Shai Bernstein is Assistant Professor of Finance at Stanford University. This post is based on an article authored by Professor Bernstein and Albert Sheen, Assistant Professor of Finance at the University of Oregon.

The private equity asset class has grown tremendously over the last thirty years, reaching $1.6 trillion in global transaction value between the years 2005 to 2007. At the same time, private equity (“PE”) firms generate much controversy. Critics argue that PE transactions are largely financial engineering schemes, burdening portfolio companies with high leverage and an excessive focus on short-term financial goals and cost cutting, which may adversely affect customers, employees, and long-term firm viability. In contrast, proponents argue that leveraged buyouts provide a superior governance form leading to better managed companies by mitigating management agency problems through the disciplinary role of debt, concentrated and active ownership, and high-powered managerial incentives which can lead to improved operations.

In our paper, The Operational Consequences of Private Equity Buyouts: Evidence from the Restaurant Industry, forthcoming in the Review of Financial Studies, we explore how PE firms affect the operations of their portfolio companies by examining the restaurant industry between 2002 and 2012. Focusing on the restaurant industry allows us to take advantage of health inspections data, which uniquely captures store-level operational practices. All restaurants in the U.S. are regulated and subject to periodic surprise inspections, as guided by the U.S. Food and Drug Administration (FDA). Examples include ensuring that food is held at proper temperature, personal hygiene of workers is adequate, toxic substances are stored properly, and food surfaces are sanitized. Such operational practices have been found to be associated with higher revenue and fewer foodborne illness hospitalizations.

Our main finding is that health related operational practices improve after a chain is acquired by a private equity firm. The number of violations at a given restaurant falls steadily over the next few years, reaching a 25% average reduction in four years. The reductions are concentrated in violations deemed critical by the FDA. This decline is relative to inspection results at competing restaurants in the same neighborhood, thus controlling for any local trends and time-varying demographics which may be affecting restaurants.

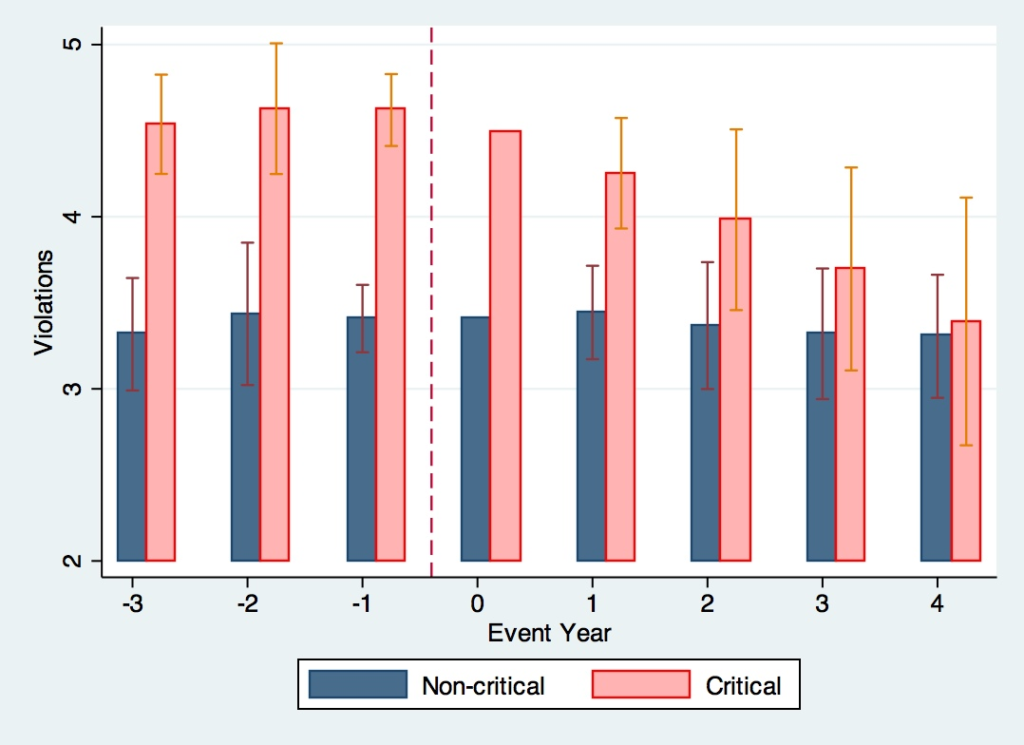

Figure 1: Critical and non-critical violations around private equity deal date

This figure plots the average number of critical and non-critical violations, along with 95% confidence interval bands, found at restaurants acquired by private equity firms. The acquisition occurs in event year zero. The graph was generated by regressing critical and non-critical violations on event year dummy variables and other controls (restaurant fixed effects, zip code-by-year fixed effects, number of employees, and number of seats) and then adding the average number of critical and non-critical violations to the resulting event year coefficients.

Of course, the key question is whether private equity firms actually cause these operational changes. An alternative explanation is that perhaps private equity firms simply happen to select chains on the verge of improving their stores. The ideal laboratory experiment would take two identical chain stores and give private equity ownership over one but not the other. If these restaurants’ fortunes diverge, the difference can be attributed to private equity ownership.

We exploit the popularity of franchising in the restaurant industry to run a close variation of this experiment. A given chain store can be owned by a franchisee or directly by the parent firm. Franchises are legally independent entities bound contractually to keep features such as brand, menu, and appearance the same as in stores owned directly by the parent. Customers are unable to distinguish between company-owned and franchised units, and thus both store types likely experience similar trajectories. Headquarters, however, have limited ability to tell franchisees what to do beyond what the franchise contracts specify (hence the common phrase in advertisements, “at participating restaurants only”). This setting allows us to compare essentially twin stores that differ only in their ownership structure and thus degree of PE influence at the time of the buyout. If PE firms actively affect the operations of their portfolio companies, any changes will manifest more strongly in the directly owned stores. We find, indeed, a divergence: a chain’s parent-owned stores improve much more than its franchised units, that is, the improvements occur in stores in which PE firms have more influence and authority. Thus, private equity firms appear to be responsible for better health inspections.

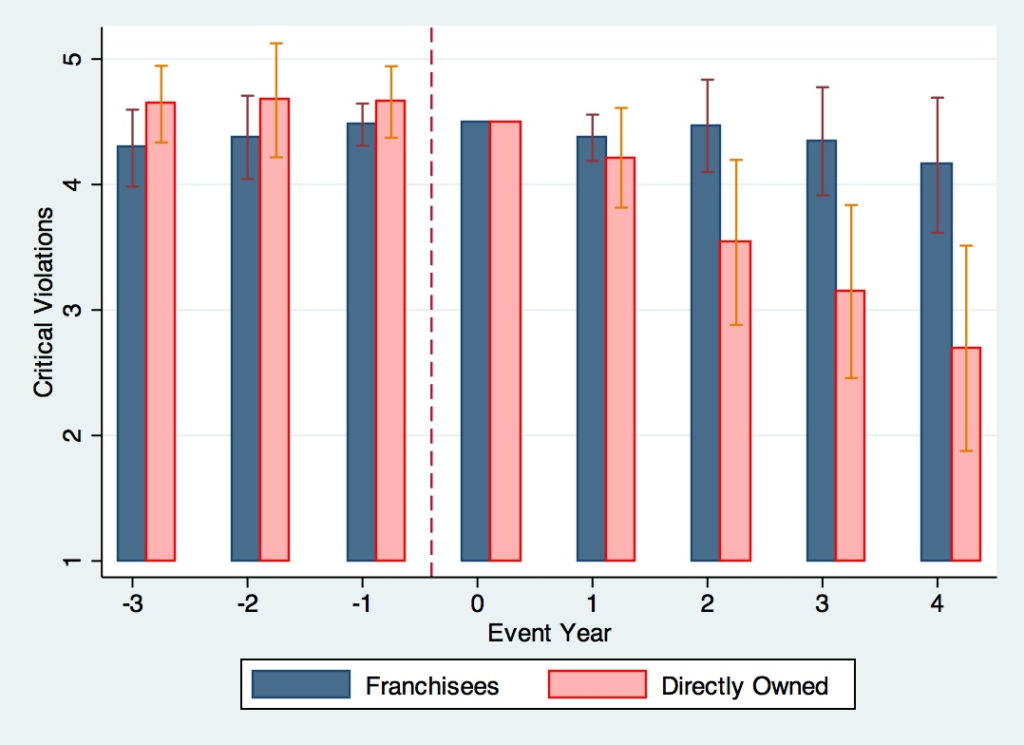

Figure 2: Franchisees and directly owned restaurants around private equity deal date

This figure plots the coefficients and 95% confidence interval bands of regressions of critical violations per inspection by directly owned and franchised stores on event year dummy variables around the date private equity acquires a restaurant. Additional control variables are restaurant fixed effects, zip code-by-year fixed effects, number of employees, and number of seats.

How do private equity firms accomplish this? One possibility is that they hire additional workers for cleaning and maintenance. We find, however, that there is a slight decline in the average employee count per store after takeover. We next explore the backgrounds of the private equity firm partners. We find that deals led by partners with prior operational experience, particularly in the restaurant industry, show greater improvement in inspection results than those led by partners with financial or banking resumes. This is consistent with operational expertise being a key element of the private equity toolkit. The private equity business model involves acquiring companies and reselling them, hopefully at a profit. Our results provide empirical support to the hypothesis that PE firms improve firm operations, and in that case, also benefiting directly the customers.

The full paper is available for download here.

Print

Print