Maureen Bujno is a Managing Director, and Kristen Sullivan is a Partner and leads Sustainability and ESG at Deloitte & Touche LLP. This post is based on their Deloitte memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain (discussed on the Forum here) and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) both by Lucian Bebchuk, Kobi Kastiel, and Roberto Tallarita; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.; and Corporate Purpose and Corporate Competition (discussed on the Forum here) by Mark J. Roe.

There’s no one-size-fits-all solution to overseeing environmental, social, and governance (ESG) matters—and for good reason. Each company must navigate its own uniqueness related to its organizational structure, global reach, environmental impact, business circumstances, and industry requirements. Further, the broad constellation of topics comprising ESG often doesn’t fit neatly into any one board committee’s charge. As a result, companies increasingly are opting for ESG governance frameworks that allocate responsibilities to various combinations of board committees and the full board.

Amid this variability, many are focused on the regulatory landscape. Given the proposed SEC rule on climate risk disclosure, reporting could transition quickly from voluntary to required. In anticipation, companies should get prepared to formally disclose, and ultimately obtain assurance on, their impact on climate as part of their 10-K financial filings.

While the proposed rule focuses on the “E” in ESG, companies should be thinking about the governance framework for their overall ESG strategy, as well as for each defined component, amid increasing political, regulatory, and stakeholder expectations. And given the major impact the proposed rule likely will have on financial reporting, audit committees should understand trends that are rapidly emerging in climate reporting and the broader ESG governance

landscape.

2022 proxy trends in ESG and climate risk

ESG nondisclosure nears extinction – Based on Deloitte’s proxy research of S&P 500 companies, only 3% of companies did not disclose information about their overall ESG board governance approach in 2022, down sharply from 14% in 2021 and 28% in 2020 (figure 1). This likely is due to the continued maturation of ESG frameworks and capabilities, coupled with the anticipation of pending SEC rulemaking.

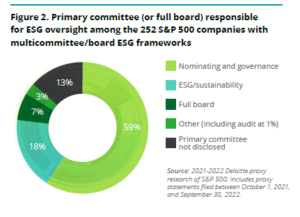

Trends in primary committee oversight of ESG – The nominating and governance committee remained the most common choice for sole or primary oversight of ESG (figure 1) at 63% of reporting

companies, up from 53% last year. Fifteen percent of companies placed primary responsibility for ESG on a dedicated ESG/ sustainability committee, similar to the 13% in 2021.

Multicommittee/board ESG frameworks on the rise – In prior years, Deloitte’s proxy research focused on the primary committee overseeing ESG. This past year has been marked by significant

enhancements in the depth and detail around ESG proxy disclosures and related governance frameworks. Based on our research of S&P 500 proxies, 51% of companies reported that either 1. the full board combined with a committee(s) or 2. multiple committees have responsibility for overseeing aspects of ESG activities. This multicommittee approach reflects a growing recognition that the complexities of ESG often overlap with numerous committees and that their responsibilities may best be addressed accordingly.

As an example, the proposed SEC rule on climate risk disclosure is of significant importance to audit committees given the direct connection to financial reporting, but the considerations encompass a broader range of topics. Measures such as decarbonization targets can have an impact enterprise-wide across strategy, finance, talent, governance, operations, risk, and compliance. Similarly, when defining the “S”—Social—in ESG, many companies note their goals regarding diversity, equity, and

inclusion (DEI) initiatives. While DEI could be framed as a talent or culture matter, for many companies, it is a strategic objective—the talent pool needed to achieve a long-term strategic goal—

and it also could be framed as a key imperative of human capital disclosures, or even considered a governance matter with regard to board diversity. This reinforces the importance of management

and the board transparently articulating how the elements of ESG are defined for the organization from a strategic and value creation perspective.

Our 2022 proxy research found that for companies disclosing a multicommittee governance framework, the nominating and governance committee was the committee with primary responsibility 59% of the time, and an ESG/sustainability committee was indicated as the primary committee 18% of the time (figure 2). Our research also indicated that some boards created one or more new committees with hybrid responsibilities such as environmental, health, safety, and technology; innovation and sustainability; corporate responsibility and sustainability; and public policy and sustainability. Some companies have combined aspects of these committees with their nominating and governance committees.

Among those companies reporting the involvement of multiple committees in their ESG governance, the audit committee was included as part of that framework 52% of the time, though only 1% of those companies indicated that the audit committee had primary, ESG oversight responsibility. Areas that audit committees often were tasked with overseeing included climate and sustainability disclosures, reporting, and assurance (where applicable); related financial reporting matters; ESG processes and controls; enterprise risk management; cybersecurity; environmental and safety matters;

and corporate ethics and standards.

| Within the categories of “nominating and corporate governance” and “ESG/sustainability,” there is considerable variation among companies in these committees’ names and areas of focus. The following are examples of committee names disclosed by S&P 500 companies in their most recent proxies. To the extent the nominating/governance committee added other responsibilities, they were still considered in the category of nominating/governance for research purposes.Sample nominating and corporate governance committee names incorporating various ESG elements

Sample ESG/sustainability committee names

|

Examples of multicommittee ESG governance approaches from proxy statements

The structure of ESG governance varies significantly from company to company, particularly when combinations of multiple committees are involved. The following examples are not intended to be prescriptive but rather to illustrate the breadth of possibilities when it comes to allocating responsibility

to appropriate committees based on industry, regulatory, and company-specific considerations. Boards and management should be deliberate in building out a framework that is responsive to the wide-ranging facets of “E,” “S,” and “G,” particularly given the increasing prospects of required disclosure.

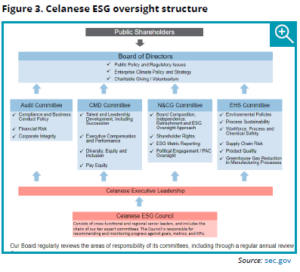

Celanese Corporation

Celanese uses a model (figure 3) that divides responsibilities among the audit committee; compensation and management development committee; nominating and corporate governance

committee; and environmental, health, safety, quality, and public policy committee, and also involves the overall board and the Celanese ESG Council, a management council that includes cross functional and regional leaders. The involvement of senior leaders within the company across geographies as part of the ESG Council provides further input to inform the board’s governance and track key performance indicators.

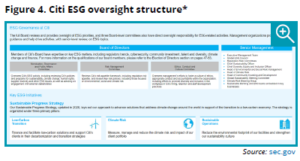

Citi

As detailed in figure 4, Citi’s nomination, governance, and public affairs committee oversees many of the policies and activities associated with climate, sustainability, human rights, and other areas; the risk management committee focuses on the review of ESG risk policies; and the ethics, conduct, and culture committee oversees management’s diversity and inclusion efforts and other talent matters. The full board monitors ESG priorities, and management provides strategic guidance through several teams and leadership groups. The areas of ESG expertise resident on the board also are highlighted in the disclosure.

*The names and responsibilities of some Citi committees have changed since the 2022 proxy was issued, and a new chart with the updated committee structure will be published in 2023.

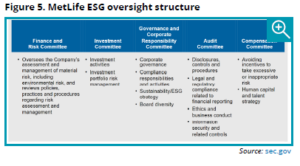

MetLife

As shown in MetLife’s 2022 proxy, primary responsibility for sustainability/ESG strategy is held by the governance and corporate responsibility committee, with the finance and risk committee responsible for environmental risk and the audit committee handling disclosures and ethics and compliance matters (figure 5). MetLife also has a sustainability function that is led by a chief sustainability officer; its responsibilities include sustainability reporting, strategy, and target-setting and the establishment of key performance indicators. Additionally, the company has launched a global Climate Advisory Council chaired by the chief risk officer. The council focuses on climate risk governance across topics such as climate regulation and climate risk modeling and analysis.

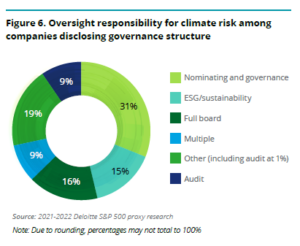

Climate risk disclosures lag behind – In contrast to the near universality of disclosing the overall ESG oversight structure, 62% of companies did not specify the oversight structure for climate risk. The proposed SEC rule would require disclosure of the specific board member(s) or board committee(s) responsible for overseeing climate-related risks, so there could be a rapid shift in this reporting paradigm within the next couple of years if the rule is adopted. Of the 190 S&P 500 companies disclosing their climate risk governance approach, 18 (9%) reported that its governance was the responsibility of the audit committee (figure 6). This is in contrast to only 1% of companies putting all their overall ESG governance “eggs” in the audit committee’s basket.

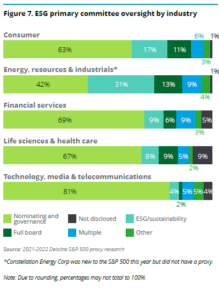

Industry trends – The overall trends in ESG oversight were largely mirrored across industries (figure 7). Energy, resources, and industrials (ER&I) companies had the highest frequency of the full board or an ESG/sustainability committee being the primary committee. Only 1% of ER&I companies did not disclose their ESG governance structure. These results likely are a function of ER&I’s longstanding focus on environmental, climate, and other ESG matters and recognition of increasing complexities in the industry context. Conversely, technology, media, and telecommunications (TMT) companies were the most likely to have the nominating and governance committee serve as the primary committee.

Conclusion

While the expectations around ESG reporting continue to rapidly evolve, the overall trend toward defined structure, disclosure, and increasing involvement on the part of multiple committees and company functions is clear. Companies may need to adapt quickly to advance their climate data measurement and reporting and to drive decision-making regarding the allocation of resources. Whether or not the audit committee has direct oversight responsibility for climate risk or other ESG disclosures, the committee will play an important role. As disclosures move from voluntary to required and become further aligned with annual financial reporting, the audit committee should have an understanding of the related data and measurement controls in place and the oversight structure across the “E,” “S,” and “G” to monitor and address related risks.

Questions for audit committees to consider

|

Print

Print