Mike Kesner is a Retired Principal and Consultant, Tara Tays is a Managing Director, and Ed Sim is a Manager at Deloitte Consulting LLP. This post is based on their Deloitte memorandum. Related research from the Program on Corporate Governance includes the book Pay without Performance: The Unfulfilled Promise of Executive Compensation, by Lucian Bebchuk and Jesse Fried and The CEO Pay Slice by Lucian Bebchuk, Martijn Cremers and Urs Peyer (discussed on the Forum here).

Now that the CEO pay ratio disclosure requirement has been in place for two proxy seasons, it has demonstrated to be less impactful than some proponents and others may have expected. However, pay ratio disclosure may just be the opening salvo in employee, shareholder, media, and regulators’ demands for additional employee and compensation data. For example, some major investors have asked companies to disclose additional details about the median employee, including the employee’s geographic location and whether he/she is a salaried or hourly employee, in addition to more general information about the composition of the workforce, including geographic distribution, proportion of salaried and hourly employees, and the percentage of the total workforce comprised of contract workers.

The CEO pay ratio disclosure also led to shareholder proposals requesting that the compensation committee consider the CEO pay ratio when setting executive pay levels and policies. Although these proposals garnered very little shareholder support in the 2019 proxy season, they will likely continue to be on the proxy ballot for some companies next year.

The CEO pay ratio disclosure has also led a number of commentators to suggest shareholders would also benefit from gender, race, and ethnicity pay disclosure similar to that in the UK, which requires all companies with 250 employees or more to disclose gender pay information.

These and other developments suggest that compensation disclosure is converging with broader concerns about issues such as gender, race and ethnicity pay equity, culture, diversity and inclusion, and employee engagement. As a result, more time is likely to be spent on human resource policies at the both the board and compensation committee levels, and compensation committees may be thinking about broadening their charters to become human capital committees.

CEO pay ratio: What have we learned?

Brief history: The SEC’s rules requiring disclosure of CEO pay ratios took effect in 2018, amid considerable speculation as to the impact those disclosures might have. Despite expectations, the disclosures did not generate much in the way of excitement. For example, contrary to what proponents of the disclosure anticipated, the median CEO pay ratio at S&P 500 companies was 163:1, [1] far lower than the 300:1 predicted by some studies. [2] Moreover, the median compensation paid to median employees was $68,708, higher than predicted.

As many experts hypothesized, the disclosures were not particularly useful in evaluating if CEO or median employee pay levels were appropriate. Moreover, as anticipated by the SEC in the final rules, [3] comparisons among companies—even those in the same or similar industries—were not particularly helpful given wide variations in each company’s global footprint, mix of temporary, part-time or seasonal employees, company size and complexity, among other factors.

Of course, there was significant media coverage spotlighting some of the more extreme CEO pay ratios (e.g. 4,000:1), but these outliers were inevitable, in some cases because the median employees at some companies were part-time (e.g., a retail employee) or seasonal (such as a worker at a theme park).

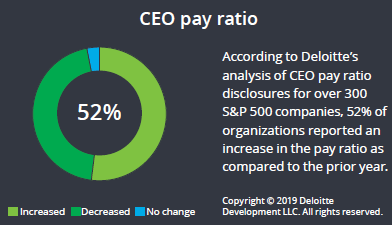

Our observations: We analyzed the 2019 CEO pay patio disclosures of 331 S&P 500 companies and saw no company disclose changes to its CEO pay program based on the CEO pay ratio, suggesting that the CEO pay ratio had no material impact on how companies establish CEO compensation. This conclusion is also supported by the fact that only five percent of companies included the CEO pay ratio disclosure within their Compensation Analysis & Discussion section (“CD&A”), which is where companies are required to describe the rationale for CEO and other executive pay.

One concern of companies was that proxy advisory firms would base voting recommendations on the pay ratios, possibly recommending votes against “say on pay” for companies with ratios above a specified level. However, the proxy advisory firms continue to refrain from using the data to evaluate CEO pay levels or the effectiveness of the company’s pay program. Instead, they have continued to report the pay ratio disclosure in their reports without any commentary.

This may suggest that the proxy advisory firms believe shareholders should be aware of the CEO pay ratio when voting on say on pay, but do not consider it a material factor when evaluating executive pay levels and the design of the pay programs.

One might have expected to see an explanation of material changes in a company’s CEO pay ratio or median employee’s compensation in this year’s disclosures. [4] However, just a handful of companies have done so. This may be a missed opportunity for companies to be transparent about the drivers of the changes, which in many cases are understandable and appropriate. For example, some companies had a drop in their median employee’s compensation of 20% to 30% due to an interest rate-driven increase in the present value of the employee’s pension in fiscal year 2017. For fiscal year 2018, the present value of the pension did not increase, as interest rates remained stable between the two years. As noted previously, comparisons to other companies’ CEO pay ratios are not particularly useful; however, comparisons of a company’s pay ratio and median employee compensation over multiple years may be of interest to shareholders and other stakeholders, and companies might consider expanding their disclosures to explain material changes or note trends between years.

In anticipation of the 2019 pay ratio disclosures, all the S&P 500 companies received a letter signed by 48 union and government pension funds and other investors requesting more detailed information about their median employees, such as the median employee’s job and location, and its workforce, such as a country-level breakdown of the company’s entire workforce and the use of temporary or seasonal workers. The letter suggested that the additional disclosures would “help investors put [the pay ratio] information into the context of your company’s overall approach to human capital management.” It is difficult to determine whether or to what extent this letter impacted disclosures; however, our analysis showed that 26% of companies added details about their median employee compared to 15% last year.

Disclosure highlights: Following is a summary of observations from our analysis of CEO pay patio disclosures of the 331 S&P 500 companies that had filed their proxy statements as of April 26, 2019.

- Forty-three percent of companies used the same median employee from last year, while 9 percent replaced the median employee with a comparable employee, as allowed under the SEC rules. The remaining 48 percent of companies determined a new median employee (despite corporate concerns that preparing the calculation was extremely time consuming and difficult). Only a few of these companies offered an explanation for redoing the calculation:

- Six companies disclosed that there were material changes to the company’s employee population, including four specifically related to M&A and spin-off activity.

- Two companies disclosed a change to the methodology used last year, which, under the SEC rules, requires a new median employee be identified.

- Two companies reported changes or anomalies to the median employee’s compensation arrangement.

- Two companies reported that the prior year’s median employee was no longer employed by the company and decided not to substitute a comparable employee from last year.

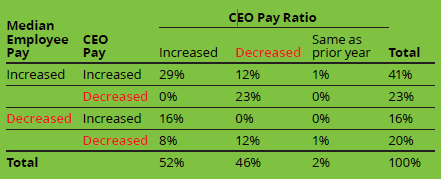

The table below shows that the change in the ratio was impacted by an increase or decrease in the compensation of the median employee and the CEO both on absolute and relative terms. For example, CEO pay ratio decreased at 46% of companies, of which 12% occurred when there was in increase in both median employee and CEO’s pay, 23% occurred when there was an increase in median employee pay and a decrease in CEO pay, and 12% occurred when there was a decrease in both median and CEO’s pay.

- Overall, other disclosure-related items, such as the placement of the CEO pay ratio disclosure in the proxy statement, distribution of the Consistently Applied Compensation Measure (CACM) and adjustments used to identify the median employee, and disclosure of alternative pay ratios were very similar to last year. The majority of companies (82%) placed the pay ratio disclosure after the Severance and Change-in-Control Table within the proxy statement, while 12% placed the disclosure between the Summary Compensation Table and Severance and Change-in-Control Table.

What’s next? There will likely be a smattering of news articles on 2019 pay ratio disclosures, particularly those involving highlighting 4-digit pay ratios. However, as was the case last year, little or no reaction is expected from shareholders, proxy advisory firms, or employees. Boards of directors and compensation committees should, however, continue to monitor developments, address any shareholder and employee concerns, and understand the reasons for any changes in the ratio between years.

The “other” pay ratio

As noted, the CEO pay ratio has received a fair amount of attention due to its “newness” as a disclosure requirement. However, boards should consider shifting their attention, if they haven’t done so already, to reviewing if the company has any gender, ethnicity, or racial pay gaps that cannot be properly supported by differences in experience, roles and responsibilities, individual performance or other factors that impact pay. A number of state legislatures have

taken steps to address gender pay biases, and one of the Presidential candidates has proposed future legislation that would impose a fine of 1% of company profits for each 1% gap in gender pay.

Other countries have already adopted gender pay measures:

- The UK requires companies with over 250 employees in the UK to disclose pay based on gender. [5]

- France will soon require companies to disclose the gender pay gap and actions taken to correct it. Failure to report or improve pay disparity within three years can lead to financial penalties of up to 1% of payroll. [6]

- Germany gives employees the right to find out what coworkers of the same level and opposite gender are paid, on average. [7]

- Iceland will soon require companies undergo an external audit to prove gender pay equity every three years. [8]

A number of companies in the US have already proactively disclosed gender, race and ethnicity pay equity results, with many concluding all pay gaps have been resolved. Many commentators believe it is just a matter of time before some type of disclosure requirement is adopted in the US.

Another interesting development is a recent report by the SEC’s Investor Advisory Committee, calling for a significant increase in corporate disclosure of workforce composition, tenure, training, performance management and other information. [9] The authors of the report note, “human capital is the most valuable intangible asset a company has that is not reported on its balance sheet,” and such information is essential in making buy/sell decisions in a company’s stock.

Taken as a whole, these events are a call to action for boards of directors and compensation committees to be more familiar and involved with employee engagement scores, diversity and inclusion initiatives, talent and leadership development efforts, and other human capital initiatives.

Boards should consider asking for periodic updates on the company’s risk management and risk mitigation efforts to address these matters. At the same time, it would be prudent for companies to review, in consultation with their legal counsel, their human resource systems and job architecture to assess if the data required to properly conduct a gender, ethnicity and racial pay evaluation can be performed, and to prepare such calculations, understand the results, and be able to support any variances or take corrective action. Gender, race and ethnicity pay analyses are more complex and burdensome than the CEO pay ratio calculation due to the need to understand factors that impact compensation, such as geography, tenure, individual performance history, being hired externally or not, and proper job classification, and companies should be proactive in addressing this matter.

Questions for the board to consider asking:

- Do our directors, including those on our compensation committee, have the requisite levels of experience and expertise on human capital, beyond just compensation?

- Should we consider expanding the compensation committee to a human capital committee? What should be addressed by a committee versus the full board?

- Are we getting the right kind of reporting on the company’s human capital from management?

- Do we need to bring in an outside party to perform an independent review of our human capital function? What would we be in scope of such a review to get comfortable with the results?

- How much of these analyses, e.g., gender pay equity, do we want to share with employees, shareholders, and the media?

Prior to conducting any review or analyses, boards should consult with legal and human resources advisors regarding any potential legal implications and/or risks.

Endnotes

1https://www2.deloitte.com/us/en/pages/human-capital/articles/ceo-pay-ratio-disclosure-updates.html?nc=1(go back)

2https://aflcio.org/paywatch(go back)

3https://www.sec.gov/rules/final/2015/33-9877.pdf(go back)

4https://www2.deloitte.com/us/en/pages/human-capital/articles/ceo-pay-ratio-disclosure-updates.html?nc=1(go back)

5https://gender-pay-gap.service.gov.uk/(go back)

6https://www.jdsupra.com/legalnews/closing-the-gender-pay-gap-in-france-83487/(go back)

7https://www.jdsupra.com/legalnews/germany-s-gender-pay-gap-law-what-it-79884/(go back)

8https://www.government.is/topics/human-rights-and-equality/equal-pay-certification/(go back)

9https://www.sec.gov/spotlight/investor-advisory-committee-2012/human-capital-disclosure-recommendation.pdf(go back)

Print

Print