Matteo Tonello is managing director of corporate leadership at The Conference Board. This post relates to an issue of The Conference Board’s Director Notes series authored by Dr. Tonello and available here.

In a Director Note recently published, The Conference Board assesses how and to what extent social and environmental issues are integrated into the strategic agenda of the board of directors of U.S. public companies. The report is based on findings from a survey of 359 SEC-registered business corporations conducted by The Conference Board in collaboration with NASDAQ OMX and NYSE Euronext. Data are categorized and analyzed according to 22 industry groups (using their Standard Industrial Classification [SIC] codes), seven annual revenue groups (based on data received from manufacturing and nonfinancial services companies) and five asset value groups (based on data reported by financial companies, which tend to use this type of benchmarking).

The study updates a previous edition of “Sustainability in the Boardroom,” released by The Conference Board in June 2010.

The following are the main findings discussed in the study.

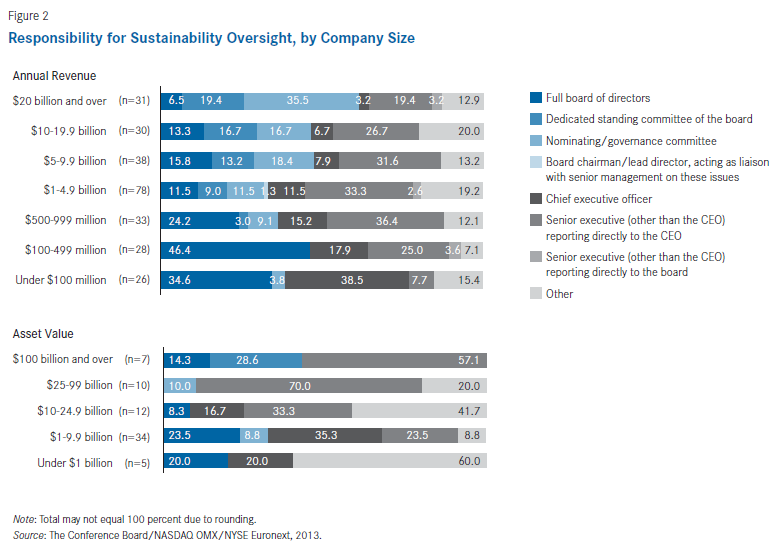

- Delegation of oversight responsibility. Companies take different approaches to assigning responsibility for sustainability oversight. Forty percent or more of manufacturing and nonfinancial companies contemplate that the board of directors should assume and perform such responsibilities—depending on the companies, this may be accomplished at the full board level (19.2 percent of cases among nonfinancial companies) or through one of its committee (the nominating/corporate governance committee in 13.3 percent of cases and a dedicated standing committee of the board in 7.5 percent of cases, also in the nonfinancial sector). In the financial services industry group, the percentage of companies assigning sustainability oversight responsibility at the board level is much lower (25 percent). When company size is measured by annual revenue, the larger the company, the more likely it is for such oversight responsibilities to be delegated by the full board to its nominating/governance committee or a sustainability committee.

- Institution of a Chief Sustainability Office. When sustainability oversight is made a primary responsibility of senior management, it tends to fall into the realm of the CEO or another senior executive reporting to the CEO. In 2010, only one company out of 10 had a Chief Sustainability Officer (CSO), while 21.6 percent of boards had decided to try assigning the subject to a newly established board committee. According to the new survey, the number of companies with a C-Suite officer reporting on these issues directly to the CEO has grown to as many as 34.2 percent in the non-financial sector and 33.8 percent in the financial sector (it is somewhat lower in the manufacturing sector—22.2 percent—but still twice as high as the 2010 figure). Among financial companies, the chances of finding a dedicated CSO or other senior executive reporting to the CEO on these issues increase with company size (with the sole exception of the largest asset size group).

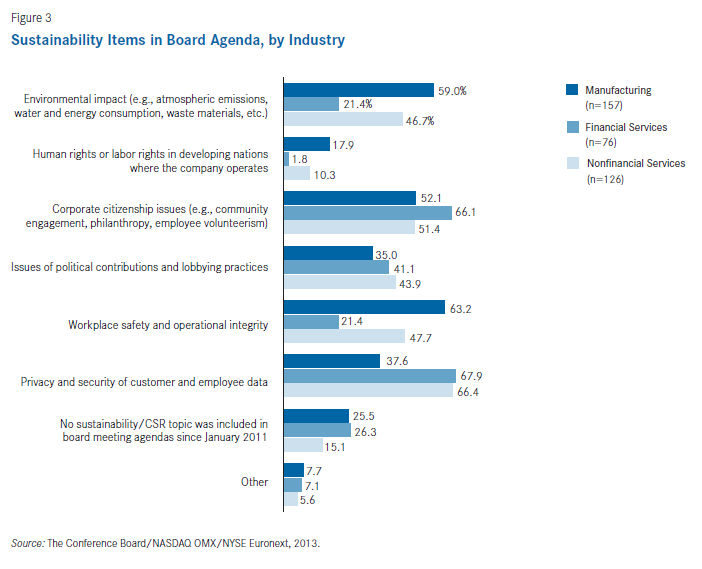

- Sustainability items in board agenda. Environmental impact has been a major concern for 59 percent of manufacturing companies, less so for the financial industry (with only 21.4 percent of financial companies reporting its recent discussion at the board level). On the other hand, data privacy and security have been hot-button issues for the services industries, showing a direct correlation with company size when measured by annual revenue. Corporate citizenship (including community engagement, corporate philanthropy, and employee volunteering) ranks consistently high across industries and company size groups. Slightly less than half of the companies in the smallest size groups (as measured both by annual revenue and asset value) have not recently included any sustainability item in the agenda for their board meetings. This percentage decreases as companies grow in size, and it is at or near zero for the each of the largest size groups.

- Forms of sustainability reporting. Companies may use multiple means to disclose their social and environmental practices. In addition to integrating environmental, social and governance (ESG) information into their traditional annual report to shareholders, some organizations publish issue-specific or comprehensive sustainability reports, whereas others engage with employees and local communities on these issues through dedicated web pages or social networking technologies. In the nonfinancial services industry group, 52.1 percent of companies publish a standalone, comprehensive sustainability report; the percentage is slightly lower in manufacturing (45.7 percent). The corporate website is also widely used by companies to engage their stakeholders. In particular, 40.5 percent of financial services companies opt for a web-based communication, compared to the meager 21.6 percent of their peers publishing a periodic sustainability report. Moreover, the financial services sector has the highest percentage of companies that incorporate sustainability issues in their annual report to shareholders, when circumstances warrant (35.1 percent). However, about half of financial services companies—the highest finding across industries—do not report at all on sustainability. The percentage of companies that do not do any sustainability reporting decreases dramatically with company size: in both breakdowns (by annual revenue and asset value), such percentages range from about 71 among the smallest companies to zero among the largest companies.

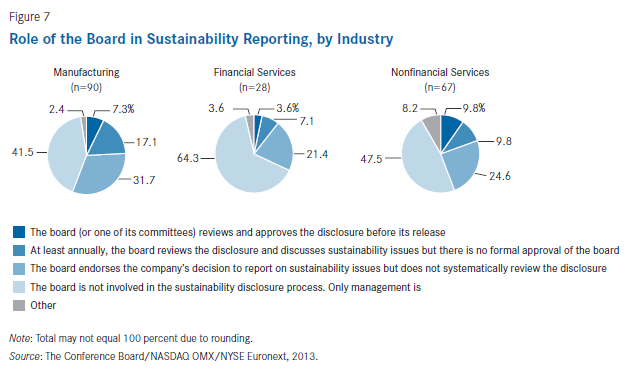

- The role of the board in sustainability reporting. In slightly less than half of manufacturing and nonfinancial services companies and in 64.3 percent of financial companies, the board of directors plays no role in the sustainability disclosure process. Another percentage of companies, across industries, indicate that their board endorses the company’s decision to report on sustainability issues but does not systematically review the disclosure. This is the case, for example, for 36.7 percent of manufacturing companies. There is no apparent correlation between these findings and the size of the organization. However, the highest percentage of companies where the board (or one of its committees) reviews and approves the disclosure on sustainability before its release is among companies with annual revenue of less than $100 million (33.3 percent).

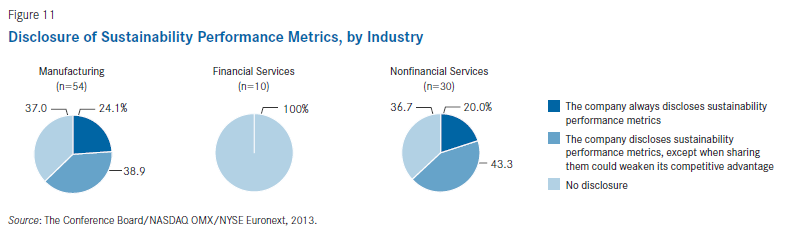

- Sustainability performance measurement. Sustainability, like any other corporate initiative, is defined not only by a set of financial and non-financial goals but also by the company’s ability to measure, track, and improve its performance vis-à-vis those objectives. The survey showed that a large majority of companies across industries do not use any type of sustainability performance metrics. The highest percentage of cases in which a combination of financial and extra-financial metrics of performance is deployed is therefore fairly low—28 percent in manufacturing. By comparison, in financial services and in nonfinancial services, the percentages are 11.8 and 14.5 percent, respectively. Among companies reporting the use of sustainability performance metrics, all financial services companies and about one-third of companies in manufacturing and nonfinancial services do not disclose metrics to the public.

Pay-for-sustainability performance. In the last few years, there has been growing interest among shareholders about the inclusion of sustainability targets in executive compensation plans. Due to the longevity of sustainability initiatives and the durable commitment that sustainability investment often requires, the link between pay and sustainability performance could help companies in the pursuit of their long-term business strategies. Only about one-fifth to one-fourth of companies across industries embed sustainability performance in their compensation formula, with no apparent correlation with annual revenue.

Print

Print