Robert Bartell is Global Head of Corporate Finance and Christopher Janssen is Global Head of Transaction Opinions at Duff & Phelps. This post is based on a Duff & Phelps publication.

Questions about the utility of fairness opinions have periodically seized headlines for many years. As the leading fairness opinion advisor, we can readily speak to the value of the opinions we provide and the best practices we observe in rendering them. But when addressing broad industry criticisms—in particular that fairness analyses generally provide valuation ranges too wide to be useful and that they are too reliant on “mechanical” discounted cash flow (DCF) analyses—our arguments have lacked the force of empirical data beyond our own client work.

Until now. This post—the compilation, review and analysis of more than 3,000 fairness opinions—is the culmination of our efforts to address those criticisms with research. We believe it does that.

We also believe that the post itself can serve as a valuable tool for boards evaluating purchase offers.

Directors seeking fairness opinions have long been left to rely on their own intuition and experience in scrutinizing valuation estimates. Our post provides them with a set of benchmarks, drawn from federal filings, for comparison. They’ll now know when a fairness opinion’s estimate falls outside the average valuation range against the offer price for similar-sized deals. Our post should empower directors to ask more informed questions, which can only improve the process of deliberating a purchase offer.

We don’t expect our study to put an end to the debate around fairness opinions. We do believe it can help elevate that debate by injecting data where there has only been conjecture, by replacing the anecdotal with the empirical and by better equipping boards to make informed decisions.

Fairness Opinions 2006-2016

Most fairness opinions use a robust set of methodologies to produce a useful range of valuations, according to Duff & Phelps’ study of more than 3,000 publicly disclosed fairness opinions.

Those conclusions disprove periodic criticisms that fairness opinions generally provide little utility for boards analyzing potential transactions. Specifically, some critics have asserted that fairness analyses produce valuation ranges too wide to provide meaningful information and that, because most fairness opinions are based in part on DCF analysis, the opinions are too reliant on financial projections that have been produced by management and left unscrutinized by the fairness advisor.

We agree that narrower valuation ranges are, intuitively, more useful to boards than wider ranges. However, some deals are likely to produce wide ranges because the companies themselves are difficult to value. The real question is whether wide ranges are pervasive. And while we would also agree that relying solely on DCF analysis (that uses projections company management has fed to the fairness advisor) can be problematic, the follow-up should be to ask: is that really happening?

In an effort to answer those questions, assess the validity of periodic criticisms and determine the overall usefulness of fairness opinions, Duff & Phelps conducted a thorough analysis of more than 3,000 fairness opinions filed with the SEC during the ten-year period ending in 2016. Specifically we looked at forms 14D and DEFM14A, which companies are required to file when they are the target of a purchase offer or require a shareholder vote.

A Valuable Tool for Boards

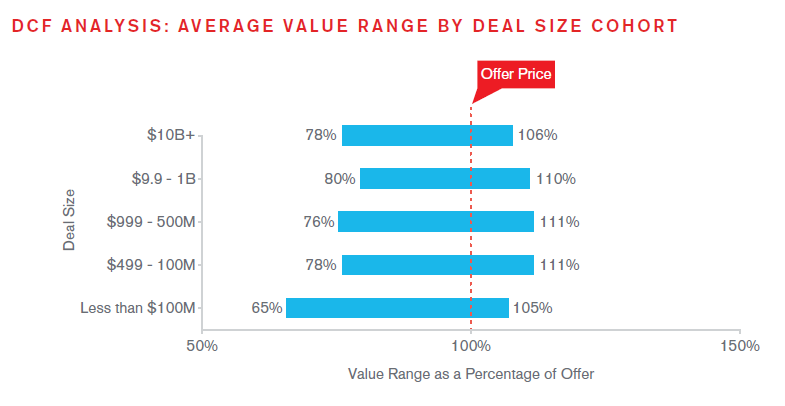

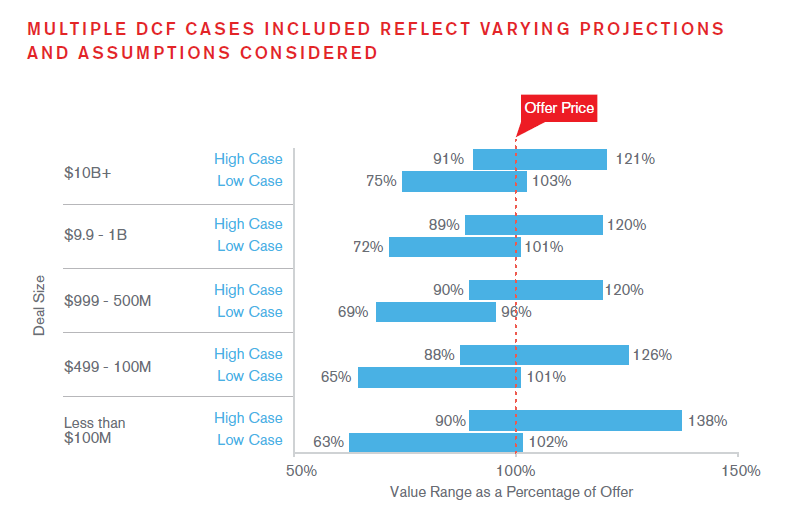

To test whether wide ranges are pervasive, we analyzed publicly disclosed fairness analyses over the last ten years. Our analysis confirms that on average, fairness opinions deliver a range of valuations that is sufficiently narrow to serve as a valuable tool in evaluating purchase offers. And the average range grows narrower as deal size grows larger. Among deals we analyzed that carried a value of $10 billion or more, DCF analyses produced average price ranges between 78 percent and 106 percent of the offer price. Large-cap companies typically are more diversified and established, with more stable and predictable cash flows and broader equity-analyst coverage. Armed with multiple, reliable sets of financial projections and a variety of perspectives on the company’s future performance, fairness opinion advisors can be expected to produce more precise valuation ranges than when this information is absent.

In the charts above and below, valuation ranges are expressed as average percentages of the implied share prices as compared to the offer price. The average range widened only slightly for deals valued at less than $10 billion but more than $100 million. For deals valued at less than $100 million, DCF analyses produced average price ranges between 65 percent and 105 percent of the offer prices. The difference in average valuation ranges for micro-cap companies versus large-cap companies is even more pronounced when we analyze the dispersion of fairness opinion ranges. As the chart below illustrates, as company size decreases, the widest 25% of valuation ranges increases.

Our observation—wider and more disperse valuation ranges for smaller companies—is not all that surprising. This reflects the heightened complexity involved in valuing enterprises that are less mature, have less historical data to analyze and compare, or are growing at a rate that causes dramatic variances in expected cash flow.

In addition, voluminous published analyses, including our own Valuation Handbook—Guide to Cost of Capital, [1] have shown that discount rates decrease as company size increases due to the diminishing effects of small-stock premiums. That research helps explain our finding that micro-cap companies receive the broadest valuation ranges.

Methodologies: Rigor and Sophistication Apparent

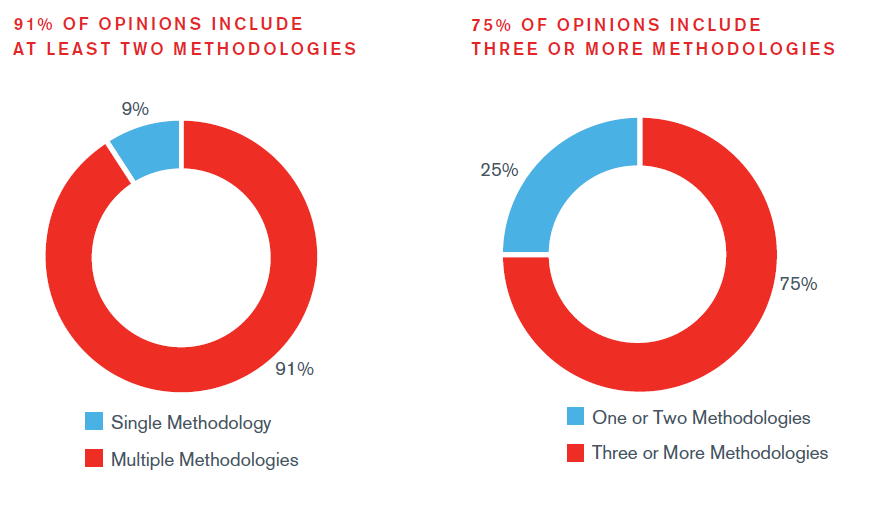

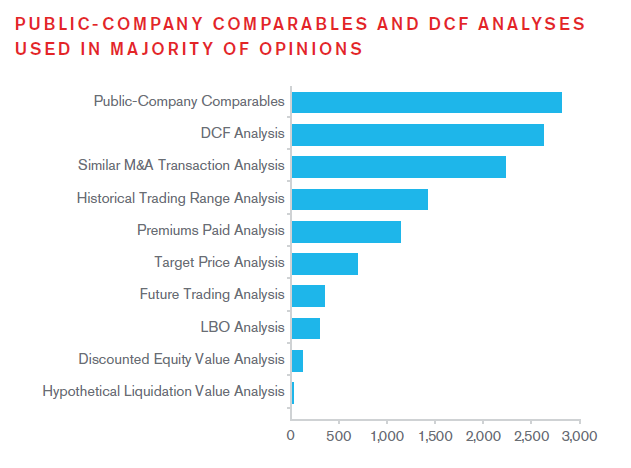

The findings present clear signs of an industry standard at work among fairness opinion advisors. Counter to the criticism that fairness opinions rely too heavily on DCF analysis, we find that fairness advisors have been using multiple methodologies for some time. For instance, 91 percent of the fairness opinions we reviewed used more than one methodology to arrive at valuations. In 75 percent of the deals, advisors used three or more methodologies.

Moreover, we also observed a slight increase in the average number of methodologies since 2008, from an average of 3.3 methodologies to nearly 3.5 in 2016.

We argue that the use of multiple valuation methodologies also significantly mitigates the criticism that DCF analysis and therefore the opinion could be too heavily influenced by unrealistic company projections. The common pairing of public-company comparables and/or precedent transactions with DCF analyses, often supplemented by one or more additional methodologies, demonstrates that, in the vast majority of cases, fairness opinion advisors diligently consider multiple perspectives and relevant analyses, when available, in assessing the fairness of transaction prices. It also dispels the notion that fairness advisors do not scrutinize management projections. Simply put, if the DCF analysis produced a valuation range that bore little resemblance to a range of values derived from other methodologies, that would be the first clue that something might be amiss and thus warrants a closer look. After all, if the public peer group or the set of precedent transactions is sufficiently comparable, valuation multiples derived from these techniques can, in many cases, provide an inherently more objective view of valuation.

Valuation Methodologies Generally Congruent

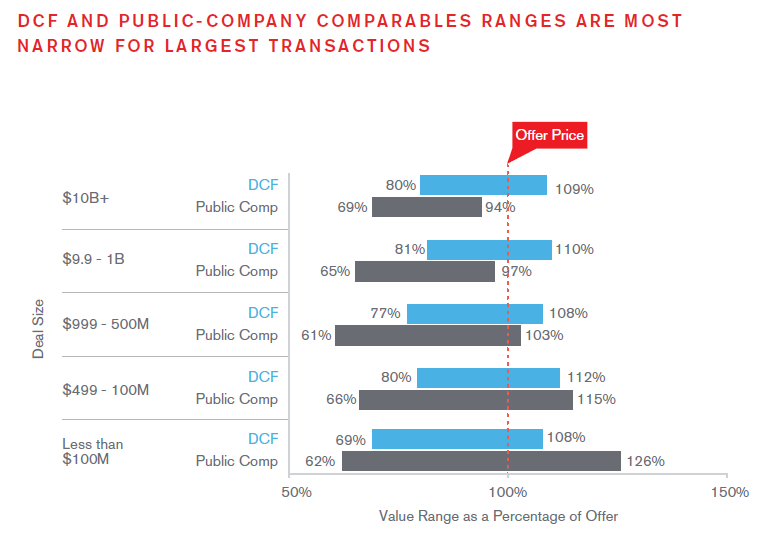

To test our assertion that a confirmatory valuation technique can serve as an effective check on the DCF analysis, we also analyzed those fairness analyses that used both DCF and public-company comparables. In the fairness opinions we reviewed, DCF analysis usually provided the narrowest range of values. For deals valued at below $10 billion, DCF analysis provided slightly narrower ranges of values than public-company comparables analyses; for the largest of deals the ranges were roughly equal.

In certain circumstances, a significantly wider public-company comparables range may indicate that a fairness opinion advisor overlooked a key step in that analysis. In order to achieve a useful valuation based on public multiples, it’s crucial that the advisor calibrate the selection of valuation multiples to those peers with risk profiles and growth prospects similar to the subject company—to the extent that such comparisons are sufficiently meaningful. Absent that refinement, valuation ranges may be wider than necessary and in some cases misleading. The data we collected showed that overall the public-company comparables and DCF analyses produced relatively consistent ranges that were reasonably narrow, particularly for larger companies where more information was available. The consistency of the average valuation ranges across DCF and public-company comparables analyses confirms the rigor and validity of both methodologies. When done correctly, neither examination is mechanical and both illuminate appropriate valuation ranges to boards and special committees.

Multiple DCF Scenarios Indicate Additional Scrutiny

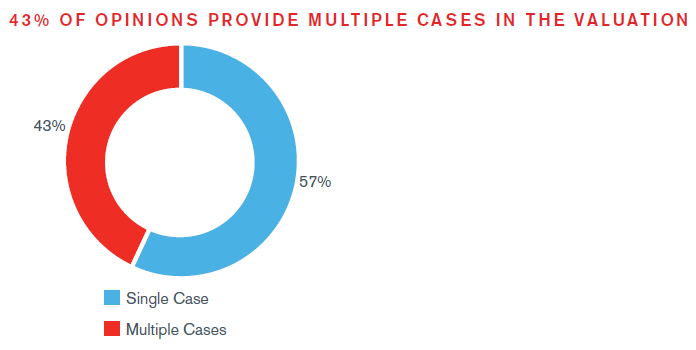

In 43 percent of the filings we analyzed, fairness opinion advisors used multiple cases of DCF analyses. This most likely indicates an attempt to account for multiple sets of projections used for different purposes by management. One might reflect stretch goals, for example, while another may have been produced to make the company more attractive to buyers. Yet another forecast may use an amalgamation of consensus projections from equity analysts to represent the market’s assessment of the company’s prospects.

Most valuation practitioners subscribe to the theory that DCF analysis should reflect the best estimates available to management, without bias in either direction. The frequent use of multiple DCF scenarios indicates that advisors are considering every potentially pertinent projection, rather than simply accepting a single set of forecasts. In addition, the presentation of two (or more) DCF scenarios is likely the result of a growing judicial emphasis—via suggestion and mandate—on disclosure. Companies today are less likely to pick and choose which projections to disclose than they were a decade ago. Those who counsel boards of directors may conclude that erroring on the side of complete disclosure—even if a certain forecast included in regulatory filings was prepared for a much different purpose than assessing fairness—is generally prudent for the filer.

Choice of Advisor Matters

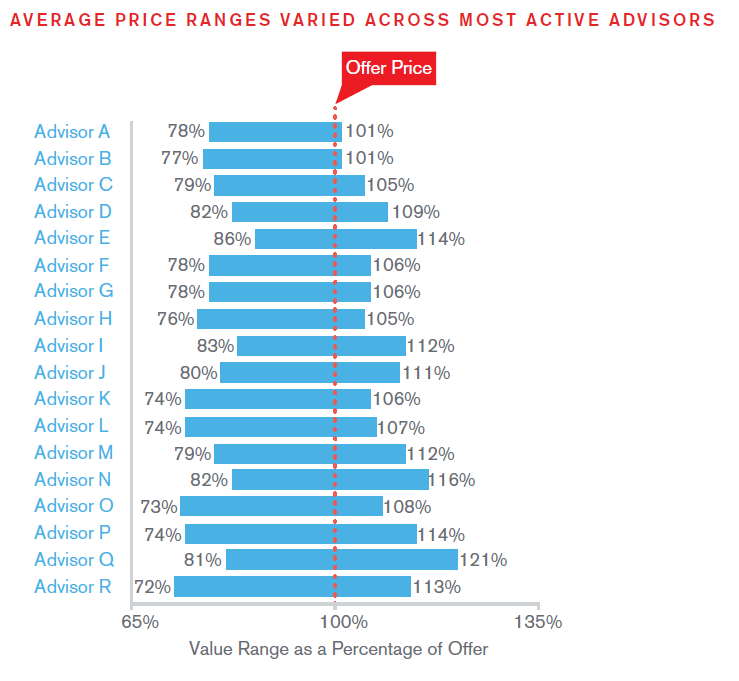

Finally, our study reveals that valuation ranges vary by provider. Among the most active advisors, the tightest average range, at 23 percentage points, is nearly twice as narrow as the broadest range of 41 percentage points. This demonstrates that the choice of an advisor does impact the precision and usefulness of a given fairness opinion and illustrates the importance of following the best practices described above—calibrating public-company comparables and scrutinizing management’s projections.

Conclusion

Even as fairness opinions have become standard practice, critics have questioned their efficacy and usefulness. The criticism often surfaces in the wake of particular transactions where there is public disagreement on the deal price or controversy surrounding the fairness analysis, which generates widespread headlines. But our analysis shows that those instances are outliers, typically owing to peculiarities in circumstances more than to faults in the process.

The vast majority of fairness opinions offer valuation indications that fall within 15 percentage points on either side of a midpoint—a clear indication of a widespread industry standard with robust methodologies and highly calibrated valuation analyses. For the minority of fairness analyses that fall outside of this precise range, it’s important to note that many of those outliers also may represent useful valuation assessments. Not all companies fit neatly into valuation models and not all deals are structured the same. When fairness opinions account for such unique factors, we would expect them to produce price ranges that stray from the average.

Our analysis indicates that fairness opinion advisors use robust, sophisticated methods to reach those valuations. From this we can only conclude that, broadly speaking, fairness opinions represent a reliable way for corporate boards and executives to evaluate purchase offers.

Methodology

This post relies on data we collected from public filings available in the U.S. Securities and Exchange Commission EDGAR database covering the timeframe January 1, 2006, through September 30, 2016.

Valuation ranges are expressed as average percentages of the implied share prices as compared to the offer price.

EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, allows collection, validation, indexing, acceptance, and forwarding of submissions by companies and others who are required by law to file forms with the SEC.

Data were collected from the following forms:

SC 14D9

Solicitation documents filed by the “being acquired” company regarding the offer it received.

SC 14D9/A

Amendment documents filed after the date of filing original document (SC 14D9) that may have amendments to the original content or new exhibits.

DEFM14A

“Definitive proxy statement relating to merger or acquisition” as required under Section 14(a) of the Securities Exchange Act of 1934.

Endnotes

1Available for purchase at www.duffandphelps.com/costofcapital(go back)

Print

Print