Subodh Mishra is Global Head of Communications at Institutional Shareholder Services (ISS). This post is based on an ISS memorandum to clients authored by Arnaud Cavé, ESG Methodology Lead – Governance, Finance, and Quantitative Research, ISS ESG; Cédric Lavérie, Head of French Research, ISS; Kosmas Papadopoulos, Head of Americas Sustainability Advisory, ISS Corporate Solutions; and Guillaume Tassin, Head of Data Solutions, ISS ESG. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Does Enlightened Shareholder Value Add Value? (discussed on the Forum here) both by Lucian A. Bebchuk and Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.; and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita.

Below is an excerpt from the ISS thought leadership paper: Corporate Governance Evolves Amid Increasing Sustainability Awareness. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- Major regulatory initiatives in Europe and in the United States could encourage the consideration of sustainability issues in boards of directors’ decision making.

- A focus on stakeholders’ interests is currently permitted by certain legislation. While this possibility exists in France and in the United States, only a few medium- and large-sized listed companies have opted for the so-called benefit corporation status.

- Investors’ increasing awareness of sustainability issues also contributes to the evolution of issuers’ corporate governance structures. Notable investor behavior in this area includes:

- An increase in the number of Principles for Responsible Investment (PRI) signatories;

- A growing proportion of global assets being managed according to sustainable investment strategies;

- An increase in engagement activities focused on environmental and social issues; and

- An increase in support for environmental and social shareholder proposals.

- Regarding evolution in issuers’ governance practices, ISS data indicates:

- An increase in the use of board-level sustainability committees;

- A notable percentage of companies with at least one director with ESG skills;

- Growth in the use of ESG metrics in executive compensation; and

- The emergence of management-sponsored say-on-climate proposals.

- Lastly, the report highlights the importance of governance best practices in relation to shareholder rights, such as respecting the one-share, one-vote principle and maintaining a high-quality and accountable board, as these practices may also help companies to address environmental and social risks and seize emerging opportunities.

The International Finance Corporation (IFC) defines corporate governance as “the structures and processes by which companies are directed and controlled.” Should companies be governed to maximize shareholder value, though, or should they consider the interests of a broader set of stakeholders? In recent years, boards of directors have been increasingly expected to consider stakeholders’ interests in their decision making.

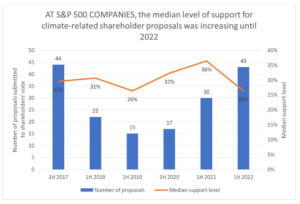

Evolution of the Number of Climate-Related Shareholder Proposals and Median Level of Support in the US

Source: ISS Research and ISS Voting Analytics. Data from the first half of the calendar year.

Explore ISS ESG solutions mentioned in this report:

- Use ISS Governance Data to drive investment, engagement, and voting decisions.

- The ISS Governance QualityScore supports investors as they consider governance in their quality analyses and incorporate unique compensation, board, and shareholder responsiveness data into management assessments.

- Action your unique investment philosophy with ISS Governance Research and Voting solutions.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

Print

Print