Julie Hembrock Daum leads the North American Board Practice at Spencer Stuart, and Susan Stautberg is the Chairman and CEO of the WomenCorporateDirectors Foundation. This post relates to the 2016 Global Board of Directors Survey, a co-publication from Spencer Stuart and the WCD Foundation authored by Ms. Daum; Ms. Stautberg; Dr. Boris Groysberg, Richard P. Chapman Professor of Business Administration at Harvard Business School; Yo-Jud Cheng, doctoral candidate at Harvard Business School; and Deborah Bell, researcher.

The growing demands on corporate boards are transforming boardrooms globally, with directors taking on a more strategic, dynamic and responsive role to help steer their companies through a hypercompetitive and volatile business environment. Economic and political uncertainties make long-term planning more difficult. The proliferation of cyber attacks—and their consequences for business in financial losses and reputational damage—increases the scope of risk oversight. A rise in institutional and activist shareholder activity requires boards to identify vulnerabilities in board renewal and performance and, in some cases, establish protocols for engagement. And all of these demands have pushed issues around board composition and diversity to the fore, as boards cannot afford to have directors around the table who aren’t delivering value.

In this context, Spencer Stuart, the WomenCorporateDirectors (WCD) Foundation, Professor Boris Groysberg and doctoral candidate Yo-Jud Cheng of Harvard Business School and researcher Deborah Bell partnered together on the 2016 Global Board of Directors Survey, one of the most comprehensive surveys of corporate directors around the world.

We received responses from more than 4,000 male and female directors from 60 countries, providing a comprehensive snapshot of the business climate and strategic priorities as seen from the boardroom of many of the world’s top public and large, privately held companies.

The survey explores in depth how boards think and operate. It captures in detail the governance practices, strategic priorities and views on board effectiveness of corporate directors around the world. It also confirmed many of our observations from working with boards. The economy is top of mind, and many directors are uncertain about economic prospects and not seeing growth in the future. At the same time, directors are responding proactively to the many new demands they face, looking for opportunities to enhance composition and improve board performance.

Findings compare and contrast the views between male and female corporate board directors, and highlight similarities and differences between public and private companies and among directors from different regions in five key areas:

- Political and economic landscape

- Company strategy and risks

- Board governance and effectiveness

- Board diversity and quotas

- Director identification and recruitment

This post highlights key findings around these topics, providing directors an overview of how their peers view their own boards and the challenges that their companies face. In subsequent reports, we will dive deeper into specific governance areas and explore additional perspectives on board composition, risk areas, and strengths and weaknesses in boardrooms today.

Key Findings

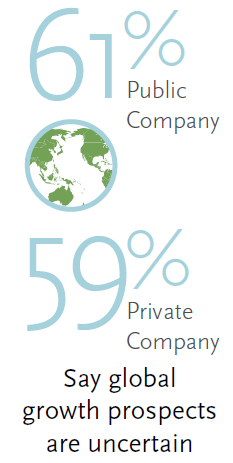

Political and Economic Landscape: Uncertainty dominates boardroom outlook.

Our survey finds that directors around the world are uncertain about global growth prospects, with directors in North America and Western Europe least confident about the prospects for growth. Sixty-three percent of directors in these regions see uncertain economic conditions, compared with 36% in Asia and 40% in Africa.

Our survey finds that directors around the world are uncertain about global growth prospects, with directors in North America and Western Europe least confident about the prospects for growth. Sixty-three percent of directors in these regions see uncertain economic conditions, compared with 36% in Asia and 40% in Africa.

Only 2% of directors across all regions predict a period of strong global growth over the next three years, while 16% expect a global slowdown. “This pessimism about growth is one of the most surprising findings of our survey,” said Boris Groysberg of Harvard Business School. “It seems that the market volatility and low prospects for growth as well as the unpredictable economic outlook are what keep board members awake at night.”

More than one-third of directors of companies headquartered in Asia and roughly one-quarter of directors of companies in Australia/New Zealand expect relatively faster growth in emerging economies versus developed countries.

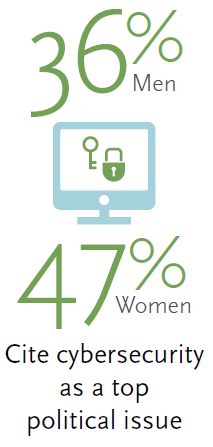

Political and Economic Landscape: Economy, regulations and cybersecurity top issues for directors.

Across all industries and regions, directors rank the economy and the regulatory environment as the political issues most relevant to them. Cybersecurity is an increasingly important issue in many regions. More than one-third of directors of companies in Australia/New Zealand, North America and Western Europe say cybersecurity is a top issue. “Cybersecurity continues to be a leading issue on the agenda from a regulatory, reputational and contingency standpoint,” says Julie Hembrock Daum, head of Spencer Stuart’s North American Board Practice.

“We see boards considering a number of different approaches to getting smart about the broader impact of technology on the business. In certain cases they have added a director with a strong digital or security background. However, the board should not isolate cybersecurity responsibility with just this one board member, but continue to view cybersecurity as a full board priority.”

Political instability is a concern in several regions. In Central and South America, one-half of directors cite political instability as an issue. Corporate tax rates are an issue particularly in North America.

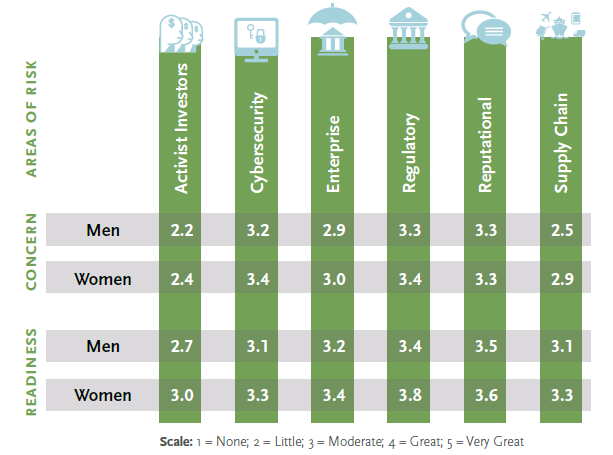

Company Risks: Women directors report higher concerns about risk than male directors.

Directors globally express the most concern about regulatory and reputational risks, followed by cybersecurity, and less about activist investors and supply chain risks. In general, directors report that their companies are prepared to handle the most important risks, with companies’ level of readiness matching the most concerning areas of risk. However, directors of private companies systematically rank their boards as being less prepared versus public company boards when it comes to such risks.

Nearly across the board, female directors report a higher level of concern about various risks to a company than their male peers—from concerns about activist investors and cybersecurity to regulatory risk and the supply chain. However, female directors also feel that their companies have a higher level of readiness to address these risks than do their male cohorts.

Susan Stautberg, chairman and CEO of the WCD Foundation, believes that women directors may be educating themselves more about the potential risks:

“We believe that women in particular bring a real thirst for knowledge and curiosity to their board service, and this includes getting up-to-speed on what the real risks are to an organization. All good directors do this, but we think being relatively new to the boardroom can create a greater sense of urgency to learn.”

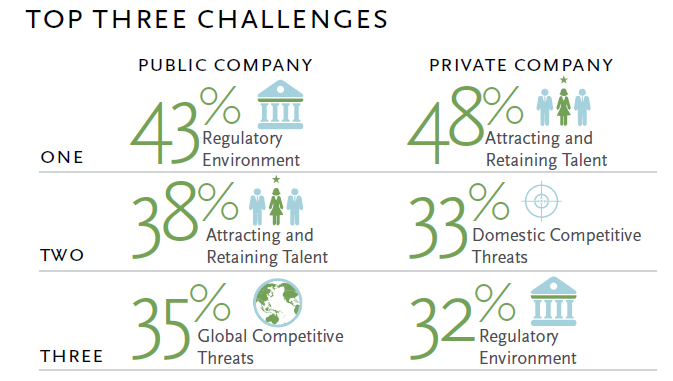

Strategy: Top challenges differ for public and private companies.

Talent, regulations, global and domestic competition, and innovation are seen by directors as the top impediments to achieving their companies’ strategic objectives. How those challenges rank specifically depends in part on whether directors are serving public or private companies.

Nearly half of private company directors (versus 38% of public company directors) rate attracting and retaining talent as a key challenge to achieving their company’s strategic objectives. This is followed by domestic competitive threats, the regulatory environment, innovation and global competitive threats. Among public companies, 43% of directors (versus 32% of private company directors) say the regulatory environment is a top challenge, followed by attracting and retaining talent, global competitive threats, innovation and domestic competitive threats.

“This was interesting because we do see in larger, more established public companies a greater maturity in their HR processes and deeper resources invested in talent management and development,” says Daum. “Identifying and recruiting individuals who fit the culture, bring impact to the organization and endure is a high priority for nearly all companies. However, many private companies, which tend to be smaller and have less brand awareness as a whole, often have less robust HR structures to attract the level of talent across the organization.”

Perceived challenges also differ somewhat by industry and region, with the regulatory environment being more concerning for companies in the energy/utilities, financials/professional services and healthcare industries, and in Asia, Australia/New Zealand, North America and Western Europe. Global competitive threats are the leading concern for companies in the industrials and materials sectors, and in Western Europe.

Interestingly, while cybersecurity is viewed as an important risk, few directors consider it a major challenge to achieving strategic objectives. Similarly, activist shareholders, compensation, cost of commodities and supply chain risk are not perceived as challenges to achieving strategic goals.

Boardroom Grades: Directors consider boards weaker in people-related processes.

On average, directors rate their board’s overall performance as being slightly above average (3.7 out of 5). Directors see their boards as having the strongest processes related to staying current on the company and the industry, compliance, financial planning and board composition, and weakest in cybersecurity, the evaluation of individual directors, CEO succession planning and HR/talent management.

“These ratings underscore directors’ views that attracting and retaining top talent is a common challenge, and underline the need for these HR competencies on boards,” says Stautberg. Harvard Business School doctoral candidate Yo-Jud Cheng adds, “Despite the fact that directors recognize their weaknesses in these areas, boards continue to prioritize more conventional areas of expertise, such as industry knowledge and auditing, in their appointments of new directors.”

Public company directors rate their overall board performance slightly higher than private company directors (3.8 versus 3.4) and give themselves higher marks for creating effective board structures, evaluation of individual directors, cybersecurity and compliance. We also see some variation across regions.

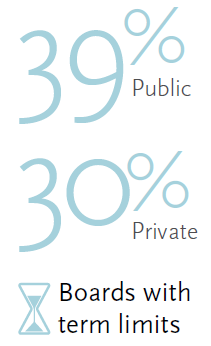

Board Turnover: Directors—especially women—favor tools to trigger change.

A little more than one-third of boards have term limits for directors, averaging six years, while approximately one-quarter of boards have a mandatory retirement age, averaging 72 years. Boards in Western Europe are most likely to have term limits, and boards in North America are least likely to set term limits. However, boards in North America are more likely to have a mandatory retirement age than boards in Western Europe (34% versus 18%). We also see a stark contrast between public and private companies in both term limits (39% versus 30%) and mandatory retirement ages (33% versus 12%).

While these tools for triggering director turnover generally have not been widely adopted, the survey indicates that directors favor adoption of such mechanisms. Sixty percent of directors think that boards should have mandatory term limits for directors, and 45% think that there should be a mandatory retirement age. Even in private companies, which are considerably less likely to adopt these practices today, directors shared similar opinions as compared to their counterparts in public companies. Female directors even more strongly support triggers for turnover; 68% (versus 56% of men) favor director term limits and 57% (versus 39% of men) support mandatory retirement ages.

“It was encouraging to see the majority of respondents in favor of retirement ages and term limits. Turnover among S&P 500 companies has trended at 5% to 7%—roughly 300 to 350 seats a year. Boards need tools they can use to ensure that new perspectives and thinking are regularly being brought to the boardroom,” says Daum. “This isn’t just an issue tied to activist shareholders, but something institutional shareholders are asking about as well: what are boards doing to ensure independent and fresh thinking?”

Not surprisingly, 43% of directors believe that a director loses his or her independence after about 10 years. Respondents from North America are less likely to tie director independence to years served, with only one-third agreeing that a director loses independence after a certain amount of time on the board.

Not surprisingly, 43% of directors believe that a director loses his or her independence after about 10 years. Respondents from North America are less likely to tie director independence to years served, with only one-third agreeing that a director loses independence after a certain amount of time on the board.

Board Diversity: Greater independence doesn’t always drive greater diversity.

Public companies represented in the survey have larger boards than private companies—on average 8.9 directors versus 7.6—and a larger representation of independent directors, 74% versus 54%. Yet, public and private company boards are similar in terms of the representation of women, minorities and new directors. On average, 18% of board members are women, 7% are ethnic minorities and 13% have been appointed in the past 12 months.

“This finding was very interesting. There has been much debate about the use and effectiveness of quotas. To see the relative parity of diversity among public and private companies reinforces that the tone needs to come from the top regarding bringing a fresh, diverse perspective representative of the company’s stakeholders and interests,” says Daum. Groysberg adds, “Although we are hearing more talk about the importance of diversity from boards, it’s not necessarily translating into numbers. Unfortunately, we haven’t seen as much progress as we were hoping for compared to our past survey on the diversity of boards.”

Boards are largest in the financials/professional services sector (9.1 directors) and smallest in the IT/telecom sector (7.5 directors). Female representation is highest (20% or more) in the consumer staples, financial services/professional services and consumer discretionary sectors, and lowest in IT/telecom (13%).

Looking across regions, board size is smallest in Australia/New Zealand, where boards average 6.7 members, as compared to the global average of 8.5 members. Boards in Australia/New Zealand and North America have the highest proportion of independent directors, and boards in Asia have the lowest proportion. Female representation is lowest in Central and South America and Asia.

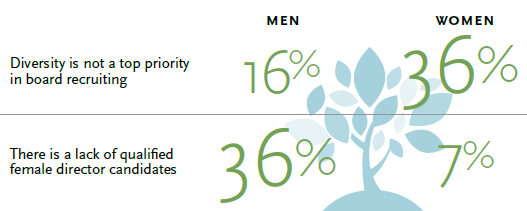

Boardroom Diversity: Why isn’t the number of women on boards increasing?

As the percentage of women on boards remains stagnant, there is both a gender divide and a generation divide on why this is. Male directors, especially older respondents, report the “lack of qualified female candidates,” while women directors most often cite the fact that diversity is not a priority in board recruiting and that traditional networks tend to be male-dominated. Younger male directors surveyed (those 55 and younger) are inclined to agree with women that traditional networks tend to be male-dominated. “Men in the younger generation, I think, just see their qualified female colleagues out there, but know that the traditional board networks still tend to be male,” says Stautberg. “It’s often hard to see an informal ‘network’ if you are in the middle of it, but you can see it very clearly when you’re on the outside.”

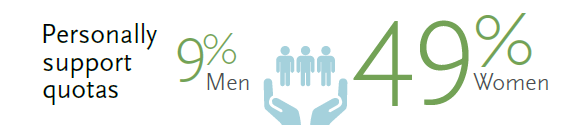

Boardroom Diversity: Quotas not supported overall.

Nearly 75% of surveyed directors do not personally support boardroom diversity quotas, but support for quotas varies significantly by gender and, to a lesser degree, by age. Forty-nine percent of female directors support diversity quotas, but only 9% of male directors do. Older women are less likely to favor quotas than younger women; 67% of female directors ages 55 and younger personally support boardroom quotas, compared with 36% of female directors over 55 (the majority of male directors, of any age, do not support quotas). Female directors also are more likely to be in favor of government regulatory agencies requiring boards to disclose specific practices/steps being taken to seat diverse candidates (43% versus 14% of male directors).

If quotas aren’t the answer, what do directors think would increase board diversity? Male and female directors agree that having board leadership that champions board diversity is the most effective way to build diverse corporate boards. Men feel more strongly than women that efforts to develop a pipeline of diverse board candidates throu gh director advocacy, mentorship and training is an effective way to increase diversity.

gh director advocacy, mentorship and training is an effective way to increase diversity.

Directors as a whole agree that shareholder pressure and board targets are less effective tools for increasing board diversity.

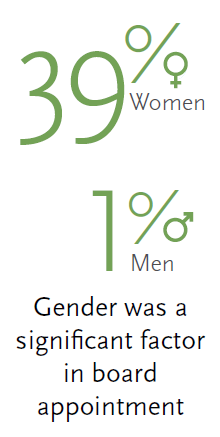

Boardroom Diversity: Search firms have been successful in expanding the talent pool of qualified female directors.

Directors take a variety of pathways to the boardroom: in roughly equal measures, directors were known to the board or another director, recruited by a search firm or known by the CEO. Public company directors are more likely to be recruited by an executive search firm than private company directors, while private company directors are more likely to have been appointed by a major shareholder.

The survey highlights gender differences, as well, in the paths to the boardroom. Female directors are more likely than their male counterparts to have been recruited by an executive search firm, while male directors are more likely to have been appointed by a major shareholder. “Search firms may be able to open doors that networking opportunities may not have been doing until relatively recently, at least for women,” says Stautberg. “Building up networks and getting known is something that women directors are engaging in much more actively now.”

And, indeed, 39% of female directors report that their gender was a significant factor in their board appointment, versus 1% of men.

Conclusion

Corporate boards face no shortage of challenges—from economic uncertainty to strategic and competitive shifts to a dynamic set of risks. Investor attention to board performance and governance has also escalated, and many boards are holding themselves to higher standards. Directors want to ensure that their boards contribute at the highest level, incorporating diverse perspectives, aligning with shareholder interests and setting a positive tone at the top for the organization.

Yet our research has revealed a gap between best practice and reality, especially in areas such as board diversity, HR/talent management, CEO succession planning and director evaluations. But the study provides hope that boards will make progress, as directors support practices that can help promote change. Future research is needed to track progress on these fronts and to study the impact of measures such as quotas and diversity on board performance.

Amid the many challenges confronting corporations—and the growing expectations on corporate boards—directors must be thoughtful about defining the skill sets needed around the board table and diligent in recruiting the right directors, planning for CEO succession and evaluating their own performance. In this way, they will be best positioned to contribute at the high levels which they are demanding of themselves, and to which others are holding them accountable.

The complete publication is available here.

Print

Print