The following post is based on a publication from the EY Center for Board Matters.

Oversight responsibilities shouldered by boards are increasing in scope and complexity. Much of the pressure is a result of heightened regulatory requirements, shifting investor expectations and transformative global changes.

To better address evolving responsibilities, boards are increasingly creating additional committees—beyond the three key committees that oversee the critical board responsibilities of audit and financial reporting, executive compensation, and director nominations and board succession planning. The need for additional committees reflects changing board priorities and pressures, boardroom needs and company circumstances. For example, responsibilities such as strategy or risk may shift from one committee to another, be distributed among multiple committees or addressed by the full board.

The EY Center for Board Matters reviewed board structure at S&P 500 companies between 2013 and 2016 through the lens of the committee’s primary function and uncovered five observations about how S&P 500 boards are structuring committees to address oversight challenges:

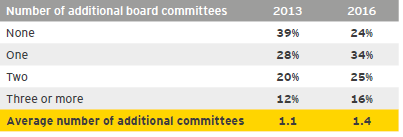

1. More boards are adding additional committees

More than 75% of S&P 500 companies have at least one additional board committee, up from 61% in 2013.

Growth in use of additional committees, 2013–16

The need for additional committees reflects changing board priorities and pressures, boardroom needs and company circumstances.

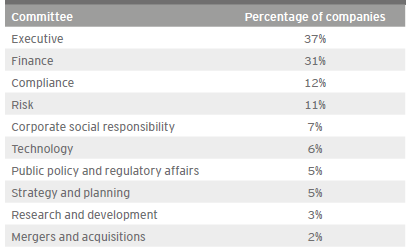

2. Executive committees are the most common type of additional committee

Executive committees tend to handle certain board-level responsibilities when the board is not in session. Finance, compliance and risk committees are also growing more common, reflecting the benefits to some boards of having specialist committees on these oversight areas.

Most common functions of additional committees

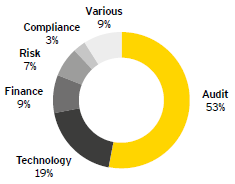

3. Cyber, digital transformation and information technology are not only for the audit committee

Of the 15% of companies that disclosed a committee focus on these topics, over half assigned this responsibility to the audit committee—and a growing number to an additional committee. In the past year alone, the number of such committees grew by one-third.

Committees addressing cyber, digital transformation and information technology

Questions for the board to consider

- Is the board’s committee structure appropriate to current board priorities and company-specific needs?

- Is the board familiar with how peer companies are addressing board oversight responsibilities?

- Do assessments of board effectiveness reveal possible pressure points that might be resolved with changes in committee structure?

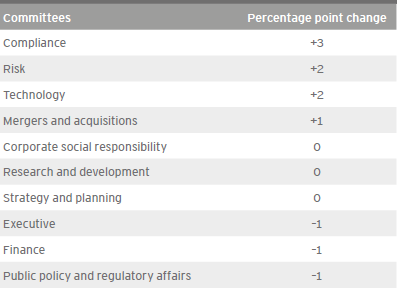

4. Compliance, risk and technology committees saw the most growth

While executive committees still are the most common additional committee (see finding No. 2), several others have seen growth in the last three years. This trend suggests that some boards may be using additional committees to achieve a greater breadth and depth of focus on these complex business areas.

2013 to 2016: net growth in additional committees

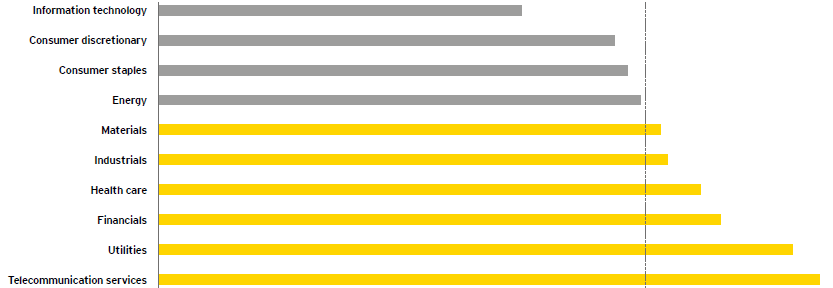

5. Sector matters when it comes to additional committees

In 6 of 10 industry sectors, over 75% of the companies have at least one additional committee, likely due in part to the unique compliance, risk and operational challenges of these sectors.

Percentage of companies by sector with one or more additional committees

What about smaller company board structure?

A review of S&P SmallCap 600 board committee structure reveals the following:

- Today, 46% of smaller companies have at least one additional board committee.

- Top five additional committees at smaller companies are executive (18%), risk (7%), finance (7%), strategy (6%) and compliance (5%).

- Technology-focused committees are relatively uncommon (2%).

- Risk committees saw the most year-on-year growth (3 percentage points); other committees held steady.

Additional board committees at S&P 500 companies

| Companies with this committee | Committees: function and common responsibilities | Top sectors with this committee |

|---|---|---|

| 37% | Executive

|

|

| 31% | Finance

|

|

| 12% | Compliance

|

|

| 11% | Risk

|

|

| 7% | Corporate social responsibility

|

|

| 6% | Technology

|

|

Print

Print