Let me preface my testimony by stressing the urgent need for broad regulatory reform in light of the financial crisis on matters ranging from the structure of our regulatory system, to the reduction of systemic risk in the derivatives market, to improving resolution procedures for insolvent financial companies, to increasing consumer protection, and to revamping the GSEs. The Committee on Capital Markets Regulation dealt with these issues in its May 2009 Report titled The Global Financial Crisis: A Plan for Regulatory Reform. These issues were also fully laid out in the Treasury Department’s June 2009 proposal on financial regulatory reform, and have been vigorously debated in public meetings, the press, and Congressional hearings for months. These efforts have so far culminated in the Wall Street Reform and Consumer Protection Act (H.R. 4173) as well as in Senator Dodd’s thoughtful Discussion Draft. And I applaud the ongoing efforts of this Committee to reach bipartisan consensus on these issues. In my judgment, we should not hold up these important reforms while we debate activity and size limitations.

The Volcker Rules would limit the ability of banks to own, invest in, or sponsor a hedge fund or private equity fund, or to engage in “proprietary trading.” The size limitation would limit the market share of all financial institution liabilities beyond the current 10% market share cap applied to bank deposits.

At the outset, it is important to focus on the stated objective of these new proposals—to reduce bank risk so as to minimize the necessity of public rescue of banks that are “Too Big to Fail.” There is no question that we need to address the “Too Big to Fail” issue. We need to understand whether the conventional wisdom—that we cannot let large financial institutions fail, in the sense of imposing a full measure of losses on the private sector, whether they be equity or unsecured debt holders or counterparties—is actually true. The concern rests on an assumption that we cannot permit certain large and interconnected financial institutions to fail because such failure would trigger a chain reaction of other financial institution failures, with disruption to the entire economy.

In the notable $85 billion federal bailout of AIG, however, some question whether the asserted prospect of severe counterparty losses actually existed. Goldman Sachs, one of AIG’s major counterparties, has stated that it had adequate cash collateral to survive an AIG default. We need to be careful that “Too Big to Fail” does not become a self-fulfilling prophecy.

Clearly, the absolute size of an institution is not the predicate for systemic risk; it is rather the size of its debt, its derivatives positions, and the scope and complexity of many other financial relationships running between the firm, other institutions, and the wider financial system. As Senator Schumer’s example at Tuesday’s hearing illustrates, 50 small but highly correlated hedge funds might combine to create systemic risk. In short, the proper focus is on a bank’s interconnectedness with other financial institutions, and we have only a primitive understanding of the nature and extent of these connections. To the extent interconnectedness is a problem, the most fundamental way to attack it is to reduce the interconnections so that we can allow institutions to fail safely. This will also require that Federal regulators be given enhanced resolution authority, as set forth in H.R. 4173 and Senator Dodd’s Discussion Draft. And as Secretary Geithner recently acknowledged, “the Bankruptcy Code is not an effective tool for resolving the failure of a global financial services firm in times of severe economic stress.”

To address our “Too Big to Fail Problem,” we need to modernize financial regulation to address the problems of today, not of the past.

Let me now turn in more depth to the Volcker Rules.

I. Proposed Restrictions on the Scope of Bank Operations

A. Proprietary Trading and “Too Big to Fail”

The Volcker Rules would prohibit banks and bank holding companies from engaging in proprietary trading “unrelated to serving customers for [their] own profit,” as well as from investing in or sponsoring hedge fund and private equity fund operations. Given that Mr. Volcker is the Chairman of the Trustees as well as the Chairman of the Steering Committee of the Group of 30 (G-30), it is worth noting that the Volcker Rules are significantly more aggressive than the G-30’s recent proposal to merely limit proprietary trading by “strict capital and liquidity requirements.”

The objective embodied in the Volcker Rules is to restrict banks that are “Too Big to Fail” from participating in non-traditional risky investment activity, thus minimizing the chance they might fail and have to be rescued to avoid endangering uninsured depositors or the FDIC insurance fund. This might have been the concern in the past but it misses the mark today. The reason for the rescues during the crisis, such as AIG, or the TARP injections to forestall failures, was not to protect depositors of banks or the FDIC insurance fund. The reason was rather to avoid a chain reaction of failures set off by interconnectedness. Furthermore, this need for rescue does not depend on what activity gives rise to the potential bank failure. We will have to rescue banks whose failure will endanger other banks even if these failing banks are engaging in traditional activities. Mr. Volcker seems to imply that it is acceptable to rescue banks engaging in traditional activities. I disagree. Quite frankly, I do not think a taxpayer would feel better about rescuing a bank that made risky loans than he would rescuing a bank that engaged in less traditional risky activity.

As a solution to the problem of “Too Big to Fail,” the Volcker Rules are over-inclusive because not all banks, and not even all large banks, pose chain-reaction risks to the financial system. The Rules are also potentially under-inclusive, because many interconnected financial institutions which do pose systemic risks are not deposit-taking banks. Goldman Sachs—which is the only U.S. bank with significant revenue exposure to proprietary trading—could avoid falling under the Volcker Rules by divesting itself of its small deposit-taking operations, which account for only 5.19% of its liabilities. Similarly, Morgan Stanley would lose only 8.70% of its liability base by giving up bank holding company status. None of the most prominent failures of the financial crisis—Fannie Mae, Freddie Mac, AIG, Bear Stearns, or Lehman Brothers—were deposit-taking banks.

Furthermore, major U.S. banks that do have high levels of deposits relative to total liabilities derive only a marginal fraction of their revenues from walled off proprietary trading activities, if “proprietary trading” is understood as trading activity carried out on internal trading desks purely for a bank’s own account. Wells Fargo and Bank of America, two of the largest deposit-funded banks, report deposits accounting for approximately 72% and 49% of their total liabilities, respectively, but are both estimated to earn less than 1% of revenues from proprietary trading. These data show that U.S. banks with significant deposit bases assume little to no balance sheet risk from proprietary trading. Riskier institutions that do have exposure, if forced to choose between proprietary trading and deposits, may opt to “de-bank.” But because banks are highly regulated entities, regulators are in a good position to respond to bank failures. By encouraging banks to take themselves off the regulatory radar, the Volcker Rules could actually increase systemic risk. The regulatory and supervisory system is much better able to deal with controlling the risky activity of regulated banks than of unregulated investment banks, insurance companies, hedge funds, or commercial companies with large financial operations. The migration of risky bank activities to other large firms that may be “Too Big to Fail” would compound, rather than reduce, the systemic risk problem. The Administration’s earlier proposals envision some level of regulation of systemically important institutions other than banks, but such regulation will be much less comprehensive than it is for banks.

The original proposal was somewhat ambiguous as to the level of the banking organization at which the Rules would apply. Unless the Rules limit the activities of bank holding companies and all holding company subsidiaries, banks could evade the restrictions by shifting hedge fund or private equity investments and proprietary trading activities to non-bank subsidiaries. This would, perhaps, protect bank depositors, but it would not solve the need to rescue bank holding companies to avoid the chain-reaction-of-failures problem. Because proprietary trading, hedge fund, and private equity investments could pose the same threat to other financial institutions because of connectedness, regardless of whether they occur in a bank or its holding company, the Volcker Rules only make sense if they apply to bank holding companies and all of their subsidiaries (including banks and non-banks).

B. What is Proprietary Trading?

Mr. Volcker is confident that he as well as bankers know proprietary trading when they see it. Yet it is notable that neither Mr. Volcker nor the Treasury Department has presented a workable definition of this term. The suggestion that it can be measured by a pattern of large gains and losses is unclear. Hedges or positions taken for customers can exhibit the same pattern.

Defining “proprietary trading” presents tremendous difficulties. Too narrow a definition, limited to discrete internal hedge fund and private equity activity undertaken by banks for their own accounts, is unlikely to lead to material reduction of risk, since these activities account for only a small fraction of most banks’ operations. Defining proprietary trading too broadly, meanwhile, might seriously impair the basic function of modern banks as market-makers in government and non-government securities, and as securitizers of consumer debt. Neither of these options is very attractive.

1. Proprietary Trading as “Internal Hedge Funds” is Insignificant to Banks

Strictly construed, proprietary trading “unrelated to serving customers” encompasses any trading activity carried out on internal trading desks for a bank’s own account, but not on behalf of clients. Writing in the New York Times on Sunday, Mr. Volcker echoed this definition, identifying proprietary trading as “the search [for] speculative profit rather than in response to customer need.” Generally speaking, there are at least two reasons why this narrow definition of the activity is unlikely to reduce systemic risk. First, in absolute terms, the scale of such internal, non-customer, proprietary trading is too negligible to drastically impact banks that engage in it. As outlined above, most U.S. banks, with the exception of Goldman Sachs, report minimal proprietary trading activity so defined.

Second, proprietary trading through internal hedge funds and other non-customer-related trading desks was not the source of the damaging losses that fatally impaired many of the banks at the center of the financial crisis. According to one Wall Street analyst’s estimate, of the approximately $1.67 trillion of cumulative credit losses reported by U.S. banks, losses taken on trading activities and derivatives accounted for less than $33 billion, or 2%, of this total. And as Bernstein Research notes in a recently published analysis, a construction of the Volcker Rules confined exclusively to internal hedge fund activity would not, for example, have reached the significant mortgage positions and unsecuritized loans held by Lehman Brothers that plummeted in value as liquidity drained from the market during the crisis. These positions, while proprietary, were not trading positions assumed by an internal trading desk for Lehman’s own account. Instead, they were accumulated as part of Lehman’s mortgage-underwriting and securitization businesses.

2. Loan and Securitization Losses Were the at the Heart of the Financial Crisis

The losses at the center of the financial crisis mainly resulted from the credit, lending, and securitization functions of U.S. banks. To date, the vast majority of overall credit losses— approximately 80%—have been linked to lending and securitization operations.17 Goldman Sachs estimates that approximately $577 billion, or 34%, of cumulative losses were incurred by banks on direct real-estate-related lending, including mortgages, commercial real-estate loans, and construction lending. An additional $338 billion of losses on non-real-estate loans accounted for 20% of cumulative losses. A further $519 billion, or 31%, represented losses on indirect real-estate-backed securitizations, including RMBS, CMBS, and CDOs. The loss experiences of smaller regional banks, where poor-quality mortgage and construction loans drove the largest failures, confirm the centrality of credit and lending to bank losses. For example, option ARMs represented 65% of total loans at Downey Savings, 59% at BankUnited, 29% at Indymac, and 22% at Washington Mutual. Construction loans accounted for 88% of Corus Bank’s loan book. At regional U.S. banks, just as at the national and global levels, under-priced credit risk embedded in loans and securitized debt, and not speculative internal hedge funds, generated the lion’s share of the losses that led to financial collapse.

To be clear, portfolios of securitized debt instruments held on- and off-balance sheet by banks were responsible for roughly one-third of total credit losses. Broadening the definition of “proprietary trading” to restrict banks from holding securitized debt instruments might address one of the central risks banks were exposed to in the financial crisis. But do we really want to prevent banks from investing in securitized debt altogether? The question is complicated by the fact that owning securitized assets typically serves several purposes for banks, including making markets in securitized assets and assuring clients that the banks that structured their deals will have “skin in the game,” particularly by holding junior tranches of securitized debt. Indeed, recently adopted legislation in the European Union requires banks to retain a 5% interest in securitizations. While it was also true that banks held securitized debt for speculative reasons, it would be difficult to separate such positions from those needed to engage in the securitization business. A blanket rule preventing banks from holding securitized debt might interfere with the revival of our already moribund securitized debt markets, since it would deprive banks of an important way of signaling the quality of issuances. Because restoring these markets is crucial to fueling new lending and economic growth—Mr. Volcker himself, in his opinion piece, cited the “large challenge in rebuilding an efficient, competitive private mortgage market, an area in which commercial bank participation is needed”—regulators must bear this risk in mind when implementing reforms.

3. Market-Making in Securities is a Core Function of Banks

In its most expansive formulation, proprietary trading could include any activity that places principal at risk, including the longstanding role that banks have played in modern capital markets as market-makers in U.S. government, agency, and non-government securities. A rule which restricts the scope of this function by classifying market-making as a form of proprietary trading would reduce liquidity and increase borrowing costs throughout a wide range of securities markets, including the market for GSE and U.S. Treasury securities. This activity cannot easily be performed by other institutions—it requires the large balance sheets of banks.

According to Federal Reserve data cumulating securities ownership across all bank securities portfolios (including held-to-maturity, available for sale, and trading), over 60% of the securities held by banks are agency MBS and Treasuries. Forced reductions in this inventory under the Volcker Rules would drain liquidity from important government funding markets and entail higher borrowing costs for the U.S. government and its sponsored entities, negatively impacting economic recovery. Mr. Volcker likewise recognizes what he has called the “essential intermediating function” banks serve in meeting the “need for reliable sources of credit for businesses, individuals, and governments.” And Glass-Steagall itself recognized the linkage between liquidity in government debt markets and proprietary trading by banks in government securities, providing for an exception authorizing banks to deal in, underwrite, and purchase for their own account securities issued by the U.S. government. So the area which comprises the largest portion of bank trading, U.S. government securities, would have to be preserved.

4. Proprietary Trading Is a Source of Diversification for Banks

Portfolio diversification reduces risk. All else being equal, more concentrated portfolios are more volatile than portfolios containing an array of uncorrelated earnings streams, even when parts of the uncorrelated income are volatile. As the breakdowns discussed earlier illustrate, a substantial portion of bank losses sustained in the 2007-2008 financial crisis emanated from highly concentrated exposures to direct real-estate loans. And past financial crises, like the sovereign debt and thrift crises of the 1980s and the Asian crises of the 1990s, also involved lending operations. Proprietary trading (excluding securitization, as discussed earlier), which barely contributed to losses in these earlier periods, is a source of diversification that may help to mitigate, not aggravate, the risk profile of U.S. banks in the future. During the financial crisis, firms with significant proprietary trading operations like Goldman Sachs, or those that ran complex, interconnected books of business, including Goldman, Morgan Stanley, and JP Morgan, survived. Indeed, this diversification helped protect them in the crisis. By contrast, firms that concentrated their exposures in real-estate, like Lehman, or isolated these exposures in large, undercapitalized, off-balance sheet silos either did not survive, or needed government capital injections to keep them afloat.

C. Limitations on Private Equity and Hedge Fund Investing by Banks

The Volcker Rules, in addition to limiting proprietary trading activity, would also restrict banks from owning, investing in, or sponsoring private equity funds (including venture capital funds whose activity is crucial to small business) and hedge funds.

Worldwide, banks and investment banks account for $115 billion, or 12%, of the $1.1 trillion of investment by limited partners including co-investments in private equity funds involved in corporate finance and buyouts. Indeed, banks are a larger source of capital as private equity limited partners than endowments or sovereign wealth funds. Historically, banks have also represented an important source of direct proprietary involvement in private equity as general partners, raising an estimated $80 billion in committed capital from investors over the past five years. Mandating the exit of banks from involvement in these activities could force the withdrawal of a substantial fraction of the private equity industry’s available investment capital. This would deal a disruptive blow to the recovery of the private equity industry on the heels of serious setbacks in terms of both fundraising and transaction activity which the industry sustained from 2007 to 2008. U.S. and global private equity fundraising activity remains at or below 2004 levels, with less than $10 billion raised by U.S. funds in Q4 2009 as compared to an excess of $100 billion raised in the same period in 2007. Nonetheless, private equity is still an important financing source for the U.S. economy, providing needed investment to undercapitalized or recapitalizing U.S. industries, including the financial sector. In Q4 2009, as investment activity began to recover, private equity funds invested $8 billion in U.S. buyouts (executing $48 billion in M&A transaction volume). At a moment when private equity activity is starting to rebound, rules that would force a withdrawal or reconfiguration of significant capital in the industry could chill investment in U.S. industry.

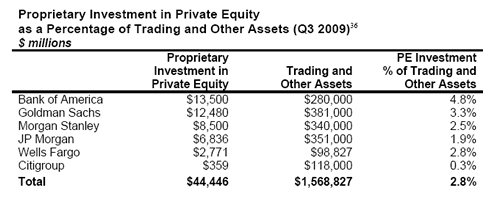

These prospective costs to the economy might be acceptable if they were offset by a commensurate reduction in bank balance sheet risk. But while bank investment is an important source of capital to private equity, it is not a meaningful proportion of bank assets. As of September 30, 2009, investment in private equity accounted for less than 3% of the aggregate reported trading and/or “other” assets of the six largest U.S. banks. As a percentage of total bank assets, private equity investments accounted for less than 1% of the total consolidated balance sheet of Bank of America, JP Morgan, Wells Fargo, and Citigroup, and less than 2% of the total balance sheet assets of Goldman Sachs and Morgan Stanley. While relatively little bank capital is at risk in the private equity business, private equity nevertheless represents an important source of advisory, syndication, and underwriting revenues for banks which sponsor private equity funds. Mandating the spin-off or closure of these funds would not improve the composition of bank balance sheets or the profile of bank riskiness, but would terminate a lucrative source of earnings at a time when banks are focused on recapitalizing.

Although we have not been able to gather much data regarding bank exposure to the hedge fund industry, the information we do have suggests that eliminating these activities will not significantly reduce bank risk profiles either. Analysis by Preqin shows that banks directly invest only $10 billion (or 0.9%) of the total capital invested by U.S. investors in hedge funds. In addition, banks have fund-of-funds units that are responsible for channeling $180 billion (or 16%) of all U.S. capital flowing to hedge funds. It is unclear what percentage of this $180 billion represents banks’ own capital. But even on the implausible assumption that all of $180 billion comes from banks, it likely represents a negligible portion of bank risk. It is far more likely that a significant portion of the $180 billion is money that banks are managing on behalf of clients. Managing client funds (apart from the use of seed money) generally does not place bank capital at risk, and therefore does not implicate the underlying rationale of the Volcker Rules.

In his written testimony, Deputy Secretary Wolin seemed to refer to Bear Stearns when he wrote that “[m]ajor firms saw their hedge funds and proprietary trading operations suffer large losses in the financial crisis. Some of these firms ‘bailed out’ their troubled hedge funds, depleting the firm’s capital at precisely the moment it was most needed.” Although Bear Stearns later pledged $3.2 billion to bailout Bear Stearns High-Grade Structured Credit Fund and Bear Stearns High-Grade Structured Enhanced Leverage Fund, Bear’s original principal exposure was only $40 million. Clearly, Bear’s real exposure, on a reputational basis, exceeded its investment. The same was true for many banks’ SIVs and conduits. This problem is best addressed by FASB’s new consolidation accounting rules, FAS 166 and 167, which effectively require banks to hold capital against these exposures. There is no need to ban these sponsorships entirely.

As the above analysis suggests, bank involvement with private equity and hedge funds can benefit bank customers in significant ways. Banks that sponsor or invest in private equity funds and hedge funds are better positioned to serve their global clients, who increasingly look to banks for “one-stop shopping” in financial products and services. Given the dramatic rise in assets under management in the private equity and hedge fund industry, it is fair to infer that clients are particularly interested in these offerings. In addition, to the extent that banks are permitted to continue managing funds or fund-of-funds, allowing them to invest their own money alongside customers’ is an important way to align interests.

Taking a more skeptical view of the implications for customers of bank involvement in proprietary trading as well as private equity funds and hedge funds, Mr. Volcker recently argued that these activities “present virtually insolvable conflicts of interest with customer relationships, conflicts that simply cannot be escaped by an elaboration of so-called Chinese walls between different divisions of an institution.” Mr. Volcker elaborated on this point in his testimony before the Committee:

I want to note the strong conflicts of interest inherent in the participation of commercial banking organizations in proprietary or private investment activity. That is especially evident for banks conducting substantial investment management activities, in which they are acting explicitly or implicitly in a fiduciary capacity. When the bank itself is a “customer”, i.e., it is trading for its own account, it will almost inevitably find itself, consciously or inadvertently, acting at cross purposes to the interests of an unrelated commercial customer of a bank. “Inside” hedge funds and equity funds with outside partners may generate generous fees for the bank without the test of market pricing, and those same “inside” funds may be favored over outside competition in placing funds for clients. More generally, proprietary trading activity should not be able to profit from knowledge of customer trades.

If there is a sound justification for the Volcker Rules, it is that they would limit systemic risk, not that they would prevent conflicts of interest. Moreover, the issue of conflicts of interest was considered and rejected during the repeal of Glass-Steagall. If Mr. Volcker’s contention were correct, it would be equally applicable to a much wider range of bank activities than proprietary trading and investment in hedge funds and private equity. It would extend to bank involvement in the underwriting of securities, for example, where the argument has long been made that a banker underwriting a faltering securities offering would encourage clients to invest in the securities. Given that there is no proposal to limit bank underwriting, or other securities services that raise potential conflicts, it is unclear why conflict of interest concerns justify restricting bank investments.

II. Proposed Restrictions on the Size of Banks and other Financial Institutions

A. Proposed Limitations on the Size of Banks

The actual operation of the size limitations is even less clear than the meaning of the Volcker Rules on bank activity. The Administration has referred to “limits on the excessive growth of the market share of liabilities at the largest firms, to supplement existing caps on the market share of deposits.” This appears to mean that the size limit would apply to banks’ market share of non-deposit liabilities.

Deputy Secretary Wolin’s recent testimony that the “size limit should not require existing firms to divest operations,” but will instead “serve as a constraint on future excessive consolidation among our major financial firms,” would appear to be addressed to market concentration and antitrust concerns since they carry the striking implication that no firm is currently “Too Big to Fail.” If market concentration is the concern, we need to understand why existing antitrust law is not up to the task of dealing with this problem, while if systemic risk is the issue, it is puzzling why the size caps should apply only to firms that grow by acquisition. Presumably we should be concerned about the size (or the interconnectedness) of firms, whether the result of acquisition, organic growth, or otherwise.

To the extent systemic risk is the issue, the central questions are: (a) whether larger banks are more or less likely to fail than smaller banks; (b) whether the failure of large banks generates higher levels of systemic risk; and (c) whether the Administration’s proposal to cap each banks’ market share of liabilities is a plausible remedy for the problem.

If larger banks are riskier than smaller ones, the differences are likely to be relatively minor. Studies have found that large banks hold more diversified portfolios and are engaged in a wider range of business, and that such diversification serves as a source of strength. Scholars have also found that size promotes stability since it is easier for large banks to obtain funding in the capital markets. On the other hand, larger banks tend to use size advantages to make riskier loans, conduct more off-balance sheet activities, and maintain more aggressive leverage ratios. As banks grow larger, they may take on additional risk by becoming reliant on non-interest income and non-deposit funding. On net, this combination of considerations may roughly balance out.

Turning to the second question, the surprising fact is that we do not know whether larger institutions pose greater systemic risk and, if so, whether that increase is significant. As discussed above, this question requires more data and discussion. The issue is whether larger banks are more interconnected in such a way that their failure would set off a chain reaction of failures. This should not be accepted on faith.

To the extent that systemic risk does increase with “size,” it is unclear that broad-brush restrictions on non-deposit liabilities are the solution. First, the focus on liabilities ignores the fact that a bank’s riskiness is determined in large part by the assets it holds. Some of the most prominent victims of the financial crisis failed because of the interactions between different parts of their balance sheets (e.g., funding risky assets with overnight loans). Second, a bank could comply with the general liability restrictions while maintaining risky assets. The Volcker Rules would not limit the ability of banks to make risky loans. Thus, the somewhat smaller bank, faced with Volcker Rules and size caps, may shift its activity to overall higher levels of risk in search of return. As Raghuram Rajan, Professor of Finance at the University of Chicago and author of a prescient paper anticipating the financial crisis, recently wrote:

Crude asset size limits, for example, would probably ensure a lot of financial activity is hidden from the regulator, only to come back to light (and to the balance sheets) at the worst of times. There are many legal ways to mask size. Banks can offer guarantees to assets placed in off-balance sheet vehicles, much like the conduits of the recent crisis. If, instead, capital is the measure, then we will be pushing banks to economize on it as much as possible, hardly a recipe for safety.

Finally, we should consider if overall size limitations are preferable to an approach targeted at individual institutions. It appears that, at most, only six banking institutions would be impacted. Assuming, for example, that a 10% of domestic wholesale funding market share ceiling is imposed on U.S. banks—analogous to the deposit market share limits already in place—Bank of America, Citigroup, Goldman Sachs, JP Morgan Chase, and Morgan Stanley are the only institutions that appear to approach this ceiling level. If a higher ceiling than 10% wholesale funding market share is imposed, it is possible that only the very largest domestic users of wholesale funding—Bank of America and JP Morgan Chase, the only two institutions with wholesale funding market shares significantly greater than 10%—would be impacted. We note that beyond these six institutions, the U.S. bank wholesale funding market is highly fragmented; no other institution has more than a 3% market share. Given that the size limitations might affect only a handful of banks, a better policy would be to address issues at those banks individually through better and more intense supervision.

We must also take into account that size limitations on our biggest banks will negatively affect their global competitiveness. Size limitations could cause U.S. banks to lose the business of their largest and most important customers, who will prefer to work with banks that have the capacity to address their global needs. Larger banks and their customers also benefit from the economies of size and scope that exist when banks are large enough to offer a wider range of products, such as lending and derivatives. One study by an economist at the New York Federal Reserve found that bank productivity grew more than 0.4% per year during the bank merger wave of the early 1990’s, while Charles Calomiris of Columbia Business School suggests that the increasing size of banks has lowered underwriting costs associated with accessing public equity markets by as much as 20%. As it is, as of the end of 2008, the United States only had two of the ten largest banks in the world, Bank of America (6th) and JP Morgan Chase (9th). The world’s five biggest banks are BNP Paribas (France), Royal Bank of Scotland (U.K.), Barclays (U.K.), Deutsche Bank (Germany), and HSBC (U.K.).

In this connection, it is worth recalling that a major motivation for the decision to repeal Glass-Steagall was the need to increase the competitiveness of U.S. financial institutions. At the time, Senator Proxmire noted that Glass Steagall’s “restrictions inhibit a U.S.-based firm from offering the entire range of financial services to both domestic and foreign customers in the United States.” Therefore, many U.S. and foreign financial institutions were choosing to locate offshore, where they could provide such products to foreign clients. Furthermore, although U.S. banks had expertise as underwriters through offshore activity, they could not achieve the economies of scale attainable through underwriting domestically. Any limitation on U.S. bank activities that did not extend to foreign banks would be damaging to their future profitability.

B. Proposed Limitations on the Size of Other Financial Institutions

To the extent that the proposed rules regarding non-deposit liability market share addresses financial institutions other than bank holding companies, it is important to consider the potential impact on four additional groups. First, there are a number of U.S. wholesale-funded lending businesses—most notably credit card lenders and non-bank commercial lenders—that are not typically grouped with banks in regulatory discussions. Many of the largest of these lending businesses are subsidiaries of bank holding companies. Of those that are not bank holding company subsidiaries, although some are large within the context of their narrowly defined business segments (credit carding lending, etc.), even the largest have modestly sized wholesale funding bases compared to the largest bank holding companies. In credit cards, for example, American Express and Capital One Financial (the largest pure-play card lenders by wholesale liabilities) have only 3% and 1% wholesale funding market shares, respectively. Similarly, GMAC and CIT, the largest wholesale-funded commercial lending businesses have only 4.5% and 2.2% non-deposit liability market shares, respectively. Though the precise details on the proposed wholesale funding limits are not yet available, it is hard to imagine that the market share ceiling would be set low enough to impact even the largest of these lenders.

Second, a number of U.S. insurance companies also have sizable balance sheets, with ostensibly sizable non-deposit liability bases. Although these large liability bases may seem to place insurers within the purview of the proposed liability size restrictions, the size caps are unlikely to apply to these institutions for two reasons: (1) insurers in general simply do not rely heavily on wholesale funding as part of their business models—the majority of the large funding bases of these institutions consists of expected future benefits or actuarial estimates of unpaid claims (classic insurance “float” funding that appears to fall outside the definition of the funding targets) and (2) as the last crisis has shown, the riskiest insurance institutions, like AIG, suffered primarily from underwriting risk—much of which was opaquely held in off-balance sheet vehicles—not from funding risk per se.

Third, there are money market mutual funds that as of the week ended January 27, had assets totaling $3.218 trillion. The five largest money market fund families managed roughly 15% (Fidelity), 11% (JP Morgan), 8% (Federated), 7% (Blackrock) and 6% (Dreyfus) of this amount. Since even the largest money market fund family does not have a dominant share of the market, and there are numerous fund families with substantial levels of assets under management, the case for capping the size of money market mutual funds based purely on market concentration of liabilities appears weak.

Fourth, though GSEs are not bank holding companies, the largest GSEs use sufficient wholesale funding to make them worth discussing here. Freddie Mac and Fannie Mae each have roughly $800 billion in wholesale funding, an amount that dwarfs the domestic wholesale funding requirements of all bank holding companies, except that of Bank of America whose wholesale funding is slightly over $1 trillion. Given these very large non-deposit liability requirements—together these two GSEs use more wholesale funding than half of the entire U.S. bank holding company total—excluding them from any new size restrictions would seem highly inconsistent with the treatment of banks.

In concluding the discussion of liability size restrictions, it is important to keep in mind that regardless of the liability size of any bank or non-bank financial institution, the proposed rules fail to address the more fundamental issue that non-deposit liability market share is not a good proxy for an institution’s broader systemic risk. Even if a commercial lender or an insurer does not rely on systemically large amounts of wholesale funding, the interconnectedness of these and similar institutions could ultimately make them “Too Big to Fail.” Any set of new regulations designed to reduce systemic risk must focus not just on the size of institutions’ wholesale liabilities, but also on institutions’ connections with the broader financial system.

III. There Has Been a Lack of International Coordination in the Newest Proposals

Up to this point, the Obama Administration wisely and appropriately has been careful to coordinate its regulatory reform recommendations with international efforts. In the Treasury White Paper, the Administration stressed the importance of international coordination stating, “The United States is playing a strong leadership role in efforts to coordinate international financial policy through the G-20, the Financial Stability Board, and the Basel Committee on Banking Supervision. We will use our leadership position in the international community to promote initiatives compatible with … [U.S.] domestic regulatory reforms.” Regrettably, this has not been the case with the Volcker Rules or size limitations.

Based on the initial reaction from international financial and regulatory bodies, we are far from reaching consensus on this issue. Speaking at the Davos economic summit, Dominique Strauss-Kahn—head of the International Monetary Fund—highlighted the lack of international cooperation behind President Obama’s proposed banking reforms saying, “The question of coordinating the financial reform is key and I’m afraid we’re not going in that direction.” The Financial Stability Board says that the proposals are “amongst the range of options and approaches under consideration” and that a “mix of approaches will be necessary to address the [‘Too Big to Fail’] problem,” hardly an endorsement. And earlier this week, the Deputy Director-General of the European Commission’s internal market and services division, David Wright, said he was surprised the U.S. had taken a radical line on the structure of banking without first consulting European leaders—especially in light of U.S. discontent last year when the European Commission took the lead on securitization and credit rating agency reforms. Wright added that it might be difficult to find the right definition of “proprietary trading” to satisfy the Obama administration’s goals without inflicting unintended consequences on the industry, emphasizing that Europe traditionally prefers to reform processes rather than change bank structure.

National leaders have also emphasized the need for a coordinated approach. French President Nicolas Sarkozy stressed that all regulation concerning banks should be dealt with at an international level, coordinated by the G-20. Sarkozy called the current crisis a “crisis of globalization itself,” urging broad coordination of regulation and accounting rules. In Germany, the Finance Ministry merely referred to the President’s proposals as “helpful suggestions,” with Chancellor Angela Merkel stating that her government will offer its own proposal to prevent G-20 banks from getting too big or interconnected.

As Mr. Volcker asserted in his testimony before this Committee on Tuesday:

A strong international consensus on the proposed approach would be appropriate, particularly across those few nations hosting large multi-national banks and active financial markets. The needed consensus remains to be tested. However, judging from what we know and read about the attitude of a number of responsible officials and commentators, I believe there are substantial grounds to anticipate success as the approach is fully understood.

In his appearance before the Committee, Mr. Volcker added that London was the other financial center whose acceptance of the Volcker Rules would be critical. Yet Prime Minister Gordon Brown of the United Kingdom, while welcoming the suggestion, stated the U.K. should consider similar rules only if there is an international agreement. The U.K.’s Chancellor of the Exchequer, Alistair Darling, expressed concerns that separating banks does not solve the problem posed by interconnectivity. To the extent there is a solution, he noted that “everything we do has to be a global solution otherwise we will get arbitrage.” Such comments are anything but an endorsement.

IV. The Perlmutter-Miller and Kanjorski Amendments Suggest a Preferable Approach

If Congress were to conclude that bank activities and the size of financial companies were a problem, the Perlmutter-Miller and the Kanjorski Amendments to the House Bill are better solutions than the Volcker Rules and size limitations.

The Perlmutter-Miller Amendment would allow the Federal Reserve Board (Board) to prohibit a systemically important financial holding company that is subject to stricter prudential supervision from engaging in all proprietary trading activities when the Board finds that trading activities threaten the safety and soundness of such company or of the U.S. financial system. The Amendment defines “proprietary trading” broadly, as “trading of stocks, bonds, options, commodities, derivatives, or other financial instruments with the company’s own money and for the company’s own account.” However, the Board has the flexibility to ban certain forms of proprietary trading at a company without putting an end to all of company’s proprietary trading activities. Instead, the Board can exempt proprietary trading activities that are “ancillary to other operations of the company” and do not pose a threat to the company or U.S. financial stability, provided they are carried on for the purpose of making a market in securities issued by the company, hedging or managing risk or other purposes permitted by the Board. While it would be preferable to extend this exemption to market making in a broader range of securities, allowing the Board to address proprietary trading at individual institutions and to distinguish between different trading activities is a better approach than the Volcker Rules.

If the Perlmutter-Miller Amendment is a better way of addressing proprietary trading, the Kanjorski Amendment is a better solution to the broader problem of all activities and size. The Kanjorski Amendment would allow a new Financial Services Oversight Council to require “mitigatory actions” whenever an individual firm that has been subject to stricter prudential supervision is deemed to pose a “grave threat to the financial stability or economy of the United States.” The Amendment anticipates that such a threat could arise from a wide range of sources—including the amount and nature of a company’s financial assets and liabilities, offbalance sheet exposures, reliance on leverage, interconnectedness with other firms, the company’s importance as a source of credit for households and businesses and the scope of its activities. It considers a wide range of remedies: requiring the institutions to terminate one or more of its activities; restricting its ability to offer financial products; and requiring the firm to sell, divest or otherwise transfer business units, branches, assets or off balance sheet items. Firms that are subject to mitigatory actions have the right to a hearing and can seek judicial review if such actions are imposed on an arbitrary or capricious basis.

I am not endorsing these amendments but do believe they are preferable to the Volcker Rules and size limitations.

Print

Print

One Comment

Professor Scott:

If proprietary trading is so unimportant to integrated banks, why are they so determined to retain it? Why are they prepared to endure public wrath to pay out giant bonuses in high-seven to low-eight figures to those traders who engage—full-time—in this supposedly peripheral activity? Why do they insist that it is essential to retain these people who would otherwise be pirated away by other banks who want to increase their presence in this area they are now claiming is marginal and unimportant?

My experience as both a major client of, and an investor in, these banks persuades me that proprietary trading is an important driver of profits, and that through the magic of leverage, a relatively small portion of their activity becomes a major contributor to earnings. That is always what the banks told me as an investor.

Whether proprietary trading was a major factor in the financial meltdown of 2008 or not, allowing it within the umbrella of an organization back-stopped by federal guarantees adds an enormous risk to the financial system. Deposit-taking banks have access to much cheaper capital than do more specialized financial entities, and their traders can thereby run greater risks. The presence of a federal backstop makes it easier both for the bank to look less closely at risks being run, and for counterparties to view the risks of their trading with such an entity more benignly. Moreover, a proprietary trading operation presents enormous potential for conflicts of interest with a bank’s client-based activities, whether they be for corporate issuers or for brokerage clients.

I thought the purpose of reform was to promote a more stable financial system for the future, rather than merely to bolt the barn door after the horse has escaped. Such an improved system should be protected against possible future risks from the tail-end of the probability curve, and not merely the problem of bad real-estate loans. Do we have to wait for a repeat of the LTCM crisis within a major bank before we deal with such a risk? I would hope not.

One Trackback

[…] Here, themselves is the object of no verb. It gives emphasis to the noun publications. President Morales’ press secretary Iván Canelas, who was himself a journalist, clarified . . . Sarkozy called the current crisis a “crisis of globalization itself,” urging broad coordination … […]