The volume of US securities class action litigation targeting companies outside the US has recently reached record levels, despite a 2010 decision by the US Supreme Court, in Morrison v. National Australia Bank, which substantially restricted the extraterritorial reach of many such cases. This increase is attributable in large part to a wave of suits filed against Chinese companies listed on US stock markets. Even excluding Chinesecompany litigation, however, the pace of US securities class actions against non-US companies has not fallen below the levels observed prior to the Morrison decision.

On the other hand, Morrison may have had some effect on settlement sizes. In the past several years, there have been few very large settlements in US securities class actions against non-US companies, a development that, as discussed below, may be attributable in part to the decision. This article surveys recent trends in filings of US securities class actions against non-US company defendants, drawing upon data up to mid-2012. It also discusses trends in settlements, and concludes by reviewing the outlook for such litigation going forward.

Trends in Filings against Non-US Company Defendants

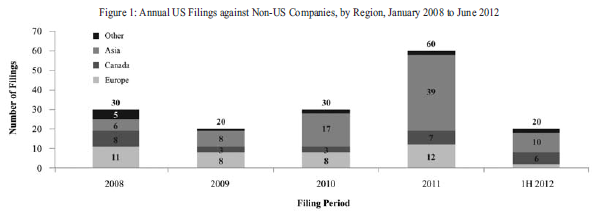

The number of US federal securities class actions against companies outside the US reached a peak in 2011, with 60 filings that named a foreign company as the primary defendant, as shown in Figure 1. Such suits amounted to more than a quarter of total US securities class action filings in 2011. While the rate of filings against non-US companies slowed in the first half of 2012, it remained higher than prior to 2011. There were 20 filings in the first half of 2012, or an annualised rate of 40 filings per year, which exceeds the rate of filing observed in each year from 2008 to 2010 (and also the average of approximately 18 filings per year over the period from 2000 to 2007).

Figure 1 also breaks down annual filings into those against companies in Europe, Canada, Asia, and elsewhere. It shows that, in 2010, 2011, and 2012, companies based in Asia were sued most frequently. This contrasts with 2008 and 2009, when European companies were most frequently targeted (European companies were also sued most often from 2000 to 2007, when they accounted for about 45 per cent of all filings against non-US issuers). As is discussed below, many of the recent filings against Asian companies targeted Chinese companies whose securities trade on US markets.

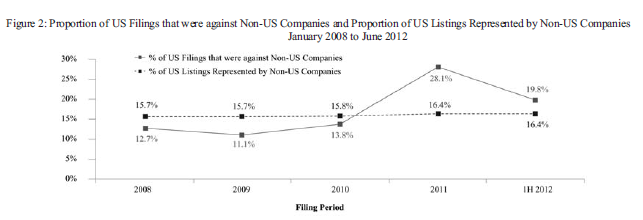

Figure 2 shows the percentage of all US securities class actions that targeted foreign companies in each year from 2008 to 2012. The pattern over time is similar to that depicted in Figure 1. In the first half of 2012, the fraction of filings that were against non-US issuers fell to 19.8 per cent from a high of 28.1 per cent in the previous year, but remained well above the levels observed in 2008, 2009, and 2010.

In 2011 and in the first half of 2012, as Figure 2 shows, the proportion of US class actions that were against non-US companies exceeded the proportion of companies listed on US stock markets that were foreign. Thus, in 2011 and 2012, non-US companies listed on US markets were more likely to be sued than US companies. This reversed the trend observed in the three previous years, when foreign companies listed on US markets were less likely to be sued than their US counterparts.

Somewhat ironically, the recent peak in filings against non-US companies followed a US Supreme Court decision scaling back the extraterritorial reach of Section 10(b) of the Securities Act of 1934, the statute under which most US securities class actions are filed. As a consequence of Morrison v. National Australia Bank, decided in June 2010, investors can no longer assert claims under Section 10(b) in connection with securities transactions made outside the US.

Prior to the decision, investors were able to claim in connection with transactions outside the US, provided the investors were US residents. Even claims by non-US investors, in connection with transactions outside the US, could be made if enough of the alleged fraudulent conduct giving rise to the claim was judged to have taken place in the US. The latter types of claims have been referred to as “foreign-cubed” (or “F-cubed”) claims, in reference to the fact that the plaintiffs, the primary defendant, and the transaction giving rise to the claim would all be located outside the US.

By setting out a transactional test that had the effect of eliminating not only F-cubed claims but any other claims stemming from foreign trades—including by US residents—the Morrison decision “set the stage for what many thought would be the slow death of multi-national securities class actions in the US”, as one commentator put it.

The Rise of Chinese-Company Filings

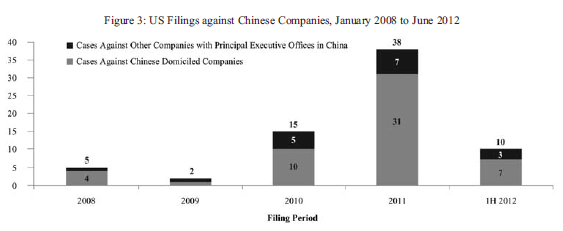

Why, instead, have filings against non-US companies substantially increased since Morrison? A review of the data indicates that this is mainly driven by the recent wave of Chinese-company filings. Figure 3 shows US securities class actions against Chinese companies annually from 2008 to 2012. While there were only a few such cases in 2008 and 2009, by 2010 there were 15 actions filed against companies domiciled in China or with principal executive offices in China. In 2011, the number had risen to 38 filings, comprising 17 per cent of the 224 total US federal securities class actions filed in that year, and nearly two thirds of the 60 suits against non-US companies.

Most of the Chinese companies recently targeted by US securities class actions were listed on US stock markets via a “reverse merger”. In a reverse merger, a private firm arranges to be acquired by a publicly traded “shell” company with little or no operations, thus giving the private firm a US listing with less expense and regulatory disclosure than is required for an initial public offering (IPO).

Over 85 per cent of US securities class actions filed against Chinese issuers from 2008 to mid-2012 have included accounting-related allegations. This is consistent with the findings of a 2011 report by the US Public Company Accounting Oversight Board, which expressed concern about the quality of the auditing process for Chinese companies that had gained US listings through reverse mergers.

In the first half of 2012, the rate of filings against Chinese companies slowed, with 10 actions filed. Moreover, this wave of litigation appears unlikely to re-emerge. For one thing, rules against reverse mergers have recently been made stricter. Also, Chinese companies may have become less likely to seek a US listing, due to an increased perceived cost of litigation.

The Effect of Morrison on Filings

A possibility is that Morrison has indeed had a depressing effect on US filings against non-US companies, but that this has been masked by the surge in Chinese company litigation. However, as Figure 4 indicates, if Chinese-company filings are removed from total suits against non-US companies, the recent trend is relatively flat. For example, in 2011, the first full year after the Morrison decision, the 22 filings against non-US companies other than Chinese ones was only slightly below the 25 such filings observed in 2008, and exceeded the 18 actions filed in 2009. In 2012, if filings in the second half of the year continue at the pace set in the first half, there will be 20 filings against non-US companies other than Chinese companies, also broadly in line with the levels observed in 2008 and 2009.

Why does the pace of filings against non-US companies not appear to have slowed appreciably following Morrison, even once the recent jump in Chinese-company suits is excluded from the picture? A possible explanation is that, even prior to the decision, class actions against non-US issuers nearly always included at least some claims on behalf of investors who transacted in the US, so Morrison’s effect is more likely to narrow the scope of a claim against a non-US company than to eliminate the claim entirely.

Some relevant evidence is provided by a recent NERA review of 340 US securities class actions filed against foreign-domiciled companies between January 1996 and June 2011. In all of these cases, the great majority of which were filed before the Morrison decision, there was at least some trading of the defendant company’s shares or American Depository Receipts (ADRs) in the US during the proposed class period. Indeed, in 193 cases, the defendant company traded only in the US; these would not be affected by Morrison’s elimination of claims in connection with non-US trading.

In the other 147 cases reviewed, the defendant company traded both in the US and on a foreign market. Of these filings, however, 40 asserted claims only on behalf of investors who had transacted in the US. That leaves 107 actions over this period filed against non-US companies trading on multiple markets, in which the proposed class encompassed investors who transacted on either US or non-US markets.

It may be that, in some of these cases, a US action would not have been filed, post-Morrison, because US trading was sufficiently small, or for other reasons. Nonetheless, it appears that, where Morrison would have had an effect, it would generally have been to reduce the scope of claims rather than to eliminate filings entirely.

Other Characteristics of Recent Filings

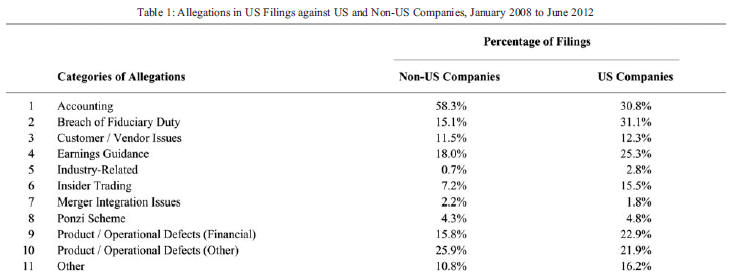

In addition to tracking trends in the number of filings, NERA also collects data on characteristics of US securities class actions, such as the allegations made and the business sector of the company sued. A review of filings from January 2008 to June 2012 reveals substantial differences in the mix of allegations in cases against US and non-US companies. As Table 1 shows, nearly 60 per cent of filings over this period against non-US issuers made allegations relating to accounting, twice the proportion in filings against US companies. This is predominantly due to the frequency of such allegations in filings against Chinese companies.

On the other hand, allegations of breach of fiduciary duty were considerably less common in filings against non-US companies (made in 15 per cent of filings) than in filings against US companies (31 per cent). Allegations of breach of fiduciary duty have occurred most frequently in class actions objecting to the terms of a merger or acquisition, which have recently accounted for a large fraction of US securities class actions.

Such “merger objection” cases typically allege that the directors of the target company in a merger or acquisition breached their fiduciary duty to shareholders by accepting a price for the company’s shares that was too low, or by providing inadequate disclosure in relation to the transaction. These actions have been filed considerably less frequently against non-US companies, accounting for about 9 per cent of such suits as compared to 32 per cent of suits against US companies.

Table 1 also indicates that filings against non-US companies were only about half as likely to allege that insider trading occurred during the class period. This may be due to less stringent reporting requirements for insider transactions in many non-US jurisdictions.

Differences are also apparent between US and non-US companies in the breakdown of filings by business sector, as shown in Table 2. Whereas nearly a third of filings against US companies from January 2008 to June 2012 targeted financial sector firms, only 22 per cent of filings against non-US companies did. Health technology and services companies accounted for 17 per cent of US-company defendants, but only 9 per cent of non-US defendants. On the other hand, non-US companies in process industries and in the producer and other manufacturing sector were targeted by class actions more frequently than were US companies in those sectors.

Trends in Settlements

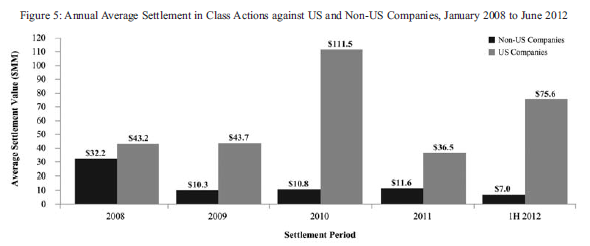

A settlement is the most common resolution of a US securities class action; NERA therefore tracks the size and other attributes of settlements. Figure 5 shows the average annual settlement amount of cases against US and non-US companies, from 2008 to the first half of 2012. The average settlement of a case against a non-US company in the first half of 2012, $7.0 million, was below the average observed in each year from 2009 to 2011, and well below the $32.2 million in 2008.

The average, however, can be substantially affected by a small number of very large settlements. For instance, the average settlement for cases against non-US defendants in 2008 includes three settlements that rank among the top 10 to date in cases against non-US primary defendants: a $138.0 million settlement in a class action against the Canadian pharmaceuticals company Biovail Corporation, an $89.5 million settlement against Royal Dutch Shell of the Netherlands, and an $84.6 million settlement against Converium Holdings of Switzerland.

Over the period year covered by Figure 5, the average settlement was lower in each year for cases against non-US companies than for cases against US companies, often by a substantial margin. At the extreme, in 2010, the average settlement in cases against US companies was $111.5 million, while in cases against non-US companies it was less than a tenth of that, at $10.8 million. As discussed further below, very large settlements have occurred with less frequency in cases against non-US companies, which substantially drives the differences in average settlements that are visible in Figure 5.

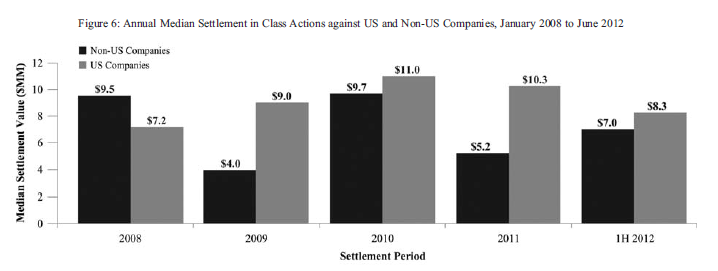

Figure 6 shows annual median settlements, again comparing settlements of actions naming a US company as primary defendants with those targeting a non-US company. The median, the level which half of settlements in a particular year exceed and which half fall below, is less influenced by outlier values than is the average. In most recent years, the median settlements in cases against non- US companies and US companies have tended to be closer to one another than average settlements have been.

Nonetheless, Figure 6 shows that in each year since 2009, the median settlement in class actions against non-US companies has been lower than in class actions against US companies. In 2011, for example, the median settlement in cases against non-US company defendants was $5.2 million, as compared to $10.3 million in cases against US companies; in the first half of 2012 these medians were $7.0 million and $8.3 million. As Figure 6 shows, this recent trend reverses the relative position of US and non-US settlements observed in 2008. It also contrasts with 2000 to 2007, when the median settlement of $8.0 million in cases against non-US companies exceeded the $5.8 million median in case against US companies.

One factor driving this trend is low settlements in many cases against Chinese companies. The median settlement of cases against Chinese companies from January 2010 to June 2012 was $3.0 million, as compared to $9.0 million for settlements against other non-US companies. An explanation that has been put forward for the low Chinese-company settlements is that many US-listed Chinese companies carry low directors and officers (D&O) insurance limits, effectively limiting the funds available to settle a case.

Figure 7 shows the distribution of settlement values for cases filed from January 2008 to June 2012. At the low end of the distribution, 59 per cent of class actions against non-US issuers that settled over this period did so for less than $10 million, as compared to 50 per cent of class actions against US issuers. At the upper end, while 9 per cent of settlements in cases against US companies were for amounts greater than $100 million, that figure was just 2 per cent in cases against non-US companies. The recent absence of very large settlements is a driver of the substantial differences discussed above between average settlements of cases against US and non-US companies.

This absence may be at least partly attributable to the effect of Morrison, which, as discussed above, can exert downward pressure on the size of settlements against non-US companies, by limiting their scope to encompass only US trading. However, even before Morrison, “F-cubed” claims could be eliminated if it was determined that they failed the “conduct test” that had been established for subject matter jurisdiction, i.e. if it was judged that not enough of the fraudulent conduct alleged in the suit had occurred in the US. Moreover, F-cubed claims could be eliminated at the class certification stage.

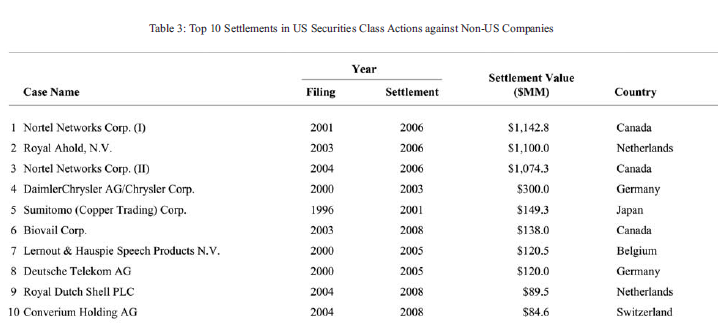

Table 3 lists the top 10 settlements to date of US securities class actions against non-US companies. Three cases have settled for slightly in excess of $1.0 billion. Two of these were class actions against the Canadian firm Nortel Networks Corp; the third was a class action against Royal Ahold NV, based in the Netherlands. These three settlements are the only ones to also be included in the overall list of top 10 settlements of US securities class actions, which ranges as high as the $7.2 billion total settlement in the Enron Corporation class action.

All of these cases settled prior to Morrison. In each, the settlement included a substantial contingent of investors who transacted outside the US. In the first Nortel Networks case, filed in 2001, 65.3 per cent of trading during the class period was in the US, and in the second Nortel Networks case, filed in 2004, 50.8 per cent of trading was in the US. Finally, in the class action against Royal Ahold, just 2.4 per cent of trading was in the US, indicating that a post-Morrison settlement might have been dramatically lower.

Of the remaining top 10 settlements in class actions against non-US issuers, five ranged between $100 million and $300 million, and two were below $100 million. There are no settlements in the top 10 list subsequent to 2008.

Conclusion

US securities class actions against non-US firms have recently surged, despite the US Supreme Court’s decision in Morrison v National Australia Bank, which was expected to curb such suits. This surge is largely explained by a wave of filings against Chinese companies, which appears unlikely to persist. However, filings against non-US companies outside of China do not appear to reflect a decline attributable to the Morrison decision.

The average settlement has recently been far lower in securities class actions against non-US companies than in cases against US companies, driven by an absence of very large settlements against non-US issuers. This absence may be attributable in part to the Morrison decision, which is likely to reduce the size of some settlements, by restricting claims to those in connection with US trading.

The typical recent settlement value for a US securities class action against a non-US company, as captured by the median, has also recently been somewhat lower in cases against non-US companies. One factor driving this trend is low settlement values for many Chinese-company cases.

Looking ahead, it is possible that Morrison will be partially or fully reversed by legislation. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 directed the US Securities and Exchange Commission (SEC) to carry out a study of whether the Congress should extend the extraterritorial application of Section 10(b) of the Securities Act of 1934. This study was published by the SEC in April 2012. The SEC expressed support for an approach that would allow suits by investors who transacted outside the US, if it could be shown that the damages to these investors resulted directly from conduct within the US. However, the SEC also advanced for consideration a range of other options, including that Congress take no action.

What, if any, legislation will result is unclear, but even in the absence of such a change, the data reviewed here underscore that the Morrison decision has not eliminated the risk of US securities class action litigation to non-US companies with securities traded in the US.

Print

Print