Avrohom J. Kess is partner and head of the Public Company Advisory Practice at Simpson Thacher & Bartlett LLP. This post is based on a Simpson Thacher memorandum by Mr. Kess, Karen Hsu Kelley, and Yafit Cohn. The complete publication, including footnotes, is available here. Related research from the Program on Corporate Governance includes Lucian Bebchuk’s The Case for Shareholder Access to the Ballot and The Myth of the Shareholder Franchise (discussed on the Forum here), and Private Ordering and the Proxy Access Debate by Lucian Bebchuk and Scott Hirst (discussed on the Forum here).

This year was a break-through year for shareholder proposals seeking to implement proxy access, a mechanism allowing shareholders to nominate directors and have those nominees listed in the company’s proxy statement and on the company’s proxy card. It is estimated that over 100 proxy access proposals were submitted to public companies during the 2015 proxy season, 75 of which were submitted by New York City Comptroller Scott Stringer on behalf of the New York City pension funds he oversees. Stringer’s “2015 Boardroom Accountability Project” affected companies in diverse industries and with a range of market capitalizations, but explicitly targeted companies with purportedly weak track records on board diversity, climate change or say-on-pay. The Comptroller’s proposals, which were precatory and identical regardless of the company’s market capitalization, generally called for the right of shareholders owning three percent of the company’s outstanding shares for at least three years to nominate up to 25% of the board in the company’s proxy materials.

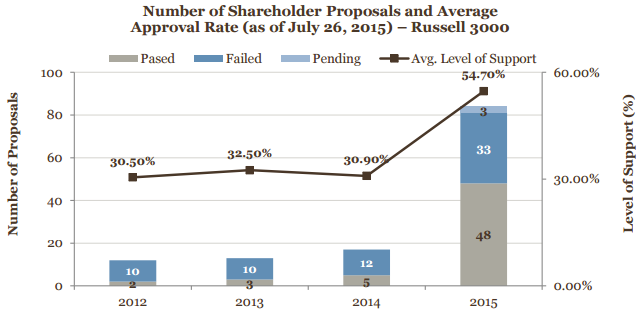

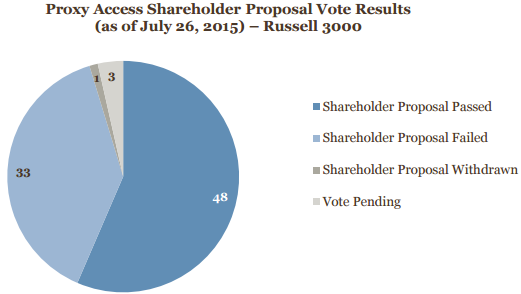

As of July 26, 2015, 81 proxy access shareholder proposals have been submitted to a vote at Russell 3000 companies, compared to 17 proposals in 2014 and 13 proposals in 2013. Of the 81 proposals that have been voted on thus far this year, 48 proposals (or 59.3%) passed, and 33 proposals (or 40.7%) failed. So far this year, shareholder proposals submitted to a vote at Russell 3000 companies received average shareholder support of 54.7%. While this appears to depart from the average support of 30.9% garnered by proxy access shareholder proposals in 2014, it is in line with the 53.4% average support received last year for proposals with 3% / three-year thresholds.

Historical Background and Proxy Access Proposal Trends Through 2014

In 2010, after the Dodd-Frank Act clarified the authority of the Securities and Exchange Commission (“SEC”) to issue a proxy access rule, the SEC adopted Rule 14a-11 under the Securities Exchange Act of 1934, as amended, which required publicly-traded companies to include shareholders’ director nominees in their proxy materials, representing up to 25% of the board. Under Rule 14a-11, a shareholder (or group of shareholders) was eligible to nominate proxy access candidates provided that the shareholder:

- held at least 3% of the voting power of the company’s securities for a minimum of three years; and

- was not prohibited by state or foreign law or a company’s governing documents from proposing a candidate.

Rule 14a-11, however, was challenged in the U.S. Court of Appeals for the D.C. Circuit by the Business Roundtable and the U.S. Chamber of Commerce. The court ultimately agreed with the plaintiffs that the SEC was “arbitrary and capricious” in promulgating the rule, finding that the SEC failed to adequately address the economic effects of the rule. The court thus vacated Rule 14a-11. The decision, however, left intact the SEC’s amendments to Rule 14a-8, which generally permitted shareholders to submit shareholder proposals seeking to amend the company’s governing documents regarding nomination procedures. This effectively allowed for the “private ordering” of proxy access through the shareholder proposal process.

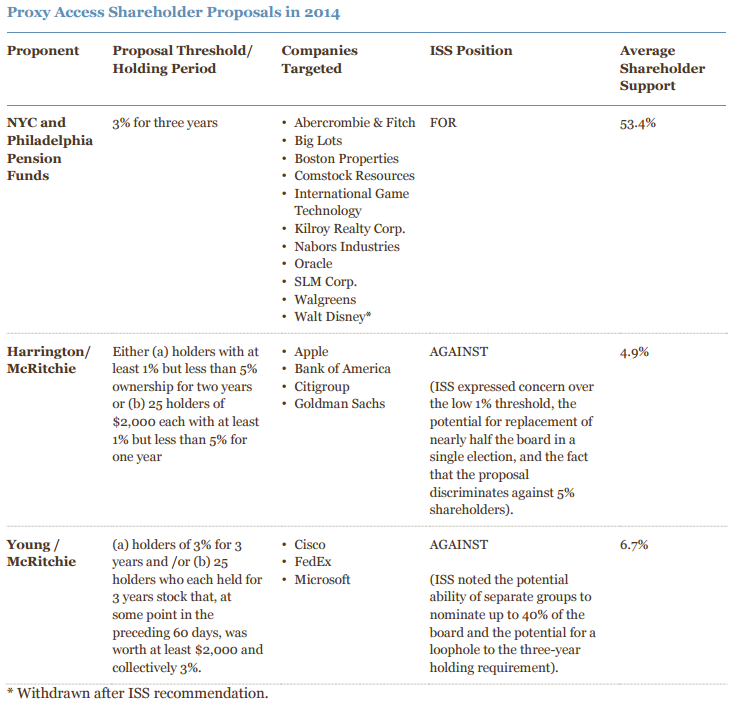

Despite the court’s 2011 decision, a limited number of proxy access shareholder proposals were submitted to public companies prior to the current proxy season. A total of 12, 13 and 17 proxy access shareholder proposals were submitted in 2012, 2013 and 2014, respectively. In 2014, for example, five of the 17 proposals submitted to public companies passed. While last year’s proxy access shareholder proposals garnered an average of 30.9% of the vote, support levels for these proposals varied significantly depending upon the specific proposal being advanced. Proposals mirroring the 3% / three-year thresholds of the SEC’s vacated rule received significantly higher shareholder approval rates than proposals with lower thresholds or those that provided the potential for shareholders to nominate up to 40% of the board or to circumvent the three-year holding requirement.

SEC No-Action Letters

“Directly Conflicting” Proposals Under Rule 14a-8(i)(9)

In addition to being marked by a proliferation of proxy access shareholder proposals, this proxy season was significantly impacted by the unusual, mid-season decision of the SEC’s Division of Corporation Finance (the “Division”) not to express any views during the current proxy season on the application of Rule 14a-8(i)(9), which permits the exclusion of a shareholder proposal “[i]f the proposal directly conflicts with one of the company’s own proposals to be submitted to shareholders at the same meeting.” The Division’s announcement immediately followed SEC Chair Mary Jo White’s announcement of the same day that “[d]ue to questions that have arisen regarding the proper scope and application of Rule 14a-8(i)(9),” she had directed the staff to review the rule and report to the SEC on its review.

Chair White’s announcement stemmed, in part, from the appeal filed by shareholder proponent James McRitchie with regard to the no-action relief granted by the Division’s staff (the “Staff”) to Whole Foods Market, Inc. in connection with McRitchie’s proxy access shareholder proposal. McRitchie’s shareholder proposal requested that the Whole Foods board amend the company’s governing documents to allow any shareholder or group of shareholders collectively holding at least three percent of the company’s shares for at least three years to nominate directors that would then be required to be listed in the company’s proxy materials. The proposal added that parties nominating directors “may collectively make nominations numbering up to 20% of the Company’s board of directors, or no less than two if the board reduces the number of board members from its current size.” Whole Foods’ board, however, opted to submit a proxy access proposal of its own for shareholder approval at the company’s 2015 annual meeting.

The company’s proposal sought to amend Whole Foods’ bylaws to permit any shareholder (but not a group of shareholders) owning at least nine percent of the company’s common stock for five years to nominate board candidates in the company’s proxy materials. The company’s proposal would have allowed a shareholder to nominate the greater of one director or ten percent of the board, rounding down to the nearest whole number of board seats.

In light of Whole Foods’ management proposal, the Staff issued a no-action letter to the company on December 1, 2014, concurring that the company may exclude the shareholder proposal from its proxy materials pursuant to Rule 14a-8(i)(9). Pursuant to the Division’s announcement of January 16, 2015 that it “will express no views on the application of Rule 14a-8(i)(9) during the current proxy season,” however, the Staff reconsidered its position with regard to Whole Foods, responding to McRitchie’s appeal with a notification that it “express[es] no view concerning whether Whole Foods may exclude the proposal under Rule 14a-8(i)(9).”

In the weeks between the Staff’s initial grant of no-action relief to Whole Foods and its reconsideration, 24 companies that received proxy access shareholder proposals similarly sought no-action relief on the ground that the company intended to submit a “directly conflicting” management proposal to shareholders at the 2015 annual meeting. Each of these companies received a response that, given the Division’s announcement of January 16, 2015, in light of Chair White’s direction to the Division to review Rule 14a-8(i)(9), “we express no view on whether [the company] may exclude the proposal under rule 14a-8(i)(9).”

Other Substantive Grounds On Which Companies Based No-Action Requests

While the vast majority of substantive no-action requests regarding proxy access proposals were based on Rule 14a-8(i)(9) and thus received no determination from the Staff, four letters sought no-action relief on other substantive grounds. The two successful requests for relief argued that:

- the proposal was substantially implemented and could, therefore, be properly excluded under Rule 14a-8(i)(10); or

- the proposal is substantially duplicative of a previously submitted proposal and could, therefore, be properly excluded under Rule 14a-8(i)(11).

The two no-action requests that were denied argued that the proposal was excludable under Rule 14a-8(i)(3), which permits the exclusion of a proposal “[i]f the proposal or supporting statement is contrary to the Commission’s proxy rules, including Rule 14a-9, which prohibits materially false or misleading statements in [a company’s] proxy soliciting materials.”

Substantial Implementation Under Rule 14a-8(i)(10): General Electric

The General Electric Company received a shareholder proposal from an individual proponent, requesting that the company’s board adopt a bylaw permitting “a shareholder or group thereof” that has beneficially owned three percent or more of the company’s outstanding stock continuously for at least three years to nominate directors in the company’s proxy materials. The proposal provided that the number of shareholder-nominated candidates appearing in the company’s proxy materials “shall not exceed 20 percent of the number of directors then serving.”

General Electric’s board subsequently adopted amendments to the company’s bylaws, implementing proxy access. The amendments provided, in relevant part, that a shareholder or a group of up to 20 shareholders “who have owned 3% or more of the Company’s common stock continuously for at least three years may include in the Company’s proxy statement and on the Company’s proxy card shareowner-nominated director candidates representing not more than 20% of the Board.” Significantly, the proxy access provision adopted by General Electric included a group limit of 20 shareholders, while the shareholder proposal did not contain a group limit.

In its no-action request, General Electric argued that the board’s adoption of the amended bylaws substantially implements the proposal, because the amended bylaws “address the essential objective of the Proposal: they provide a proxy access procedure under which a group of shareowners who have owned 3% or more of the Company’s common stock continuously for at least three years may include in the Company’s proxy statement and on the Company’s proxy card shareowner-nominated director candidates representing not more than 20% of the Board.” The SEC concurred that General Electric substantially implemented the proposal under Rule 14a-8(i)(10), notwithstanding the company’s addition of the group size limit.

Duplication Under Rule 14a-8(i)(11): United Therapeutics

Rule 14a-8(i)(11) permits the exclusion of a shareholder proposal if the proposal “substantially duplicates another proposal previously submitted to the company by another proponent that will be included in the company’s proxy materials for the same meeting.” United Therapeutics Corporation sought to exclude a proxy access proposal it received from UAW Retiree Medical Benefits Trust on the ground that it was “virtually identical to, and therefore substantially duplicates” a proposal previously received from the New York City Comptroller’s office that the company intended to include in its 2015 proxy materials. United Therapeutics argued that the “principal thrust” of each proposal is the same—to request that the company adopt proxy access—and that the proposals “seek to address this issue through the same process.” Moreover, the company noted that aside from minor capitalization or spelling differences, the two proposals “are substantially identical in all substantive respects.” The SEC agreed that the UAW proposal substantially duplicates the Comptroller’s proposal and may, therefore, be excluded from the company’s 2015 proxy materials pursuant to Rule 14a-8(i)(11).

Violation of Proxy Rule Under Rule 14a-8(i)(3): CSP and Rite Aid

Two companies submitted no-action requests to the SEC, arguing unsuccessfully that the proxy access shareholder proposal is excludable under Rule 14a-8(i)(3), which permits the exclusion of a shareholder proposal if it or its supporting statement “is contrary to any of the Commission’s proxy rules, including Rule 14a-9, which prohibits materially false or misleading statements in proxy soliciting materials.”

In its letter to the SEC, CSP Inc. presented three reasons why it believed the proposal could be excluded pursuant to Rule 14a-8(i)(3). First, the company took issue with a portion of the proposal that quoted from a “fight letter” disseminated to the company’s shareholders in 2013 in connection with a contested election of directors, arguing that its statements regarding the company’s financial performance over the past 20 years are both “stale and materially misleading.” Second, CSP contended that the proposal was materially misleading due to the statement that “[t]hree acquisitions cost stockholders approximately $7 million, yet the Company wrote off over $5 million … the full cost of an acquisition only one year after the purchase!” According to CSP, this language suggests the acquisitions were recent, “when in fact the Company’s acquisition history must be traced back 17 years to find the acquisitions that were followed by goodwill write-downs.” The company further argued that the proposal’s language “misleadingly implies that the acquisitions failed to generate new, profitable areas of business for the Company, when the opposite is true” and that the proponents “do not explain to readers that there have been no goodwill write-offs by the Company in over five years.” Finally, CSP argued that the proposal’s statement that the company “has conducted value-destroying acquisitions, leaving our company with two disparate businesses that lack synergies, while enriching management and directors” has no basis in fact and “impugn[s] the character, integrity and personal reputation of the Company’s management.” The SEC did not accept these arguments, declining to grant CSP no-action relief.

Rite Aid Corporation similarly sought relief to exclude a proxy access shareholder proposal on the basis of Rule 14a-8(i)(3). Rite Aid presented two arguments in its no-action request letter. First, Rite Aid took issue with the supporting statement that “[t]he SEC fully supports this Proposal and the two largest institutional proxy advisory firms, ISS and Glass Lewis, generally support this shareholder protection proposal to include shareholder director nominees in Rite Aid’s proxy statement and proxy cards, providing an inexpensive means for opposing management’s slate.” Rite Aid maintained that this is a materially false and misleading statement because “neither the Commission nor the Staff has reviewed the Proposal or expressed any view in relation to the Proposal or would ever express any view on how shareholders should vote on the Proposal.” Additionally, Rite Aid explained that “neither ISS nor Glass Lewis has reviewed the Proposal or its application to the Company or has expressed any views on the Proposal.” It further noted that pursuant to their respective proxy voting guidelines, ISS will consider each proxy access proposal on a case-by-case basis, and Glass Lewis “considers several factors when evaluating whether to support” proxy access proposals. According to Rite Aid, because the language in the proposal’s supporting statement is materially false or misleading, the proposal violates Rule 14a-9 and should be excluded under Rule 14a-8(i)(3).

Rite Aid further argued that the proposal is excludable under Rule 14a-8(i)(3) because it contains vague and indefinite language, rendering the proposal false or misleading. In particular, the company noted that the proposal, if adopted, would require Rite Aid to include in its proxy statement a supporting statement, defined in the proposal as “a Supporting Statement not exceeding the current SEC word limit.” Rite Aid claimed that “it is not entirely clear whether the Proposal is referencing Rule 14a-8(d), in which case many shareholders may not be familiar with the word limit in that rule, or whether the Proposal is referencing some other ‘current SEC word limit,’ in which case there is complete uncertainty as to what that word limit may be.” The company took the position that the proposal is, therefore, impermissibly vague and indefinite so as to be materially false and misleading.

Interestingly, while the SEC did not agree that the proposal could be excluded from Rite Aid’s proxy materials in its entirety, it did opine that, pursuant to Rule 14a-8(i)(3), the company could exclude from the supporting statement the one sentence regarding the position of the SEC and the proxy advisory firms regarding the proposal.

Positions of the Proxy Advisory Firms

Institutional Shareholder Services, Inc. (“ISS”)

Policy

On February 19, 2015, after the Division announced that it would not issue substantive responses to no-action requests predicated on Rule 14a-8(i)(9), ISS released a new policy on proxy access proposals.

Moving away from its previous case-by-case approach in evaluating these proposals, ISS’s new policy provides that it will generally recommend a vote in favor of management and shareholder proxy access proposals with the following features:

- A maximum ownership threshold of three percent of the voting power;

- A maximum duration requirement of three years of continuous ownership for each member of the nominating group;

- “[M]inimal or no limits on the number of shareholders permitted to form a nominating group”; and

- A cap on shareholder nominees generally set at 25% of the board.

ISS noted that it will also “[r]eview for reasonableness any other restrictions on the right of proxy access” and will “[g]enerally recommend a vote against proposals that are more restrictive than these guidelines.”

In addition, ISS will apply its governance failures policy to “generally recommend a vote against one or more directors (individual directors, certain committee members, or the entire board based on case-specific facts and circumstances)” where the company has excluded a properly submitted proxy access shareholder proposal without obtaining voluntary withdrawal from the proponent, no-action relief from the SEC, or a federal court ruling allowing it to exclude the proposal. ISS will recommend against directors in this case “regardless of whether there is a board-sponsored proposal on the same topic on the ballot.” ISS added, however, that if a company “has taken unilateral steps to implement the proposal, … the degree to which the proposal is implemented, and any material restrictions added to it, will factor into the assessment.”

Practice

Thus far this proxy season:

- ISS has recommended a vote “For” each of the 83 proxy access shareholder proposals submitted to Russell 3000 companies for which it has published a report.

- ISS has recommended a vote “Against” seven of the 11 proxy access proposals submitted by management for which they published a report.

Glass Lewis

Policy

Glass Lewis’s policy provides that the proxy advisory firm “will consider supporting reasonable proposals requesting shareholders’ ability to nominate director candidates to management’s proxy” and will review such proposals on a case-by-case basis, considering the following factors:

- company size;

- board independence and diversity of skills, experience, background and tenure;

- the shareholder proponent and its rationale for submitting the proposal;

- the proposal’s thresholds;

- shareholder base in both percentage of ownership and type of shareholder;

- responsiveness of board and management to shareholders;

- company performance and steps taken to improve poor performance;

- existence of anti-takeover protections; and

- opportunities for shareholder action (e.g., ability to act by written consent, right to call a special meeting).

Following the Division’s January announcement, Glass Lewis published a blog post regarding its views on proxy access, reiterating that it “will continue to review each proxy access proposal, along with the company’s response, on a case-by-case basis.” In addition, Glass Lewis noted that consistent with its “case-by-case approach to evaluating management and board responsiveness to shareholders in general, Glass Lewis will review a company’s response to the submission of a shareholder proposal on proxy access, including an alternative management proposal submitted to shareholders in lieu of or in addition to the shareholder proposal, based on the specific facts and circumstances of the company and its actions,” evaluating the “reasonableness and proportionality of the company’s response to the shareholder proposal.”

With regard to alternate management proposals, Glass Lewis indicated that it will take a variety of factors into account, including whether the proposal differs materially from the shareholder proposal, “the company’s performance and overall governance profile, the board’s independence, leadership, responsiveness to shareholders and oversight, the opportunities for shareholders to effect change, e.g. call a special meeting, other differences in the terms of the competing proposals, the number/type/nature of the shareholders above the proposed threshold as well as the nature of the proponent.” Glass Lewis added that it may, in limited cases, “recommend against certain directors if the management proposal varies materially from the shareholder proposal without sufficient rationale.”

Practice

Glass Lewis generally recommends “For” proxy access shareholder proposals. Thus far this proxy season, Glass Lewis has recommended a vote “Against” six of the 11 proxy access proposals submitted by management for which they published a report (i.e., those management proposals with a 5% shareholding threshold).

Positions of Large Institutional Shareholders

At present, there is no consensus among the major institutional shareholders on the issue of proxy access. BlackRock and State Street Global Advisors, for example, currently consider proxy access proposals on a case-by-case basis. BlackRock’s current policy reflects its belief that “long-term shareholders should have the opportunity, when necessary and under reasonable conditions, to nominate individuals to stand for election to the boards of the companies they own and to have those nominees included on the company’s proxy card,” provided that the proxy access mechanism will “provide assurances that the mechanism will not be subject to abuse by short-term investors, investors without a substantial investment in the company, or investors seeking to take control of the board.” State Street Global Advisors evaluates “the company’s specific circumstances, the impact of the proposal on the target company and its potential effect on shareholder value,” taking into account considerations such as “the ownership thresholds and holding duration proposed in the resolution, the binding nature of the proposal, the number of directors that shareholders may be able to nominate each year, company performance, company governance structure, shareholder rights, and board performance.”

The Vanguard Group also currently considers proxy access proposals on a case-by-case basis, but generally supports proxy access provisions that provide a shareholder (or group of shareholders) holding five percent of a company’s outstanding shares for at least three years with the right to nominate up to 20% of the board’s directors. The Vanguard Group “may, however, support different thresholds based on a company’s other governance provisions, as well as other relevant factors.”

Finally, Fidelity Management & Research is currently opposed to proxy access, generally voting against management and shareholder proposals seeking to implement proxy access.

Proxy Access Proposal Trends

Overall Trends

- The number of proxy access shareholder proposals submitted to public companies skyrocketed this year, largely due to the Comptroller’s initiative. Proxy access shareholder proposals have been the most popular of the governance-related proposals in 2015, with a total of 81 proposals that have gone to a vote thus far among Russell 3000 companies. In contrast, between 12 and 17 proxy access shareholder proposals were submitted to a vote in each of the previous three years.

- All proposals submitted to a vote at Russell 3000 companies called for proxy access at the thresholds of three percent and three years. In contrast, of the 17 shareholder proposals submitted to a vote in 2014, only ten contained the 3% / three-year thresholds. Given the marked difference observed last year between the support of shareholders and proxy advisory firms for 3% / three-year proposals, on the one hand, and proposals with lower thresholds, on the other, shareholder proponents converged on the 3% / three-year thresholds this year.

- The vast majority of shareholder proposals capped proxy access nominees at 25% of the board. Of the 81 shareholder proxy access proposals submitted to a vote this year at Russell 3000 companies, 79 proposals (or 98%) provided that the nominating shareholder could nominate up to 25% of the board, while two proposals capped shareholder nominees at 20% of the board.

- Almost all shareholder proposals were silent with respect to limits on the number of shareholders that can be aggregated to reach the shareholding threshold. Only one of the 81 proposals submitted to a vote at Russell 3000 companies (submitted to Citigroup) included a group limit of 20 shareholders.

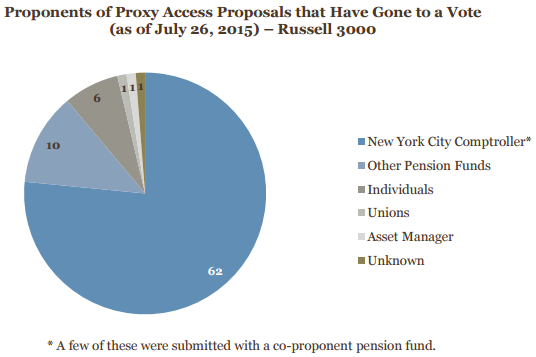

- The New York City Comptroller’s office submitted the vast majority of proxy access proposals. While the New York City Comptroller’s office submitted 75 proposals in all, 62 of which went to a vote at Russell 3000 companies so far this proxy season, there were other institutional and individual proponents that submitted similar proposals, as well.

- Vote results have been decidedly mixed, though the majority of proposals have passed. Of the proposals that have been voted on at Russell 3000 companies so far this season, forty-eight shareholder proposals (or 59.3%) have passed, while 33 shareholder proposals (or 40.7%) have failed. One shareholder proposal, submitted to Comstock Resources, was withdrawn prior to the meeting. Another three proposals remain pending as of July 26.

- Average shareholder support for proxy access shareholder proposals rose significantly from last year, but was consistent with average support received in 2014 for proposals with 3% / three-year thresholds. Proxy access shareholder proposals among Russell 3000 companies received average support of 54.7% thus far in 2015, compared to 30.9% average support in 2014 and 53.4% average support for proposals with 3% / three-year thresholds in 2014. In cases where the shareholder proposal was submitted in addition to a conflicting management proposal, the shareholder proposal received an average of 55.1% of the vote. In cases where the company simply opposed the shareholder proposal, the shareholder proposal received an average of 53.9% of the vote.

Management Responses to Proxy Access Shareholder Proposals

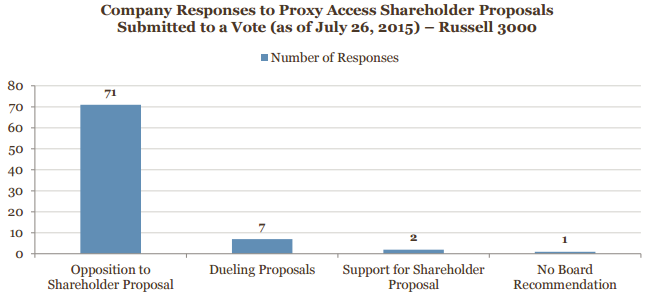

Following the Division’s decision not to express an opinion on no-action requests based on Rule 14a-8(i)(9) and the proxy advisory firms’ publication of their policies on proxy access proposals, companies chose to pursue different options in response to the shareholder proposals they received.

| Option | Statistics (among companies across all indices and including those whose meetings are pending, as of July 26, 2015) |

|---|---|

| Opposition to the Shareholder Proposal | Approximately 78 companies (seven of which adopted proxy access in 2015 and one of which adopted proxy access in 2014) have included the shareholder proposal, accompanied by an opposition statement from the board. |

| Voluntary Adoption of Proxy Access | Approximately 16 companies, including General Electric, have amended their bylaws to adopt proxy access on their terms, virtually always following the receipt of a shareholder proposal and often following negotiations with the shareholder proponent. At least one of these companies, Prudential, had not received a proxy access shareholder proposal. |

| Negotiation | Based on publicly available information, at least six companies negotiated a compromise with the proponent. Five of these companies reached agreements with the Comptroller’s office. Staples, Abercrombie & Fitch and Splunk agreed to submit board proposals on proxy access to their shareholders. Big Lots and Whiting Petroleum agreed to adopt bylaws to provide proxy access at 3% / three years / cap of 25% of the board / no group limit. In addition, one company (FirstMerit) negotiated an agreement with a different proponent to submit a management proposal with the thresholds 3% / three years / cap of 20% of the board / group limit of 20 shareholders. There may be additional companies that have reached an agreement with the proponent—namely, certain of the companies that have voluntarily adopted proxy access. |

| Dueling Proposals | Approximately seven companies decided to include both the shareholder proposal and their own proxy access proposal in their proxy materials. Two of these management proposals were binding, while five were non-binding (i.e., if they pass, they would not automatically implement proxy access if adopted). |

| Support for the Shareholder Proposal | Two companies, including Citigroup, determined to support the proxy access shareholder proposal contained in their proxy statements. |

| No Board Recommendation | One company provided no board recommendation in response to the proxy access shareholder proposal. |

With respect to the 81 proposals that have been submitted to a vote thus far among the Russell 3000, companies pursued the following options:

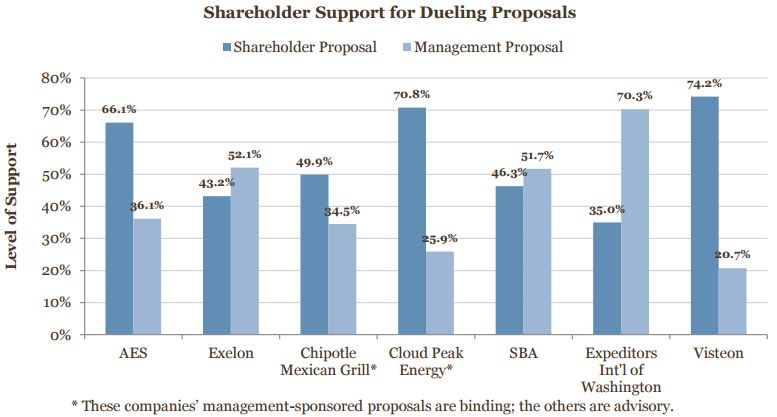

Trends Among Companies Submitting Dueling Proposals

Vote results for shareholder proposals that were submitted in conjunction with a conflicting management proposal were decidedly mixed. Of the seven shareholder proposals that were part of a pair of dueling proposals, three passed; the management proposals in each of those pairs garnered majority support. Among the four companies at which the shareholder proposal failed, the management proposal passed in three cases and failed in one case.

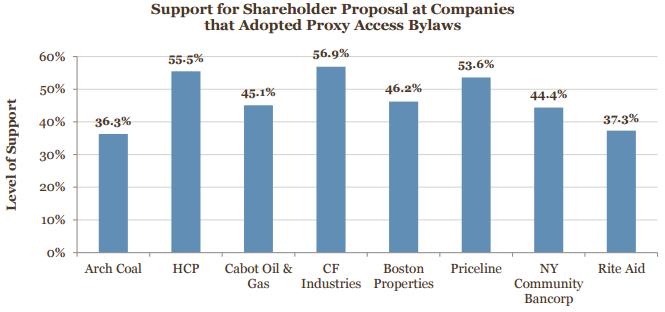

Trends Among Companies That Have Voluntarily Adopted Proxy Access

Of the 71 shareholder proposals that went to a vote among Russell 3000 companies and that were accompanied by an opposition statement of the board, eight were opposed in part because the company had already adopted its own version of proxy access. While average support for the shareholder proposal at companies that already adopted some form of proxy access was 46.9%—lower than the 54.7% average support among the Russell 3000 generally—the outcome of the vote among these companies was mixed, with the shareholder proposal garnering majority support at three of the eight companies. These results seem to indicate that prior adoption of proxy access was not, in itself, determinative of the company’s chances of defeating the shareholder proposal.

In addition to the above eight companies that adopted proxy access and subsequently submitted the shareholder proposal to a vote, another eight companies that adopted proxy access bylaws did not submit a shareholder proposal to a vote. At least one of these companies did not receive a shareholder proposal on proxy access. The others most likely excluded the proposal pursuant to negotiation with the proponent or, in General Electric’s case, pursuant to SEC no-action relief on the ground that the proposal was substantially implemented.

The 16 companies that have voluntarily adopted proxy access did so with the following thresholds (though there are some nuanced variations even among companies that generally adopted the same thresholds):

| Companies | Thresholds Adopted |

|---|---|

| 8 Companies: General Electric, YUM! Brands, Prudential Financial, Bank of America, Rite Aid, United Therapeutics, H&R Block, McKesson* | 3% / 3 years / cap of 20% of board / group limit of 20 |

| 3 Companies: CF Industries, Arch Coal, Priceline Group | 5% / 3 years / cap of 20% of board / group limit of 20 |

| 3 Companies: HCP, Cabot Oil & Gas, New York Community Bancorp | 5% / 3 years / cap of 20% of board / group limit of 10 |

| 1 Company: Boston Properties | 3% / 3 years / cap of 25% of board / group limit of 5 |

| 1 Company: Biogen | 3% / 3 years / cap of 25% of board / group limit of 20 |

* subject to shareholder approval

Takeaways

When the Division announced that it would not express any views on no-action requests based on Rule 14a-8(i)(9), many issuers that received a proxy access shareholder proposal engaged in thoughtful analysis regarding how to proceed in response to the proposal, ultimately choosing the path they thought would be most likely to yield favorable results. This season’s voting results, however, indicate that the decision to either submit a conflicting management proposal alongside the shareholder proposal, oppose the shareholder proposal outright, or voluntarily adopt proxy access prior to submitting the shareholder proposal to a vote were not determinative of the outcome. Rather, a closer look at the voting results at each individual company that received the proposal suggests that the most relevant factors to influence the results were, in fact, the company’s performance and its shareholder base.

Since the “private ordering” of proxy access at the thresholds of the SEC’s vacated proxy access rule is very likely to continue, issuers should begin to think about how they will approach proxy access in the 2016 proxy season. In preparation for 2016, issuers and their in-house counsel should consider taking the following actions:

- Educate the Board. The board of directors should be prepared for the 2016 proxy season by being informed about the trends that have developed during the current proxy season, as well as the advantages and disadvantages of pursuing each potential option for responding to a proxy access shareholder proposal.

- Evaluate the Company’s Shareholder Base and Engage with Shareholders. As noted above, there is no consensus among the large institutional shareholders on the issue of proxy access. Given the strong link between a company’s shareholder base and its voting results on proxy access shareholder proposals, issuers should analyze their shareholder base and their shareholders’ policies on proxy access and should begin to engage their largest shareholders.

- Consider the Proxy Access Structure, If Any, Appropriate for the Company. To the extent a company is open to voluntarily adopting a proxy access bylaw, it should consider what thresholds it would be comfortable with and what “bells and whistles” it might want to include in the provision.

Print

Print