Paula Loop is Leader of the Governance Insights Center at PricewaterhouseCoopers LLP and Arthur H. Kohn is a partner at Cleary Gottlieb Steen & Hamilton LLP. This post is based on a co-publication from PwC and Cleary Gottlieb Steen & Hamilton LLP. Related research from the Program on Corporate Governance includes the book Pay without Performance: The Unfulfilled Promise of Executive Compensation, by Lucian Bebchuk and Jesse Fried.

More and more, we are seeing boards engage with shareholders and other stakeholders about executive compensation. But what has motivated this new attitude? We take a closer look at the drivers behind it, including provisions of the Dodd-Frank Act, the role of proxy advisors and shareholder pressure, and offer advice on how boards can do a better job of talking to shareholders and other stakeholders about the issue.

The impact of Dodd-Frank on executive compensation

The Dodd-Frank Act, signed into law in July 2010 in the wake of the financial crisis, focused on financial system reform. It also included a number of corporate governance provisions targeting executive compensation at US public companies, including:

- Mandating a shareholder advisory vote on pay practices (“say on pay”), and a similar advisory vote on golden parachutes

- Strengthening independence requirements for compensation committee members

- Strengthening rules regarding use of consultants by the compensation committee

- Mandating disclosure of the ratio between CEO pay and the median employee pay

- Mandating disclosure of the relationship between pay and performance

- Mandating executive compensation clawback policies in the case of restatements

- Requiring disclosure of hedging policies covering employees, officers, and directors

Say on pay

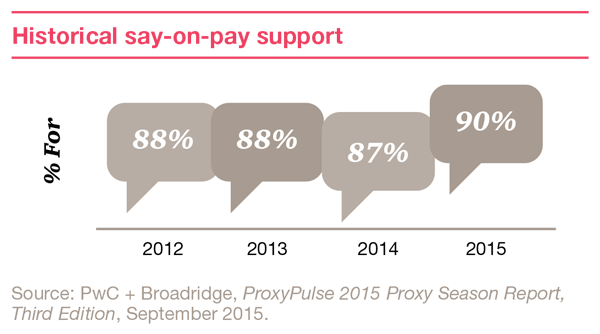

Since 2011, the Dodd-Frank Act has mandated a non-binding shareholder vote on a company’s executive compensation at least once every three years, with most companies opting for an annual vote. On average, shareholder support for say on pay has been strong. In the circumstances when say on pay support is weak, we’ve observed weakened support for directors in the following year. It remains to be seen how new rules from the SEC on the CEO pay-ratio disclosure, as well as anticipated rules on clawbacks and a new pay for-performance disclosure, could impact say on pay voting in the future.

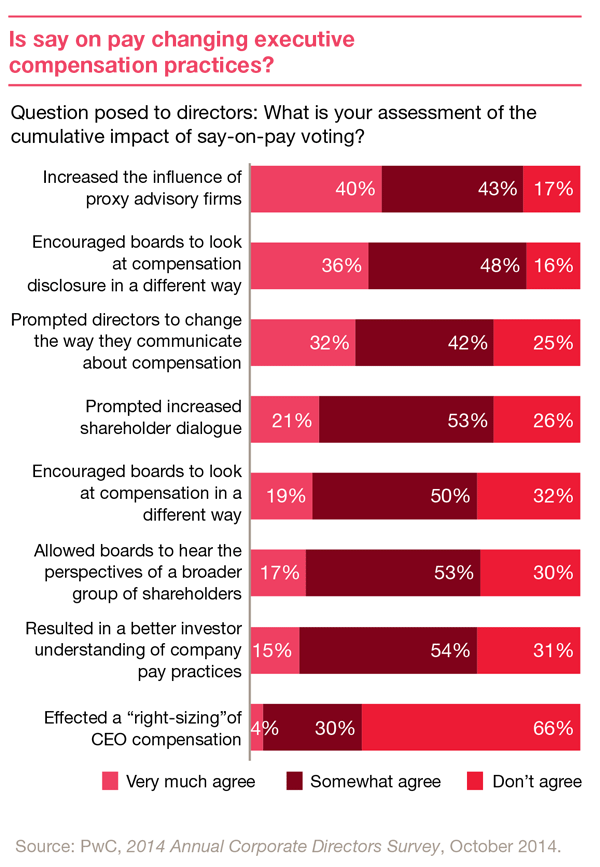

People disagree as to how useful say on pay votes really are. While some claim they strengthen the relationship between directors and shareholders, others argue that they do nothing to control or monitor executive pay. Overall, directors believe these votes have increased the influence of proxy advisory firms and encourage boards to look at compensation disclosure in a different way.

Elements of effective CD&A design

Design and drafting of the Compensation Discussion and Analysis (CD&A) section of the proxy has evolved as companies recognize the need to communicate clearly, not only to their influencers, but to other stakeholders like proxy advisory firms. Some leading design practices that contribute to an effective CD&A include:

- An executive summary highlighting the board’s philosophy on executive pay, changes to the compensation package, and features that might be considered controversial-explaining why the compensation committee believes the features are necessary

- Visual elements like tables, charts, and graphs that help readers understand the information

- Disclosure of What we do and What we don’t do to explicitly address important pay practices (such as tying pay to performance) and highlight the lack of potentially controversial pay features or perks (such as tax gross-ups on perquisites or personal use of corporate aircraft)

The influence of proxy advisors on compensation

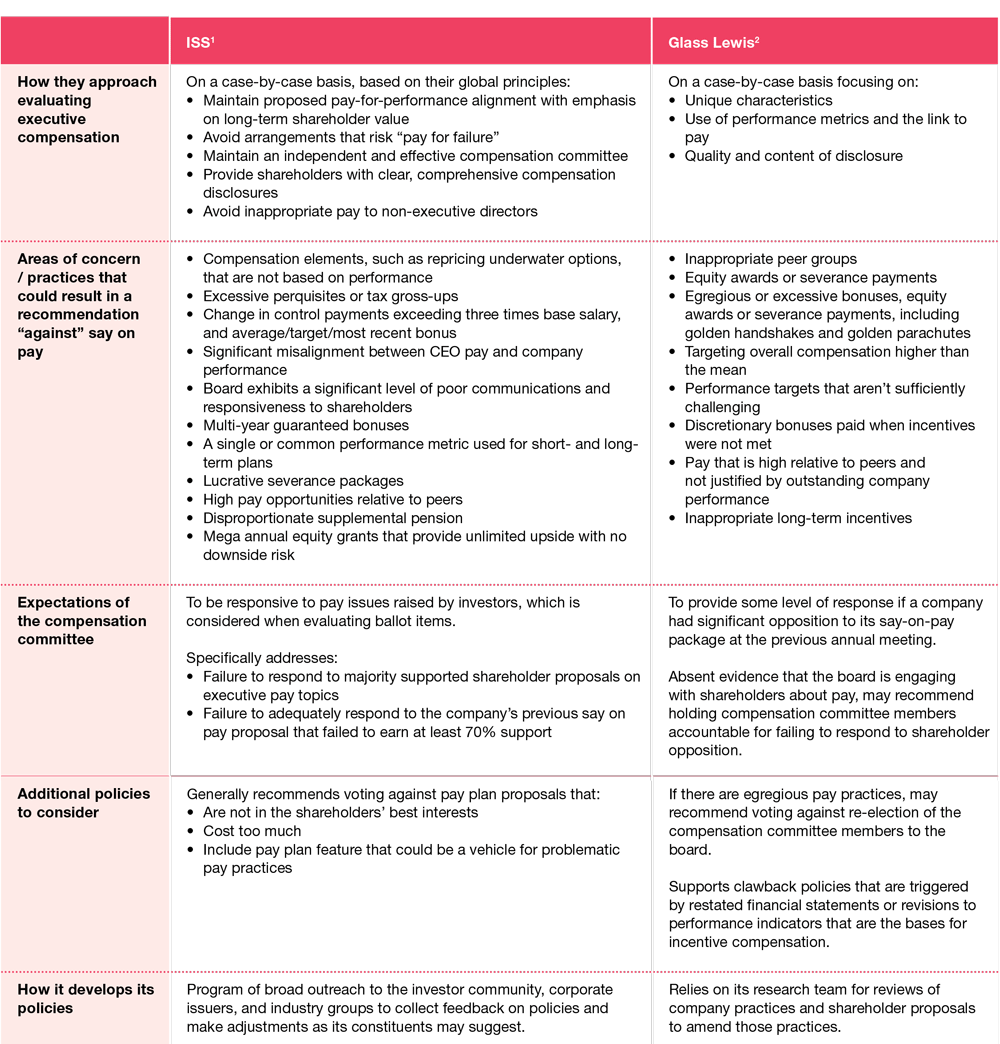

The two largest proxy advisors, with more than 90% combined market share, are Institutional Shareholder Services (ISS) and Glass Lewis. ISS and Glass Lewis analyze the proxies of public companies and make recommendations about how their clients (largely institutional investors) should vote their shares. Each firm makes voting recommendations based on their policies, and these policies are posted on their websites.

Both firms have established processes through which they arrive at their recommendations, but those recommendations are not without controversy. In a January 2014 article by David Larker and Allan McCall of Stanford’s Graduate School of Business, they said “rules based approaches, such as those developed by proxy advisory firms, tend to be based on ‘best practices’-better termed ‘one-size-fits-all best guesses’-that have little or no relation to the specific strategic, competitive, or management situations facing individual companies.”

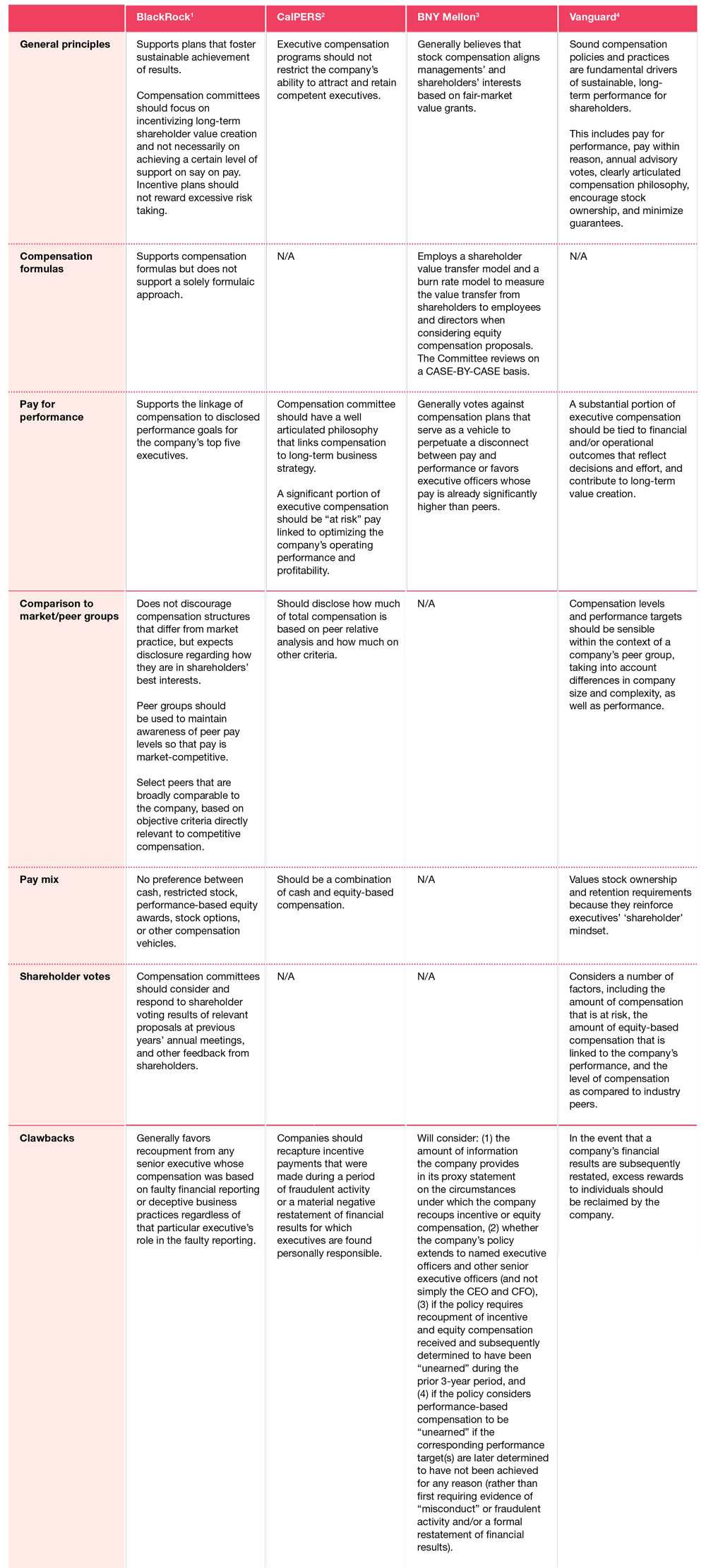

Appendix A compares the voting recommendation policies of ISS and Glass Lewis for executive compensation issues. Appendix B compares executive compensation voting policies of four large institutional investors.

In light of these proxy advisory firm policies, companies should consider the following actions if they have concerns about a proxy advisor’s recommendations to investors:

- Reach out to the proxy advisors to discuss the recommendation and why the company’s actions were appropriate. Note that scheduling meetings during proxy season may be difficult, and proxy advisors often do not change their recommendations.

- Issue supplementary proxy materials that either explain the company’s position for all shareholders to read, or revise the company’s position to one that is more acceptable to the proxy advisors.

- Reach out to large institutional investors to understand their perspective(s) on the issue(s) and help them understand the company’s position.

Should directors meet with investors about pay?

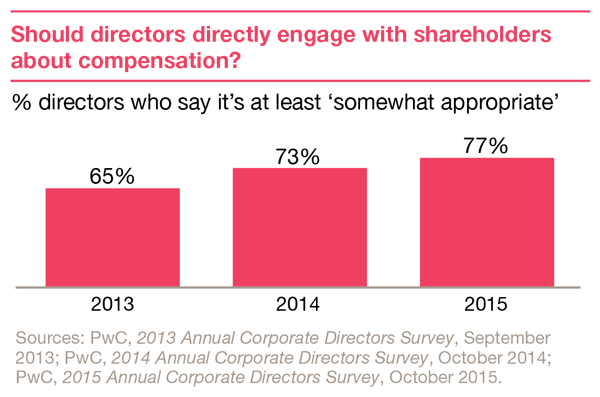

Direct communication between the board and investors is a fairly new phenomenon that largely began with the advent of say on pay voting. Some boards started to reach out directly to select investors to discuss incentive pay, and help them understand the executive behaviors the plan is meant to motivate. When this happens, the compensation committee chair is often called upon to be the point person and to engage in dialogue with those investors.

Steps should be taken to prepare the directors for meeting with investors. To do so, the company should:

- Agree on the agenda with the participants

- Review what information is acceptable to discuss

- Define directors’ roles in the engagement, which is to represent the board

- Prepare directors to demonstrate knowledge of the executive compensation package,the behaviors it is designed to promote, and elements that might be controversial

- Brief the directors on the background of the investors, including its voting policies and voting history with the company

- Advise directors on the roles of the investor representatives, whether they trade the company’s stock, vote the proxies, etc.

Regulation Fair Disclosure

When engaging with shareholders about executive compensation, directors need to be careful not to communicate material non-public information selectively to those shareholders.

The SEC’s Regulation Fair Disclosure (Reg FD) is designed to prevent selective disclosure of such information, and it requires contemporaneous public disclosure when information is inadvertently disclosed. Ordinarily, these concerns should not interfere with efforts to engage with shareholders to explain a company’s executive compensation philosophy and practices, but they should be considered.

Shareholder proposals on executive compensation

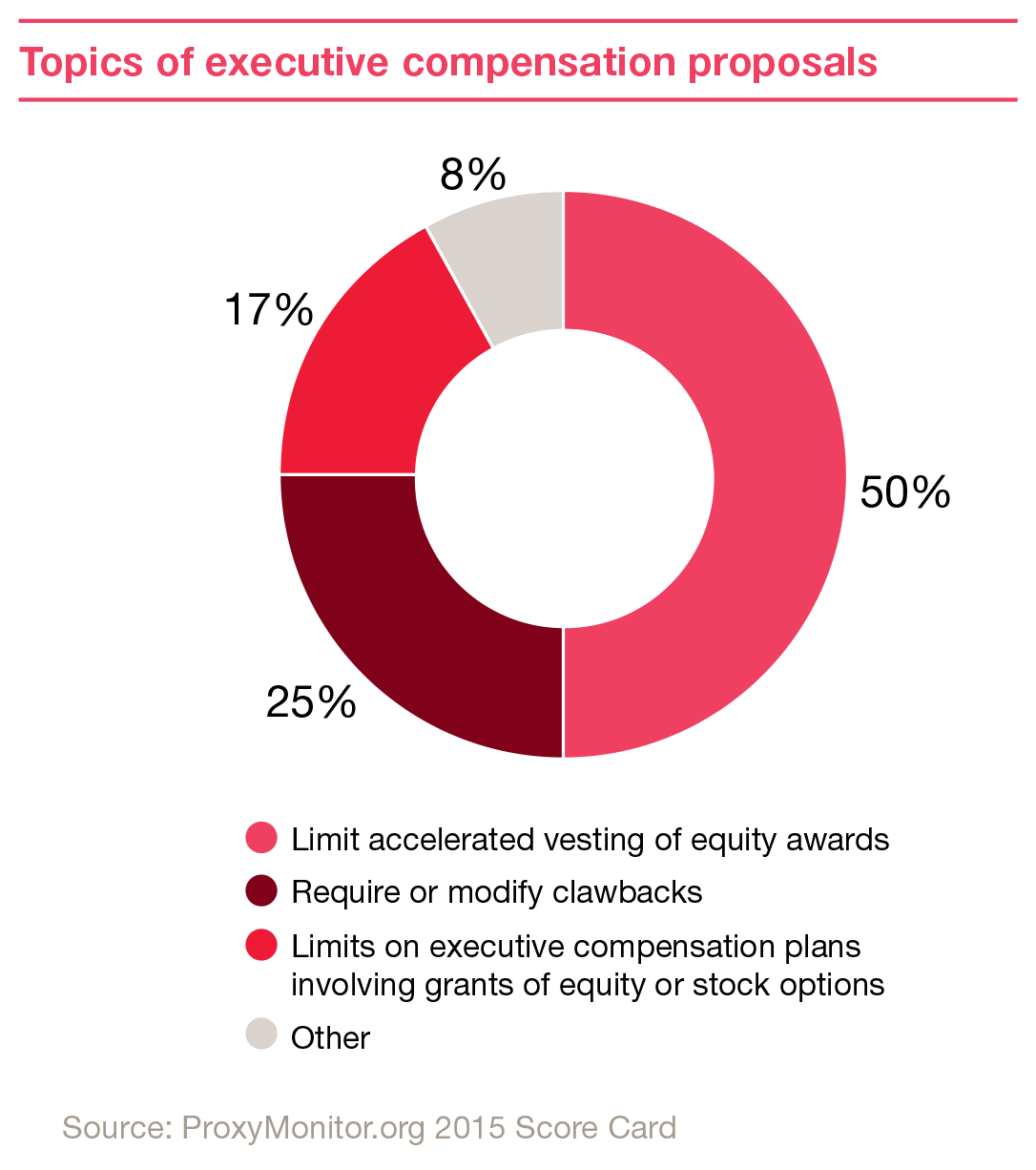

Shareholder proposals on executive compensation have become less common since say on pay votes began in 2011. During the 2015 proxy season, there were 52 such proposals among Fortune 250 companies. [1] Approximately half of these focused on limiting accelerated vesting of equity awards.

Say on golden parachutes

Many compensation arrangements include a change in control (CIC) provision, in which pay is increased or accelerated in connection with a sale or other change in control of the company. CIC agreements may be:

- single-trigger-triggered by the occurrence of the CIC, without anything more needing to happen, or

- double-trigger-when there is both a CIC and the employee separates from the company.

Since CIC provisions are typically built into compensation agreements, they are effectively voted on as part of the company’s say on pay vote.

Nevertheless, in the case of a merger or similar transaction that requires shareholder approval, the CIC package usually must be disclosed to and voted on by shareholders. The vote is advisory only, but reputational risks for the directors may be implicated.

Endnotes

1 Proxy Monitor, Fortune 250 proxy shareholder proposals, 2015, http://www.proxymonitor.org/ScoreCard2015.aspx, viewed June 2016.(go back)

Print

Print