Warren Suh and Caroline Cubberly are consultants at FW Cook. This post is based on the Executive Summary of a FW Cook publication by Mr. Suh, Ms. Cubberly, and Edward D. Graskamp.

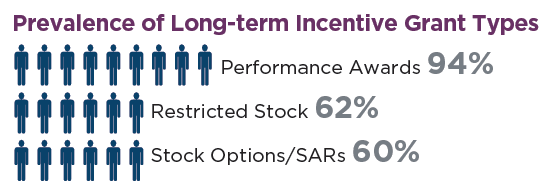

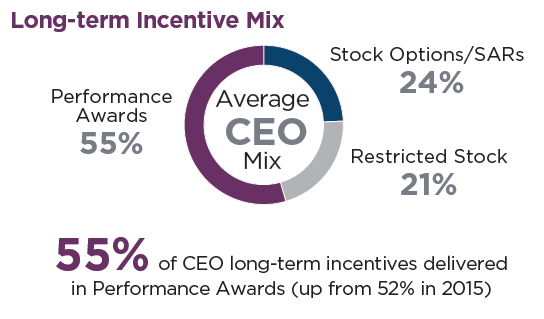

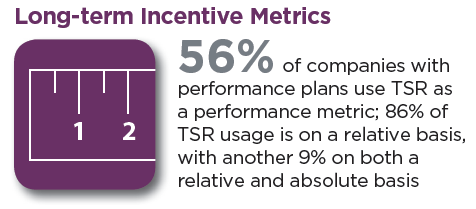

In 2016, external forces, including Dodd-Frank Act rules, Say-on-Pay and proxy advisors, continue to influence the executive compensation landscape. Meanwhile, internally, major overhaul to long-term incentive plans at large companies over the years have resulted in most plan designs and practices now more closely aligned with a pay-for-performance philosophy. With Say-on-Pay in its sixth year and 94% of the Top 250 already using performance-based awards in their long-term incentive programs, companies are shifting attention to finding the right balance of grant types and performance features that provide meaningful retention and incentivize proper behavior. Nearly 90% of the Top 250 use two or more grant types, and 58% of performance awards feature two or more performance metrics. The prevalence of performance awards increased, coming at the expense of stock options and stock appreciation rights (“SARs”), which have declined notably since 2014. The 2016 Top 250 marks the first time that use of stock options/SARs (60% of Top 250) dips below the use of restricted stock grants (62%).

2016 is also the first time a new sector was added to the Global Industry Classification Standard (“GICS”) since its inception in 1999. The 2016 Top 250 results include Real Estate, the new industry sector.

The FW Cook Top 250 Report (available here) details the long-term incentive practices of the 250 largest companies in the Standard & Poor’s (“S&P”) 500. Notable trends and key findings from this year’s study are described in the report.

Trends Impacting Long-term Incentive Design

- Performance award prevalence reaches a new peak, edging closer to universal usage among the Top 250 companies

- Shareholder engagement has increased, facilitated by improved transparency and enhanced disclosure of long-term incentive plan design, including why metrics are selected and how goals are set

- Despite declining use of stock options/SARs, there is reason to believe usage may pick up as large investor funds, understanding the inherent performance-orientation of such awards, vote more independently of proxy advisors

- Investor funds and proxy advisors are scrutinizing the rigor of incentive goals; particularly for sub-par performing companies with above-target incentive payouts

- Companies are beginning to contemplate CEO pay ratio calculations, but the outcome on long-term incentive design (if any) remains to be seen assuming initial disclosures appear in 2018 proxy statements

The complete publication is available here.

Print

Print