Shirley Westcott is a Senior Vice President at Alliance Advisors LLC. This post is based on an Alliance Advisors publication by Ms. Westcott.

As the 2018 proxy season enters its final weeks, several notable trends have emerged which may inform post-season engagements and shape next year’s shareholder campaigns.

Calls for various types of climate action have resonated strongly with investors as have social initiatives on gun violence, sexual misconduct and the opioid epidemic. Pay programs have faced more frequent rebukes and even auditors, in isolated events, have been challenged over independence and performance. Retail proponents also stepped up their game with filings of exempt solicitations, while conservative investors countered liberals’ messages by co-opting their proposals.

In short, shareholders are increasingly flexing their muscles on everything from environmental and social (E&S) issues to executive compensation. A brief look at some of the season’s highlights is presented below.

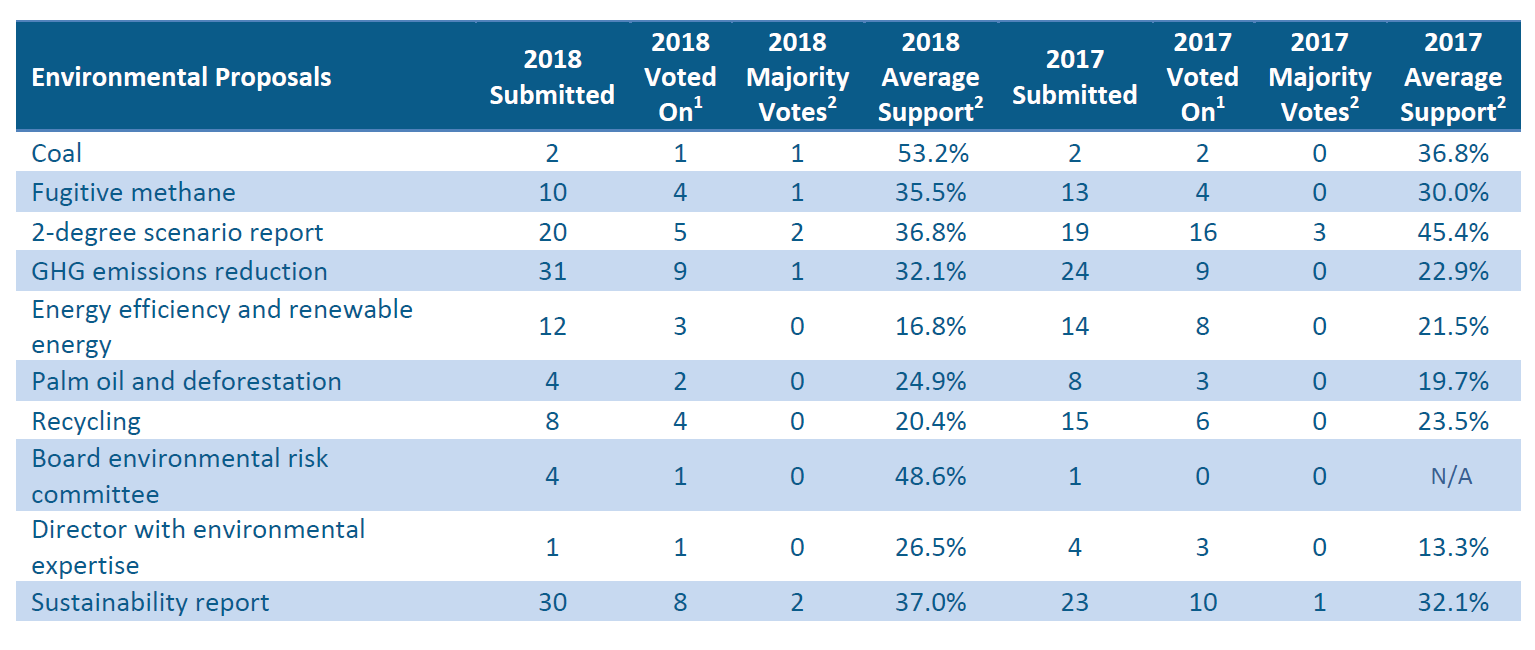

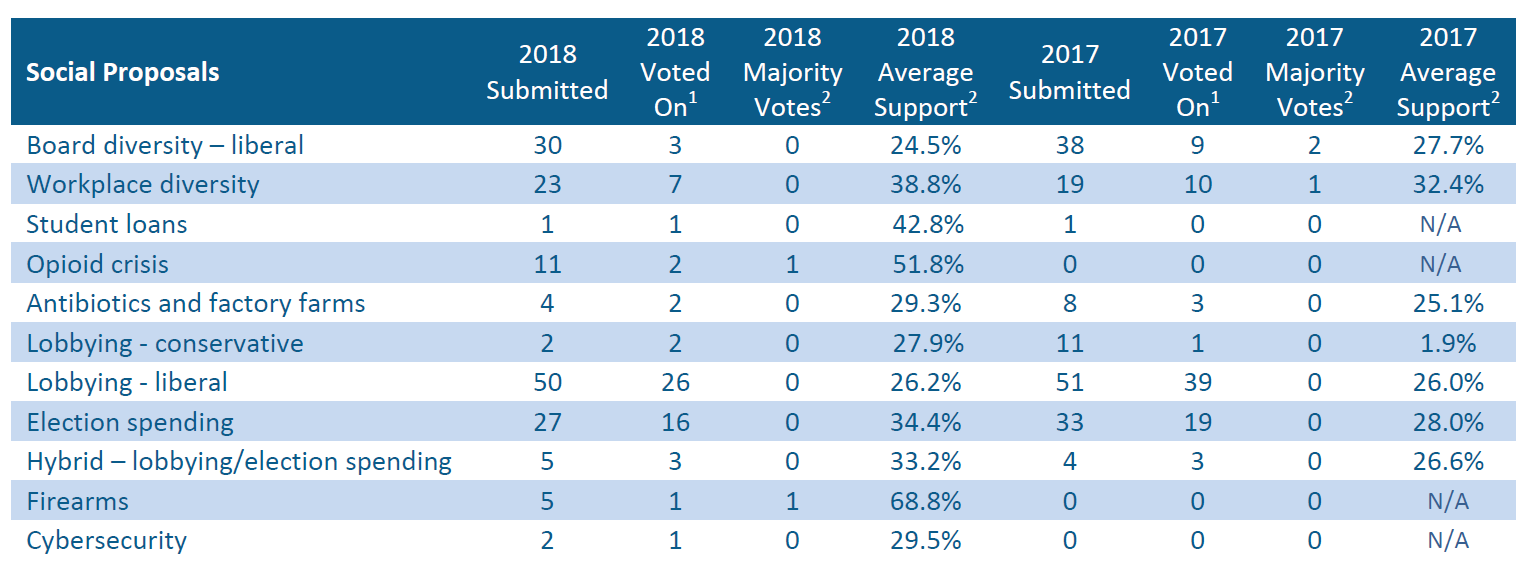

E&S proposals score record majority votes

Filings of E&S proposals have been somewhat lower this year than in 2017 but have racked up nine majority votes (excluding abstentions), surpassing the record set in 2016. [1] Eighteen other proposals—on topics ranging from climate change to workplace diversity, student loans, health issues and political activities—have received support in the 40% range.

Topping the majority vote list were resolutions at Kinder Morgan (59.7%) and Anadarko Petroleum (53%) to report on how they are preparing for a 2° Celsius limit on global warming pursuant to the 2015 Paris Accord (“2-degree scenario” or “2DS”). On the heels of three successful proposals last year, companies have been more willing to reach agreements with proponents on climate risk reporting, resulting in two-thirds of this year’s 2DS resolutions being withdrawn.

Five majority votes have been recorded on other environmental proposals, including reporting on coal ash risk (53.2% at Ameren), reporting on methane emissions management (50.3% at Range Resources), reporting on sustainability (60.4% at Kinder Morgan and 57.2% at Middleby), and setting goals for reducing greenhouse gas (GHG) emissions (57.2% at Genessee & Wyoming, where the board made no recommendation). The two additional majority votes—on gun safety and opioid abuse—are discussed further below.

Special meeting and written consent proposals surge

This year has seen an upswelling of filings by John Chevedden, James McRitchie and their associates on special meeting and written consent rights, which have nearly tripled in volume over 2017. Notably, one-third of the proposal recipients were targeted last year with proxy access “fix-it” resolutions, primarily to raise group aggregation limits in existing bylaws. Most of those were omitted as substantially implemented or generated only modest support (28.1% on average), apparently motivating the proponents to switch to more unassailable topics. Support for special meeting and written consent proposals has declined on average from 2017 and proportionately fewer have received majority backing (see Table 1).

New twist to conflicting proposal exclusions

Notwithstanding the hike in submissions, the Chevedden group has faced unexpected challenges to its “special meeting enhancement” resolutions which seek to reduce current ownership thresholds for calling special meetings (typically 25%) to 10% or 15%. Six companies were able to omit the proposals by presenting competing management resolutions asking shareholders to simply ratify their existing special meeting provisions. A similar no-action request is pending at NetApp.

This use of the 14a-8(i)(9) exclusion produced an outcry from both the proponents and the Council of Institutional Investors (CII) who accused the companies of “gaming the system.” [2] Proxy advisors Institutional Shareholder Services (ISS) and Glass Lewis apparently agreed by recommending against the management advisory resolutions and, in many cases, the governance committee chairs as well. To date, all of the company resolutions have received approval, albeit by a narrow margin in some instances.

Retail investors initiate exempt solicitations

Chevedden and McRitchie are testing the waters this year with exempt solicitations to generate support for their proposals or express their views on corporate ballot measures. [3] So far, their efforts haven’t had any meaningful impact on votes, which only went their way in two out of 16 cases—written consent at HP (bare majority support) and elimination of supermajority voting at Invesco (where the board made no recommendation). Nevertheless, because this is a cost-effective way for the proponents to augment their proxy statement message, McRitchie said they will increase their PX14A6G filings in the future.

Proxy access proposals wane

Last year’s most popular governance resolution—proxy access—has slackened both in volume and voting support this season. With the provision now in place at two-thirds of S&P 500 firms, the lead sponsor—the New York City Comptroller—has moved on to other topics.

Retail investors remain active in this space, accounting for 80% of the 2018 proxy access resolutions, primarily seeking revisions to existing bylaws. However, these have enjoyed no more success than last year, other than being reworked to avoid omissions. “Fix-it” resolutions have averaged 28.4% in favorable votes, on par with 2017.

To date this year, only three proxy access resolutions have received majority support—at Joint (96.1%), where the board made no recommendation, and at repeat targets Netflix (57.9%) and Old Republic International (77.4%), where the boards have persistently declined to implement the measure. Other proposals to adopt access rights were, in most cases, poorly targeted (controlled companies or high insider ownership).

Notwithstanding the dearth of shareholder resolutions, proxy access adoptions have continued at a steady pace and are increasingly migrating downstream. Over the past year, over 40% of adoptions occurred at small and mid-cap firms.

Conservatives preempt liberal proposals

The National Center for Public Policy Research (NCPPR) sidelined several lobbying and political spending proposals submitted by liberal groups by availing itself of the SEC’s “first-to-file” rule for similar resolutions, which results in the later-dated proposal being excludable. NCPPR’s “shadow” proposals are essentially identical to the liberal version but with a conservative spin in the supporting statement that urges companies to resist attacks from the left over their membership in pro-business organizations that advocate for smaller government, lower taxes, and free-market reforms.

Despite making an equivalent disclosure request, NCPPR’s liberal counterparts—the New York State Comptroller and Mercy Investment Services—refused to back the proposals, calling NCPPR’s approach “partisan gamesmanship.” ISS, on the other hand, stayed consistent with its voting policies and recommended in favor of the NCPPR resolutions, which received 34.6% support at Duke Energy and 21.2% support at General Electric. NCPPR plans to sponsor more preemptive proposals in the future, which may lead to a race to file.

Say-on-pay (SOP) failures are on the rise

Newly disclosed CEO pay ratios may have captured media attention this season, but investors remain sharply focused on pay-for-performance and are expressing it with their votes. Through May, average SOP support—at 91.2%—fell well behind the 2017 level for the same period (92.6%), while the failure rate more than doubled to 2%. Notably, there was a pronounced upswing in failures at S&P 500 firms, in most cases for the first time. These included Ameriprise Financial, Chesapeake Energy, Halliburton, Mattel, Mondelez International, Walt Disney and Wynn Resorts. In contrast, investors rejected SOP proposals at only one S&P 500 company (ConocoPhillips) during the first five months of 2017.

Shareholders and proxy advisors are also keeping a watchful eye on changes to compensation plans resulting from the repeal of the performance-based exception under IRS Code Section 162(m). One of the more high-profile cases was Netflix, which announced last December that it was scrapping performance-based bonuses for higher executive salaries. The company is also facing a shareholder derivative complaint that its prior bonuses were rigged with easily attainable performance goals to take advantage of the tax deduction. Investors gave cautious approval to its SOP proposal with 61.2% support.

Auditor encounters high dissent

This season revisited the longstanding question of whether an audit firm’s lengthy tenure—or to be sure, a really lengthy tenure—can ultimately compromise its independence and effectiveness. In a surprising upset, General Electric’s auditor for the past century—KPMG—received a 35.1% no-confidence vote from shareholders. The proxy advisors, which were unanimous in their negative opinions, cited newly revealed accounting issues related to GE’s insurance reserves and long-term service agreements, which are under SEC investigation. [4]

According to data from Audit Analytics, this magnitude of dissent is extremely rare. Over the past three years, auditor ratification has averaged 98.7% support and in only 0.3% of cases did shareholder opposition exceed 25% of the votes. [5] Even with strong investor objections, the audit firms were typically retained.

Glass Lewis also urged votes against the retention of KPMG at Wells Fargo for its failure to flag the company’s unauthorized consumer accounts scandal, despite its prior knowledge of the incident. As with GE, Glass Lewis’s concerns were heightened by KPMG’s longstanding relationship with the company—in this case, 87 years. Shareholders, nonetheless, ratified KPMG’s reappointment with 91.1% support.

Dissidents go diverse

Board gender diversity was a focal point in a proxy battle at Destination Maternity where for the first time in recent years a majority-female dissident slate prevailed. According to Proxy Insight, the last occurrence of a predominantly female slate in a contested situation was in 2016 at Chico’s FAS, where the company’s five nominees—consisting of four women and one man—received the backing of ISS and Glass Lewis, forcing Barington Capital to withdraw. [6]

The dissident slate at Destination Maternity prevailed, despite the fact that neither proxy advisor supported the dissident candidates, which ISS faulted for their lack of public company board experience. In response, insurgents Nathan Miller and Peter O’Malley pointed out that if such experience is pre-determinant to board membership, then the gap between the number of male to female directors will never close. According to Equilar, 16.9% of Russell 3000 board seats were occupied by women at the end of Q1 2018 and are not expected to reach gender parity until 2048.

Sexual misconduct scandals spur shareholder action

The ongoing fallout at Wynn Resorts over allegations of sexual improprieties against founder and former Chairman/CEO Steve Wynn has exposed the considerable financial and reputational risks that can arise from toxic corporate cultures. The company’s damage control—which included adding three women to the board in April—failed to placate the proxy advisors who sided with Elaine Wynn’s “vote no” campaign against legacy director John Hagenbuch, a close friend of Steve Wynn who also served on the special committee investigating the complaints against him. Avoiding a showdown with investors, Hagenbuch withdrew his name from reelection two days before the annual meeting and another longtime director—Robert Miller—resigned.

In light of this and other incidents, shareholders are taking preemptive action. BlackRock is prioritizing human capital management—including creating a healthy culture and preventing unwanted behaviors—in its 2018 engagements with issuers. [7] The California Public Employees’ Retirement System (CalPERS) is also considering revisions to its corporate governance principles to include references to corporate culture and sexual harassment in the board responsibilities and human capital management sections. CalPERS proposes that all settlements, including those involving harassment, be reported to boards and those that are material be publicly disclosed. [8]

Separately, Trillium Asset Management filed a first-ever proposal on sexual misconduct risk management at Nike, where two executives recently departed over complaints of inappropriate workplace behavior. The resolution—which asked the company to consider linking executive compensation performance metrics to improvements in corporate culture or diversity—was withdrawn after Nike committed to ongoing dialogue. Other such resolutions could emerge in the future.

New proposals gain traction

Galvanized by news events, shareholder activists made significant inroads this year on several new and revived campaigns, particularly those related to the opioid crisis, drug pricing, and gun safety.

Opioid crisis. Opioid manufacturers and distributors have come under fire from Investors for Opioid Accountability—a coalition of union, faith-based and public pension funds—to report on how they are monitoring and managing financial and reputational risks related to the opioid epidemic. With the backing of the proxy advisors, this first-time resolution has received vigorous support—62.3% at Depomed and 41.2% at AmerisourceBergen. Two resolutions remain pending at McKesson and Cardinal Health, while others were withdrawn because the firms in question exited the opioid business or are combating opioid dependence by developing abuse-deterring compounds.

Drug pricing. Shareholder campaigns to curb the high cost of prescription drugs—now being taken up by the Trump administration—have gotten more play this year by tying the issue to executive compensation. The new proposal formulation—which asks pharmaceutical companies to report on how rising public concerns over drug pricing factor into executive incentive pay—has averaged 22% support and received the backing of ISS.

In contrast, the proponents have had less success with their traditional proposals asking for reports on the risks and rationale behind drug price increases. All of those filed in 2017 were omitted as ordinary business and the one voted this year—at Vertex Pharmaceuticals—received a meager 5.1% support.

Compensation tie-ins to other social issues—or to sustainability more broadly—haven’t fared as well. A new resolution at Verizon Communications to report on the feasibility of integrating cybersecurity and data privacy into executive compensation performance metrics generated only 11.6% support. A proposal at Alphabet to link executive compensation to meeting certain executive diversity goals was also defeated with 8.7% of the votes, though it was backed by ISS and 26.8% of the non-insider shareholders.

Gun safety: In the wake of recent school shootings, a group of faith-based investors were able to rally the holders of 68.8% of the shares—including heavyweight BlackRock—to back a proposal at Sturm Ruger to issue a report detailing its actions to address gun safety and the mitigation of harm associated with its products. ISS and Glass Lewis also endorsed the resolution. A similar reporting request is pending at American Outdoor Brands.

A separate “vote no” campaign spearheaded by Amalgamated Bank and Majority Action fell flat. The targeted Sturm Ruger director—Sandra Froman, who has ties to the National Rifle Association (NRA)—received 97.9% support. NRA connections are also referenced in a forthcoming shareholder proposal at FedEx. A retail investor wants the company to adopt a non-partisan policy regarding its affiliations with outside entities, such as the NRA, including refraining from providing discounts or gratuitous benefits to them unless they enhance the firm’s reputation or shareholder value.

More than any other proxy season initiative, activism around gun violence has epitomized the national divide on politically-charged issues. In response to the votes, Sturm Ruger CEO Christopher Killoy said the company will honor the proponents’ request, which is to prepare a report and nothing else. “What the proposal does not and cannot do is force us to change our business, which is lawful and constitutionally protected.” Other companies that have bowed to activist demands are now facing backlash from Second Amendment advocates. Several prominent gun manufacturers recently cut their ties to Dick’s Sporting Goods after it reportedly hired lobbyists to advocate for gun control legislation and announced that it would destroy its inventory of assault-style weapons.

Final thoughts

This year’s annual meetings produced some unexpected results and revealed the extent to which investor views are shifting. Several key votes are still in the pipeline for this summer which, along with Form N-PX filings, will further aid issuers in their shareholder outreach and planning for 2019. Alliance Advisors will follow up with additional reflections on 2018 proxy season developments in the coming months.

Table 1: Votes on Key Shareholder Proposals—2018 & 2017

Source: SEC filings, proponent websites, and media reports.

1. Includes floor proposals; excludes proposals on ballots that were not presented or were withdrawn before the annual meeting. 2017 figures are for the full year and 2018 figures are through June 8, 2018.

2. Based on votes FOR as a percentage of votes FOR and AGAINST.

Endnotes

1In 2016, there were eight majority votes on E&S resolutions, including two on election spending, two on board diversity, and one each on animal rights, methane emissions management, EEO policies, and sustainability reporting.(go back)

2See CII’s letter to the Division of Corporation Finance at https://www.cii.org/files/issues_and_advocacy/correspondence/2018/January%202018%2014a-8(i)(9)%20FINAL.pdf.(go back)

3See Chevedden’s and McRitchie’s PX14A6G filings at https://www.sec.gov/cgi-bin/browse-edgar?CIK=0001734335&action=getcompany and https://www.sec.gov/cgi-bin/browse-edgar?company=mcritchie&owner=exclude&action=getcompany.(go back)

4According to data from Proxy Insight, ISS has opposed only 0.2% of auditor ratification proposals this year, while Glass Lewis has opposed 1%.(go back)

5See Audit Analytics’ study at http://www.auditanalytics.com/blog/a-closer-look-at-votes-against-auditor-ratification/.(go back)

6As additional perspective, an ISS/IRRC Institute study found that between 2011 and 2015 women accounted for only 8.4% of dissident nominees on ballots or appointed through settlements, while racial and ethnic minorities represented only 4.6% of dissident candidates. See https://irrcinstitute.org/wp-content/uploads/2017/08/FINAL-Activism-and-Board-Refreshment-Trends-Report-Aug-2017.pdf.(go back)

7See BlackRock’s perspectives on human capital management at https://www.blackrock.com/corporate/literature/publication/blk-commentary-engagement-on-human-capital-march2018.pdf.(go back)

8See CalPERS’ proposed changes to its governance principles at https://www.calpers.ca.gov/docs/board-agendas/201804/invest/item06b-02_a.pdf.(go back)

Print

Print