Sean Quinn is the Head of U.S. Research at Institutional Shareholder Services Inc. This post is based on an ISS publication.

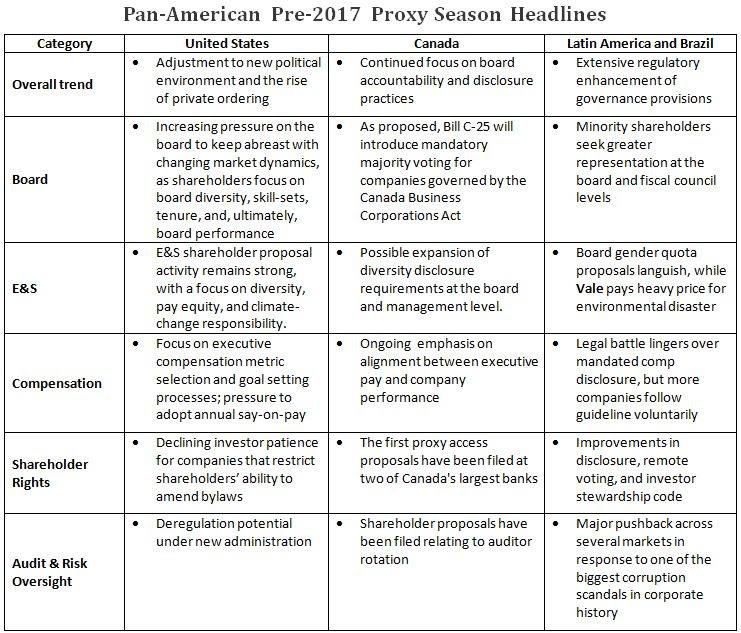

Proxy season is in full swing in Latin America, and is just beginning to heat up in Canada and the United States, and some early trends are already becoming evident across the Americas. Interestingly, there seems to be a slow but potent convergence of the governance world, composed of so many individual markets, as investor concerns expand to all markets and sectors. Things like boardroom composition, engagement practices, enhanced disclosure, continually evolving regulation, investor stewardship, environmental & social focus from investors and issuers, transparency in compensation, and pay that is aligned with performance are factors that are now being considered by investors in markets across the Americas. Activism, whether promulgated by traditional activists, large investors or small, concerned special-interest groups, or others, is appearing in every market, and gender diversity and climate-change response are concerns for issuers and investors alike.

Since 2015, proxy access has been the single dominant issue in the U.S. market. Although a majority of S&P 500 companies have adopted some form of proxy access, proponents continue to identify new targets while seeking line-item changes at companies that have already adopted proxy access. Board composition, director accountability, and shareholder rights will be key themes in 2017; these can be expected to propel a number of targeted shareholder proposals and campaigns against directors. Sustainability and long-term value creation remain high priorities for investors and will drive dialogue and shareholder action, as necessary.

Advisory votes on say-on-pay frequency will return to ballots in 2017. Recent controversies at companies such as Wells Fargo will shift investor attention to risk mitigators in compensation programs and the expansion of existing policies to guard against reputational risks.

Environmental and social shareholder proposals are expected to feature prominently in this year’s U.S. proxy season, as proponents seek to replicate success on various environmental issues, board diversity, and human-capital issues amongst a decline in overall governance- and compensation-related proposals. Political issue proposal filings are also expected to decline as companies increase transparency related to their political activities.

In Canada, there have already been some eyebrow-raising moments involving M&A activity and shareholder proposals, but nothing earth-shattering as of yet. Based on filed proposals, and the results from last year, there will be a set of meetings worth following closely (check for updates in ISS publications). Compensation is a focal point for investors, as always, and a proposed change to stock option taxation drove some issuers to a premature response.

The Government of Canada released new Bill C-25 proposed regulations which supplement and facilitate certain proposed amendments to the Canada Business Corporations Act (CBCA), announced last fall. The proposed regulations would come into effect at the same time that the final amendments under Bill C-25 are effective. Majority voting requirements and mandatory board diversity disclosure are two of the main corporate governance topics covered in the updates.

While the Latin America region has been slow in its recovery from a sluggish economy, new laws and regulatory changes are being implemented at an accelerated pace in different countries trying to shake off a massive corruption scheme with cross-border and regional implications. Some of the changes, such as the remote voting card in Brazil, will directly impact the landscape of the 2017 proxy season.

Other market-specific changes stem from common trends in the region, such as the adoption of comply-or-explain corporate governance rules, anti-corruption regulations, the push for increased transparency and accountability, and the increased focus in compliance mechanisms to reduce financial, legal, and reputational risks.

Print

Print