Mary Ann Cloyd is leader of the Center for Board Governance at PricewaterhouseCoopers LLP. This post is based on an edition of ProxyPulse™, a collaboration between Broadridge Financial Solutions and PwC’s Center for Board Governance; the full report, including additional figures, is available here.

ProxyPulse™ provides data and analysis on voting trends as the proxy season progresses. This first edition for the 2013 season covers the 549 annual meetings held between January 1, and April 23, 2013 and subsequent editions will incorporate May and June meetings. These reports are part of an ongoing commitment to provide valuable benchmarking data to the industry.

The analysis is based upon Broadridge’s processing of shares held in street name, which accounts for over 80% of all shares outstanding of U.S. publicly-listed companies. For purposes of this report, the term “institutional shareholders” refers to mutual funds, public and private pension funds, hedge funds, investment managers, managed accounts and voting by vote agents. The term “retail shareholders” refers to individuals whose shares are held beneficially in brokerage accounts.

Shareholder voting trends during the early part of the proxy season represent a snapshot in time and may not be predictive of full-season results.

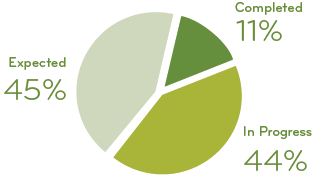

Voting Progress

549 annual meetings were completed between January 1 – April 23, 2013.

Is Your Company Connecting With All of its Shareholders?

A diverse shareholder base means a one-size engagement approach may not fit all. While some companies have ramped up their shareholder engagement programs over the last few years, many of these programs focus largely on communicating with institutional shareholders. Retail shareholders can also influence voting outcomes, and opportunities exist for companies to better connect with these potentially influential shareholders.

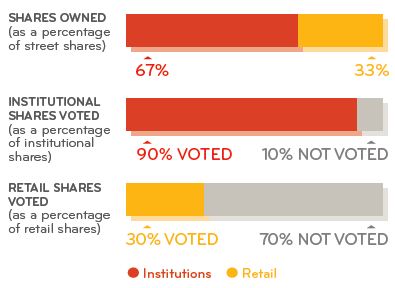

Ownership and Voting by Shareholder Segment

Rates of voting vary substantially between institutional and retail voting segments.

The company may have a higher level of retail ownership than you think; but few retail shareholders are voting. On average, institutions owned approximately 67% of public company shares and retail owned 33%. On average, 70% of the street name shares were voted: 60 percentage points by institutions and 10 percentage points by retail. With low rates of retail participation that leave 70% of retail shares un-voted, companies should reconsider strategies to encourage voting by all shareholders.

In particular, retail shareholders support management’s voting recommendations at high rates. Simply stated, an objective of engaging with this important group is to get them to vote. Newer communication channels make it more efficient for companies to engage with retail shareholders – and, more convenient than ever for them to access proxy materials and vote. In contrast, because institutional shareholders vote at very high rates, the objective is to ensure ongoing dialogue throughout the year and to eliminate the potential for “surprises” at the annual meeting.

Director Question:

- What is the extent of our retail share ownership?

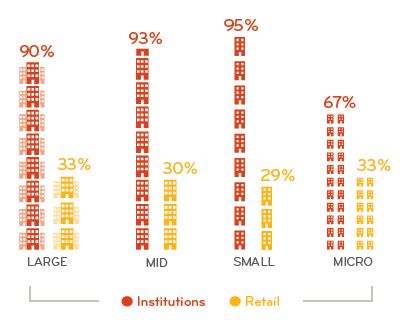

Voting Rates by Company Size

There are significant differences in voting rates between institutional and retail shareholders at companies of different sizes.

Voting rates vary by company size – particularly among institutional shareholders. There were substantial differences in voting rates by the two major shareholder groups relative to company market capitalization. Institutional shareholders voted 90% of their shares at large cap companies, 93% at mid caps and 95% at small caps. However, they voted only 67% of their shares at micro caps. This difference is significant and we will continue to monitor it for the remainder of the proxy season. Retail voting was more consistent across companies of different market caps, with 33% of shares voted at large and micro caps and 30% and 29% at mid and small caps, respectively.

Director Questions:

- How does our company’s size impact the voting participation of our shareholders?

- Does the company have an engagement program that allows for adequate communications with all shareholders?

- Do we fully understand the impact of retail voting at our company?

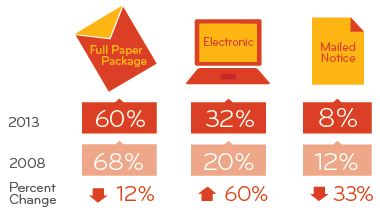

Proxy Delivery Methods to Retail Shareholders

Companies have increasingly utilized electronic delivery of proxy materials to retail shareholders over the last five years.

Electronic distribution of proxy materials continues to grow – and it impacts shareholder participation. Virtually all institutional shareholders held received proxy materials through electronic platforms. When it comes to retail shareholders, 60% of the shares received materials in full paper format, 32% by electronic delivery and 8% through a mailed Notice of internet availability (compared to 68%, 20% and 12%, respectively, in 2008). While companies realize printing and postage cost savings by mailing a Notice, its use results in reduced voting participation. In fact, only about 17% of the retail shares receiving a Notice were voted over the last six years (compared to 36% of shares who received full paper packages). Newer channels, including voting by smart phone and tablet computer, can boost shareholder conveniences in voting.

As such, companies should evaluate and understand the costs and benefits of using only a mailed Notice if they are concerned about shareholder participation. Some companies are using hybrid delivery strategies with good results.

Director Question:

- Have we done sufficient cost/benefit analysis of our distribution method(s) for proxy materials and its effect on voting participation?

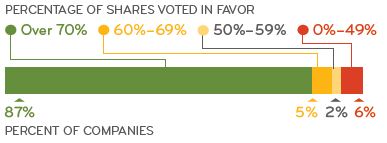

2013 Say On Pay Approval Rates

Say on pay is one example where engagement with a broader group of shareholders could be the difference in achieving important voting benchmarks.

Broader engagement with all shareholders can provide a more complete view of shareholder sentiment – and not only on issues requiring majority support. While retail shareholders can influence voting on an issue uncertain of winning majority support, there are other circumstances where retail support may be equally important. As just one example, proxy advisory firms more closely scrutinize compensation plans at companies that receive less than 70% approval of their prior year’s executive compensation plan. In situations where support levels are on the cusp of this benchmark, retail shareholder participation could move the needle. In fact, about 5% of the companies that completed their annual meetings this season had say-on-pay approval rates between 60% and 69%. Had these companies encouraged even half of their non-voting shares to be voted with the company, the 70% threshold would have been exceeded. During the entire 2012 proxy season, 107 companies were in the 60% to 69% range.

Director Questions:

- Does the company anticipate a close shareholder vote on a sensitive issue?

- Are there situations where additional outreach to retail shareholders might make the difference on a close or sensitive voting issue? Are we leaving any opportunities to enhance a favorable voting outcome on the table?

Director Sensitivity to Shareholder Voting

In the past few years, there has been significant criticism of public company boards. However, shareholders continue to resoundingly support directors put forth by nominating and governance committees.

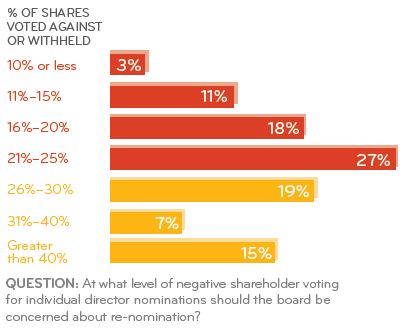

Director Sensitivity to Negative Shareholder Voting

The above chart shows the percentage of negative or withheld shareholder votes that directors said would cause them to reconsider re-nomination of a fellow director.

Directors are sensitive to shareholder support levels. PwC’s 2012 Annual Corporate Directors Survey reported on the sensitivity of directors to various levels of negative shareholder voting. For instance, 27% of directors said that “no” or withheld votes of 21% to 25% would cause them concern about putting that director up for re-election. And with 16% to 20% negative shareholder voting, 18% of directors said they would be concerned. The sensitivity of directors to lower levels of shareholder support appears to occur despite the fact that many companies have majority voting. Lower shareholder support may be interpreted by some as a “lack of confidence” vote, and there have been a few cases where this has resulted in a director stepping down from the board or not being asked to stand for re-election the following year.

Director Question:

- Do we understand the concerns of any shareholders who may decide to organize a “vote no” campaign against one or more of our directors and what have we done to address them?

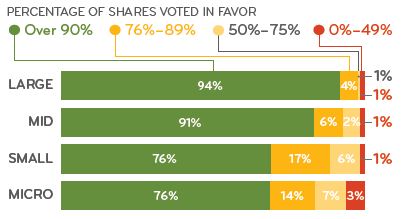

Director Voting by Company Size

A large majority of directors have received high, affirmative shareholder support, with some variances by market cap.

How does director voting look so far this year? Eighty percent of directors up for election received over 90% shareholder support. And nine of ten received at least 80% support. Directors of large-cap companies had the highest rate of support, averaging 95% approval. Small cap and Micro-cap directors had the lowest affirmative rates, with 76% voting “for.” Only a very small number of individual directors (less than 2%) failed to receive majority shareholder support.

Director Question:

- How do the results of our director elections compare to our peers?

Print

Print

One Comment

Proxy voting by retail shareholders has fallen to alarmingly low levels since the 1970s and 80s when over 70% of such shares were voted. Yes, some of the falloff is due to those “Notices” that no one notices or follows up on, but the biggest inhibitors in my experience are (1) the sheer volume of proxy-statement info these days, (2) the poor way in which it is so often presented – esp on the web -(3)widespread belief that retail holdings are “too small to count” and (4) a lack of retail investor interest in so many of the rote “governance proposals” that flood their in-boxes. The SEC needs to wake up – and recognize that investors need and want much shorter and clearer statements of the voting issues…ideally on the Notice – and on all other voting sites and media. If we really want to dig thru a 400 page proxy statement we are free to do so, but we really don’t need the SEC to be our “big brother” to protect us from ourselves. Where is their long-promised educational program on proxy voting…and action on their half-hearted promises to simplify proxy voting docs? Votes DO have value, but you’d never know it based on current SEC efforts to explain – and to make voting quicker and easier for over-busy retail investors.