Marc Weingarten and Eleazer Klein are partners at Schulte Roth & Zabel LLP. This post is based on portions of the 2016 Shareholder Activism Insight report by Mr. Weingarten, Mr. Klein, and Jim McNally, published by Schulte Roth & Zabel in association with Activist Insight and FTI Consulting, available here. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here), and Pre-Disclosure Accumulations by Activist Investors: Evidence and Policy by Lucian Bebchuk, Alon Brav, Robert J. Jackson Jr., and Wei Jiang.

In June and July of 2016, Schulte Roth & Zabel commissioned Activist Insight and FTI Consulting to interview 37 respondents from different activist firms. The survey sample consisted of economic activist funds with combined assets under management of $153 billion that have engaged over 420 companies in more than 50 countries in public activist campaigns since 2010, including some of the largest and most high-profile situations. Respondents were asked about their experience with shareholder activism in their respective regions and their expectations for activity in the next 12 months. All respondents are anonymous and results are presented in aggregate.

Schulte Roth & Zabel foreword

Corporate advisers had predicted, or at least hoped, that a combination of factors—increased competition in the activist sector, fewer attractive targets, increased engagement by institutional investors and some poor returns in 2015 and early 2016—would stem the rise of shareholder activism in 2016. While the headwinds led some to believe that activism must have peaked, the activists are having none of it and continue to expect the level of activism to rise. The market has evolved into a complex dance between public companies familiar with the classic activist playbook, newcomers making forays, and seasoned players engaging in unique types of campaigns.

If anyone thought that the vulnerability of multi-billion dollar behemoths such as Apple, Allergan, DuPont and Yahoo in the past two years was an anomaly, activists’ large cap campaigns in 2016 were a wake-up call. The number of campaigns at large cap companies for the first three quarters of 2016 has already surpassed the total number of such campaigns in 2015 by 20%. Given the finite number of large cap companies, however, activists in our survey reported that they do not anticipate significant future activism in the largest companies, with over two-thirds of respondents predicting little to no activist opportunities in the mega cap sector.

With companies now well-studied in classic activist campaign tactics, those targeted by activists know better than to pull from the old bag of tricks like poison pills, shareholder-unfriendly bylaw amendments and litigation. Companies have come to understand that to stand a chance, they must engage in early and open dialogue with investors–both active and passive. Where in the past activists often criticized companies for aggressively attacking their shareholders, many companies have pulled from the shareholder playbook and now regularly accuse agitating shareholders of “not playing nice.”

Regardless of the public posturing of targeted companies and an increase in the average length of time before companies enter into settlement agreements, a majority of activists reported that they were able to more easily settle disputes with management teams in 2016.

In 2014 and 2015, activists running majority slates became a norm, with nearly one-third of proxy contests seeing a majority slate proposed by activists. A significant percentage of respondents expect even more majority slates to be a cornerstone of activist campaigns through 2017.

Proxy contests, however, only represent one tool in the activist playbook. A majority of activists expect to see an increase in precatory proposals over the next year. After Carl Icahn’s successful push at eBay for a PayPal spin-off following his announcement of a precatory proposal, and Relational Investors and CalSTRS’ success with a similar proposal at Timken, activist funds have grown to appreciate that success does not always require a full-fledged proxy fight. While such proposals are nonbinding, companies know that the failure to implement a proposal supported by shareholders will lead to increased scrutiny from Institutional Shareholder Services possibly including withhold recommendations, and an increased likelihood of a fight with shareholders next year.

Fading are the days of the “activist season”—the predictable six-month stretch between the time when activists build their stakes and submit notice of their proposals to companies and when annual meetings are held in May and June. A significant number of activists have turned to post-annual meeting tactics, such as the use of special meetings, consent solicitations and simple public campaigns, to exact corporate change. Thus, not only should we expect activism to continue to thrive, we should expect it to become an ever-present activity in the marketplace seeking to unlock value and hold managements accountable.

Activist Insight foreword

These are hugely interesting times to be covering the world of shareholder activism. After three years of activism going from strength to strength, there are again questions about whether this growth can be sustained. Some have argued that there is a brewing rejection of activist ideas by other investor groups, or that capital will be pulled from activist funds as rapidly as it has been poured into them. Sudden dislocations in the market—last September and in January of this year—have added to the conviction of these voices, especially when prominent activist positions have been among those to suffer.

The evidence of this survey suggests activists are far from pessimistic. While there is plenty of nuance in the pages that follow, activists believe most stakeholder groups have become more accepting of their role in capital markets, that the volume of activism will at least stay the same, and that they will continue to find management teams willing to work with them to create value. Many are even planning to add to their assets under management.

In particular, activists believe companies remain keen to settle campaigns before they get out of hand, even though the time taken to negotiate such agreements has lengthened. This may not be a contradiction—activists are not becoming any more modest in their demands, if their expectations for majority slate contests or special meeting demands are anything to go by. Yet the diversification of activism has made room for many different approaches. Sandell Asset Management may be followed by many other firms, if its use of a precatory proposal at Bob Evans Farms helps prompt a strategic transaction.

Although recovery in the markets has surely helped ensure that activists do not feel under siege, there are signs that their jobs will become slightly harder. Despite slightly more optimistic responses than last year, many still feel that the U.S., historically the source of most activist opportunities, is overcrowded. Favorite sectors to target, such as consumer goods, appear to be more fully valued. Larger targets are less plentiful. All of the above may push some activists overseas and the evidence is that Europe and the U.K. in particular, will be the focus of attention if this is the case. If anything, “Brexit” may have made these two destinations more attractive to activists. By contrast, fewer activists seem to be intrepid enough to follow the likes of Elliott Management and Third Point into Asia.

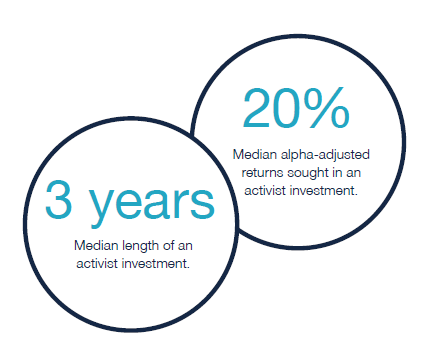

The sections of the complete publication dedicated to how activists identify their targets contain insights rarely touched on elsewhere. First, it is performance that matters most, not valuation (surprising, given that many activists see themselves as value investors first and foremost). Second, although activists expect their investments to last three years on average, and spend six months researching before buying stock, M&A opportunities are the most prominent catalysts. The selection process is therefore a mixture of careful review and opportunism, not one or the other.

Will activism continue to grow?

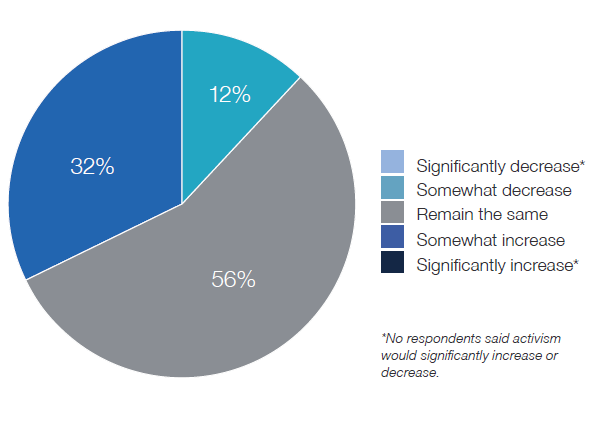

What do you expect to happen to the volume of shareholder activism campaigns over the next 12 months?

Many factors have been predicted to precipitate the decline of shareholder activism, from higher interest rates to greater corporate preparedness, a more long-term

agenda from passive shareholders, and the topping of the M&A cycle. So far, none have been able to dent activism’s rise.

In recent years, shareholder activism has gone from being a niche investing strategy to a thriving industry. Activism has facilitated some of the biggest transformations in capital markets—from sector consolidation to changing capital allocation trends—and accelerated the search for margin growth.

Today, few activists expect any backsliding. Only 12% of those surveyed see the volume of activism decreasing over the next 12 months—and almost three-times as many

(32%), expect it will increase. However, the bulk of respondents expect activism to continue at current levels.

“Activism is an established asset class with constant, continued growth.”

—Marc Weingarten, Partner

Schulte Roth & Zabel

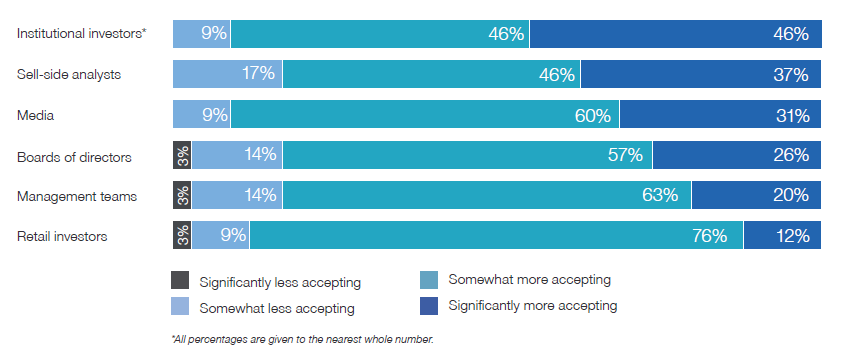

Compared to previous years, how accepting have the following stakeholders become of activist investors?

As they did in 2015, activists surveyed for this report believe most stakeholders have become more accepting of their role. Notably, 92% of respondents believe institutional investors are more accepting of activists than in previous years, with activists also experiencing increased receptivity from the media, retail investors, directors and management.

On the other hand, some activists have come to expect a tougher ride from sell-side analysts. While none of the funds surveyed last year believed that analysts were becoming less supportive, 17% of respondents this year perceive a growing chill in attitudes.

“Acceptance and support for shareholder activism continues to increase across all types of investors.”

—Eleazer Klein, Partner, Schulte Roth & Zabel

Where is activism heading?

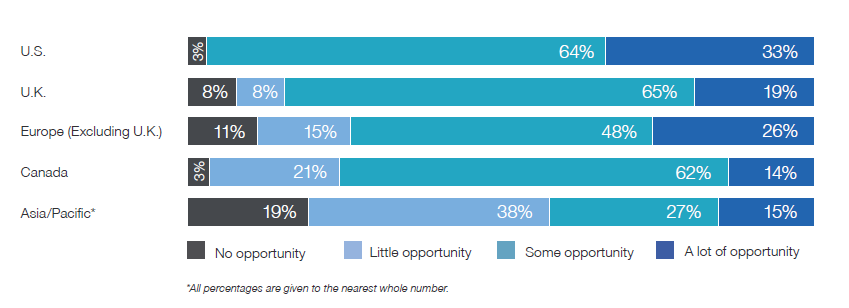

For shareholder activism, how much opportunity do you anticipate in the following regions?

Activism continues to be a predominantly U.S. phenomenon. It has, however, spread around the world in recent years. Activists remain confident there is a place for it in Europe and Canada.

Activists believe the U.S. continues to present the largest investment opportunity, with 97% saying there is some or a lot of opportunity there. Activists have become more bearish on Canada, however, with 21% seeing little opportunity—up from 5% last year—perhaps because of continued weakness in commodity prices.

In Europe, respondents foresee a stronger future for activism in the U.K. than on the Continent, with 84% seeing some or a lot of opportunity in London-listed stocks, compared to 74% on the Continent. Surveys were sent out immediately after voters in the U.K. opted to leave the European Union, so this development should be factored in—although the timing and impact of “Brexit” remains unclear and subject to dispute.

A majority of activists surveyed see little opportunity for activism in Asia, despite notable campaigns at Samsung C&T, China Vanke and Seven & i Holdings in recent years. Indeed, almost one-fifth expect no opportunity for activism there—a view that is sure to be tested in years to come as recent corporate governance and shareholder rights reforms in markets such as Japan and Hong Kong are applied.

“In Continental Europe, which activist tools work and which do not need to be carefully analyzed, while in the U.K., Brexit is casting a long shadow.”

—Jim McNally, Partner, Schulte Roth & Zabel

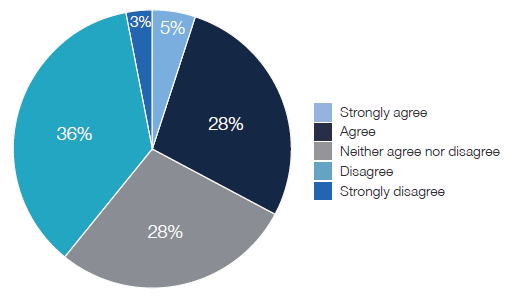

To what extent do you agree with the following statement: “Activism is becoming crowded in the U.S. and targets are becoming increasingly hard to find”?

In 2015, activists were evenly divided over whether U.S. opportunities had become overcrowded. This year, while they still divided sharply, more disagree with the

above statement (39%) than agree with it (33%), suggesting that a shakeout in financial markets has bolstered the conviction activists have in their strategy. Indeed, the proportion of activists believing opportunities remain rose seven percentage points.

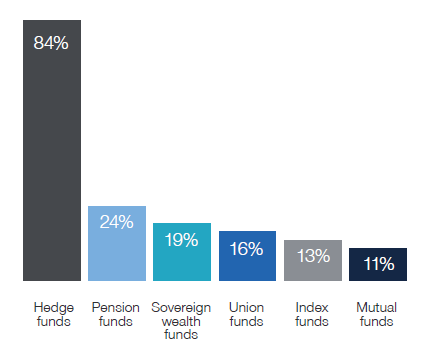

From which of the following investor groups do you expect to see activism increase over the next 12 months?

As expected, an overwhelming majority (84%) of respondents expect hedge funds to continue to take the fight to management. Activists were entitled to select

more than one option, but less than one-quarter see pension funds becoming more involved. And despite much talk of a more muscular approach from index funds

to underperforming companies, only 13% of activists surveyed expect them to increase their efforts.

“Traditional long-only investors are seeing value in activism and are awake to its benefits.”

—Jim McNally, Partner, Schulte Roth & Zabel

What kind of activism can we expect?

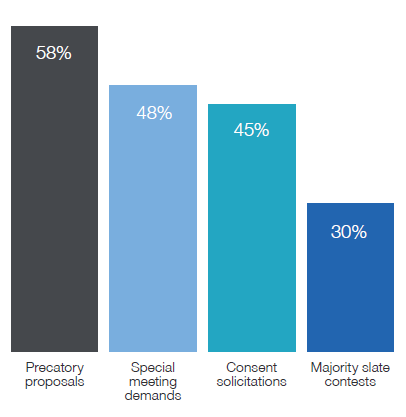

Do you think there will be an increase in the following activities in the next 12 months?

Although activism is dominated by hedge funds, pension and union funds have always had a broad role in shaping the governance of companies in their portfolios. Might the different types of activists learn from each other tactically?

A majority of activists (58%) expect to see an increase in precatory proposals, and several instances of activists using the tactic over the years to push for spinoffs or strategic reviews—even when not taken to a vote, as at eBay—may light a path forward. And while substantial minorities of activists expect to see increases in special meeting demands and consent solicitations—confirming activism as a year-round phenomenon—it is notable that three in 10 expect to see an increase in majority slate proxy contests, showcasing the heightened ambition of some funds.

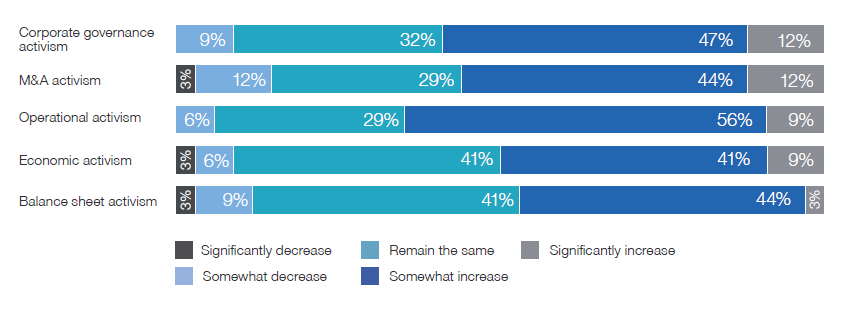

For the types of shareholder activism below, what are your market expectations for the amount of each type over the next 12 months?

As for the type of activism anticipated, most activists expect the full gamut of demands to continue to be in use. A high point in the M&A cycle appears to signal a reduction in the amount of activism designed to initiate, amend or halt deals.

In 2015, nearly 80% of respondents expected M&A activism to increase—in 2016, that number fell by 24 percentage points. In its place, activists expect to see a small increase in operational campaigns (up 4% year-on-year) and a big return to balance sheet activism (up 41%).

“Activists continue to focus on excess cash and underwhelming margins but will pursue any strategy that can generate value.”

—Steve Balet, Managing Director, FTI Consulting

The complete publication is available here.

Print

Print