Michael McCauley is Senior Officer, Investment Programs & Governance, of the Florida State Board of Administration (the “SBA”). This post relates to an SBA report authored by Mr. McCauley, Jacob Williams, Tracy Stewart, Hugh Brown, and Michael Levin.

The State Board of Administration (SBA) of Florida recently completed a first-of-its-kind empirical analysis of an institutional investor’s proxy voting decisions involving dual board nominees and their impact on portfolio value. The study examined the SBA’s own voting decisions covering proxy contests occurring between January 1, 2006 and December 31, 2014 at U.S.-domiciled companies with market capitalizations exceeding $100 million. The SBA’s total investment across all examined companies, at the time of the initial announcement of the proxy contest, equaled $1.9 billion. The study also provides coverage of the types of activist fund campaigns, level of activity, and several specific proxy vote case studies.

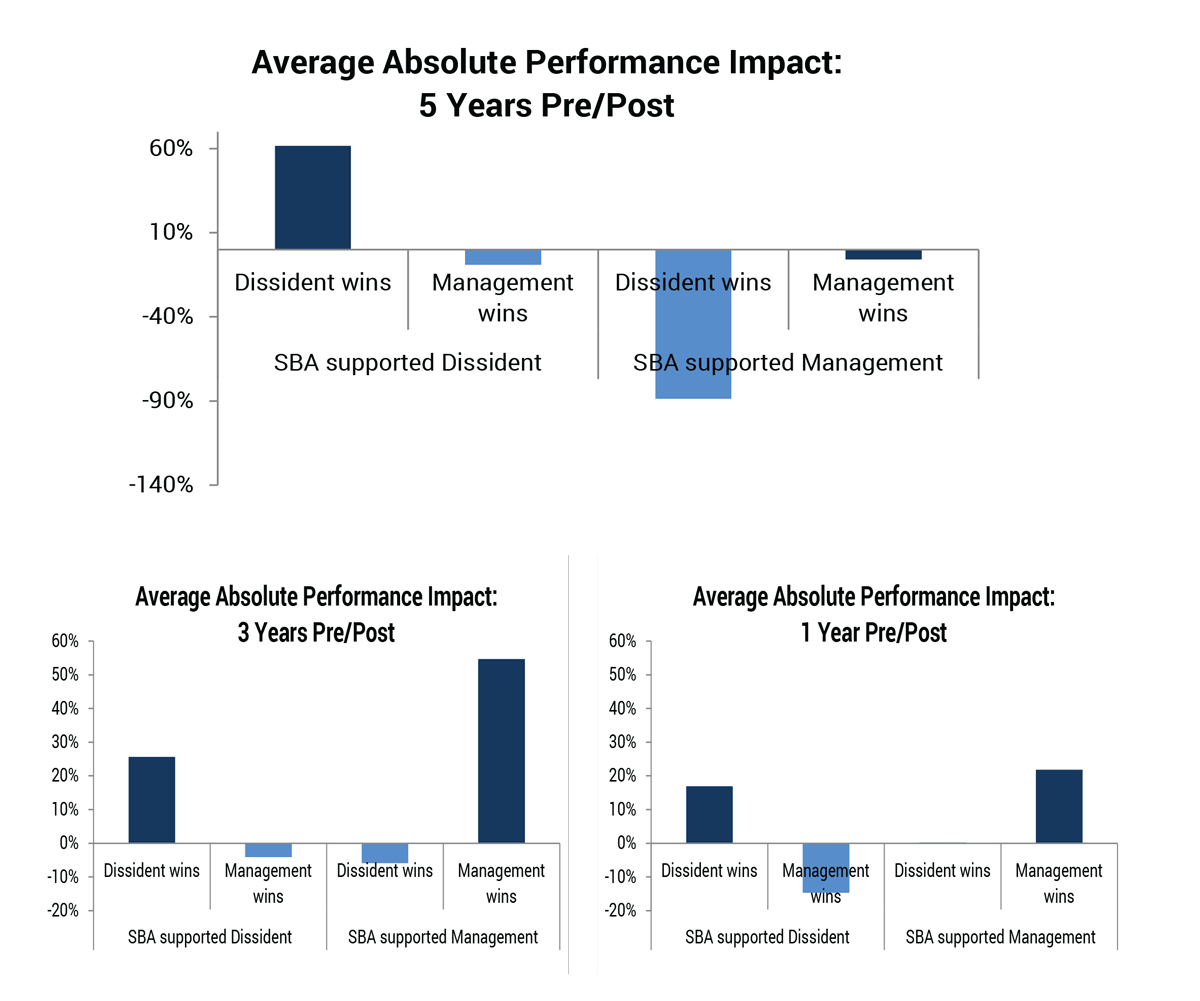

The authors of the study believe the quantitative results provide evidence of a sound analytical framework employed by SBA staff in evaluating proxy contests, and the historical proxy voting decisions enhanced portfolio performance through improved investment returns over both short and long time periods. Among SBA votes to support one or more dissident nominees where the dissident won seats, the company’s subsequent 1, 3, and 5-year relative cumulative stock performance was positive, at levels of 12%, 21%, and 26%, respectively. The same returns for cases where SBA supported the dissident but management won all seats were negative, at -14%, -16%, and -15%. The study demonstrates that the proxy voting decisions of investors can have significant and positive economic effects on portfolio value.

The SBA examines a variety of criteria before casting its vote in proxy contests including the historical performance of the companies and dissident investors, proposals to improve business strategy, and corporate governance procedures, among many others. SBA proxy votes supporting management in initial contests when management subsequently won all seats were associated with a positive economic portfolio gain equal to $137 million over the study’s time frame. In sharp contrast, when SBA supported one or more dissident nominees but management won all board seats, the SBA experienced an aggregate loss of $259 million. SBA proxy votes supporting dissident nominees where the dissident won in initial contests were associated with a positive economic portfolio gain equal to $51 million in the five years after a contest is announced, over the study’s time frame from 2006 to 2014. The SBA’s equity value linked to proxy contest holdings in the company sample increased by $572 million (or $5.3 million per vote) in the five years after a proxy contest is announced, during the study’s time frame from 2006 through 2014.

In all time periods (over the 1, 3 and 5 years) and for both relative (industry-adjusted) and absolute (nominal) measures, the average stock price performance of the firms was better when the market vote agreed with the SBA proxy vote. When the market voted differently than the SBA, subsequent stock performance lagged.

In all, the study evaluates SBA proxy voting decisions related to 107 distinct proxy contests. The study finds that the SBA supported one or more dissident board candidates 65% of the time during the examined time frame. The SBA’s vote was on the prevailing side (either the dissident investor or management) in 64% of all proxy contests examined during the study’s time frame.

A copy of the full study is available here. Accompanying the study, SBA staff developed a data visualization of the voting information, available here.

Print

Print