Natalie Cooper is Senior Manager and Robert Lamm is an independent senior advisor, both at the Center for Board Effectiveness, Deloitte LLP; and Randi Val Morrison is Vice President, Reporting & Member Support at the Society for Corporate Governance. This post is based on a Deloitte/Society for Corporate Governance memorandum by Ms. Cooper, Mr. Lamm, Ms. Morrison, Debbie McCormack, Carey Oven, and Darla C. Stuckey.

This post identifies some of the key areas and trends expected to be on boardroom agendas this year, according to a December 2020 survey of in-house members of the Society for Corporate Governance. These areas look beyond perennial agenda items, such as strategy and risk, and instead focus on new and emerging topics as many companies continue to respond to unanticipated events that unfolded during 2020. The survey explored two specific topics in detail, pandemic response and recovery and human capital management, to obtain greater insight on shareholder engagement, meeting agendas, and disclosures.

Findings

Respondents, primarily corporate secretaries, in-house counsel, and other in-house governance professionals, represent public companies (91%) and private companies (9%) of varying sizes and industries. [1] The findings pertain to all companies; public and private. Where applicable, commentary has been included to highlight differences among respondent demographics. The actual number of responses for each question is provided.

Access results by company size and type.

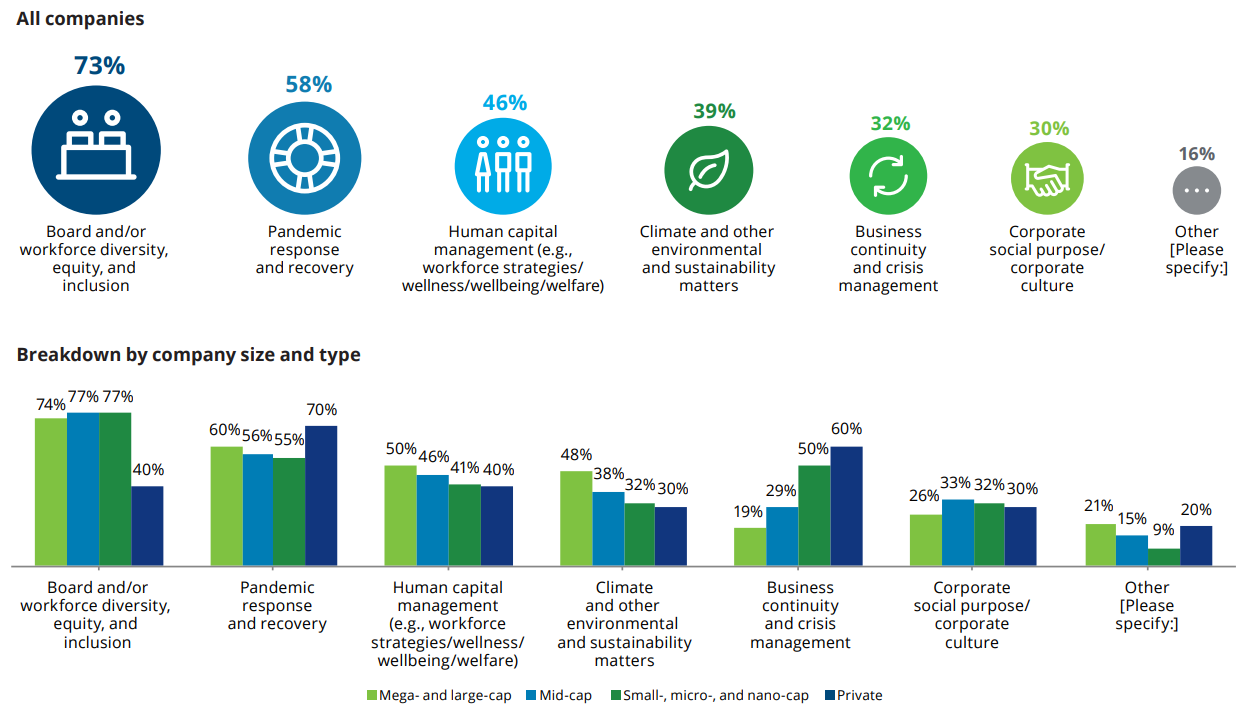

From your perspective as the corporate secretary or other corporate governance professional, whtop three emerging or trending issues do you think your board will want to focus on in 2021 (beyond perennial topics, e.g., strategy, risk, executive compensation). Select a total of three issues, which may include “other,” if applicable. (122 responses)

Top three topics for mega- and large-cap and mid-cap companies were consistent: board and/or workforce diversity, equity, and inclusion; pandemic response and recovery; and human capital management. For small-, micro-, and nano-cap companies and private companies, the top three topics looked slightly different: board and/or workforce diversity, equity, and inclusion; pandemic response and recovery; and business continuity and crisis management.

Some respondents specified “other” responses, and the most common was digital transformation. Others included board retirement and succession planning; business transformation initiatives; capital structure and stockholder returns; activist preparedness; M&A; and cybersecurity.

For each of the following topics, indicate which of the following (or similar) board committees, if applicable, or full board, oversees it. Select all that apply. (110 responses)

Among public companies, 96% of respondents said the full board oversees pandemic response and recovery, and results were disparate across the other topics. For private companies, across all topics, at least 70% said the full board has oversight.

Across public and private companies, board oversight of diversity, equity, and inclusion (DEI) is primarily with the full board (59%), the compensation committee (51%), and/or the nominating/governance committee (51%).

Human capital management is the only topic where most public company respondents indicated oversight is not at the full board level, but with the compensation committee, at 72%. Further, oversight of climate and other environmental and sustainability matters was virtually equal between the full board (47%) and the nominating/governance committee (46%).

Risk committee oversight was most prevalent for pandemic response and recovery and business continuity and crisis management among small-, micro-, and nano-cap companies and private companies.

| Board and/or workforce diversity, equity, and inclusion | Pandemic response and recovery | Human capital management | Climate and other environmental and sustainability matters | Business continuity and crisis management | Corporate social purpose/ corporate culture | |

|---|---|---|---|---|---|---|

| Full board | 59% | 96% | 41% | 48% | 85% | 67% |

| Audit | 1% | 20% | 3% | 8% | 39% | 4% |

| Compensation | 51% | 11% | 70% | 1% | 2% | 13% |

| Nominating/Governance | 51% | 3% | 14% | 43% | 6% | 47% |

| Finance | 0% | 3% | 0% | 3% | 5% | 1% |

| Compliance | 0% | 2% | 0% | 1% | 2% | 0% |

| Technology | 1% | 3% | 0% | 0% | 4% | 0% |

| Public policy and regulatory affairs | 0% | 0% | 0% | 0% | 0% | 0% |

| Risk | 0% | 14% | 0% | 7% | 17% | 2% |

| CSR or sustainability | 3% | 1% | 1% | 12% | 0% | 5% |

For each of the following topics, indicate who within management serves as the principal liaison with the board (e.g., provides reports and updates to the board and/or a board committee). Select all that apply. (104 responses)

Next to the CEO, the chief HR officer or equivalent was most often cited as the management liaison, and specifically on corporate social purpose/corporate culture; board and/or workforce diversity, equity, and inclusion; and human capital management. This highlights the growing importance of the role, as many companies have increased their focus in these areas.

The COO was most seen among private companies in relation to business continuity and crisis management (67%); this role was at most 27% among public companies.

| Board and/ or workforce diversity, equity, and inclusion | Pandemic response and recovery | Human capital management | Climate and other environmental and sustainability matters | Business continuity and crisis management | Corporate social purpose/ corporate culture | |

|---|---|---|---|---|---|---|

| CEO | 37% | 80% | 34% | 35% | 64% | 56% |

| CFO | 2% | 31% | 4% | 8% | 37% | 3% |

| COO | 7% | 28% | 7% | 10% | 19% | 8% |

| Corporate secretary or assistant corporate secretary | 17% | 3% | 4% | 13% | 4% | 14% |

| General counsel or CLO | 26% | 24% | 13% | 25% | 22% | 23% |

| Chief HR officer or equivalent | 76% | 28% | 85% | 7% | 9% | 46% |

| Chief diversity officer or equivalent | 18% | 0% | 7% | 0% | 0% | 3% |

| Chief technology officer or equivalent | 0% | 12% | 0% | 1% | 17% | 1% |

| Chief sustainability officer or equivalent | 2% | 0% | 1% | 21% | 1% | 12% |

| Chief risk officer or equivalent | 0% | 17% | 1% | 5% | 21% | 1% |

| Chief compliance or ethics officer | 2% | 3% | 3% | 6% | 5% | 5% |

| Business unit president(s) or equivalent | 2% | 9% | 3% | 6% | 8% | 3% |

| Head of governmental affairs or corporate citizenship | 0% | 5% | 0% | 7% | 2% | 6% |

A closer look at pandemic response and recovery and human capital management

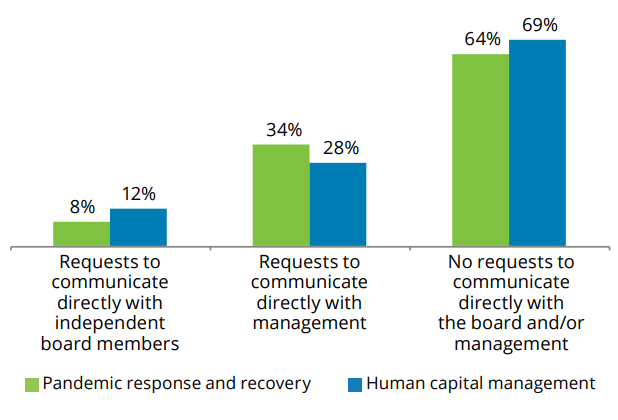

Have your company’s major shareholders requested to engage with the board and/or management on the following topic in the past year? Please check as many boxes as applicable. (97 responses)

Shareholder requests to communicate directly with the board and/ or management on these topics varied across public company sizes. Nearly 50% of mega- and large-cap public company respondents that said their companies did not receive such requests. More than 80% of small-, micro-, and nano-cap said the same.

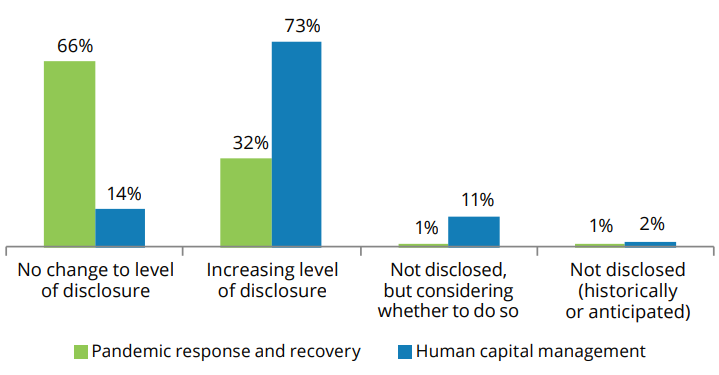

Describe the anticipated level of your company’s disclosure of the following topics in the next three to six months. (101 responses)

Nearly 80% of public company respondents said their companies plan to increase disclosure pertaining to human capital management, and 34% plan to do so on pandemic-related matters. More than two-thirds of private company respondents said their companies will make no change to their level of disclosure on either pandemic response or recovery and human capital management.

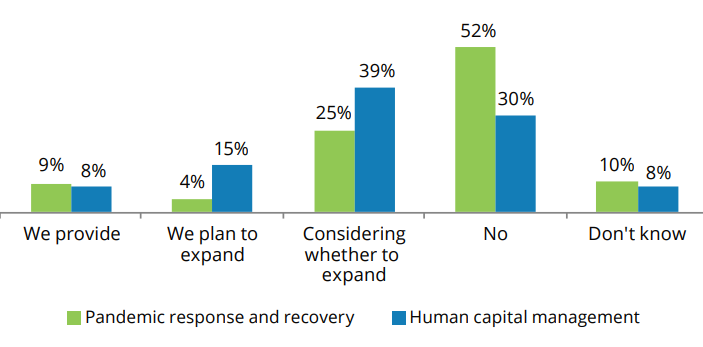

Does your company provide, or does it plan to expand, disclosure of its board and/or directors’ skills and qualifications relevant to these topics? (102 responses)

Fewer than 10% of public company respondents provide such disclosure on either topic; however, one-third plan to expand it or are considering whether to do so on pandemic matters, and this is nearly two-thirds for human capital matters. 83% of private companies said they do not provide such disclosure for either topic.

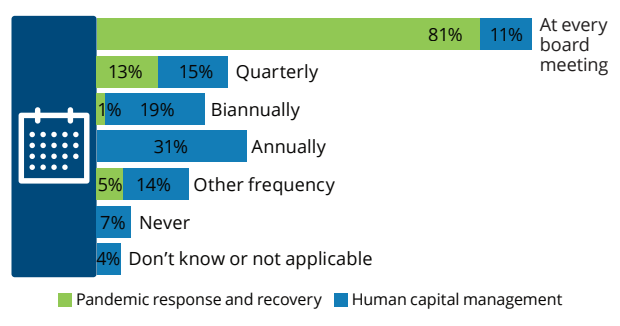

Describe the frequency of the following topics on full board meeting agendas (vs. those addressed solely at the committee level and then potentially reported to the board in conjunction with a committee report or otherwise). (102 responses)

Of public company boards, 84% address matters pertaining to the pandemic “at every board meeting,” compared with private companies, which most commonly address such matters quarterly, at 67%. One-third of public company respondents said human capital management topics are on board agendas annually, followed by biannually at 20%, and quarterly or other frequency, both at 15%. For private companies, one-third said this topic is on the agenda annually, and another one-third said it is never on the agenda.

Endnotes

1Public company respondent market capitalization as of December 2019: 38% mega- and large-cap (> $10 billion); 43% mid-cap ($2 billion to $10 billion); and 19% small-, micro-, and nano-cap (<$2 billion). Private company respondent annual revenue as of December 2019: 45% large (> $1 billion); 36% medium ($250 million to $1 billion); and 18% small (<$250 million). Respondent industry breakdown: 33% energy, resources, and industrials; 29% financial services; 26% consumer; 8% life sciences and health care; and 5% technology, media, and telecommunications.

Throughout this post, in some cases, percentages may not total 100 due to rounding and/or a question that allowed respondents to select multiple choices.(go back)

Print

Print