shareholders have rejected the election of at least two board nominees. In 2014, shareholders voted down three of seven nominees, and, in 2015, four of the firm’s seven directors drew majority opposition and tendered their resignations, which the board turned down. In rejecting the four resignations, Nabors defended the contributions of the directors with failed votes.

Tempur Sealy: Vote-No Campaign

H Partners, a 10 percent-shareholder, disrupted Tempur Sealy board’s slumber via a “vote no” campaign against three of the firm’s 11 board nominees. H Partners faulted the incumbent board for the firm’s long-term underperformance, feeble financial results and corporate governance shortcomings. The three Tempur Sealy nominees targeted by H Partners were CEO Mark Sarvary, board chair P. Andrews McLane, and co-founder Christopher Masto, chair of the Nominating and Governance committee.

In the fall of 2013, when discussing Tempur Sealy’s earnings guidance that fell short of expectations and the possible addition of an H Partners representative to the board, McLane famously suggested that H Partners “return home to carefully study the background of each Tempur Sealy director,” and the firm did not subsequently follow up with H Partners to discuss its request for board representation. This rebuff came home to roost when H Partners demanded the replacement of CEO Sarvary and the resignation of McLane and Masto in a letter addressed to the board. A rare active proxy solicitation against the re-election of Sarvary, McLane, and Masto followed. H Partners clamoring for boardroom change resonated with investors at the firm’s May 8 shareholder meeting. With just 10.3 percent support, McLane’s reelection was opposed by around 90 percent of votes cast. Masto did not fare too well either, with just 14.3 percent support. CEO Sarvary managed to scrape together a mere 23 percent support. To place these vote results in appropriate context, in looking at boardroom election vote outcomes at U.S. firms over the past decade, McLane suffered the tenth lowest support and Masto’s support was the sixteenth lowest. In accordance with the company’s majority vote standard, all three directors tendered their resignations and all resignations were accepted by the board. Further, the board saw the sense in re-engaging with H Partners, its largest shareholder, and both parties quickly reached an agreement (on May 11) to appoint Usman Nabi, an H Partners representative, to the board and appoint an additional independent director recommended by H Parters. Jon Luther was subsequently appointed to the board on May 30. As part of this agreement Tempur Sealy agreed to terminate Sarvary as President and CEO and replace him, on an interim basis, with COO Timothy Yaggi, and create a CEO search board committee to comprise Nabi (as chairman) and Luther.

Bank of America: Unilateral Bylaw Amendment

While calls for independent board chairs barely caused a ripple at firms with shareholder proposals on their ballots, it had a big impact at one meeting where the topic was not on the proxy card. A majority of investors at Bank of America’s (ISS Governance Quickscore: 7) 2009 shareholder meeting approved a binding shareholder requisitioned bylaw amendment mandating that the board’s chair be an independent director. That move led to then-CEO Ken Lewis being stripped of his title as board chair and likely speeded his subsequent departure from the board and the firm. Despite this strong mandate, which unambiguously rejected a combined CEO/Chair role leadership structure, the bank’s board unilaterally rescinded the shareholder approved bylaw and elected to re-combine the CEO and chair positions in October 2014. The bank’s board did not disclose whether it vetted the bylaw’s annulment with shareholders and it also failed to put the change up for a vote stating instead, that the 2009 vote reflected shareholder views particular to the firm at the time and that the company had since evolved.

Shareholder anger over the board’s move was immediate and visceral. A shareholder proposal requesting an independent chair was filed and some high-profile asset owners lined up to lead a vote no effort. In response, the board went on the offensive—negotiating with the proponent for the withdrawal of the shareholder resolution and adopting proxy access to pacify some asset owners’ concerns. Despite these efforts to diffuse dissent, the board, a mere two days before the shareholder meeting, disclosed that it would ask shareholders to ratify its decision to nullify the board leadership structure bylaw amendment no later than at the firm’s 2016 shareholder meeting. Despite this eleventh hour promise, investors still expressed dissent with significant opposition against members of the board’s Corporate Governance Committee, ranging from 28 percent for three committee members to 33 percent for the committee’s chair.

Director Election Trends

Uncontested Boardroom Elections

For directors running without a direct challenge this season, 2015 was a great year to be a board member with ISS Voting Analytics data showing that average support for the 16,000-plus nominees at Russell 3000 Index companies (where vote results are available) soared to 96.3 percent of votes cast. More than 90 percent of these Russell 3000 nominees drew support of at least 90 percent of votes. Unlike recent seasons (recall the Hewlett-Packard board’s botched oversight of Autonomy, the JPMorgan Chase’s risk committee’s comeuppance in the wake of the London Whale losses, Occidental Petroleum’s Ray Irani mutiny, Chipotle Mexican Grill’s say-nay-on-pay spillover, and Coke’s tussle with David Winters’ Wintergreen Advisors), 2015 lacks a signature vote “no” campaign against incumbent directors.

Thanks to instances of aggressive engagement by directors, only 41 nominees in the Russell 3000 have failed to win majority support so far in 2015. While problems may be isolated, they tend to be severe when they occur. “Zombie” directors at a trio of serially unresponsive boards—at Healthcare Services Group (at least one nominee has failed to attract majority support at each of the past four annual meeting), Nabors (at least one failed nominee at three of the past five annual meetings), and Vornado Realty Trust (a lone nominee at the 2015 meeting is the sole director candidate to have drawn majority support over the course of the company’s past five annual meetings)—accounted for nearly half of the season’s sub-majority board nominee tallies to date this year. Notably, none of 2015’s vote challenged directors at these firms has stepped down so far.

Hottest Shareholder Proposal Topics

An analysis of ISS’ Voting Analytics data shows that a plethora of shareholder proposals have once again been submitted for 2015 shareholder meetings with more than 1,030 resolutions spread across roughly 540 firms. Forty five percent of all proposal filings address E&S topics, reflecting the continuing prominence of E&S subjects, almost 43 percent of resolutions submitted are attributable to governance issues, and proposals addressing compensation topics account for about 12 percent of the 2015 proposal tally.

ISS Voting Analytics data show that, in the aggregate, proposals with vote results available have received 33.3 percent average support, with governance, compensation, and E&S proposals drawing average support levels of 43.7 percent, 29.2 percent, and 20.1 percent, respectively.

Governance

While proxy access had a breakout season, some long-standing governance-related shareholder proposal campaigns actually lost momentum in 2015.

- Independent chair resolutions, for example, lost the crown as king of the shareholder proposal hill after several years of occupying that lofty perch. To add insult to injury, the issue also suffered a loss of shareholder support and the number of majority votes on the topic dropped as well.

- The number of majority voting proposals on ballots plummeted with activism shifting off proxy as investors used letter-writing campaigns and direct board engagement to push the reform downstream, at smaller portfolio firms.

- The campaigns calling for annual board elections and the elimination of supermajority vote rules continue to attract sky-high voting support, but few proposals on these topics appeared on ballots thanks to engagement.

The controversy swirling around access may have benefited proponents of proposals seeking to enhance shareholders’ rights to take action in-between scheduled meetings. The number of proposals asking boards to boost shareholders’ ability to act in lieu of a meeting—via written consent—was likely to rise this season as some individual investor proponents had jumped to the topic after the SEC staff had repeatedly permitted issuers to exclude shareholder proposals asking for enhanced rights to call special meetings by proposing their own counter-proposals on the topic. With the SEC’s moratorium on Rule 14a-8(i)(9) guidance, shareholders ended up with more opportunities to vote on both written consent and special meeting proposals. Both topics also produced small increases in voting support.

Executive Compensation

While the number of compensation-related shareholder proposals appearing on ballots has dropped markedly since the advent of Management Say on Pay (MSoP) in 2011, shareholders still cast their votes on a healthy number of resolutions addressing certain practices around or specific elements of executive compensation that may not be well-suited for tackling via the advisory say-on-pay vote. The “thumbs-up-or-down” pay vote is often viewed by many investors as a mechanism by which aspects of executive pay are evaluated holistically and in their totality.

More than 80 compensation proposals have appeared on ballots. With vote results available in Voting Analytics for 73 resolutions, just five (7 percent) have received majority support.

- Proposals requesting shareholder ratification of severance agreements drew majority votes in favor at TCF Financial Corporation—78 percent support (ISS Governance Quickscore: 9; Compensation Pillar: 10), Staples—69.2 percent (ISS Governance Quickscore: 8; Compensation Pillar: 10), and Hologic—54.4 percent (ISS Governance Quickscore: 6; Compensation Pillar: 9).

- Proposals seeking pro-rata vesting of equity awards garnered majority support at FirstMerit Corporation—59.2 percent (ISS Governance Quickscore: 2; Compensation Pillar: 6) and Rite Aid Corporation—58.4 percent (ISS Governance Quickscore: 1; Compensation Pillar: 2).

Environmental and Social Issues

Proposals addressing E&S topics have dominated resolution submissions over the last several years. While roughly 40 percent of the proposal filings are withdrawn and thus do not appear on ballots, proposals on a number of E&S topics are often voted on by investors in meaningful numbers—almost 230 resolutions have appeared on ballot so far in 2015.

Proposals with the highest ballot volumes include those addressing corporate political activities (67 proposals in 2015 vs. 98 proposals in 2014), climate change/GHG emissions (34 proposals in 2015 and 31 proposals in 2014), general human rights issues (29 proposals in 2015 and 15 in 2014), and sustainability reporting (20 in 2015 vs. 13 in 2014).

Despite high ballot volumes, E&S issue resolutions represent just 1 percent of all majority votes in 2015 compared to 8 percent of majority votes in 2014. Only one E&S topic proposal so far this year has received majority support—a sustainability reporting proposal at Nabors received 51.5 percent support.

Executive Compensation Highlights

Say on Pay’s Biggest Failures

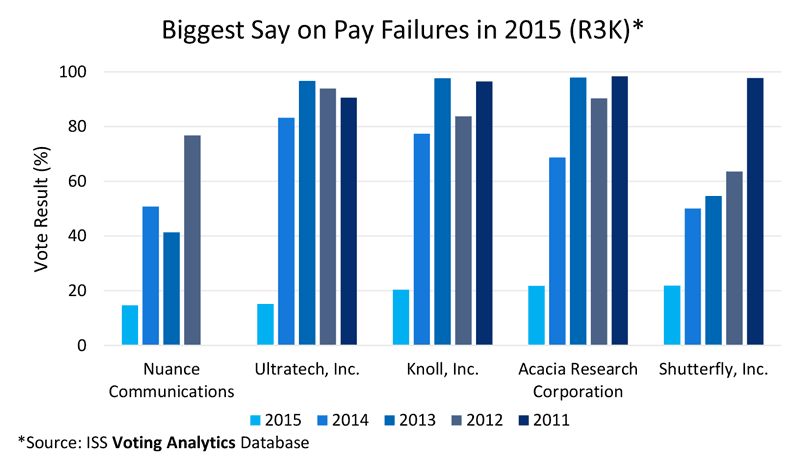

The say-on-pay votes at 50 firms have so far failed to garner majority support, 43 of which are in the Russell 3000 with three in the S&P 500 This season’s five lowest MSoP votes all had one thing in common—significant pay and performance misalignment concerns. Nuance Communications’ (ISS Governance Quickscore: 10; Compensation Pillar: 10) 2015 result, 14.6 percent support, was the fourth-lowest say-on-pay vote outcome since the advent of the MSoP vote mandate in 2011. This unusually low vote tally was driven by multiple years of above-target payouts despite sustained underperformance, undisclosed incentive performance objectives, and a failure by the compensation committee to respond to shareholder concerns following a barely passing (50.7 percent) vote in 2014.

- With just 15.3 percent support, Ultratech, Inc.’s (ISS Governance Quickscore: 6; Compensation Pillar: 10) MSoP vote is the second lowest for the 2015 proxy season, driven by elevated pay in the face of sustained underperformance. The firm’s pay program also contained several concerning features, including lifetime health benefits for certain executives, the use of outsized peers, and a lack of any performance conditions on equity awards.

- Knoll, Inc.’s (ISS Governance Quickscore: 9; Compensation Pillar: 9) 20.4 percent support was fueled by discretionary short-term incentive plan payouts and excessive equity grants, half of which were time-based and half that were based on a target that was not rigorous.

- The pay vote at Acacia Research (ISS Governance Quickscore: 9; Compensation Pillar: 10) drew just 21.8 percent support, largely as a result of incentive programs that were wholly subjective or discretionary and featured annual incentive awards that had more than doubled over previous year levels without a commensurate increase in firm value.

- At Shutterfly (ISS Governance Quickscore: 4; Compensation Pillar: 7), the subject of a proxy contest focused in part on pay concerns, sizeable CEO equity retention awards following the announcement of plans to decrease equity compensation, duplicative performance metrics in the short-and long-term incentive plans, and concerns around the rigor of performance equity awards fueled the low 21.9 percent support pay vote outcome.

Just three firms in the S&P 500 index have hosted failed pay votes thus far in 2015. Hospira Inc. (ISS Governance Quickscore: 7; Compensation Pillar: 9) earned its 31.6 percent support after providing for excise tax gross ups in anticipation of an acquisition by Pfizer after Hospira committed, in 2012, to not include such gross-up provisions in change-in-control agreements. Bed Bath and Beyond’s (ISS Governance Quickscore: 9; Compensation Pillar: 10) say-on-pay program was voted down (with just 35 percent support) likely due to concerns regarding the magnitude and design of CEO pay in light of sustained underperformance. Vertex Pharmaceuticals (ISS Governance Quickscore: 10; Compensation Pillar: 9) garnered just 45.1 percent support; ISS noted that the CEO’s pay was excessive and comprised largely of time-vested awards, and that the firm adjusted its peer group to include outsized peers. The CEO also received a sizeable special retention award without rigorous performance hurdles.

Repeat failures were common this season. Tutor Perini (ISS Governance Quickscore: 6; Compensation Pillar: 7), a Russell 3000 index firm, lost its say-on-pay vote for a record fifth year in a row, never having mustered up investor support since say on pay’s arrival in 2011. Despite making some improvements to its pay program, the company entered into an agreement with the CEO that raised his already high compensation and provided a sizeable cash retention bonus for “effective succession planning.” Russell 3000 firms Masimo Corporation (ISS Governance Quickscore: 10; Compensation Pillar: 9) has lost the vote four times in a row (counting abstentions), Spectrum Pharmaceuticals (ISS Governance Quickscore: 10; Compensation Pillar: 10) and Cogent Communications (ISS Governance Quickscore: 9; Compensation Pillar 10) have witnessed failed say-on-pay votes three years in a row, whereas Mack-Cali Realty Corporation (ISS Governance Quickscore 9; Compensation Pillar: 10), Carriage Service (ISS Governance Quickscore: 10; Compensation Pillar: 10) and the TCF Financial Corporation (ISS Governance Quickscore: 7; Compensation Pillar: 10) have each lost the vote for two consecutive years. In aggregate, since the emergence of the say-on-pay vote, Monster Worldwide (ISS Governance Quickscore: 5; Compensation Pillar: 10) has lost the vote two times. In addition, Patriot Scientific Corporation, a firm outside the Russell 3000 universe, has failed to garner majority support for three years running.

Biggest Say on Pay Rebounds

2015’s three largest say-on-pay “reversals of misfortune,” in order of magnitude are BroadSoft, Inc. (ISS Governance QuickScore: 9, Compensation Pillar: 10), Chipotle Mexican Grill (ISS Governance QuickScore: 8, Compensation Pillar: 9), and Lexington Realty Trust (ISS Governance QuickScore: 2, Compensation Pillar: 1).

All three firms received upwards of 70 percentage point gains from 2014 support levels when their respective pay votes failed, following consultations with their shareholders.

The biggest winner this season was Broadsoft, whose shareholders blessed the say-on-pay vote with 99.3 percent support after a dismal 2014 vote outcome of 26.8 percent in favor. The firm reached out to its shareholders after the failed votes and upgraded its compensation programs with more rigorous cash bonus financial metrics and also refrained from granting equity awards for FY 2014, which resulted in the CEO’s total pay tumbling from $6.9 million to a relatively modest $864,000.

The next biggest winner was S&P 500 firm Chipotle Mexican Grill, whose say-on-pay proposal received the thumbs up from 95.4 percent of investors, up from a paltry 23.4 percent approval in 2014—the lowest of any S&P 500 firm to date. Chipotle won back the confidence of over 90 percent of its shareholders for the first time since 2011 through outreach and engagement, by subsequently lowering the grant date value of equity awards, granting only performance-based equity awards, and leveraging multiple relative performance metrics for incentive pay programs.

Lexington Realty Trust, the third largest rebounder, improved its say-on-pay score to a toasty 98.2 percent this year from a frigid 27.8 support level in 2014, also following outreach to over 40 percent if its shareholder base, by not providing equity grants in 2014, and by implementing a new long-term incentive program, 70 percent of which is subject to a three-year performance period.

Other noteworthy turnaround stories include S&P 500 firms:

Hasbro Inc. (ISS Governance QuickScore: 7, Compensation Pillar: 8), which also engaged its shareholders and managed to move the support needle up from 46 percent in 2014 to 97.5 percent this year after renegotiating the CEO’s employment agreement and adding more performance conditions, among other actions.

Nabors Industries, which found itself in unfamiliar territory—on the winning side of an advisory vote on pay in 2015 (65.7 support, up from 40.3 percent support in 2014). Nabors had previously failed to receive majority support for four years running, but after repeated prodding from shareholders, the firm eventually made adjustments to its pay program that reduced the CEO’s pay levels to the lowest they had been since 2011, in line with the firm’s lagging performance.

2015’s Largest CEO Pay Packages

In an age of advisory votes on pay, many boards have tightened their purse strings, but some mega-pay packages always manage to make their way through these boardroom cracks. Some of the common themes that pop up as drivers of the top 2015 CEO pay packages (as measured by ISS’ Executive Compensation Analytics database) come as no surprise. Dual class stock/controlled company structures, classified boards, infrequent (read triennial) say-on-pay votes, and high concern levels (as flagged by ISS’ pay evaluation methodology) are common markers for these super-sized payouts. Some of the CEOs that made 2015’s highest-earners list are first-timers while others are mainstays on the pay stage.

Discovery Communications—CEO David Zaslav: $169.8 million

CEO David Zaslav earned the distinction of being the single highest paid CEO in corporate America in 2015. For fiscal year 2014, ISS valued Zaslav’s equity awards at $158.8 million, of which $87 million were in the form of Restricted Stock Units (RSUs) and $71 million in Stock Appreciation Rights (SARs). Zaslav’s large base salary and bonus opportunity brought his total pay for 2014 to nearly $170 million. The equity awards were made in conjunction with his new six-year employment agreement with the firm. Only a slim majority of the eye-popping equity grants were performance-conditioned—the proportion of Zaslav’s equity pay mix that had performance hurdles attached was 55.1 percent compared to 44.9 percent in time-vesting (read can you fog a mirror) awards.

Discovery Communications (ISS Governance QuickScore: 10, Compensation Pillar: 10) has both a classified board and a dual-class stock structure in place. Its potential CEO termination payments amount to $257.4 million in the event of a termination without cause and $266.7 million in the event of a termination upon a change-in-control. Notably, Discovery experienced negative one-, three-, and five-year shareholder returns, which also lagged its peers. Given that the firm, in 2011, elected to hold say-on-pay votes triennially, shareholders did not have an opportunity to weigh in on a pay vote this year, although 43 percent of proxy voters opposed Discovery’s say-on-pay program in 2014. In the absence of a pay vote this year, shareholders expressed their displeasure at the company’s generous pay practices in light of lagging performance by opposing the staggered board members standing for election this year by a margin of 44 percent for a member of the compensation committee and 31 percent for the other board nominee up for election.

Liberty Global—CEO Michael Fries: $110.1 million

2015’s second highest earner was Liberty Global (ISS Governance QuickScore: 10, Compensation Pillar: 10) CEO Michael Fries. His gig-grant of equity awards represented upwards of 85 percent of his centi-million dollar plus total compensation package for the year. Like Discovery’s Zaslav, a large proportion (85 percent) of Fries’ sizeable equity award was made in connection with a new employment agreement. Notably, the grant was conditioned on performance measured over only a nine-month period. U.K.-based Liberty Global’s governance profile features a classified board, a dual class stock structure and triennial say-on-pay votes. Liberty’s severance arrangements, which make Discovery’s look more reasonable, include the potential for a $276.1 million payout in the event of a termination without cause and $287.3 million if a change-in-control leads to the CEO’s termination. In 2014, almost 39 percent of investors opposed Liberty’s say-on-pay vote. Concerns around the lack of board responsiveness regarding the low say-on-pay vote at the 2014 annual meeting were directed at Compensation Committee member Larry E. Romrell, but he nonetheless received more than 99 percent support at the 2015 shareholder meeting although that outcome was clearly influenced by the board’s chair, John Malone, who controls close to 90 percent of the firm’s super-voting (10 votes-per-share) Class B shares.

FleetCor Technologies—CEO Ronald Clarke: $91.1 million

FleetCor’s (ISS Governance QuickScore: 10, Compensation Pillar: 10) Ronald Clarke weighed in as the third-most highly compensated CEO in the United States. He earned $88.5 million in the form of equity awards—comprised of 41.7 percent restricted stock awards and 58.3 percent in stock options, based on ISS’ valuation. Although Clarke’s FY 2014 equity awards were 100 percent performance-conditioned, the company’s valuation of his 850,000 performance stock options is unusual. FleetCor valued Clarke’s mega stock option award at $0 and disclosed only a partial value for the restricted stock grant. ISS valued the stock option grant at a higher level—S51.6 million. For each of the equity grants, the company made the determination that the performance targets were so rigorous that they were unlikely to be achieved. For this reason, the proxy statement disclosure for Clarke’s total pay of $17.3 million is lower than ISS’ valuation of $91.1 million. While the company’s valuation of equity is permissible under SEC rules, it is uncommon and serves to obscure transparency for shareholders.

FleetCor’s governance features include a classified board and triennial say on pay votes. The company’s severance provisions include for a payout of $114 million if the CEO is terminated upon the occurrence a change-in-control event. FleetCor’s say-on-pay proposal failed last year with only 30.2 percent support, likely driven by concerns around large discretionary grants whose underlying performance hurdles were not particularly rigorous. In 2015, given the absence of a say-on-pay vote, investors directed their discontent with the firm’s pay program, as well as its failure to respond to last year’s failed say-on-pay vote, at the three board members up for election (no compensation committee members stood for election this year given the classified board structure), who all drew opposition votes between 38 and 30 percent.

GAMCO Investors—CEO Mario Gabelli: $88.5 million

GAMCO’s (ISS Governance QuickScore: 10, Compensation Pillar: 10) Mario Gabelli’s pay structure is unusual in that it does not feature the typical base salary, bonus, and equity awards structure. Instead, it consists of management fees. Per the terms of Gabelli’s employment agreement, his pay structure consists of; (i) $14.4 million for an incentive management fee equal to 10 percent of GAAP pre-tax profits, and (ii) $74.1 million for other fees for portfolio management and client services. Gabelli’s total compensation in FY 2014 represented 80.9 percent of the company’s 2014 net income and 20.1 percent of 2014 revenue. Gabelli owns $1.4 billion in company stock (excluding options). Notable highlights of GAMCO’s corporate governance profile include a dual class stock structure with CEO Gabelli as a controlling shareholder.

Like the other firms with the most highly paid CEOs, GAMCO elected a triennial say-on-pay frequency. Despite concerns with Gabelli’s 2014 pay that amounted to $85 million, last year’s say-on-pay vote received over 99 percent support. This year, in the absence of a pay vote, and in spite of concerns directed at all but one director for a broad range of governance issues including pay, independence and accountability, all director nominees received at least 99 percent support. Gabellli owns about 98 percent of Class B supervoting shares—10 votes per share—and effectively controls approximately 95 percent of the firm’s combined voting power.

GoPro—CEO Nicholas Woodman: $77.4 million

In fifth place on ISS’ Executive Compensation Analytics’ highest-paid list is GoPro’s (ISS Governance QuickScore: 10, Compensation Pillar: 10) CEO and founder Nicholas Woodman. He received a 4.5 million RSU award with a grant date value of $75 million in connection with the company’s IPO in July 2014. Woodman’s mega equity grant ranks amongst the highest of any equity award recently made in connection with an IPO—for context, the equity grants awarded to the CEOs at recently IPO-ed firms LinkedIn and Zulily amounted to $55.9 million and $26.9 million, respectively. Woodman owns $1.7 billion in company stock (excluding options).

GoPro also boasts a dual class stock structure and the firm is controlled by Woodman (and his family trust) who wields 74 percent of the firm’s voting power. Like its other counterparts whose CEOs are amongst the top five earners in the country, the firm recommended that shareholders adopt a triennial pay frequency. It should also come as no surprise that, despite concerns with the Compensation Committee’s approval of the CEO’s IPO pay package as well an employment agreement that provided for excise tax gross-up provisions, all Compensation Committee members received upwards of 98 percent support at this year’s annual meeting.

Upcoming in 2015

ISS hopes this quick look at the top trends and most memorable meetings of the 2015 season whets your appetite for the full ISS Post Season Report. Over August and September, ISS will publish a full wrap-up of the U.S. season, and many voting seasons from around the globe, including up-to-date statistics drawn from ISS’ Voting Analytics, Executive Compensation Analytics, and QuickScore databases.

The complete publication is available here.

Print

Print