Norman Schürhoff is Professor of Finance at the Swiss Finance Institute. This post is based on an article authored by Professor Schürhoff; Terrence Hendershott, Professor of Finance at the University of California, Berkeley; and Dmitry Livdan, Associate Professor of Finance at the University of California, Berkeley.

Who is informed on the stock market? There are plenty of reasons to believe that institutional investors possess value-relevant information. Unlike retail investors, institutions often directly communicate with publicly traded firms as well as brokerage firms through their investment banking, lending, and asset management divisions. Most mutual funds and hedge funds employ buy-side analysts and enjoy better relationships with sell-side analysts. Their economies of scale allow institutions to monitor many sources of information. Last but not least, institutions employ professionals and technologies with superior information processing skills. Yet, the academic literature has struggled to identify the information channel in institutional trading. There is some evidence that institutional investors are informed, but studies examining institutional order flow around specific events provide mixed evidence.

Our recent Journal of Financial Economics study Are Institutions Informed about News? uses daily non-public data on buy and sell volume by institutions from 2003 through 2005 for about 1,700 NYSE-listed stocks with all news announcements from Reuters Natural language processing to show that institutions are indeed informed about both the content and timing of future public news. Our findings, along with Campbell, Ramadorai, and Schwartz (2009), suggest that using the broadest possible set of institutional trading data is important to isolate the link between institutional trading and news.

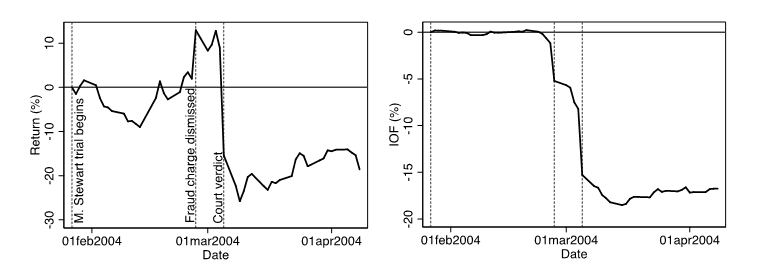

Our results are best illustrated using trading by institutional investors during the Martha Stewart insider trading trial. Stewart’s broker tipped her that drug manufacturer ImClone’s stock price was about to drop because its drug Erbitux failed to get the expected Food and Drug Administration (FDA) approval. In response, Stewart sold about $230,000 in ImClone shares on December 27, 2001, a day before the announcement of the FDA decision. On June 4, 2003, a federal grand jury in Manhattan indicted Stewart on charges of securities fraud, obstruction of justice, and conspiracy. The same day, Stewart resigned as chief executive officer and chairman of Martha Stewart Living Omnimedia (MSO), but remained on the company’s board. Stewart’s trial began on January 27, 2004 in New York City and ended on March 5. We document (see Figure 1) that institutions roughly maintained their positions in MSO until February 27 as their order flow remained close to zero. On February 27, the judge threw out the securities fraud charge against Stewart, which could have led to up to ten years in prison and a $1 million fine. In response MSO’s stock price rose roughly 10% and remained there until the verdict on the remaining charges was announced on March 5. In contrast to the rising stock price, institutions sold MSO heavily from February 27 through March 5. Prior to the verdict, institutions sold 8% of MSO’s market capitalization. Trading in MSO was halted after Stewart was found guilty of conspiracy, obstruction of justice, and two counts of making false statements to a federal investigator. When trading in MSO reopened, the stock price plunged roughly 30%. On the same day institutions sold 10% more of MSO’s market capitalization. Thus, approximately half of institutions’ selling occurred prior to the news. Institutions’ selling is consistent with them being informed about the final verdict and them correctly interpreting the lack of good news in the charges being dismissed on February 27.

Figure 1: Stock returns and institutional order flow in MSO around the Martha Stewart insider trading trial.

In the much broader context, we use the aggregate institutional order flow (buy volume minus sell volume) to find broad evidence that institutions are informed. Specifically, we first show that institutional trading volume increases a few days before news announcements. Institutional trading volume predicts also whether or not a news announcement will occur after controlling for prior stock volatility and prior news announcements. This is consistent with institutions being informed about whether or not news announcements will occur, although it does not (yet) establish that institutions are informed about the content of the news itself. Therefore, we next analyze whether institutions are informed about the contents of the news. We find that institutional order flow increases more than five days prior to the announcement of good news as measured by the natural language sentiment of the news; institutional order flow decreases more than five days prior to bad news announcements. Multivariate regressions show that institutional order flow predicts the sentiment of news announcements and the stock return on announcement days after controlling for prior stock returns, news sentiment, and trading volume. Vector autoregressions that control for longer and more complex joint dynamics of returns, institutional order flow, and news sentiment confirm these results.

Exploiting the broad cross-section of Reuters’s news categories, we also investigate the types of news about which institutions are informed. We find that while institutional trading predicts returns on macroeconomic news days, institutions trade in the direction of macroeconomic news for none except one category of macroeconomic news. By contrast, institutional order flow predicts returns and sentiment of unexpected value-destroying events, such as bankruptcy and court decisions. In addition, we use news on earnings announcements to study whether institutions are informed about longer-term fundamental information embedded in stock prices. We find that institutional order flow predicts the surprise component of earnings announcements. Finally, we study whether institutions trade in advance of news unrelated to longer-term fundamentals, which we refer to as hype: press releases and news with large subsequent sentiment reversal (i.e., news which is “wrong” ex post). Using both proxies we find both qualitatively and quantitatively that institutional order flow shows no abnormal activity around these events. Thus, we find no evidence that institutions trade on news containing little information on fundamentals.

In summary, we find that institutions trade on future news before the news comes out to profit from their informational advantage, pushing prices in the direction of the news. Our findings suggest that significant price discovery related to news stories occurs through institutional trading prior to the news announcement date. These results shed light on the economic role of institutions in modern financial markets and force us to rethink the role of institutions and media in the economy.

The full paper is available for download here.

Print

Print