Luigi L. De Ghenghi and Margaret Tahyar are partners at Davis Polk & Wardwell LLP. This post is based on a Davis Polk publication.

[In] November 2016, we noted that the Financial CHOICE Act proposed by Rep. Jeb Hensarling was only the beginning. While many eyes continued to be fixed on the House Financial Services Committee and the much anticipated CHOICE Act 2.0, on Monday, March 13, FDIC Vice Chairman Thomas Hoenig made a regulatory reform proposal of his own in a speech to the Institute of International Bankers and in a more detailed term sheet. [1] Calling the Dodd-Frank Act “well intended” yet with “many and complicated” regulations that are “burdensome,” Vice Chairman Hoenig proposed a series of structural reforms that, in his view, would simultaneously end too-big-to-fail, provide regulatory relief to banking organizations and enhance competition in non-banking services and financial stability.

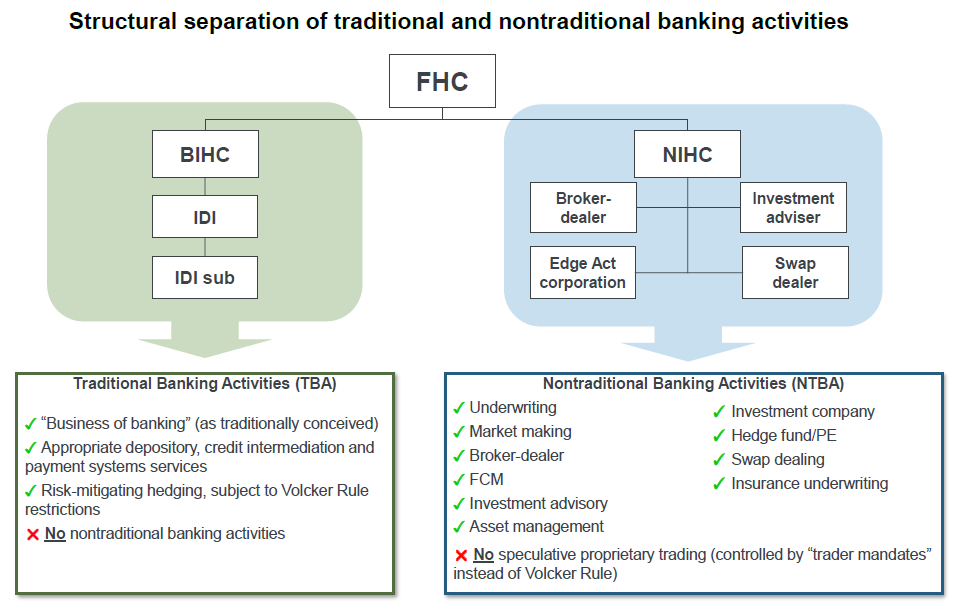

Rather than provide banking organizations with an optional off-ramp from certain regulations, as the first iteration of the CHOICE Act proposed, Vice Chairman Hoenig’s proposal mandates structural separation within most banking organizations (i.e., any banking organization other than custody banks and “traditional banks” that would qualify for regulatory relief under Vice Chairman Hoenig’s 2015 proposal, which could be adopted separately or in tandem). This structural separation, much like the structural reforms proposed by Sir John Vickers in the United Kingdom, would be accomplished by splitting what he terms “traditional” and “nontraditional” banking activities and placing each in a separately capitalized and managed intermediate holding company silo within a top-tier financial holding company, subject to modified Section 23A/23B affiliate transaction restrictions between the two. Although the proposal bears a superficial resemblance to what some have called a “21st Century Glass-Steagall,” Vice Chairman Hoenig in his remarks expressed opposition to this concept and acknowledged the value of permitting banking organizations to continue to offer investment banking, capital markets and other “nontraditional” banking services under the common ownership and management of a single, top-tier financial holding company.

The key architectural element of the proposal is the imposition of multiple and functionally independent intermediate holding companies. As an initial matter, any insured depository institution would be placed under a “bank intermediate holding company” (“BIHC”), which would be permitted to engage only in “traditional” banking activities. The proposal does not specifically describe what activities qualify as “traditional,” but notes that the 2015 traditional bank regulatory relief proposal would not apply to banks with:

- trading assets or liabilities (other than permissible derivatives), or

- derivative positions other than interest rate and FX derivatives.

The term sheet acknowledges that “a discussion of [traditional banking activities] would be necessary to ensure that appropriate depository, credit intermediation and payment systems services are conducted.” The “nontraditional intermediate holding company” (“NIHC”) would house all other activities of a banking organization, including any activities involving securities or derivatives broker-dealers, insurance, investment advisory, investment fund or merchant banking activities, and, in a departure from over a century of practice, any Edge Act or agreement corporations (which have long been bank subsidiaries). The following simplified chart illustrates Vice Chairman Hoenig’s proposal:

With respect to capital, the BIHC and each IDI subsidiary would be required to maintain a minimum consolidated Tangible Leverage Ratio of 10%, a level consonant with the 10% modified supplementary leverage ratio requirement at the heart of the current CHOICE Act. Vice Chairman Hoenig expressed a preference for a “simpler” leverage ratio that would recognize only “payment netting” for derivatives, similar to the IFRS approach, over the current U.S. banking agencies’ enhanced SLR. The NIHC would be subject to a minimum leverage ratio requirement at a level yet to be determined, although in his remarks to the IIB Vice Chairman Hoenig expressed flexibility on the calibration and noted that a leverage ratio in the range of 8% could be appropriate. Each NIHC would be capitalized through the issuance of tracking stock by the top-tier FHC that would track to the gains and losses and financial condition of the NIHC. According to Vice Chairman Hoenig, this would impose market discipline on the activities and risks taken by an NIHC and would give the top-tier FHC’s management the right information to manage each NIHC. He stated that the market’s assumption of the risk of an NIHC’s activities was preferable to the current framework in which “risk averse banking agencies govern an FHC’s business plan.”

Each NIHC would also be subject to limitations on funding from the top-tier FHC and the FHC’s other bank and non-bank affiliates, in the form of (1) Section 23A/23B limits that would be based on both a bank’s capital stock and surplus as well as the capital stock and surplus of the relevant NIHC affiliate, as well as (2) a limit of 20% of an NIHC’s debt and liabilities that could be held by the top-tier FHC and any other FHC affiliate. According to Vice Chairman Hoenig, these limitations are designed to ensure that NIHCs do not benefit from the lower cost of funding from the “federal safety net” represented by bank deposit insurance—which, in his view, gives BHC-affiliated broker-dealers an unfair competitive advantage over broker-dealers that are not affiliated with BHCs—and would help ensure that the failure of an NIHC would not result in the failure of the entire banking organization.

As for corporate governance, each of the intermediate holding companies would be required to be overseen by a fully independent board of directors, with no management representation on any board and no overlap between boards of the intermediate holding companies. In his remarks, Vice Chairman Hoenig clarified that a single management team could manage the top-tier FHC and each of its IHCs. The top-tier FHC would also be required to appoint an independent General Internal Auditor (“GIA”) who would report exclusively to the FHC’s board of directors and would not be permitted to serve in any other capacity within the FHC or any of its affiliates for five years from the end of his or her tenure as the GIA.

In exchange for undertaking these structural reforms, Vice Chairman Hoenig’s proposal contemplates eliminating many of the regulations promulgated under the Dodd-Frank Act, including: CCAR, DFAST, risk-based capital rules, LCR, NSFR, other enhanced prudential standards under Dodd-Frank, Title I resolution plans and Title II orderly liquidation authority. Vice Chairman Hoeing also indicated that his proposal would provide banking organizations with relief from the requirements of the Volcker Rule, because (i) proprietary trading would now be policed via trader mandates rather than the unduly complicated regulations currently in effect, and (ii) covered fund activities could be permitted in the NIHC. The term sheet does, however, contain a section entitled “Supervisory Expectations” that makes it clear that some of these requirements, such as risk-based capital and liquidity measurements, internal stress tests, capital plans and equity-based internal loss-absorbing capacity, would continue to be included in banking agencies’ assessments of a banking organization’s safety and soundness. As with any proposal to provide regulatory relief, an assessment of the effectiveness of Vice Chairman Hoenig’s proposal would necessarily depend on the devil in the details. We also note that the status of the custody banks is unclear under this proposal: they are excluded from the scope of the proposal, but they also appear to be excluded from the 2015 traditional bank regulatory relief proposal.

In terms of whether and how this new proposal may accord with the Trump administration’s views on bank regulatory reform (let alone those of Congress), we note that Treasury Secretary Steven Mnuchin’s written answers to questions as part of his confirmation hearing endorsed the idea of activity-based bank regulation and possibly some sort of structural split. Specifically, Secretary Mnuchin’s written responses indicate his belief “in a regulatory framework that is determined by complexity and activity, not simply size”, and that “[a] bright line between commercial and investment banking, although less complicated, may inhibit the necessary lending and capital markets activities to support a robust economy.”

Endnotes

1This post reflects not only the term sheet and the text of Vice Chairman Hoenig’s speech, but also additional remarks he made, including in response to questions from the audience, at the IIB conference.(go back)

Print

Print