Chad Johnson is a partner in the litigation practice at Bernstein Litowitz Berger & Grossmann LLP. This post is based on an article by Ross Shikowitz in the Spring 2011 edition of the BLB&G publication Advocate for Institutional Investors.

Two and half years removed from the worst financial crisis since the Great Depression, the investing public has grown increasingly frustrated with the lack of criminal prosecutions of, and absence of truly significant fines levied against, the senior executives and companies responsible for igniting the subprime meltdown. Pundits have criticized the Securities and Exchange Commission (the “SEC”) and the Department of Justice (the “DOJ”) as capitulating to the interests of “big finance,” citing SEC settlements that have been characterized as mere “slaps on the wrist” and the DOJ’s failure to convict a single executive responsible for creating the “great recession” despite significant evidence of intentional misconduct.

For decades, the public’s trust in the integrity of U.S. capital markets was a source of economic stability and unparalleled prosperity. To maintain this trust, investors must believe that they compete on a relatively equal playing field and that the laws governing the markets will be strictly enforced. In furtherance of these goals, violators of federal rules face civil penalties from the SEC or criminal prosecution by the DOJ. In connection with previous corporate scandals, the government held a significant number of the principal wrongdoers civilly and criminally accountable for their misconduct. In the wake of the current financial crisis, however, many argue that the lack of such accountability has eroded the public’s faith in U.S. capital markets.

Now, more than ever, private lawsuits are needed to supplement the existing regulatory structure, both to ensure that shareholders are adequately compensated for their losses and to send a strong message that fraudulent conduct will not be tolerated. Indeed, institutional investors continue to vigorously prosecute suits against the companies and executives at the heart of the mortgage crisis, well after the SEC and DOJ have shuttered their civil and criminal investigations. While it remains to be seen whether government regulators will eventually force Wall Street executives to answer for their improprieties, it is clear that sophisticated public pension funds will continue to play an essential role in obtaining compensation for injured investors and deterring future wrongdoing by corporate executives.

Wrongdoers Have Largely Escaped Government Penalties

While the SEC has reached several settlements in connection with misconduct related to the financial meltdown, those settlements have been characterized as “cheap,” “hollow,” “bloodless,” and merely “cosmetic,” as noted by Columbia University law professor John C. Coffee in a recent article. Moreover, one of the SEC’s own Commissioners, Luis Aguilar, has recently admitted that the SEC’s penalty guidelines are “seriously flawed” and have “adversely impact[ed]” civil enforcement actions. “We continue to have in place…a misguided approach to how to weigh factors one considers when deciding whether to seek a corporate penalty…and the Commission fails to appropriately focus on deterrence,” Aguilar explained.

Perhaps the most cogent criticisms of the inadequacy of the SEC’s settlements with companies and their senior officers can be found in rulings from federal judges considering whether to approve such agreements. For example, Judge Jed Rakoff castigated the SEC for its attempted settlement of charges that Bank of America failed to disclose key information to investors in connection with its acquisition of Merrill Lynch (“Merrill”), including that Merrill was on the brink of insolvency (necessitating a massive taxpayer bailout), and that Bank of America had entered into a secret agreement to allow Merrill to pay its executives billions of dollars in bonuses prior to the close of the merger regardless of Merrill’s financial condition. The SEC agreed to settle its action against Bank of America for $33 million in August 2009, even though its acquisition of Merrill resulted in what The New York Times characterized as “one of the greatest destructions of shareholder value in financial history.” In rejecting the deal, Judge Rakoff declared that the proposed settlement was “misguided,” “inadequate” and failed to “comport with the most elementary notions of justice and morality.” Indeed, Judge Rakoff described the agreement as “[a] contrivance designed to provide the SEC with the façade of enforcement and the management of the Bank with a quick resolution of an embarrassing inquiry.” When the SEC later submitted a revised $150 million settlement for approval, Judge Rakoff reluctantly approved the agreement while “shaking [his] head,” explaining that it was “paltry” in nature and “[w]hile better than nothing, [was] half-baked justice at best.”

Similarly, federal Judge Ellen Huvelle criticized the SEC’s $75 million settlement of its charges that Citigroup concealed $40 billion of subprime exposure from investors. As part of the agreement, the SEC fined two Citigroup executives— former CFO Gary Crittenden and investor relations chief Arthur Tildesley Jr.—a combined $180,000, though Crittenden alone pocketed $19.4 million during the time of his alleged wrongdoing. Judge Huvelle questioned the fairness of the deal, adding that, “for the life of [her],” she could not understand why the SEC only charged Crittenden and Tildesley and failed to pursue claims against other Citigroup executives. Strikingly, the SEC did not require Crittenden, Tildesley, or Citigroup to admit to wrongdoing to resolve the claims, and as Judge Huvelle remarked in approving the settlement, “[t]here’s nothing in here to address a flawed system; not a thing.”

Federal judges have not been the only ones to criticize the SEC’s settlements. Journalists have portrayed the SEC’s agreements with corporations and their senior officers as “paltry” and a “win” for executives, and have chastised the regulator when it failed to impose any penalty whatsoever. For instance, in a recent Rolling Stone essay, Matt Taibbi described the SEC’s failure to levy sanctions against Lehman Brothers (“Lehman”) and its former CEO, Dick Fuld, as “tantamount to the state marching into Wall Street and waving the green flag on a new stealing season.” Nevertheless, as recently reported by The Wall Street Journal, it appears increasingly unlikely that Fuld and other high-ranking Lehman executives will face any meaningful repercussions from the U.S. government despite the two thousand- page bankruptcy examiner’s report detailing the company’s use of deceptive accounting practices and its most senior executives’ knowledge and approval of those practices. Among other things, the bankruptcy examiner concluded that “colorable” legal claims existed against Fuld and other top Lehman executives, as well as Ernst & Young, the auditor that blessed Lehman’s financial statements. Lehman’s utilization of accounting gimmicks “paint[ed] a misleading picture of its financial condition” by masking tens of billions of dollars in debt from investors each quarter. Fox Business Network Senior Correspondent Charlie Gasparino recently reported that Fuld “act[s] as if he has nothing to worry about,” and revealed that a source close to Fuld stated that the ex-Lehman CEO “fears private litigation more than [government] enforcement action over his role in Lehman’s bankruptcy.” Ernst & Young, which currently faces civil fraud charges from the New York Attorney General’s office for its role in Lehman’s accounting, has not been charged by federal authorities despite evidence uncovered by the bankruptcy examiner demonstrating that Ernst & Young knew about the manipulative accounting practices.

The SEC was also recently criticized for failing to tack fraud claims onto its “record” $550 million settlement with Goldman Sachs (“Goldman”) in July 2010, even though the company admitted that it failed to disclose critical information to investors relating to its ABACUS transaction, a deal that was “born-tolose,” according to Taibbi. Specifically, Goldman chose not to tell its clients that prominent hedge fund manager John Paulson had selected the securities included in the ABACUS vehicle, while at the same time betting against the value of those same securities. Indeed, because of the strength of the claims against Goldman and the concurrent criminal probe by the DOJ, many investors expected a settlement in excess of $1 billion. John Carney, a CNBC senior editor, noted that in light of the deal, “somewhere Goldman’s lawyers and executives are probably popping the cork on a bottle of bubbly. This settlement was a win for them.”

Academics have also questioned whether the SEC’s recent civil penalties are sufficient to punish and deter misconduct. Columbia University law professor John C. Coffee recently published an article suggesting that the SEC’s settlement with Countrywide Financial’s (“Countrywide”) CEO Angelo Mozilo was far from equitable. The SEC charged that Mozilo and other Countrywide executives misled investors regarding the company’s risky loan portfolio as the mortgages it originated and securities it generated transformed a recession into a full-blown crisis. The SEC’s complaint revealed that Mozilo himself authored emails that described the company as “flying blind,” explained that the company’s loans were “poison,” and described one category of Countrywide loans as “the most dangerous product in existence…there can be nothing more toxic.” Indeed, Mozilo admitted in his emails that he “personally observed a serious lack of [underwriting] compliance” and recognized that “it was just a matter of time that we will be faced with…much higher delinquencies.” Nonetheless, in October 2010, the SEC agreed to settle the action against Mozilo for $67.5 million, lauding the settlement as a “record penalty.” Coffee highlights that Mozilo, who was not required to admit to any wrongdoing, paid only $22.5 million of the settlement because Bank of America (and its shareholders) indemnified Mozilo for $45 million. These figures are even more egregious when juxtaposed with Mozilo’s estimated $140 million in profit reaped from his insider trading of Countrywide stock. As Coffee questions, “[i]s $22.5 million a successful outcome for the SEC where the defendant retains the other $117.5 million of his estimated $140 million in profits?”

Significantly, as described by Coffee, Mozilo was “in an especially vulnerable position” because the SEC civil trial was looming and could have provided federal prosecutors with the information necessary to indict and prosecute the executive. Instead, following the settlement, the DOJ closed its criminal investigation of Mozilo in February 2011 without taking any action against him. This oft-characterized “hollow victory” bolsters the view that executives consider government penalties and sanctions to be a mere “cost of doing business” and illustrates the absence of meaningful deterrence in financial markets.

The DOJ has faced similar criticism for its lack of prosecutions. Documentary filmmaker Charles Ferguson, whose film “Inside Job” won the 2011 Academy Award for Best Documentary for its examination of the financial crisis, recently decried the DOJ’s relative paucity of prosecutions during his Oscar acceptance speech. “Forgive me, I must start by pointing out that three years after our horrific financial crisis caused by financial fraud, not a single executive has gone to jail, and that’s wrong,” Ferguson said. In response to similar criticism a few months prior, the DOJ proclaimed the “successes” of its financial fraud task force “Operation Broken Trust.” So far, however, the task force has not shined a light into executives’ corner offices at the corporations that placed the global economy in peril. Instead, observers have criticized Operation Broken Trust as targeting hundreds of “petty thieves” who committed small-time frauds, which some claim demonstrates that the DOJ is either unwilling or unable to hold Wall Street titans accountable for their role in the subprime bust.

Further, a review of the DOJ’s recently released statistics supporting Operation Broken Trust’s purported accomplishments reveals that the DOJ’s figures are, at best, unsupported. As columnists such as Andrew Ross Sorkin of The New York Times and Jonathan Weil of Bloomberg have detailed, several of the criminal and civil cases touted by the DOJ were commenced before Operation Broken Trust was initiated, and certain of the criminal convictions that the DOJ highlighted did not lead to any criminal sanctions whatsoever.

The lack of meaningful government sanctions raises legitimate questions as to whether corporate executives will continue to evade responsibility for their actions. Many have described the financial crisis as “unexpected” or “unforeseeable.” In contrast, the recent report from the Financial Crisis Inquiry Commission (“FCIC”) makes clear that the mortgage meltdown was an avoidable event born of fraud, as well as of failures in corporate governance and risk management. Significantly, the FCIC explicitly concluded that banks selling mortgage products failed to disclose critical information to investors. Indeed, a former president of one of the top mortgage research companies testified before the FCIC that, even though approximately 28 percent of the loans issued to homeowners with poor credit examined by his company failed to meet even basic underwriting standards, nearly half of those loans were nevertheless packaged and unloaded onto unsuspecting investors. According to publicly released emails, “vomit” and “crap” were the terms of art used by UBS employees in 2007 to describe the company’s assetbacked securities; a Bear Stearns Deal Manager wrote in 2006 that investors were being sold a “SACK OF S**T.”

Nevertheless, in response to this accumulating evidence, the SEC and the DOJ have remained largely silent. Are large, systemically important institutions and their ilk too big to be threatened with sanctions that approximate the size of the frauds perpetrated against the public? Has “too big to fail” transformed into “too big to challenge?”

The relative lack of prosecutions stemming from the financial meltdown stands in sharp contrast to the government’s response to past corporate malfeasance. The criminal cases arising from the Savings and Loan scandals of the 1980s and 1990s, where some of the biggest kingpins—including Charles Keating of Lincoln Savings & Loan and roughly 3,800 other bankers—were thrown behind bars, as well as the Enron and WorldCom accounting debacles in the early 2000s where Jeffrey Skilling, Kenneth Lay and Bernard Ebbers were jailed, demonstrated that executives would be held accountable for their crimes. This time, the public is left wondering whether the U.S. government possesses the appropriate tools to adequately police its markets and protect against future misconduct. As prominent hedge fund manager David Einhorn recently told The New York Times, “since there have been almost no big prosecutions, there’s very little evidence that [the government] has stopped bad actors from behaving badly.” Simply put, without forcing executives to answer for their misconduct, no amount of financial reform will restore public trust in government or the markets.

Regulatory Impediments

While many accuse the SEC and DOJ of being “gun shy” with regard to cases against high profile executives, several commentators note that the SEC and DOJ are significantly underfunded. The funding problem is especially acute at the SEC, where budgetary constraints hamper the agency from fulfilling its most basic obligations. For example, the SEC’s travel restrictions limit on-site visits to financial firms and have confined such investigations to locations near SEC offices. Further, lack of funding forced the SEC to cap the number of expert witnesses it hires, significantly hindering its ability to litigate actions where defendants have seemingly unlimited resources. SEC Chairperson Mary Schapiro recently stressed that budget constraints were thwarting the agency’s ability to enforce the securities laws, and House Representative Barney Frank (D-Massachusetts) emphasized that the SEC is unable to carry out its mandate at its current rate of funding. While fiscal 2012 budget proposals include a $316 million increase to SEC funding, it remains unclear what percentage, if any, of this increase will be realized in the current political climate.

Beyond underfunding, many observers point to the free flow of SEC and DOJ officials between the government and private sector as contributing to lackluster regulatory enforcement. This “revolving door” of personnel fosters “regulatory capture,” which aggravates the conflicts of interest that materialize between regulators and the regulated. Concern arises when skilled high-level public employees gain significant experience and abandon their posts for the private sector where they may earn millions of dollars per year. Similar issues emerge when private sector employees seek government regulatory positions and ultimately oversee their former peers. In his recent essay, Matt Taibbi portrays an environment in which SEC officials and Wall Street bankers attend cocktail hours where “[e]very single person had rotated in and out of government and private service,” and the attendees joke how neither the regulators nor the law firms representing Wall Street could exist without each other. As Taibbi describes, the SEC settlement with Citigroup illustrates that the revolving door may cause agency officials to bestow preferential treatment upon executives at the large financial institutions the SEC regulates. Specifically, according to an anonymous letter that spawned an internal investigation, Robert Khuzami, the SEC Director of Enforcement, ordered his staff to drop fraud claims against Citigroup executives Crittenden and Tildesley after a “secret conversation, without telling the staff, with a prominent defense lawyer who is a good friend of Khuzami’s…and who was counsel for [Citigroup].”

Further, to the bewilderment of numerous observers, Khuzami recently stated that it would be the SEC’s general policy going forward to act as “middle man” between the DOJ and Wall Street financiers and to provide potential defendants with information as to whether the DOJ plans to pursue litigation arising from their alleged misconduct—a procedure that critics have described as conflicting with the SEC’s own enforcement manual. Recognizing the inherent conflicts in this practice, Senator Charles Grassley (R-Iowa) explained that “[a]ll the promises of financial regulatory reform ring hollow if the administration is allowing the top enforcement official at the SEC to relay to potential targets of an investigation exactly what the Justice Department has in store for them.”

Lack of funding and regulatory capture notwithstanding, the SEC is being provided with additional tools to combat fraud while private litigants are not being afforded similar weapons. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd- Frank”) extends the jurisdiction of federal district courts to adjudicate SEC and DOJ actions involving securities transactions consummated outside the United States— a jurisdictional hook that is unavailable to private litigants under a recent Supreme Court ruling. Dodd-Frank also failed to reverse recent Supreme Court precedent that stymied private litigants’ attempts to recover from so-called “secondary actors” such as bankers, auditors, lawyers and accountants who fanned the flames of the financial meltdown by issuing favorable audit opinions or legal advice to Wall Street firms. While the SEC and DOJ may hold such “aiders and abettors” accountable, columnists agree that the agencies have failed to do so. Such enforcement mechanisms in the capable hands of institutional investors, however, would mark an important beginning to deterring future crimes and restoring the public’s faith in financial markets.

How Institutional Investors are Filling the Void

It has increasingly fallen to institutional investors to hold mortgage lenders, investment banks and other large financial institutions accountable for their role in the mortgage crisis by seeking redress for shareholders injured by corporate misconduct and sending a powerful message to executives that corporate malfeasance is unacceptable. For example, sophisticated public pension funds are currently prosecuting actions involving billions of dollars of losses against Bank of America, Goldman Sachs, JPMorgan Chase, Lehman Brothers, Bear Stearns, Wachovia, Merrill Lynch, Washington Mutual, Countrywide, Morgan Stanley and Citigroup, among many others. In some instances, litigations have already resulted in significant recoveries for defrauded investors.

It has increasingly fallen to institutional investors to hold mortgage lenders, investment banks and other large financial institutions accountable for their role in the mortgage crisis by seeking redress for shareholders injured by corporate misconduct and sending a powerful message to executives that corporate malfeasance is unacceptable. For example, sophisticated public pension funds are currently prosecuting actions involving billions of dollars of losses against Bank of America, Goldman Sachs, JPMorgan Chase, Lehman Brothers, Bear Stearns, Wachovia, Merrill Lynch, Washington Mutual, Countrywide, Morgan Stanley and Citigroup, among many others. In some instances, litigations have already resulted in significant recoveries for defrauded investors.

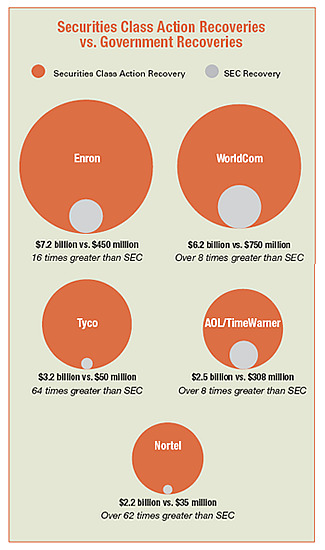

Historically, institutional investors have achieved impressive results on behalf of shareholders when compared to government- led suits. Indeed, since 1995, SEC settlements comprise only 5 percent of the monetary recoveries arising from securities frauds, with the remaining 95 percent obtained through private litigation as demonstrated by several examples in the chart at right.

Institutional investors must continue to lead the charge and prosecute fraud to send a strong message that such misconduct will not be tolerated and to guarantee that shareholders are fairly compensated for their losses. Both the courts and Congress have recognized that meritorious private securities litigation is “an indispensable tool with which defrauded investors can recover their losses[,]…promote public and global confidence in our capital markets and help to deter wrongdoing.” While originally intended as a supplement to government regulation, recent events demonstrate that institutional investors may now be the entities best positioned to protect investors’ rights. Without such protection, and if Wall Street bankers are permitted to profit from their frauds without a proportionate retributive response, we may be fated to repeat the same economic calamity that has defined our generation.

Print

Print

3 Comments

Curious to hear what the folks over at the Harvard business school think of this article, in that so many of the best and brightest on Wall Street – whose brilliance brought us many of the scams that led to the collapse of our economy – seem to have received a Harvard MBA….

I wonder if this has something with the right going after public employee pensions….

The public’s lack of trust in the DOJ (to pursue prosecutions that it should) has definitely contributed to the deterioration and instability of the economy. This is no doubt felt strongly in local economies of big cities such as San Diego, California. The big banks all got their bailouts in the form of TARP funds and consumers have to hire and pay attorneys for bankruptcy to get their debt relief and bailout.

6 Trackbacks

[…] Too Big to Fail or Too Big to Change Harvard Law School Forum on Corporate Governance and Financial Regulation (hat tip Richard Smith) […]

[…] to buy Treasuries.Debt Hamstrings Recovery Wall Street Journal. The Journal figured this out now?Too Big to Fail or Too Big to Change Harvard Law School Forum on Corporate Governance and Financial Regulation (hat tip Richard […]

[…] The wheels of justice grind slowly, but they grind exceedingly fine: Too Big to Fail or Too Big to Change […]

[…] up at the Harvard Law School Forum on Corporate Governance and Financial Regulation called “Too Big to Fail or Too Big to Change“. It points to failure of the SEC and the DOJ to hold corporations and their officers […]

[…] by society. Fraud must be called fraud and, in contrast to recent experiences (examples here and here), legal consequences must be quick and […]

[…] Johnson, a partner in the litigation practice at Bernstein Litowitz Berger & Grossmann LLP, writes in the Harvard Law School Corporate Governance and Financial Regulation Forum that private litigants, in spite of some significant impediments, are picking up the slack for the […]