Mary Ann Cloyd is leader of the Center for Board Governance at PricewaterhouseCoopers LLP. The following post is based on a PricewaterhouseCoopers publication. Related research from the Program on Corporate Governance about hedge fund activism includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here), The Myth that Insulating Boards Serves Long-Term Value by Lucian Bebchuk (discussed on the Forum here), The Law and Economics of Blockholder Disclosure by Lucian Bebchuk and Robert J. Jackson Jr. (discussed on the Forum here), and Pre-Disclosure Accumulations by Activist Investors: Evidence and Policy by Lucian Bebchuk, Alon Brav, Robert J. Jackson Jr., and Wei Jiang.

Activist investors are increasing in number and becoming more assertive in exercising their influence over companies in which they have a stake. Shareholder activism comes in different forms, ranging from say-on-pay votes, to shareholder proposals, to “vote no” campaigns (where some investors will urge other shareholders to withhold votes from one or more directors), to hedge fund activism.

Activism can build or progress. If a company is the target of a less aggressive form of activism one year, such as say-on-pay or shareholder proposals, and the activists’ issues are not resolved, it could lead to more aggressive activism in the following years. (For more background information, see a previous PwC publication, discussed on the Forum here.)

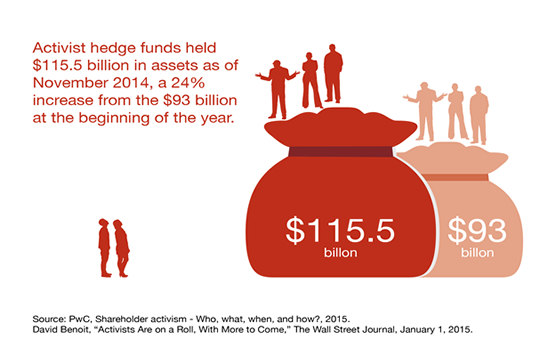

Hedge fund activists are increasing their holdings

Hedge fund activists may push a company to spin off underperforming or non-core parts of their businesses seek new executive management, operational efficiencies, or financial restructuring, engage in a proxy contest for full control of the board, or work to influence corporate strategy through one or two board seats. Some hedge fund activists target a company’s “capital allocation strategy” and push the company to change its acquisition strategy or return reserved cash to investors through stock buybacks or dividends. In order to drive these changes, activists are generally engaging with at least some of a company’s other major investors to get support for their proposals.

Hedge fund activists may push a company to spin off underperforming or non-core parts of their businesses seek new executive management, operational efficiencies, or financial restructuring, engage in a proxy contest for full control of the board, or work to influence corporate strategy through one or two board seats. Some hedge fund activists target a company’s “capital allocation strategy” and push the company to change its acquisition strategy or return reserved cash to investors through stock buybacks or dividends. In order to drive these changes, activists are generally engaging with at least some of a company’s other major investors to get support for their proposals.

Directors have been taking notice of hedge funds and other activist shareholders, and they are talking about activism in the boardroom: Last year, 29% of directors said their board has interacted with an activist shareholder and held extensive board discussions about activism. [1] An additional 14% said they extensively discussed shareholder activism, though they hadn’t had any interactions with an activist. Given the state of activism, we anticipate the level of boardroom discussion on this topic will continue, or even grow, this year.

What might make your company a target?

About one in five S&P 500 companies was the target of a public activist campaign in 2014—and the number more than doubles when you consider the activity that never become public. [2] What are some common themes?

Companies where management appears to be either unable or unwilling to address issues that seem apparent to the market, investors, or analysts are ripe for activism. In addition, poor financial and stock performance, a weak pipeline of new products, a lack of innovation, the absence of a clear strategy, and turnover in leadership are also frequent red flags.

Hedge fund activists often focus on whether a company’s business line or sector is significantly underperforming in its market. They may target profitable companies with low market-to-book value, a well-regarded brand, and sound operating cash flows and return on assets. If a company’s cash reserves exceed historic norms and those of its peers, the company may be a target, particularly when it’s unclear why it has a large cash reserve. And board composition practices can also draw an activist’s attention—for example, if the company has a classified board or a long average director tenure and few new board members

An activist campaign can come at a very high cost. In addition to the out-of-pocket legal and advisory fees for a proxy battle, the management distraction, emotional impact, and potential business disruption can take a toll. Relationships with suppliers, customers, and even employees can also be damaged.

Preparation is key

Viewing a company through the eyes of an activist can help management and boards anticipate, prepare for, and respond to an activist campaign. A first step is to critically assess the company’s businesses as an activist would—looking for underperforming components. Some companies proactively examine their portfolios and capabilities to determine what fits both strategically and financially.

Companies that can articulate their strategy and demonstrate that it is grounded in a well-considered assessment of both their asset portfolios and their capabilities may be more likely to minimize the risk of becoming an activist’s target. Companies will want to tell a compelling story about their vision for success to shareholders.

Companies should also understand their shareholder base and have a tailored engagement plan in place.

Responding when an activist comes knocking

Companies and their boards will need to consider how to respond based on the facts and circumstances. Generally, an effective response plan will objectively consider the activist’s ideas to identify if there are areas around which to build consensus. Finding a way to work with an activist may avoid the potentially high costs of a proxy contest.

“One of the first areas of focus for boards and the management team is to engage. Sit down, have a discussion, hear out the activist, understand what’s on their mind, and then see if you can find common ground. We find engaging and listening is important,” Tim Ryan, PwC’s Vice Chairman and Markets, Strategy and Stakeholders Leader said in a recent interview with Wall Street Journal Live’s MoneyBeat.

It is important to recognize that the pressure from shareholder activists is not likely to go away any time soon, and companies of all sizes and in all industries need to be on alert. A well-articulated strategy, supported by a proactive assessment of the company’s existing portfolio, is critical. By telling a clear story and openly communicating with shareholders and investors, companies may minimize the risk of becoming a target of activists.

Endnotes:

[1] PwC, 2014 Annual Corporate Directors Survey, October 2014 (discussed on the Forum here).

(go back)

[2] Brendan Sheehan, “Trends in Shareholder Activism,” Global Governance Advisors, October 2014.

(go back)

Print

Print