Jennifer Burns is Audit & Assurance Partner; Christine Robinson is Senior Manager; and Kristen Sullivan is an Audit & Assurance partner at Deloitte & Touche LLP. This post is based on a Deloitte memorandum by Ms. Burns, Ms. Robinson, Ms. Sullivan, Deb DeHaas, Maureen Bujno, and Debbie McCormack.

Discussions and debates regarding the importance of environmental, social, and governance (ESG) disclosure have continued their fast-paced trajectory over the past several months. In January 2020, the CEO of the world’s largest asset manager stated, “ . . . we will be increasingly disposed to vote against management and board directors when companies are not making sufficient progress on sustainability-related disclosures and the business practices and plans underlying them.” Specifically, BlackRock is asking the companies they invest in on behalf of their clients to:

- Provide disclosure in line with industry-specific Sustainability Accounting Standards Board (SASB) guidelines, or equivalent standard, by year-end

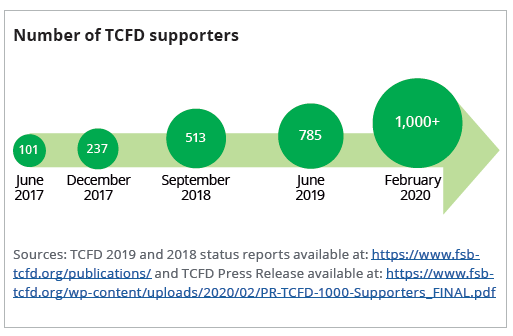

- Disclose climate-related risks in line with the Financial Stability Board’s (FSB) Task Force on Climate-related Financial Disclosures’ (TCFD) recommendations.

Adding to BlackRock’s ask of companies, State Street Global Advisors has stated that “Beginning this proxy season, we will take appropriate voting action against board members at companies in the S&P 500 . . . that are laggards based on their R-Factor scores and that cannot articulate how they plan to improve their score.“

Also, in January, at the World Economic Forum annual meeting in Davos-Klosters, world leaders focused on the theme of a cohesive and sustainable world. The World Economic Forum Global Risks Perception Survey 2019–2020 set the stage reporting that “Severe threats to our climate account for all of the Global Risks Report’s top long-term risks.”

The World Economic Forum and International Business Council (IBC) report is another market development emphasizing the need for more standardized, high-quality, and business-aligned ESG reporting. The IBC recommended 22 metrics drawn from existing, recognized sustainability reporting standards, including SASB, TCFD, and the Global Reporting Initiative (GRI). The objective of the report was to serve as a further catalyst to corporates, with a sense of urgency, around how ESG transparency is critical for the market to navigate evolving environmental and societal risks and disruptors. The IBC report emphasizes that for the capital markets to hear this message, ESG disclosure should increasingly be provided through more mainstream disclosures, further emphasizing the importance of effective governance and board oversight.

These and other developments have shone a spotlight on ESG performance and disclosures specific to climate change. It is important for boards and audit committees to be aware of the increased focus being placed on climate-change disclosures and determine how best to exercise their oversight role to respond to this focus. In this capacity, we recommend that boards:

- Engage with management to understand 1) the climate-related risks and opportunities facing the business, 2) how these risks and opportunities impact the company’s strategy, and 3) whether these risks are integrated into the company’s enterprise risk management activities.

- Evaluate the governance structure to 1) define or refine the role of the board and determine the specific responsibilities of the board and committees, including with respect to oversight of climate-related risk assessment and disclosure, and 2) understand management’s roles and responsibilities to be able to effectively measure, manage, and report on climate-related risks and opportunities.

- Understand the landscape with respect to 1) relevant standards and frameworks (for example, TCFD, SASB, and GRI) and 2) expectations of the company’s priority stakeholders.

- Engage the audit committee to oversee related disclosures and coordinate with the board or other committee which may have primary ownership of overseeing climate-related risk management.

What has the TFCD recommended?

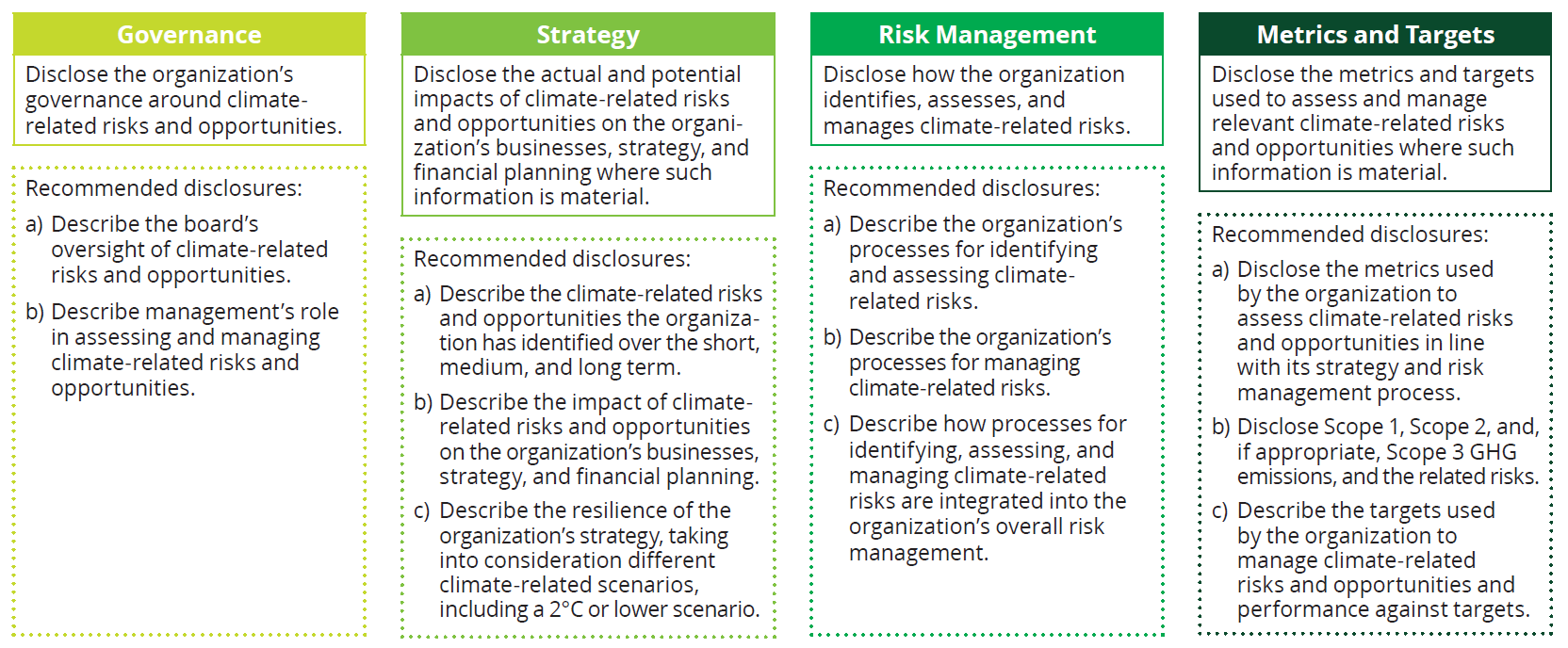

The Task Force identified four thematic areas for organizations to evaluate and disclose, as part of their financial statement preparation and reporting processes, the climate-related risks and opportunities that are most pertinent to their business activities. The recommended disclosures are intended to provide information that helps investors and others understand how reporting organizations think about and assess climate-related risks and opportunities. There is supporting guidance to assist organizations generally as they develop climate-related financial disclosures, as well as supplemental guidance for specific sectors. This structure encourages integrated thinking across the organization with respect to climate-related issues generally and financial statement impacts specifically (such as asset and liability measurement or impairment).

Four thematic areas of climate-risk disclosures

What are the SEC’s views on climate-related disclosures?

Recent comments by the Securities and Exchange Commission’s chairman and other commissioners on climate-related disclosures reiterate that the SEC’s 2010 guidance regarding climate-related disclosures remain relevant and further indicate that views vary about whether the SEC should take action beyond what is contemplated in the 2010 guidance.

The 2010 SEC guidance reminds registrants that they “must identify and disclose known trends, events, demands, commitments and uncertainties that are reasonably likely to have a material effect on financial condition or operating performance.” William Hinman, current director of the SEC Division of Corporation Finance, has explained “that [the 2010] guidance remains a relevant and useful tool for companies when evaluating their disclosure obligations concerning climate-change matters.”

Chairman Clayton has stated: “I am pleased with the Commission’s approach to this issue to date and believe it has been consistent with our ongoing commitment to ensure that our disclosure regime provides investors with a mix of information that facilitates well-informed capital allocation decisions. . . . [T]his commitment has been, and in my view should remain, disclosure-based and rooted in materiality, including providing investors with insight regarding the issuer’s assessment of, and plans for addressing, material risks to its business and operations.”

Commissioner Lee, on the other hand, has stated that it is “clear that the broad, principles-based “materiality” standard has not produced sufficient disclosure to ensure that investors are getting the information they need—that is, disclosures that are consistent, reliable, and comparable” and that “voluntary disclosures, while a welcome development, are no substitute for Commission action for a number of reasons.”

While views amongst the commissioners vary, Chairman Clayton has reiterated that the SEC continues to evaluate climate-related disclosures in ongoing filing reviews; issue comments on such disclosures when necessary; work with other regulators and standard-setters, including the FSB’s TCFD; and engage with issuers and investors on this topic. In particular, the SEC “has been focused on: (1) better understanding the environmental and climate-related information investors currently use and how they analyze that information to make investment decisions on both an issuer- and industry-specific basis and more generally; (2) better understanding the extent to which (and how) issuers identify, assess and manage environmental and climate-related risks in their particular business and industry.”

Boards and audit committees should be aware of their risk oversight role with respect to climate-change disclosures and that “to the extent a matter presents a material risk to a company’s business,

the company’s disclosure should discuss the nature of the board’s role in overseeing the management of that risk.”

Using the COSO ERM framework to consider climate-change risks

Organizations looking to apply risk management concepts and processes to ESG-related risks, including climate change, can look to the Committee of Sponsoring Organizations of the Treadway Commission’s (COSO) Enterprise Risk Management: Applying enterprise risk management to environmental, social and governance-related risks (October 2018). When considering how to evaluate evolving risks, this guidance can help organizations enhance resilience, articulate ESG-related risks, improve resource deployment, enhance pursuit of ESG-related opportunities, realize efficiencies of scale, and improve disclosure.

| COSO ERM framework—Components | Examples of ESG application |

|---|---|

| Governance and culture | Support a culture of collaboration throughout the organization and among those responsible for risk management of ESG issues and consider opportunities for embedding ESG in the entity’s culture |

| Strategy and objective-setting | Examine the value creation process and business model to understand impacts and dependencies on all capitals in the short, medium, and long term |

Performance

|

|

| Review and revision | Review and revise ERM activities related to ESG in order to evaluate their effectiveness and modify approaches as needed |

| Information, communication, and reporting | Consult with risk owners to identify the most appropriate information to be communicated and reported internally and externally to support risk-informed decision-making |

Internal controls for climate-change disclosures

When determining appropriate disclosures (if any) and assessing whether the disclosures are subject to appropriate controls, boards, audit committees, and management may consider whether controls are in place regarding:

- Competence—Climate-related disclosures are evaluated and prepared by competent individuals familiar with climate change or ESG-related matters and understand potential impacts on the company.

- Compliance—The disclosures, if included, meet the SEC’s expectations.

- Consistency of preparation—A consistent process is in place to consider, evaluate, and prepare climate-change disclosures, and that process considers accepted standards (for example, TCFD recommendations).

- Data quality—The quantitative disclosures (if known and estimated) are calculated based on reliable inputs that are subject to appropriate internal control.

- Accuracy of calculation—Any metrics that are provided are calculated with accuracy and supported through management’s books and records.

- Transparency—Descriptions are clear and not confusing.

- Review—The disclosures are reviewed by appropriate levels of management.

- Monitoring—The company’s monitoring function (for example, internal audit, disclosure committee, or audit committee) appropriately reviews the internal controls in accordance with company protocols. In addition, the audit committee is involved in the oversight of the disclosures’ preparation.

In terms of implementing further controls in relation to risks identified, the organization may want to

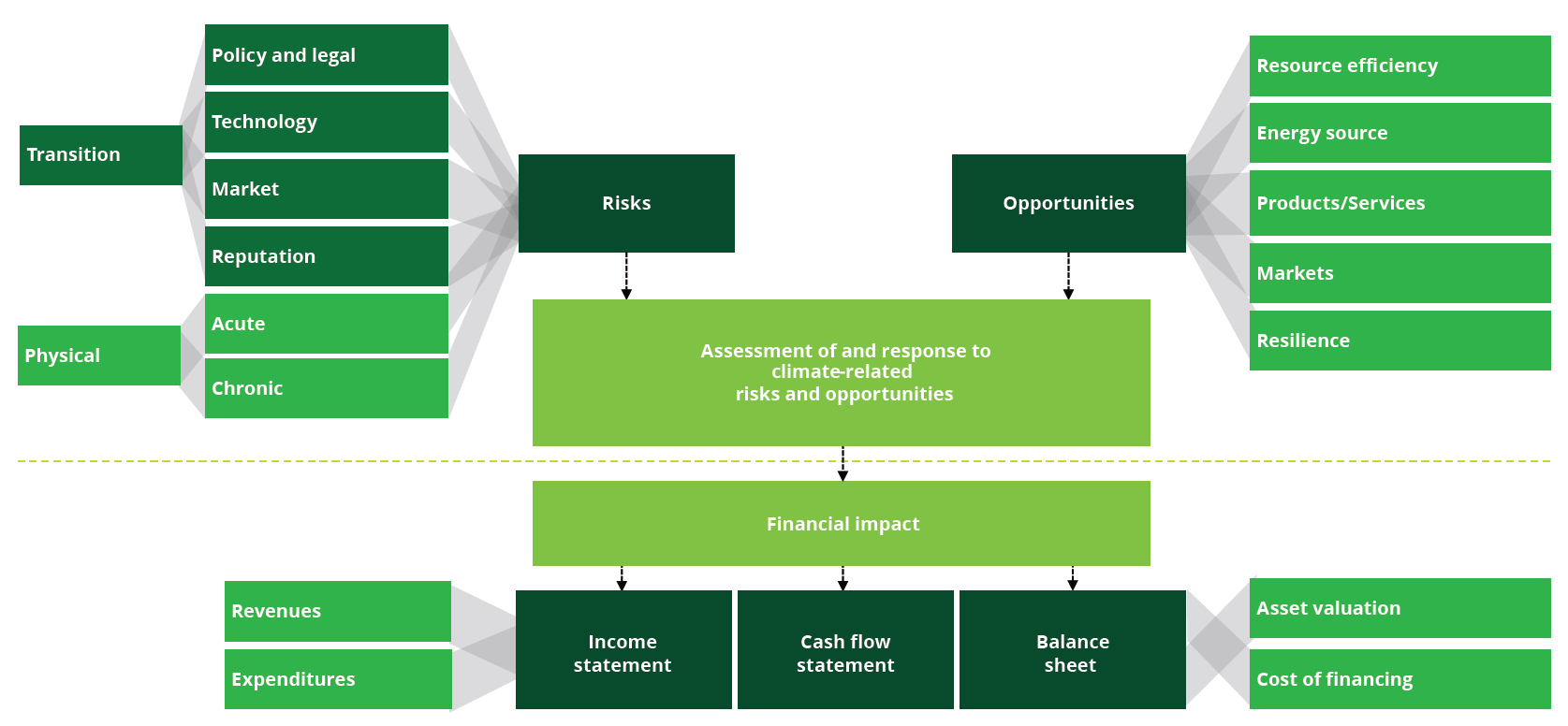

consider COSO’s Internal Control—Integrated Framework (the “2013 COSO Framework”), which provides a framework for designing and evaluating internal controls through the use of 17 principles and related guidance. As organizations consider implementing controls related to climate-change risks, particularly those organizations that apply the 2013 COSO Framework in management’s assessment of internal control over financial reporting, they should consider the COSO principles in evaluating and designing controls. In addition, Figure 1 below depicts climate risks and opportunities that organizations should consider.

Figure 1. Climate-related risks and opportunities that organizations should consider can be depicted in the following manner

Questions for the board to consider asking:

- Does the board understand the risks and opportunities to the business with respect to climate change?

- How does the company identify climate-related risks and opportunities, both from a physical and transition risk perspective, that are material to the business?

- Are climate-change risks incorporated into the company’s enterprise risk management activities?

- Has management undertaken any form of scenario analysis to evaluate climate risk across different time horizons as informed by leading market initiatives

(such as IPCC)? - How does the company collect data that supports high-quality disclosure? What processes and controls are in place to address evolving climate-change

risks and related disclosure aligned with TCFD recommendations? Does a disclosure committee regularly consider these issues? - Does the company obtain external assurance on disclosures of ESG performance?

- Does the company understand what types of disclosures its stakeholders seek, and how the company and the board respond?

- How does the board oversee the management of climate-related risks, and is the board’s role in the management of that risk disclosed?

- Where does the oversight responsibility for climate-related risks reside within the board? How about with management?

- Have climate-related risks been discussed with institutional investors, and how have their responses been considered?

The complete publication, including footnotes, is available here.

Print

Print