Melissa Burek is Founding Partner and Mike Bonner is a Senior Associate at Compensation Advisory Partners (CAP); and Melanie Nolen is a Research Editor at Corporate Board Member. This post is based on their CAP memorandum. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance (discussed on the Forum here) and the book Pay without Performance: The Unfulfilled Promise of Executive Compensation, both by Lucian Bebchuk and Jesse Fried.

What makes a company successful?

Stock price growth? Meeting the business plan? Beating external expectations? Long-term stability? Companies must consider success across multiple fronts, and boards of directors play a role in defining success by working with management to set the strategic plan and by overseeing how the company progresses toward the achievement of the plan.

Incentive plans are foundational to motivating the senior management team to achieve the goals of a company’s strategic plan. Determining how to best measure and reward performance against these goals is key to designing effective incentive compensation programs that ensure proper alignment of pay outcomes with various degrees of success against the plan.

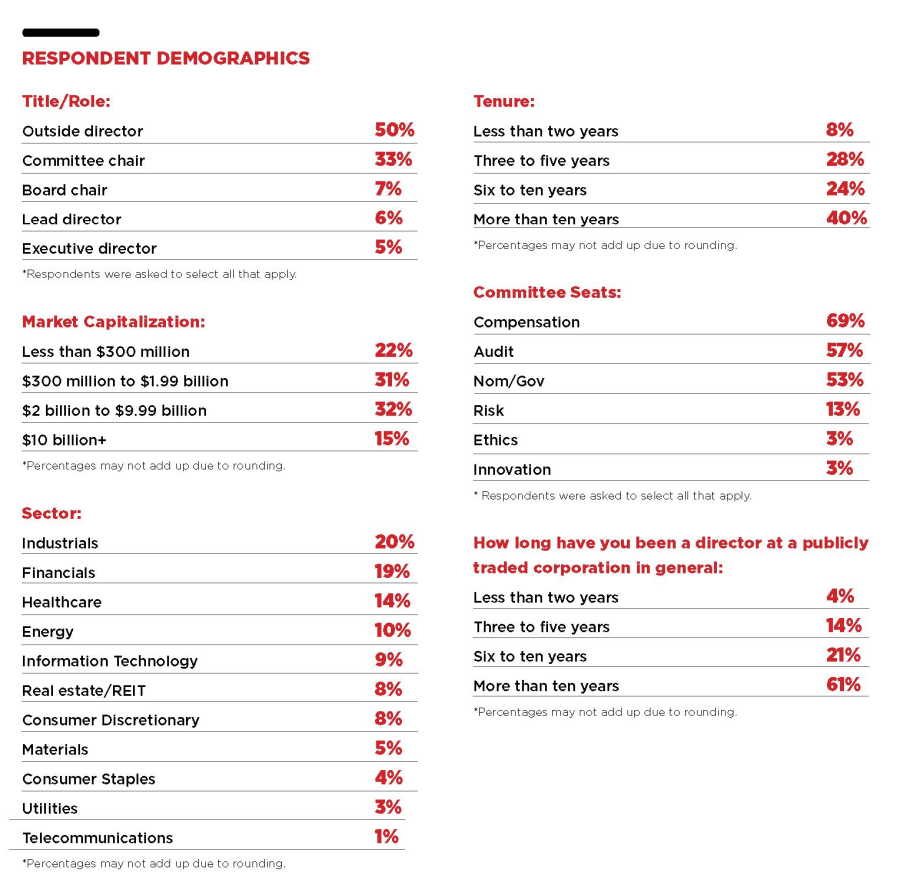

To determine how board members measure performance and incorporate it in their company’s incentive compensation plans, Corporate Board Member and Compensation Advisory Partners partnered to survey more than 250 public company directors. In this post, we present our findings and share our perspective on these key issues.

Key Findings

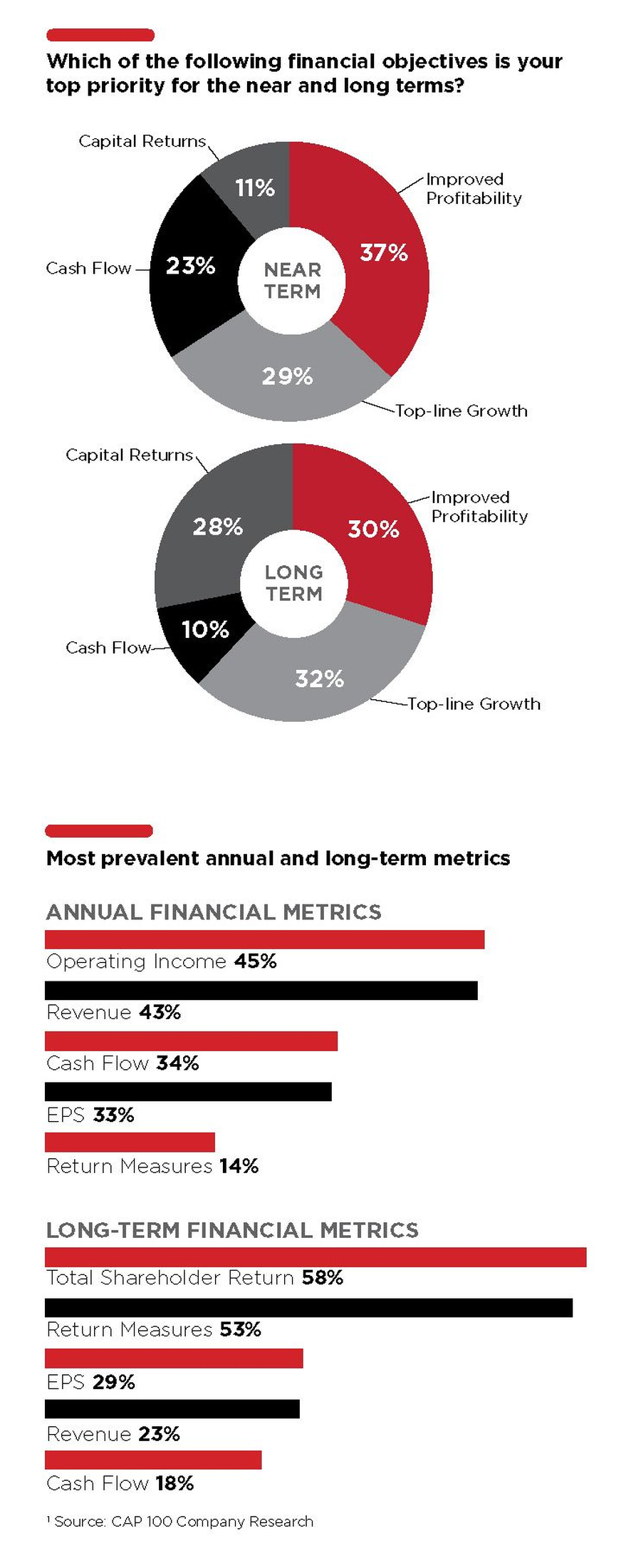

- When establishing financial objectives, profitability is the highest priority in the near term, while top-line growth takes precedence over the long term

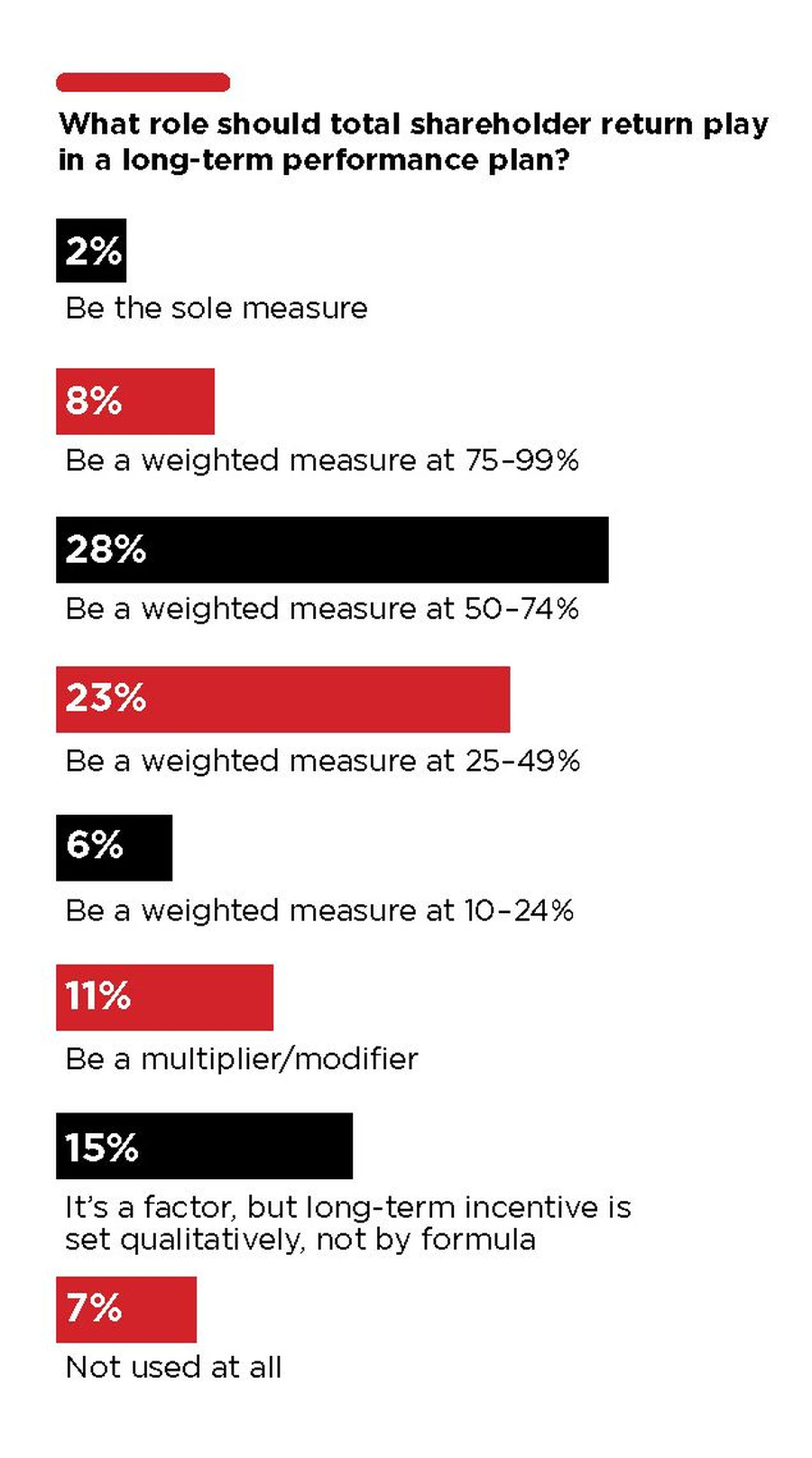

- 93 percent of directors surveyed believe that TSR has a place in long-term performance plans

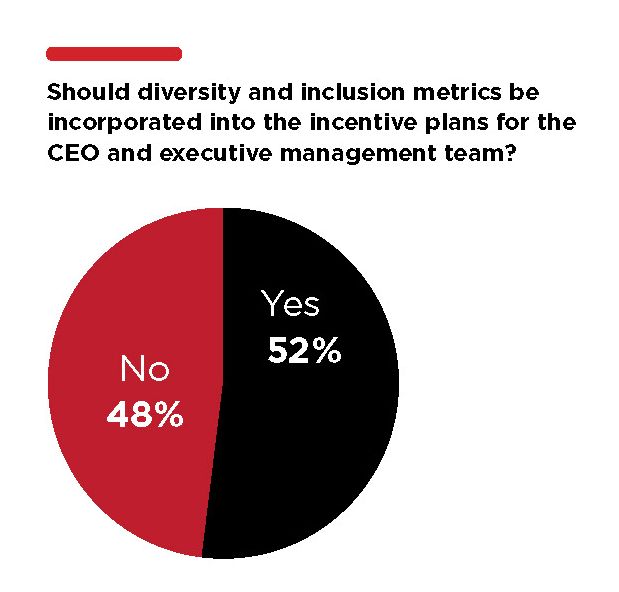

- Directors are evenly divided on whether or not D&I metrics should be incorporated into incentive plans.

- When setting target performance goals, 76 percent of directors surveyed view the company’s internal budget/strategic plan as the most important consideration

- 35 percent of directors surveyed believe that companies should exclude the impact of share buybacks

- 64 percent believe that one-time special retention awards are important to attract and retain talent

Survey Methodology

Corporate Board Member, in partnership with Compensation Advisory Partners, conducted a survey on executive compensation from November 2018 to January 2019. A total of 258 U.S.-based directors of publicly traded companies completed the voluntary and anonymous online survey.

Performance Metric Selection

Incentive plans are vital to driving specific behaviors, and selecting the right performance metrics to drive company strategy and support culture is a key decision point and an ongoing exercise in developing and maintaining an effective executive compensation program. Among board members surveyed in the study, improving profitability is the highest priority in the near-term, while over longer time horizons, top-line growth takes the number one spot.

According to Melissa Burek, partner at Compensation Advisory Partners (CAP), these findings bear out in the metrics that companies use, in practice, in their annual and long-term incentive plans.

“Our CAP 100 Company Research Report shows that operating income is the most common annual incentive metric, followed by revenue, cash flow and EPS, reflecting directors’ top near-term priorities,” she says. “In long-term performance plans, the most common financial measures are return measures, EPS and revenue, consistent with directors’ views for the longer-term.”

Total shareholder return (TSR), usually measured on a relative basis, is also a common metric in long-term performance plans. Among directors surveyed, 93 percent believe that TSR has a place in long-term performance plans. In practice, this is also reflected in the CAP 100 Company Research Report, which finds that 58 percent of companies use TSR.

Mike Bonner, consultant at Compensation Advisory Partners, says that the reason companies use TSR is that it explicitly links long-term incentive plan payouts to shareholder returns and serves as a credible way to measure multi-year performance without relying on a company’s ability to set reasonable multi-year financial goals.

While most surveyed directors agree that TSR should be a long-term performance metric, the role that TSR should play in these plans is widely debated. The debate centers around the idea that TSR is an outcome measure rather than one that drives certain behaviors. In part, for this reason, few directors (2 percent) believe that TSR should be the sole metric in a long-term performance plan. Most directors surveyed believe that it should be weighted between 25 percent and 75 percent.

In CAP’s experience, companies typically try to strike a balance by pairing relative TSR with a financial metric. “We’ve found that among companies that use TSR in their long-term performance plans, 89 percent use it in conjunction with another metric, typically a return measure or EPS,” says Burek. “Among these companies, 33 percent use relative TSR as an award modifier. The remainder use TSR as a weighted component in their plan. For these companies, it is most common to weight the TSR component 50 percent.”

Expert Forecast: We see investors placing a greater emphasis on capital returns in many sectors, though in some, like consumer discretionary and consumer staples, growth continues to be a primary focus. The increased attention on capital returns may cause more companies to adopt or more heavily weight return metrics, particularly in long-term performance plans. We expect that companies will concurrently continue discussions on the role that TSR should play in these same plans. However, as long as longterm performance plans comprise at least 50 percent of the total long-term incentive opportunity at many companies, it is likely that many companies will continue to use relative TSR.

Non-Financial Metrics: Spotlight On Diversity and Inclusion

In recent years, there has been a slight increase in the number of companies incorporating non-financial metrics into their incentive plans. In most cases, companies weight non-financial metrics as a small portion of the total incentive (e.g., 10 percent) or use a basket of non-financial measures as a modifier to the final payout. Relevant non-financial measures vary by industry. For instance, pharmaceutical companies commonly use pipeline and R&D metrics, banks often use customer service metrics and manufacturing companies use health and safety measures.

The role that diversity and inclusion should play in incentive plans has recently moved to the forefront of the discussion around non-financial metrics. The key question is a philosophical one: Should executives be rewarded for promoting a culture of diversity and inclusion or should it be an expectation of responsibly running a company? Directors surveyed are evenly divided.

CAP Partner Melissa Burek says that, in practice, companies are less divided; fewer than 10 percent of them currently use formal diversity-related measures in their incentive plans. This does not suggest, however, that directors and executives are not considering a company’s practices around diversity and inclusion when making compensation decisions for top executives. Companies can incorporate diversity considerations into individual or “strategic” performance assessments. After all, employees with diverse backgrounds can provide diversity of thinking to an organization, contributing to innovation and financial success. Similarly, leaders with diverse backgrounds can provide perspectives that may be more reflective of the needs of customers, employees and stakeholders.

Expert Forecast: There is no question that in today’s environment shareholders expect companies to make progress on diversity and inclusion initiatives. The real question for companies is “how”? One way is to use diversity and inclusion metrics in incentive plans, which may help formalize objectives and hold executives accountable for achieving them. To that end, we may see an uptick in the use of such metrics in the near-term. However, we believe that over the long-term, building a diverse and inclusive workplace should be standard practice for a well-run company rather than an objective for which companies reward executives.

Goal Setting

One of the key challenges that compensation committees face is setting appropriate incentive plan performance goals. Target goals should be both rigorous and achievable, while maximum goals should require true “stretch” or top-tier performance. Companies typically set performance goals where executives have a 70-75 percent chance of achieving target performance and a 15 percent chance of achieving maximum performance.

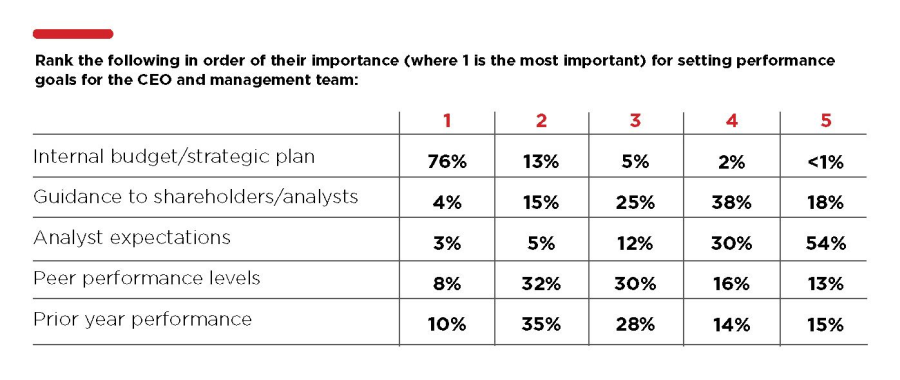

Seventy-six percent of the directors surveyed view the company’s internal budget/strategic plan as the most important consideration in setting target performance goals. To a much lesser extent (5 to 10 percent), directors also consider prior-year performance, peer performance levels, guidance to shareholders/analysts and analyst expectations.

Mike Bonner says in his experience, company practice aligns with this philosophy. Most companies use the internal financial plan as the primary basis for setting incentive plan goals. Prior-year performance indirectly influences incentive plan goals to the extent that it informs the business plan.

Expert Forecast: The incentive plan goal-setting process should be a joint effort between management, the compensation committee and external advisors. Compensation committees will need to continue to spend a good deal of time working with senior finance leadership to review and evaluate the rigor of incentive plan goals. We find that companies are beginning to establish more robust processes around goal-setting. We believe these processes should include conducting sensitivity analyses around results and payouts, assessing sharing ratios (i.e., the portion of value created that is shared through compensation programs) and reviewing historical volatility of performance metrics.

Measuring Results: GAAP vs. Adjusted

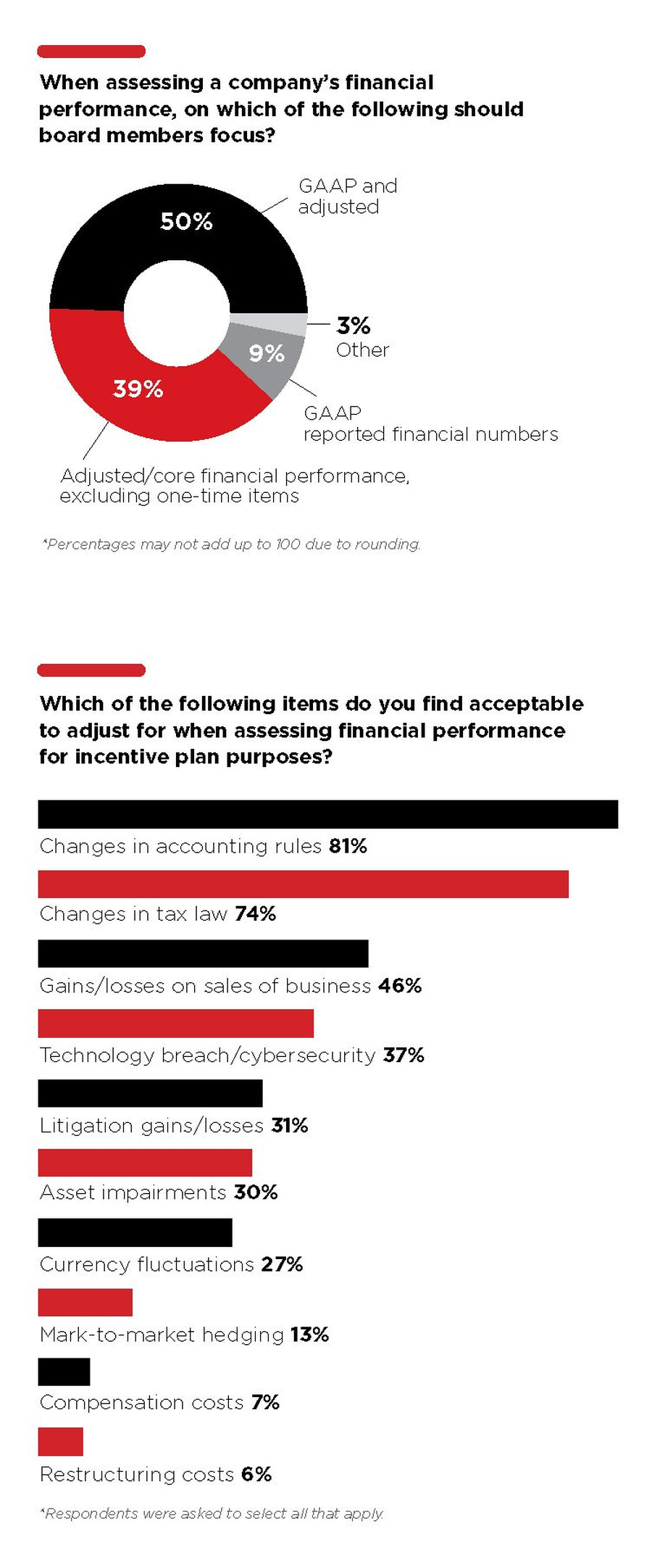

The goal of performance measurement is to hold executives accountable for performance results that impact shareholders while not penalizing or rewarding them for items that are outside of their control. Companies need to determine whether GAAP results or adjusted re-sults best thread the needle between these objectives. Nine out of ten directors surveyed believe board members should focus on adjusted results either in combination with GAAP results or on their own.

When adjusting results, companies must consider the type of “appropriate” adjustments. The directors surveyed overwhelmingly find changes in accounting rules and tax law to be acceptable adjustments.

Less than one-third of directors surveyed viewed items such as currency fluctuations and restructuring costs as acceptable adjustments. Yet, in practice, companies commonly adjust financial results for these items in incentive plans. In CAP’s 100 Company research, 47 percent of companies adjust revenue for currency fluctuations (relevant for global companies), and 53 percent of companies that use profit metrics adjust for restructuring.

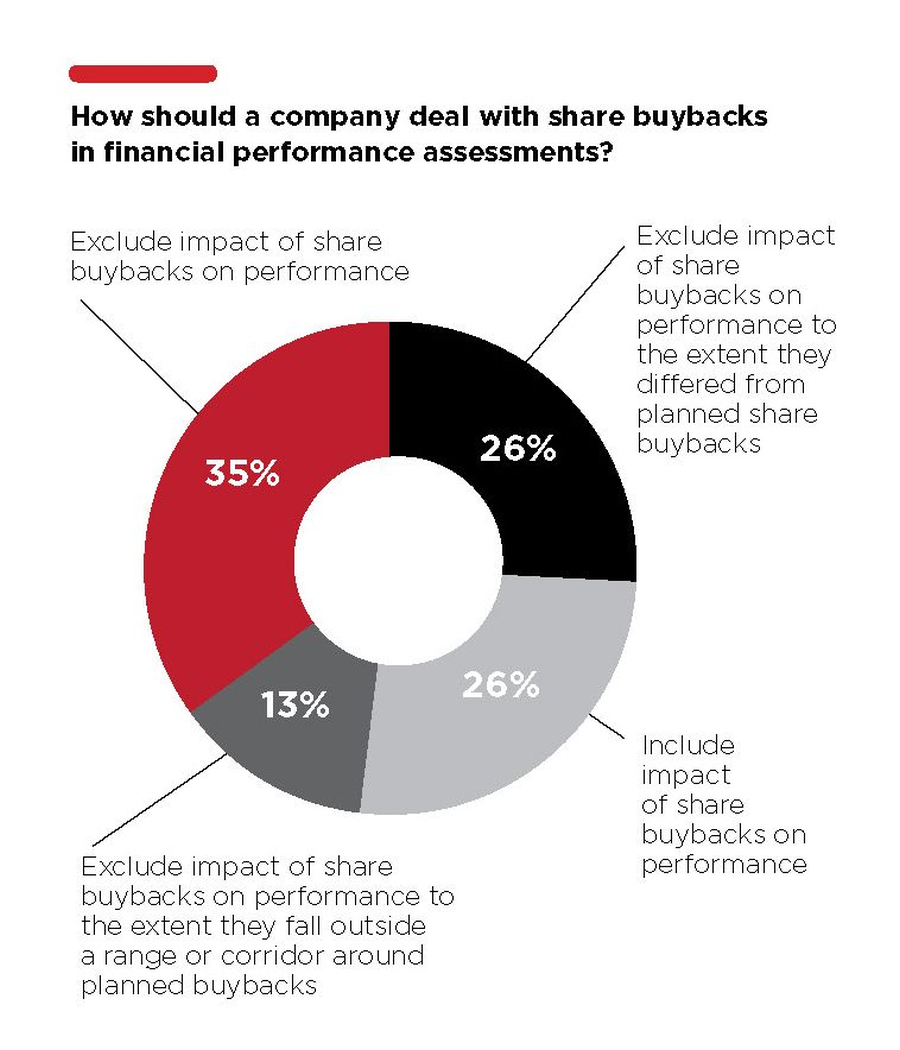

In the conversation around performance adjustments, the treatment of share buybacks has garnered a great deal of attention as of late. For companies that use EPS as a performance metric, shareholders have become increasingly interested in how share buybacks impact incentive payouts. There are four common ways that companies treat share buybacks for performance plan purposes, detailed in the chart on the next page.

Slightly more than a third (35 percent) of directors surveyed believe that companies should exclude the impact of share buybacks. In CAP’s field experience, however, most companies consider buybacks in the budgeting (and therefore goal-setting) process and do not adjust for actual buybacks at the end of the performance period, unless they are substantially higher or lower than planned.

Expert Forecast: Compensation committees are responsible for questioning the appropriateness and fairness of adjustments at the beginning and end of the performance period to ensure that executives’ incentive payouts correlate with value delivered to shareholders. Certain items, such as changes in accounting rules and tax law, will likely continue to be widely accepted adjustments. Others will need to be re-evaluated annually, as they relate to the company. There are also items, such as technology/cybersecurity breaches and share buybacks, that we believe will draw an increasing amount of attention from shareholders and the media. Compensation committees need to carefully evaluate the merits of adjusting for these types of items. Further, companies should not adjust results for a pre-determined laundry list of items each year, but, rather, reassess the rationale behind each adjustment on an annual basis.

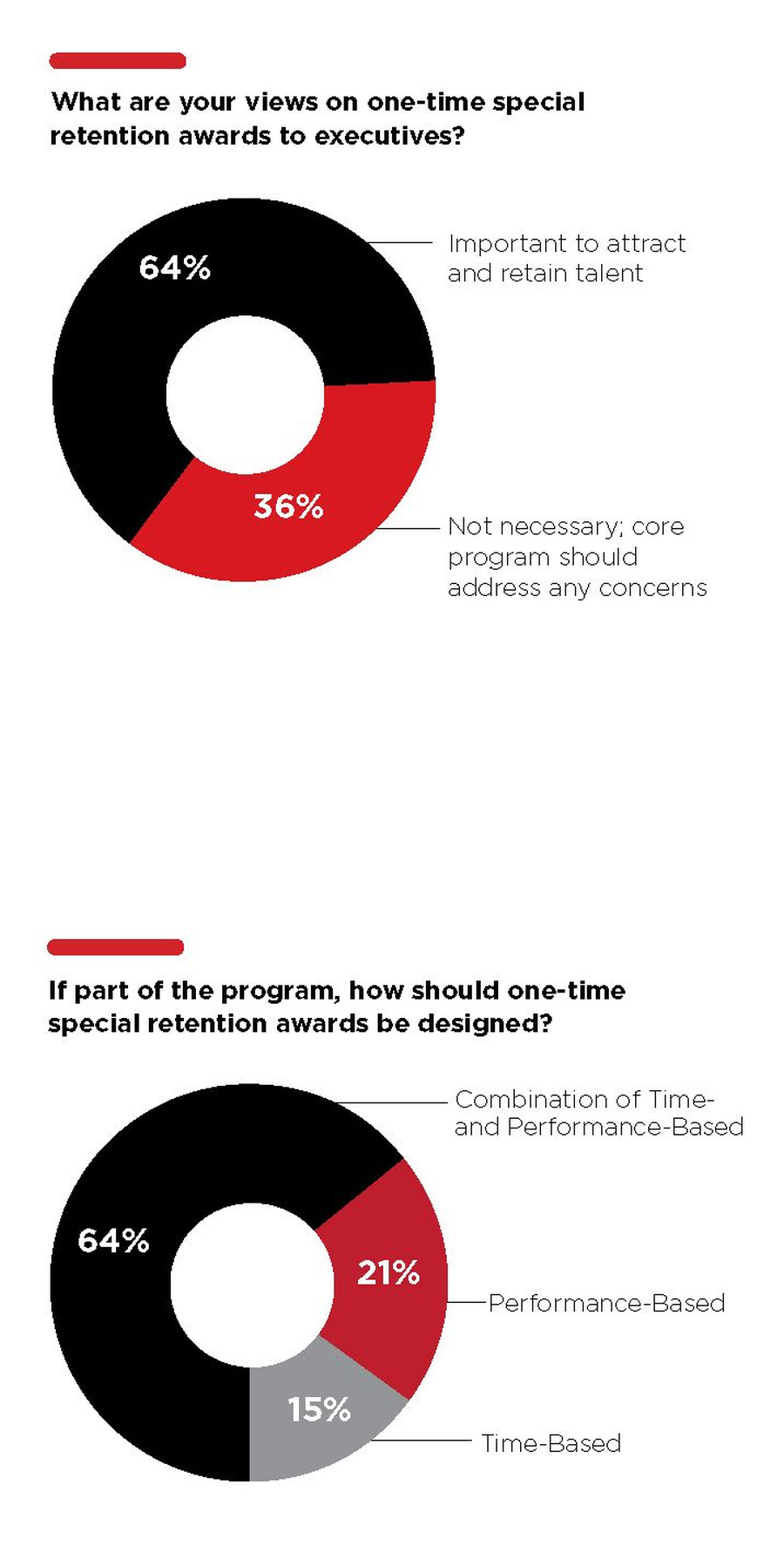

Special Awards

In addition to focusing on appropriately rewarding executives for results, compensation committees cannot lose sight of retention of key talent and future succession needs. The prevailing view is that core compensation programs, if designed properly, should provide executives with sufficient wealth accumulation over time, which, in turn, supports executive retention. In that light, many directors believe that one-time special retention awards have a valid purpose and place in compensation programs, with 64 percent of them saying these awards are important.

Yet, Burek says that, in practice, such awards are not common. “Companies tend to limit the use of one-time special retention awards to certain unique circumstances, such as company transactions, company transformation, or following a period of executive turnover,” she says. “Many boards also feel these awards are instrumental in succession planning, so companies tend to use them very selectively in these cases and tie their vesting to periods of three or more years.”

In our survey, 85 percent of directors believe that these awards should—at least in part—be tied to the achievement of performance criteria. Doing so makes them more palatable to external stakeholders, such as proxy advisory firms and institutional investors.

Expert Forecast: Compensation committees are keenly aware of the optics of special one-time awards, as they often trigger negative commentary from proxy advisory firms. However, their use is a business decision, and compensation committees must evaluate the merits of these awards on a case-by-case basis and determine whether there is a compelling need for them after considering the potential implications. We, therefore, expect that companies will continue to use these awards selectively and that vesting will become increasingly performance based, with larger awards subject to vesting beyond three years.

Tax Reform and Its Impact On Executive Compensation Design

The passing of the Tax Cuts and Jobs Act at the end of 2017 created waves in executive compensation, when it amended section 162(m) of the internal revenue code to eliminate the deduction for performance-based compensation, effectively limiting the deductibility of senior executive compensation to $1 million per year.

For years, companies have designed compensation programs to be tax efficient by taking advantage of this deduction. Some speculated that the elimination of the tax benefit would cause companies to dramatically change pay practices.

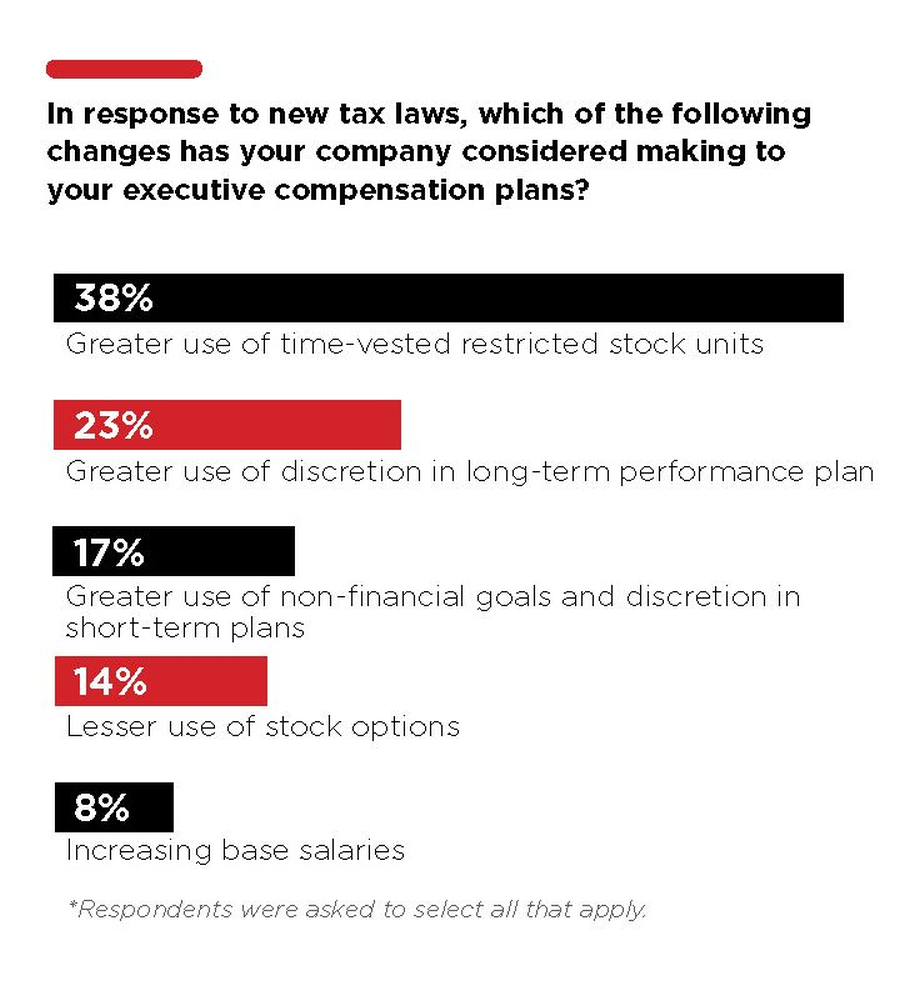

Slightly more than half (53 percent) of directors surveyed say their companies have considered greater use of time-vested restricted stock awards in the wake of tax reform, while 32 percent say their companies considered the use of discretion in the long-term performance plan. To a lesser extent, directors considered other changes, such as increasing the use of non-financial goals and discretion in short-term plans, decreasing the use of stock options and increasing base salaries.

Expert Forecast: We see boards discussing the use of non-financial measures, discretion and time-based equity awards, as they relate to tax reform. However, thus far, we have only seen changes in executive compensation programs on the margins.

While companies will undoubtedly have more flexibility in this post-tax reform world, they should continue to operate using principles of good governance. For instance, companies that choose to incorporate non-financial measures or increase the use of discretion will need to be prepared to include robust disclosure around the qualitative or discretionary evaluation process. Similarly, if we see an increase in the use of time-based restricted stock, it will likely remain a small portion of the total incentive mix, considering, among other factors, the preferences of institutional shareholders and proxy advisory firms.

A Look Ahead

The current, high-visibility, say-on-pay environment requires companies to continually demonstrate the inextricable link between executive pay and company performance. Definitions of success will continue to evolve both internally, within companies and externally, among investors and other stakeholders.

We believe compensation committees are well-equipped to respond to these evolving expectations and will continue to meet the challenge of maintaining responsible pay programs with a strong performance orientation.

Print

Print

One Comment

“Companies typically set performance goals where executives have a 70-75 percent chance of achieving target performance…”

This seems high relative to my own experience and the data I have reviewed, which suggests that target payouts (or above) are achieved approximately 55% – 60% of the time. Or perhaps we just set more aggressive goals…