Dan Ryan is Leader of the Financial Services Advisory Practice at PricewaterhouseCoopers LLP. This post is based on a PwC publication by Mr. Ryan, Mike Alix, Adam Gilbert, Armen Meyer, and Christopher Scarpati.

Over the past two weeks, the US banking regulators released their much anticipated final margin requirements for the uncleared portion of the derivatives market. [1] This portion amounts to over $250 trillion of the global $630 trillion outstanding and has up to now been operating in “business as usual” mode, [2] while other derivatives have been pushed into clearing. The final rule’s release completes a long process since it was proposed in 2011 and re-proposed in 2014. [3]

The good news for the industry is that the final rule is generally aligned with international standards [4] and similar requirements proposed in major foreign jurisdictions. Most notably, the final rule increases the threshold of swap activity that would bring a financial end user (e.g., hedge fund) within the rule’s scope from $3 billion to $8 billion. This change, which aligns the rule with European and Japanese proposals, eases the compliance burden of smaller, less-risky market participants.

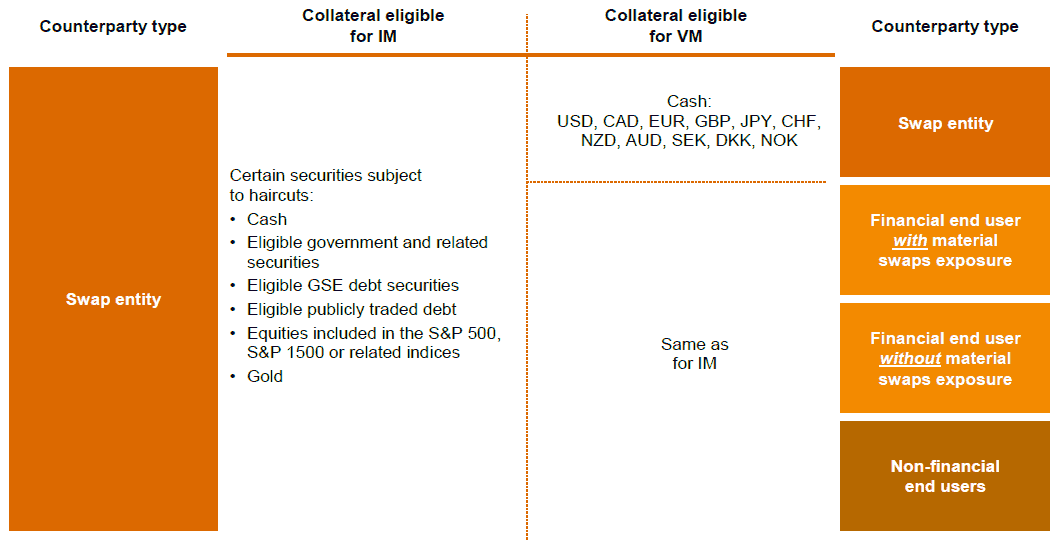

The final rule also increases the types of assets eligible as collateral for variation margin (VM) beyond only cash (as proposed in 2014). Non-cash assets that qualify as initial margin (IM) now also qualify as VM in trades between certain counterparties. This expansion alleviates industry concerns regarding potential collateral shortfalls.

However, with these positive steps toward global alignment [5] come some additional requirements not incorporated into the international framework. Most importantly, the final rule mandates both IM and VM on transactions between affiliates. [6] This requirement comes as no surprise as it was contemplated by the US proposal, and in fact came out more leniently with respect to IM by requiring swap entities to only collect IM from affiliates (but not post to them).

While the portion of the uncleared swaps market that is regulated by the CFTC and the SEC still awaits finalization of those agencies’ margin requirements, we expect little variation between their final rules and the banking regulators’. Thus, as the last chapter of Dodd Frank’s Title VII framework, this final rule represents realization of the policy intent of reducing systemic risk and increasing transparency in the derivatives market. There is no doubt that compliance will require costly and complex efforts. With only one year until the earliest compliance date, “business as usual” is no longer an option.

This post analyzes the final rule, and provides our views on how market participants should respond.

Analysis

What entities are in the final rule’s scope?

Similar to the proposal, the final rule recognizes four categories of counterparties: Swap entities, financial end users with material swaps exposure, financial end users without material swaps exposure, and non-financial end users.

Because each of these counterparty types poses a different level of risk to the financial system, the final rule calibrates requirements to each type’s perceived risk level, as did the proposal. However, to focus on larger financial end users that pose greater risk to market stability, the final rule pares back on the proposal’s definition of “material swap exposure” by increasing the materiality threshold from the proposal’s $3 billion to $8 billion. [7]

Who has to post and collect margin?

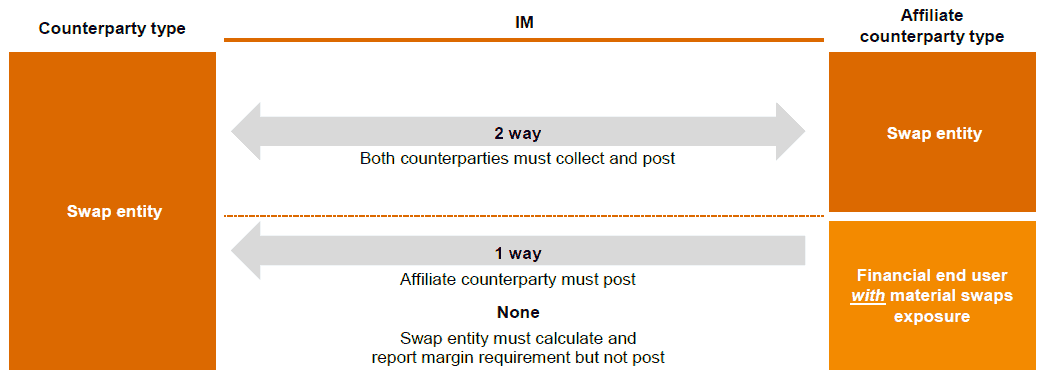

Also consistent with the proposal, the rule sets forth different requirements for the posting and collecting of IM and VM depending on the inherent risk the counterparty type poses.

Regarding IM, trades between a swap entity and another swap entity or a financial end user with material exposure (i.e., $8 billion or more) are subject to two-way margin. Trades with other counterparties are not subject to mandatory IM, but IM must be collected if warranted by the swap entity’s assessment of the counterparty’s credit risk.

With respect to VM, the final rule does not distinguish between counterparty types, so margin must be collected and posted on all trades with other swap entities and financial end users. The table below provides an overview of these requirements.

What threshold must be exceeded before margin must be exchanged?

Requiring margin will no doubt increase the volume of activity going through institutions’ middle office margin processing functions. To help, the final rule sets minimum thresholds to limit when margin must be exchanged, in order to relieve the operational burden associated with de minimis transfer amounts, as indicated below.

| Category | Threshold Amount |

|---|---|

| IM | $50,000,000 |

| VM | $500,000 |

How will IM be calculated?

Under the final rule, IM must be calculated using either a standardized margin schedule or a regulator-approved internal model. The schedule is a more straightforward approach, but is of course also far less precise. It calculates IM simply as a percentage of notional exposure ranging from 1% for interest rates swaps with a tenor under two years to 15% for commodity swaps.

The internal model, on the other hand, is a heavier lift. Internal models must calculate margin that is equal to the potential future exposure using a one-day, 99% confidence interval over a holding period of 10 days or less. Netting and offsetting is allowed, but only if all underlying swaps are part of the same master netting agreement.

Furthermore, to provide a holistic picture of the underlying swap’s risk profile, internal models must capture all material sources of risk. This process will be challenging, especially for more complex and esoteric trades involving multiple risk factors (e.g., FX risk, interest rate risk, credit risk, and equity risk) that must be deconstructed and modeled separately. Finally, internal models must be approved by national regulators, subject to appropriate governance and controls, reviewed at least annually, and independently back-tested both prior to implementation and on an on-going basis.

Due to these complexities, it is likely that internal models at different swap entities would calculate exposures differently, which would result in margin disputes among counterparties and trades not being put on. To avoid such an outcome, the International Swaps and Derivatives Association (ISDA) has developed a Standard Initial Margin Model (SIMM) with the industry to establish a common methodology. The uptake of this effort globally will depend on the degree to which regulatory approaches are aligned in different jurisdictions. Regardless, standard models will still require individual regulatory approval, and internal review and maintenance.

What collateral is eligible to satisfy margin requirements?

The final rule expands the scope of assets eligible as collateral for both IM and VM to alleviate concerns around potential shortage of high quality liquid collateral that would have likely resulted from the proposed requirements. Similar to the approach taken by central counterparties, the final rule applies haircuts to these assets that are commensurate with asset risks.

Most notably, under the final rule, non-cash collateral (with applicable haircuts) that is eligible as IM [8] can also be used to satisfy VM requirements in trades between a swap entity and financial and non-financial end users. VM for trades between two swaps entities is still limited to cash, as proposed, but the final rule expands the scope of eligible currencies from the proposal’s US dollars to include any major currency. [9]

The table below provides more details on collateral eligibility under the final rule.

What limitations exist around collateral handling and reuse?

To address risks associated with collateral recovery in the event of a counterparty’s insolvency, the final rule requires segregation of IM (but not VM) with an independent third party custodian (similar to the proposal). Unlike the proposal, however, the final rule allows the posting counterparty to substitute collateral with assets that would qualify as eligible collateral themselves (e.g., corporate securities).

In addition to requiring segregation, the rule also prohibits re-hypothecation of the funds held by the custodian. This restriction remains largely unchanged from the proposal, except that under the final rule a custodian may hold cash collateral in a general deposit account if the funds are used to purchase collateral-eligible assets. This change is likely to increase the cost of collateral due to increased demand for eligible assets, and to force efficient use of existing collateral through optimization methods such as “cheapest to deliver.”

What about swaps transactions with affiliates?

Margin requirements for affiliate transactions were one of the most controversial aspects of the 2014 proposal, due to their cost implications on widely used back-to-back booking models. In response to industry’s concerns, the final rule provides some relief for IM requirements, but only in trades with affiliates that are not swap entities themselves. Collection and posting of VM remains mandatory vis-à-vis all affiliates.

Most notably, the final rule requires a swap entity to only collect IM in transactions with affiliates that are financial end users with material exposure. However, while the swap entity does not have to post, it must calculate the amount of IM that otherwise would have been required, and report it to the affiliates on a daily basis. In addition, the final rule also establishes a $20 million de minimis threshold per affiliate (for both collection and daily reporting), and allows the swap entity itself or an affiliate to act as custodian. The table below provides an overview of these requirements.

It should be noted that affiliate swap transactions are also subject to a similar but separate regulatory regime: Sections 23A/B of the Federal Reserve Act, as implemented by the Federal Reserve’s Regulation W (Reg W). Reg W seeks to protect banks (and its subsidiaries) within a holding company by imposing collateral (and other) requirements on certain transactions between the bank and its nonbank affiliates.

How are cross border transactions handled?

Uncleared swaps between foreign swap entities are not subject to the final rule’s requirements. In defining the swaps that benefit from this exclusion, the banking regulators’ approach generally relies on the jurisdiction in which the counterparties are incorporated, which is simpler than the CFTC’s now-infamous “US person” definition approach. [10]

The final rule’s definition of “foreign swap entity” excludes US branches and subsidiaries of foreign banks, as well as foreign branches, offices, and subsidiaries of US firms.

Furthermore, to benefit from this exclusion, an uncleared swap should not involve a counterparty or guarantor on either side that is a US resident or US-registered entity (including its foreign branches, offices, or subsidiaries).

The final rule would allow foreign swap entities and US branches of foreign banks (and certain other foreign counterparties) to substitute compliance with their home jurisdiction regulations, as long as the foreign regulatory framework is determined to be comparable to the US’s.

While this will ease the regulatory burden on foreign counterparties that would otherwise have to comply with two separate regulatory regimes, recent experience has shown that comparability determinations could take years to finalize. Making such determinations is easier said than done, as demonstrated by the CFTC’s experience with cleared derivatives. [11] If not done promptly by the US banking regulators, the result will be even more bifurcated liquidity pools (attempting to avoid US regulations) as is now well-known to swap exchanges under CFTC rules (i.e., SEFs). [12] Foreign entities should prepare for the worst case scenario, i.e., compliance with both US and home jurisdiction uncleared margin requirements, in the absence of no-action relief.

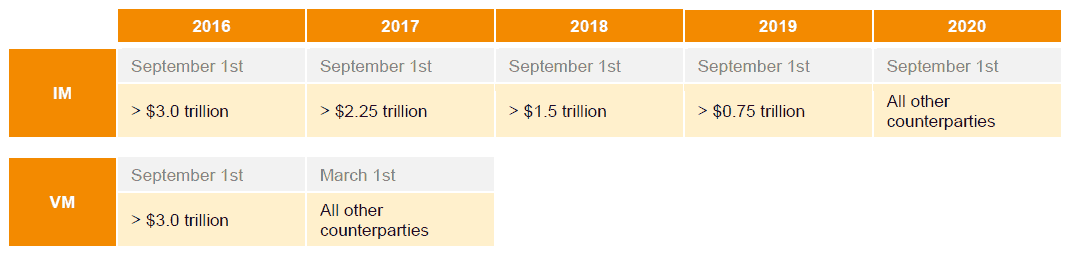

What is the compliance timeline?

The final rule’s compliance timeline is largely aligned with international standards and market expectations. However, consistent with the rule’s risk-based approach, the timeline is staggered, starting earlier for counterparties with higher swaps exposure, as detailed in the table below.

How should market participants respond?

Compliance begins with a strategic assessment of current business models, and operational and technology infrastructure. Additionally, entities will need to negotiate and modify agreements with counterparties and third party service providers to facilitate the calling, collecting, and segregation of margin. To that end, entities should take the following actions.

Strategic planning and analysis

- Perform hypothetical margin calculations and compare IM cost using internal models against the final rule’s standardized margin schedule

- Carry out counterparty and trade flow analysis to assess the funding and liquidity impact of margin requirements

- Determine the rule’s impact on the current cross-border portfolio, taking into account future strategic growth plans

- Analyze the existing internal collateral haircuts versus the final rule’s, to address potential collateral shortage/excess in the future

- Explore alternative strategic options, such as possible migration from OTC to cleared swaps

and futures

Operational and infrastructure review

- Review collateral management platforms and assess improvements needed to calculate margin requirement under the final rule, including risk-based collateral haircuts

- Assess resources and operational capabilities needed to address increased disputes and to manage margin calls

- Determine the need to negotiate and execute new contracts (tri-party arrangements)

- Evaluate current model risk standards around reporting lines, governance structure, model parameters, and documentation/controls

- Establish a process to independently review the IM model on an annual basis to assess the effectiveness of the model and the underlying controls

Endnotes:

[1] The major US banking regulators are the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (FDIC). The release of the final rule on October 22nd by the FDIC was followed by the Federal Reserve’s release on October 30th. Banking regulators also issued a narrow interim final rule exempting certain counterparties (e.g., certain non-financial entities, cooperatives, and treasury affiliates) from initial and variation margin, pursuant to the Terrorism Risk Insurance Program Reauthorization Act of 2015.

(go back)

[2] Figure derived using 2014 clearing volumes and assumes FX and Commodity products are not available for central clearing.

(go back)

[3] See PwC’s First take: Uncleared margin re-proposal (September 2014).

(go back)

[4] These standards were proposed in September 2013 jointly by the Basel Committee on Banking Supervision and the Board of the International Organization of Securities Commissions. See PwC’s Regulatory brief, Margin on uncleared swaps: Global agreement in theory but not yet in practice (September 2013).

(go back)

[5] Other noteworthy areas that are generally consistent with international standards, and the EU’s and Japan’s proposed regulations, include: minimum transfer amounts that define when collateral must be exchanged to satisfy VM calls and certain rehypothecation restrictions on initial margin that has been posted to satisfy a collateral shortfall.

(go back)

[6] While the international standards mentioned the need for affiliate transactions to require collateral, it did not set forth any hard or fast rules, instead leaving the issue up to national regulators.

(go back)

[7] This threshold applies at the aggregate level (i.e., the entity and its affiliates) and is calculated using average daily aggregate notional amount over June, July, and August of the previous calendar year.

(go back)

[8] This eligible IM includes (in addition to the proposal’s government and cash collateral instruments) certain corporate debt securities, US and foreign public debt, gold, and certain listed equities.

(go back)

[9] An additive 8% haircut is applied for cross-currency collateral to account for currency mismatches in the margin posted versus the underlying derivative contract. Note that the proposal also allowed margin in the currency of settlement (if non-USD).

(go back)

[10] See PwC’s First take: SEC’s cross-border derivatives rule (June 2014) (discussed on the Forum here), and Regulatory brief, Derivatives: A first take on cross-border comparability (December 2013).

(go back)

[11] See Regulatory brief cited in prior note.

(go back)

[12] See PwC’s Regulatory brief, Derivatives: SEFs – Opening bell sounds (June 2013).

(go back)

Print

Print