David Felsenthal is a partner at Clifford Chance LLP focusing on financial transactions. This post is based on a Clifford Chance publication by Mr. Felsenthal and Christopher Bates, partner at Clifford Chance; and Mary Johannes and Richard Metcalfe of International Swaps and Derivatives Association, Inc. The full report is available for download here.

Both the EU and the US have now adopted the primary legislation which aims to fulfill the G20 commitments that all standardised over-the-counter (OTC) derivatives should be cleared through central counterparties (CCPs) by end 2012 and that OTC derivatives contracts should be reported to trade repositories (and the related commitments to a common approach to margin rules for uncleared derivatives transactions). The US Dodd-Frank Wall Street Reform and Consumer Protection Act was passed in July 2010 and the text of the EU Regulation on OTC Derivatives, CCPs and Trade Repositories (EMIR) was finally published in the Official Journal on 27 July 2012.

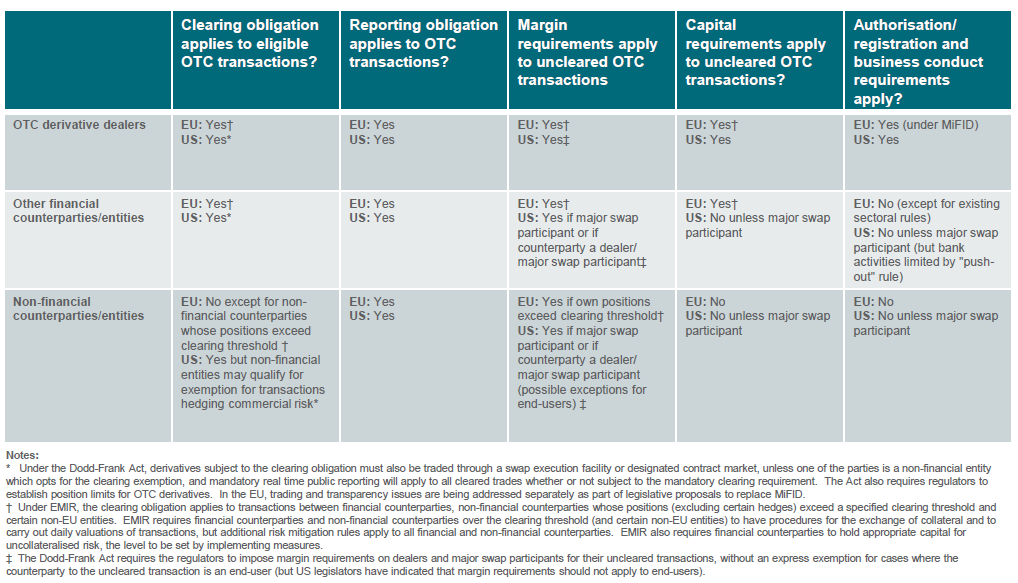

There is a significant commonality of approaches between EMIR and the Dodd-Frank Act in relation to the regulation of OTC derivatives markets, but there are also some significant differences. This paper summarises the way in which the two regimes treat different categories of counterparty and highlights certain other major differences between EMIR and the Dodd-Frank Act in relation to OTC derivatives regulation.

However, both EMIR and the Dodd-Frank Act require the adoption of extensive implementing rules and technical standards before they can become fully effective and these will significantly affect how the two regimes operate in practice. While the US regulators have now adopted many of the rules required to implement the Dodd-Frank Act, a number of key points are not yet settled and the EU consultation process on implementing measures under EMIR is still in progress. Both the EU and the US regulators have paused progress on their proposals for margin rules for uncleared derivatives pending the outcome of the BCBS-IOSCO consultation on common international standards.

In addition, the Dodd-Frank Act addresses issues relating to the execution of OTC derivative contracts on electronic trading platforms, post-trade transparency and position limits for commodity derivatives. The EU is addressing these issues (and others relating to trading and transparency of OTC derivatives markets) in the proposals to replace the existing Markets in Financial Instruments Directive (MiFID) with a new restated Directive (MiFID 2) and a new companion EU Regulation (MiFIR). This legislation is only likely to be adopted in 2013 and will itself also require extensive implementing measures before it comes into effect. Comments in this paper on MiFID 2 or MiFIR are based on the latest proposed compromise text of the legislative proposals prepared by the Presidency of the EU Council of Ministers.

There is significant commonality of approach between the EU and the US but some important differences

- Both the EU and the US regimes aim to impose clearing and reporting on a broadly defined class of OTC derivatives (with differences for some classes of derivatives) and give regulators the ultimate decision on when the clearing obligation applies.

- The EU clearing regime is potentially less burdensome for end-users. In the US, the clearing obligation falls on everyone who trades an eligible contract, with a narrow exemption when non-financial entities enter into certain hedging transactions. In the EU, the clearing obligation only applies to transactions between financial counterparties, non-financial counterparties whose positions (excluding certain hedges) exceed a specified clearing threshold and certain non-EU entities.

- Both the EU and US regimes include a broad requirement on counterparties to report all derivatives transactions to trade repositories and to keep records of transactions.

- Both the EU and US regimes envisage that there will be mandatory margin rules for uncleared derivatives transactions but both EU and US regulators have paused progress on these rules pending the outcome of the BCBS-IOSCO consultation on common international standards.

- While both regimes envisage registration and conduct of business rules for dealers (the EU already had rules under MiFID), the US regime also extends registration, business conduct, margin and other risk mitigation rules and capital requirements to “major swap participants” as well. EMIR applies some obligations even more broadly: some risk mitigation rules (e.g. on confirmations, reconciliation, compression and dispute resolution) apply to all financial and non-financial counterparties and obligations to carry out daily valuations and exchange collateral apply to all financial counterparties and non-financial counterparties over the clearing threshold.”

- Both regimes seek to allow cross-border clearing by allowing the recognition/exemption of non-domestic CCPs. They are less flexible in relation to cross-border provision of trade repository services, with the US requiring compliance with full US requirements and the EU making recognition of non-EU repositories conditional on conclusion of a treaty.

- The US regime requires the execution of OTC derivatives subject to the clearing obligation on a swap execution facility or designated contract market (if such a facility or market makes the swap available to trade), real time post-trade transparency for cleared derivatives trades and position limits. In the EU, these issues are being addressed separately as part of the legislative proposals to replace MiFID.

- The EU regime has no equivalent to the US “push out” rule restricting the derivatives trading activities of banks, the “Volcker rule” restricting the proprietary trading operations of bank groups or the provisions allowing regulators to restrict bank ownership of CCPs. However, the UK government proposes legislation to implement the recommendations of the Independent Commission on Banking would significantly limit the derivatives business of ring-fenced retail banks. The European Commission has also appointed a high level expert group to review the structure of the EU banking sector.

- EMIR contains exemptions from both the clearing and the margin and other risk mitigation rules for intra-group transactions. There are no corresponding provisions in the Dodd-Frank Act but the CFTC has proposed rules exempting transactions between affiliates from the clearing obligation, subject to a number of conditions, including requirements for payments of variation margin where both the affiliates are financial entities.

- The US and EU regimes take different approaches to the extra-territorial application of their rules. In particular, the CFTC has proposed guidance that would impose the US swap dealer requirements on non-US persons that engage in more than de minimis swap dealing activities with US persons, but non-US persons may be able to comply with certain swap dealer requirements through compliance with home-country rules. While EMIR does apply to certain transactions between EU and non-EU entities (and between non-EU entities), it also contains a general provision that deems a transaction to have complied with the clearing, reporting and risk mitigation rules where at least one of the counterparties is established in a non-EU jurisdiction that the European Commission has determined to have an equivalent regulatory regime which is applied in an equitable and non-distortive manner.

- The US headstart on the adoption of implementing rules means that a significant part of the US regime could be in force in advance of the corresponding EU rules.

Application of OTC derivatives rules to different categories of counterparty

Print

Print Click to enlarge image

Click to enlarge image