Olwyn Alexander is Global Asset and Wealth Management Leader and Dariush Yazdani is Global Asset and Wealth Management Market Research Centre Leader at PricewaterhouseCoopers LLP. This post is based on their PwC report. Related research from the Program on Corporate Governance includesThe Illusory Promise of Stakeholder Governance (discussed on the Forum here); and Will Corporations Deliver Value to All Stakeholders? (discussed on the Forum here) both by Lucian A. Bebchuk and Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy – A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr; Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita.

Introduction: The ESG imperative

As ESG-orientated mandates fast become the default—not just in Europe but also the US—the race is on to shift allocations and retrofit existing funds to keep pace with investor expectations. But as vital as the conversion efforts are, they’re only a stopgap. As our survey underlines, long-term survival and success depend on the ability of asset managers to prepare for the next big shakeup in the market by differentiating their strategy and delivering on their purpose.

As the AWM industry and its investors emerge from the covid-19 pandemic with renewed purpose, ESG funds have moved from the margins and into the mainstream. One of the most striking findings from our worldwide survey of 250 institutional investors and 250 asset managers, representing nearly half of global assets under management (AuM), is the exponential rate at which this transformation is taking place, as established markets grow and new markets come on stream.

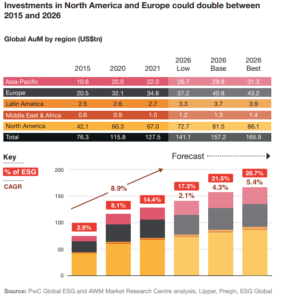

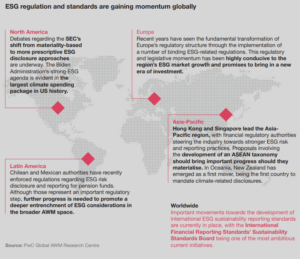

The US, which is the largest AWM market (US$67 trillion in AuM at the end of 2021), had been thought to trail behind Europe in attitudes towards ESG. But our survey found that 81% of institutional investors in the US plan to increase their allocations to ESG products over the next two years, almost on par with Europe (83.6%). Under our base-case growth projection scenario, ESG AuM in the US would more than double, from US$4.5 trillion in 2021 to US$10.5 trillion in 2026. Spurred on by recent landmark legislation that commits US$390 billion to fight climate change, the overall direction of travel among US investors is clear, even if the complexion of administrations changes and some state governments continue to push back on ESG.

Other global regions aren’t far behind. Asia-Pacific is projected to have the fastest growth in ESG AuM in percentage terms, albeit while starting from a much lower base than Europe or the US. AuM in Asia-Pacific will more than triple to US$3.3 trillion in 2026. ESG investment products in the Middle East and Africa are also gaining market share from their base in well established Shariah-compliant funds, though such growth in these regions is much smaller in absolute terms. And in Latin America, where ESG products now account for US$25 billion in AuM, investor interest is also growing.

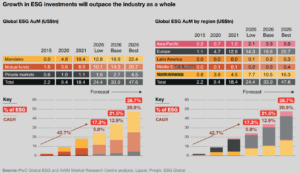

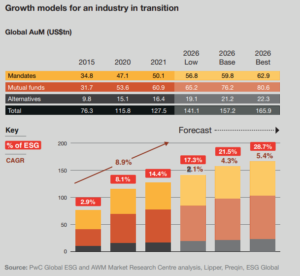

Simply put, ESG-orientated AuM is set to grow much faster than the AWM market as a whole. In our base case scenario, the share of ESG assets over total AuM would increase from 14.4% in 2021 to 21.5% in 2026, comprising more than one-fifth of all assets (see ‘Growth in ESG investments will outpace the industry as a whole’). Although the current growth is derived largely from retrofitted funds—at the end of 2021, 27% of funds in Europe had been repurposed to integrate ESG factors—we believe that new funds will be set up, raising new capital.

The upside of setting up a new ESG fund is the opportunity to drive growth and meet investor demands as they evolve and become more targeted. A majority of investors (60%) report that ESG has already resulted in higher yields in their investment performance, compared with non-ESG equivalents. And more than three-quarters of investors would be willing to pay higher fees for ESG funds. However, there has been little sign that higher fees are being applied to retrofitted funds so far, despite higher compliance costs for asset managers.

Data challenges for both new and converted ESG funds are well-known. These challenges are compounded by a continuing lack of clarity or consensus over what regulators and investors deem to be green and socially inclusive. The rising bar for ESG expectations, though less well-charted, is just as big a challenge. In the EU, for example, to comply with regulations, it’s no longer enough to disclose and explain principal adverse impacts (PAIs) related to ESG factors such as carbon footprint, greenhouse gas emissions, anti-corruption measures and modern slavery. Firms are now expected to mitigate and address the PAIs and the issues underlying them.

The EU is more prescriptive on ESG than the principles based approach taken by the US Securities and Exchange Commission. But on both sides of the Atlantic, the shift to a more tightly regulated ESG marketplace is decreasing the range of securities that are sufficiently ESG-friendly to choose from. However, we expect the investible universe to start expanding again as more and more businesses across different sectors embrace ESG in their strategy and operations.

The other big issue is timing. In particular, the impact of the war in Ukraine on energy supply, security and prices has raised questions among some investors, asset managers and portfolio companies over whether their green transition may need to be altered in the short term—although the longer-term intentions for ESG allocations are clear from our survey.

Opportunities ahead

Given that ESG is growing rapidly—and is projected to continue to do so—we believe that the market will open up over the next three to five years and present frontrunners with significant opportunities and challenges.

The catalyst will be the broadening of ESG classification as investors and regulators focus more closely on supporting businesses that are undergoing green transitions. ESG-designated funds will no longer be restricted to a narrow taxonomy of fully sustainable and inclusive assets but could also invest in a much wider array of businesses to help reshape production techniques and to develop clean and green models. In turn, more businesses will be moving along this ESG path.

These market developments offer a sweet spot for the AWM industry. Asset managers have a once-in-a-generation opportunity to drive innovation and win new mandates through the compelling appeal of their ESG story and ability to deliver on their promise.

As the following ten trends show, ESG represents an area of growth for the industry. At the same time, it introduces new challenges to the traditional ways of doing business. There is also a significant gulf between what investors want and what asset managers are doing in response. Those who get the transition right by rethinking their strategy will create a virtuous circle of purpose and opportunity, yielding sustainable growth.

Ten ways ESG is shaping the future

Our survey highlights a surge in demand for ESG funds that exceeds almost all previous expectations. Here we list the ten key market trends, industry priorities and stakeholder expectations that are helping to shape the ESG agenda in the AWM market.

1. ESG is replacing asset price increases as an engine of growth

Strong AWM market growth over the past ten years has been driven by rises in both asset prices and flows. Now, ESG is poised to become a key market driver, as gathering economic headwinds threaten the traditional growth engines in the industry. These changes underline the importance for asset managers and institutional investors alike to understand how to capture the shift to ESG as a counterbalance to potential portfolio underperformance.

ESG-orientated funds are set to grow much faster than the market as a whole (at a base-case CAGR of 12.9%), and, as headwinds persist, are rapidly becoming one of the go-to assets for differentiation. With ESG AuM under this scenario set to reach US$33.9 trillion by 2026, the ESG share of overall AuM would increase from 14.4% in 2021 to more than one-fifth of all assets (21.5%) by 2026. Even in the low-case scenario, the CAGR would be 5.8%—much higher than the growth estimates for the wider industry over the same time frame.

Our base-case estimates for total global AuM reflect the covid-related spike in inflation that has pushed central banks across the globe to tighten monetary policy. The scenario allows for a capital market contraction of 20 to 30% between 2022 and 2023, followed by a recovery from 2024 onwards. Under this scenario, the 8.9% compound annual growth rate (CAGR) in AuM achieved between 2016 and 2021 would slip to 4.3% between now and 2026.

However, our low-case estimate shows a significantly slower growth in overall AuM, slightly above 2% CAGR until 2026 and reaching US$141.1 trillion, driven by further hikes in interest rates to mid-2023. Under this scenario, these enduring high inflationary pressures would continue in the coming months and years as the war in Ukraine and supply chain bottlenecks persist, leading to heightened protectionism and a fractured global landscape. This would result in stagflation and a more pronounced asset price correction, leading, in turn, to a further downturn of revenues, profits and overall AuM within AWM.

2. Pursuing ESG is fundamental

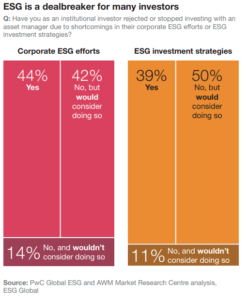

ESG is far more than just a compliance exercise. Our survey highlights the emergence of a new breed of institutional investor. Nearly eight in ten institutional investors (79%) plan to increase their allocations to ESG products over the next two years. What’s more, nearly nine in ten have either already rejected or stopped investing with a specific asset manager (39%) or would consider doing so (50%) due to shortcomings in the manager’s ESG investment strategies. And it isn’t just investors who are driving change. PwC research into ESG sentiment highlights the extent to which both consumers and employees expect organisations to share their own values.

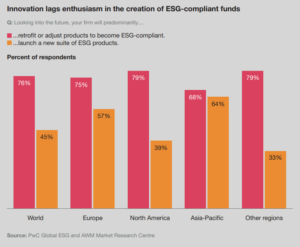

The immediate priority for the asset managers in our survey (76%), therefore, is to convert existing products so that they can be labelled as ESG-orientated. The adjustments could focus either on complying with Sustainable Finance Disclosure Regulation (SFDR) Articles 8 and 9 in the EU or on de facto alignment with stakeholder expectations elsewhere. Given the proportion of investors who are increasing their allocations to ESG funds, retrofitting is the minimum that asset managers need to do to stay in the game.

Though conversion costs less than launching a new ESG fund, it still brings many of the same challenges. Data gaps are easing, but they continue to be prevalent enough to force many managers to rely on estimates and even guesstimates. At the very least, these approximations and their impact need to be fully disclosed and explained. The challenges are heightened by grey areas in taxonomies of what is and isn’t sustainable and inclusive. In the EU, the regulatory bar for green designation has been raised still further by the move to a duty of care on addressing adverse impact.

3. The investible universe for ESG funds will open up

More than seven in ten institutional investors (72%) assess their asset managers’ ESG investment strategies before deciding where to allocate funds. Right now, however, the number of securities that could be classed as unquestionably sustainable, and hence included with an ESG-orientated fund, is limited. If we look at the SFDR criteria, the range of investments and activities that would qualify for Article 9 status, in which the objective of the financial product is geared primarily to an E, S or G impact, is especially few and far between. This makes it hard for asset managers to set their funds apart from competitors’.

But the investible universe and opportunities for differentiation will increase. New legislation, public market activity and government investment in longerterm sustainability goals are gaining momentum just as more businesses in different sectors embrace their own transition to ESG. This trend towards a more investible ESG landscape includes investing in companies that aren’t sustainable now, and then helping them with the finance and expertise needed to incorporate positive ESG outcomes into their operations. Asset managers have the opportunity to take an actively interventionist approach. This next phase of evolution in ESG is evident in the work of the EU’s Technical Expert Group on sustainable finance, which could set the direction for developments elsewhere.

4. ESG has broadened objectives and fiduciary duties

Market observers have pointed to the potential tensions between ESG investment priorities and asset managers’ fiduciary duty to maximise financial returns for investors. Previous PwC research has shown that some asset managers aren’t prepared to compromise financial returns for ESG credentials. In that prior PwC study, more than 80% of self-described active asset managers were either unwilling to accept a reduction in returns or would agree only to a drop of 100 basis points (bps) or less.

But the tide is clearly turning. Three-quarters of institutional investors in our survey believe that ESG is now part of their fiduciary duty. Nearly as many (72%) set ESG-related goals for their asset managers at a portfolio level, though whether this overrides financial return would vary. The winners will be marked out by their ability to deliver on both fronts.

As to whether financial and ESG performance might conflict, nine in ten asset managers are convinced that integrating ESG into their investment strategy will improve overall returns in the long term. Six in ten institutional investors are already recording higher yields on their ESG investments compared with non-ESG investments (see ‘Investors are reporting higher yields on ESG investments’). More than half noted that ESG integration had taken less than three years to deliver higher returns.

5. Investors are pushing for new ESG products—but demand outstrips supply

Nearly nine in ten institutional investors (88%) believe that asset managers should be more proactive in developing new ESG products. However, fewer than half of managers (45%) are planning to launch new ESG funds. If we look at the EU, for instance, our analysis shows that of the 8,017 funds classified as ‘environmentally and socially promoting’ (Article 8) by the end of Q2 2022, only 989 were new and the rest were reclassified. Of the 1,061 classified as ‘products targeting sustainable investments’ (Article 9), only 286 were new and the rest reclassified.

This expectation gap opens up opportunities. By accelerating new product development and actively supporting green transition, early movers would sharpen innovation, boost relevance and seize market share.

6. To attract new investment, managers will need to differentiate their products and demonstrate ESG performance

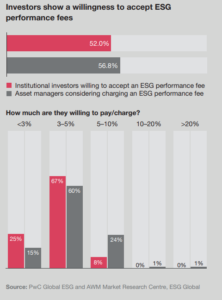

More than three-quarters of investors are willing to pay higher fees (78%) for ESG funds—57% would accept 20 to 40 bps, equal to a 0.2 to 0.4% increase in fees. Nearly eight in ten asset managers (79%) would consider charging higher fees for their ESG offerings (an average of 35 bps higher). But even if asset managers do seek to charge higher fees to cover some of their additional costs, the question is how sustainable such a premium would be in the long term. This uncertainty underlines the need to focus on product differentiation and value for money.

Our survey results revealed a potential appetite to build ESG into performance-related fees. More than half (52%) of investors would be willing to link compensation to ESG performance. Two-thirds of these would accept a 3 to 5% ESG premium. But far fewer are prepared to pay the 5%-plus fees envisaged by some asset managers. In turn, more than half of asset managers (57%) are looking into the possibility of charging performance fees. Most managers (60%) believe an ESG performance consideration of 3 to 5% would be acceptable.

Notably, however, we’ve not yet observed any ESG performance fees being charged. Moreover, any performance fees would require the development of clear and credible impact measurement to justify them. This is possible, though it may increase data collection and reporting costs and hence eat into any additional revenues.

7. Investors say they want more regulation

Both asset managers and institutional investors see regulation as the main obstacle to ESG growth.

Concerns over regulation aren’t surprising. It can be costly, complex and inconsistent. The demands can also draw resources away from much-needed strategic planning and product development.

Nonetheless, institutional investors believe that regulation is an important driver for integrating ESG into asset managers’ investment strategies. Precise and transparent regulation can act as an important lever to build trust and decrease the risk of mislabelling. They also believe regulatory standards provide a useful basis for due diligence on asset managers’ investment strategies. More than seven in ten (71%) are therefore in favour of strengthening ESG regulatory requirements for asset managers.

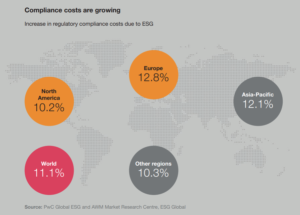

8. A meaningful ESG strategy requires investment

An ESG strategy requires a significant shift in governance and corporate practices. It also increases the need for employees with ESG and reporting expertise. It could thus raise near-term costs for asset managers. Our survey finds that regulatory and compliance costs have increased by more than 10%. This development favours large asset managers with the scale and resources to absorb these extra demands and spread the costs. For others, it creates a barrier to entry or puts further pressure on an already squeezed middle.

9. E, S and G must be balanced as part of a just transition

There is still opposition to ESG among some policy-makers and regulators, who believe that asset managers should not broaden their objectives beyond financial return. Curbs on ESG-focused investment can already be seen in some jurisdictions, such as the US states of Texas and Florida. However, any change in policy would need to be weighed against the pro-ESG attitudes among investors that we have noted in our survey.

Even some stakeholders who recognise the importance of action on climate change are worried about the impact of an accelerated green transition on energy security and the jobs that depend on it. These concerns have been heightened by the spike in energy prices in the wake of the war in Ukraine and the resulting impact on business costs and consumer prices. As a result, some investors, asset managers, portfolio companies and policy-makers have begun to draw distinctions between their short-term and long-term strategies for ESG. The shift in sentiment is reflected in the inclusion of nuclear power and natural gas in the EU Taxonomy and the increased allocation of oil and gas companies within a number of asset managers’ portfolios while, at the same time, these asset managers also work with energy providers to build efforts around a longer-term transition.

10. Managers need a proactive risk-mitigation strategy for mislabelled products

More than seven in ten institutional investors (71%) and more than eight in ten asset managers (86%) believe that mislabelling is prevalent in the AWM industry. The risks are heightened by the pace at which new regulations are coming on stream and uncertainty over the ESG designations within them.

One example of this uncertainty is the continuing debates over which investments are included in the EU Taxonomy. Mislabelling is rarely intentional, however. More often than not it stems from the lack of clarity in regulatory classifications, insufficient consistency in data standards and poor information coming from portfolio companies. It can also be rooted in silos and inconsistencies within the organisation—marketing or reporting teams not communicating closely enough with fund managers, for example. If slip-ups do occur, it’s important to be able to quickly explain why, and to correct and learn from the mistakes. Delays or lack of transparency can only heighten the reputational damage and risk of regulatory sanction.

Adapting your business to ESG

As the preceding trends show, investor expectations of ESG commitments have set the scene for a radical overhaul in how value is defined and delivered in the AWM industry, from mandate selection to how fund performance is judged.

The focus on actively supporting green transition will add further impetus to this shakeup, creating opportunities for new and creative strategies but also increasing competition to attract and sustain mandates.

How can your organisation get up to speed? Drawing on the survey findings and our wide-ranging work with AWM organisations, we’ve identified four actions—stepping up strategic integration, reconfiguring your operating model, storytelling and focusing on governance—that are becoming increasingly urgent.

1. Step up strategic integration

The faster and more effectively you can build ESG into the heart of your strategy and capabilities, the better your ability to meet investor expectations and attract new mandates. Some asset managers will be ESG opportunists, responding to changing stakeholder expectations and looking for quick wins. But there are opportunities to adopt a more strategic approach by anticipating stakeholder demands, developing a new generation of ESG funds, and moving to the forefront of social and environmental change. Examples include supporting investment in green transition and infrastructure with the development of leading-edge expertise in these areas.

The speed at which stakeholder expectations are changing means that ESG strategies can often be piecemeal and reactive—modifying specific products to meet regulatory designations, for example. Taking the initiative and realising the full potential of ESG demands a clear vision of what your business stands for, a plan for change, and a durable framework for governance, accountability and reporting to make sure that what is being promised is delivered.

Practical steps

In setting near-term objectives, it’s important to talk to employees, investors and other key stakeholders to find out what they want from your strategy and reporting.

In developing the plan, materiality analysis can help to identify the issues and opportunities that are most likely to have an impact on you, your investors and other key stakeholders. Consider the client journey with ESG as a starting point—awareness, engagement, servicing, and upselling or cross-selling—to build up credibility and service offerings. Homing in on what matters most would also allow you to align your ESG goals with your corporate strategy, stakeholder expectations and organisational strengths in the most targeted and realisable way.

Your CEO and leadership team should own the shift in strategy and set the tone for the change in behaviour and alignment between ESG and wider objectives. Without this high-level direction and intent, business units may just carry on as before or see ESG as a compliance exercise with little relevance to their day-to-day activities and decisions.

To secure organisational buy-in and build momentum, the initial focus should be the most effective and easyto-implement actions. Areas where the impact is high but implementation is relatively straightforward include the establishment of an ESG investment committee (see ‘Expectation gap: Exerting influence’).

As the current issues surrounding energy supply and security attest, there will be shifts in sentiment and shortterm priorities. Expectations will also keep evolving, so ESG integration isn’t going to be a one-off exercise. The integration frameworks developed by the UN Principles for Responsible Investment and the CFA Institute can provide a reference point for integration and help you to compare your business against those of your peers.

Expectation gap: Exerting influenceAll the asset managers in our survey incorporate ESG into their investment approach to at least some extent. However, fewer than half (46%) have an ESG investment committee, and not all of these have veto rights over investments. Clearly, an ESG committee is not the only way to strengthen ESG influence and governance. ESG could be included in the investment committee agenda or built into portfolio management services as a red flag, for example. But an ESG committee offers one of the most effective ways to make sure that ESG is considered at a portfolio level and is therefore a reasonable yardstick for the level of focus and action ahead. |

2. Reconfigure your operating model

ESG touches on virtually every aspect of your operating model. Key priorities include setting investment selection and performance criteria that are consistent with your ESG agenda. You would then need to identify, source and analyse the data that would be required to meet these criteria, while also delivering value for money.

Though the availability and deployment of ESG data is on the rise, the data still lacks sufficient breadth and consistency. This can hamper investment decisions and make it difficult to compare sectors and securities. It also makes it harder to demonstrate ESG performance and to align products and services with the expectations of investors and regulators. These data deficiencies are the most serious constraint to the greater adoption of ESG in the AWM industry, and they are likely to intensify as upcoming regulations call for new datasets and processes.

As a result, asset managers must address the shortcomings in their data management processes. This would not only help them to deal with regulatory requirements, but also to capitalise on the opportunities opened up by the surge in client demand for sustainable investing.

Practical steps

Adoption of the latest technology holds the key to overcoming the ESG data and reporting challenges. If properly implemented and integrated, new technologies could soon redefine the industry, helping you as an asset manager to fully incorporate ESG considerations into your investment process and enabling you to develop a highly differentiated, sustainable value-creation offering. There are also opportunities to digitise the data coming from portfolio companies to help you assess their ESGrelated risks and advise on ways to address them.

Are disclosures sufficiently trusted and transparent?More than one-third of investors (38%) believe that the lack of data from asset managers represents a challenge when investing in or considering ESG products. Nearly two-thirds of asset managers (64%) believe that data challenges are one of the main obstacles when adopting or considering ESG investments. Clearly, this will require investment. The scale and cost of reporting is likely to spur an acceleration in the outsourcing of reporting. Compliance would in turn be increasingly delivered as a managed service. The ESG criteria that you set for the businesses in your portfolio should be consistent with how you manage your business internally. Reducing the carbon footprint of your operations in areas such as switching to renewable energy is reasonably straightforward. The harder, but equally critical, challenge is making demonstrable progress on diversity and inclusion. If they are business imperatives, they should be treated as such, from building them into business strategy to full and candid disclosure. |

3. Develop and convey a compelling story

Determining what you stand for and how to deliver on your commitments can form the basis for a clear and compelling ESG story. This is about building trust at a time when it’s more fragile and harder to earn than ever.

Practical steps

The starting point is a realistic set of goals. For example, saying you intend to be net zero in five years’ time may sound compelling, but may be difficult to deliver in practice. It may be better to focus on what you’re actually doing on the ground within your portfolio and your operations, and how it’s making a demonstrable difference.

The other key priority is the quality and reliability of information to support decision-making and credible reporting. It’s important to recognise that what is considered sustainable today may change over time. This evolving landscape underlines the need to document the reasoning behind decisions to ensure that the rationale can stand up to scrutiny further down the line.

Good information is the key foundation for performance against objectives and value for money. With most key performance indicators (KPIs) focused on sustainability, priorities include broadening measurement and reporting in areas such as social impact and diversity and inclusion.

Reporting should be consistent and joined up. This will require close collaboration and systems integration between investment evaluation, regulatory reporting and investor relations teams. It helps to question practices: is the messaging consistent? Does the data support it?

It will take time to get measurement up to speed. The current inefficiencies in quantitative data also reinforce the importance of setting out a clear vision and reporting on progress against it in enriched qualitative disclosures. Fuller explanation doesn’t just help to bridge any gaps in the numbers; it also helps to justify strategies that have positive objectives but that could come across negatively in the reported data. A clear case in point is explaining why financing is still going to companies with high emissions now and how you are helping those companies to move onto a sustainable footing.

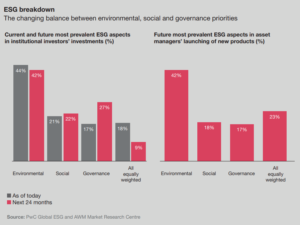

4. Focus on the G, as well as the E and the S

Governance—the G in ESG—doesn’t always get as much public attention as the E or the S, but it’s just as critical and growing in focus.

Effective governance can help to align corporate commitments on ESG with frontline business decisions and operations. Amid the backlash against greenwashing and social washing, governance is also a key foundation for credible disclosure.

Practical steps

If the foundation is building ESG into strategy, the key priorities from a governance perspective are clear lines of accountability and the management information to deliver timely and effective oversight. It’s also important to build ESG into performance objectives and rewards alongside financial measures.

Additional priorities include developing a clear understanding of new and emerging risks. Boards should take the lead in setting the risk appetite and putting in place the necessary lines of reporting and accountability.

At a portfolio level, it’s important to make sure that material risk exposures for specific investments are identified, assessed and tracked. More than half (56%) of institutional investors and 76% of asset managers are in favour of strengthening ESG disclosure rules for listed companies.

Are you ESG-ready?

How quickly and effectively you embrace, embed and operationalise ESG will determine not only your ability to attract investment and employees but also how well you can deliver on your purpose and potential. To help, we’ve developed ten key considerations to jump-start your thinking and set your business up to thrive in today’s ESG-orientated marketplace.

Ten strategic considerations

|

Print

Print