The following post comes to us from David Felsenthal, a partner at Clifford Chance LLP focusing on financial transactions, and is based on a Clifford Chance client memorandum by Mr. Felsenthal, Gareth Old and David Yeres.

Introduction

In September 2009, the leaders of the G-20 stated that “All standardized OTC derivatives contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at the latest.”

In the United States, legislation to give effect to this statement was a central pillar of the over-the-counter derivates provisions of the Dodd–Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”). Dodd-Frank requires that, following the effective date of detailed rules, standardized swaps that are accepted for clearing by clearing organizations must be submitted by the parties to the relevant clearing organization, unless one of the parties is an end-user exempt from the clearing requirement. Further, unless an end-user exemption applies, if a swap is accepted for trading by a registered execution facility, it must be traded on the exchange or by an approved off-exchange transaction like a block trade or “request-for-quote” (see “Swap Execution Facility” below).

This new regime will necessarily change the infrastructure within which swaps are transacted. Swap traders will have to become familiar with the roles of the clearing organizations, execution facilities and brokers involved in exchange trading and clearing, and in some cases, will need to execute new documentation to establish the contractual framework for trading and clearing. This briefing note briefly summarizes the roles of the key players in the new market, their regulatory status and the main contracts that bind them together.

It should be noted that Dodd-Frank distinguishes between two categories of swap transactions. “Security-based swaps” are swaps based on a single security or loan or a narrow index of securities or loan and are under the regulatory oversight of the Securities Exchange Commission (the “SEC”). “Swaps” are all other swap transactions, specifically those based on interest rates, commodities, broad-based indices and foreign exchange options, and are regulated by the Commodity Futures Trading Commission (the “CFTC”). This briefing note concentrates on the CFTC regulations, which are, at the time of writing, substantially more developed than the equivalent SEC rules.

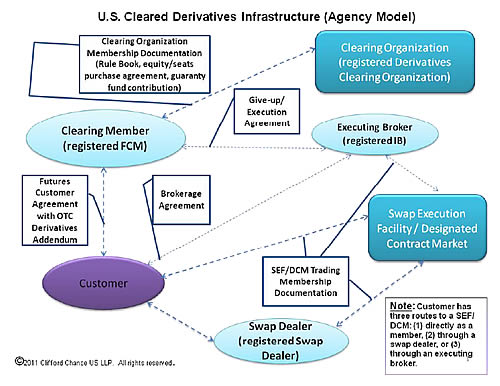

The diagram shows the main participants in an agency-model US cleared swap infrastructure and the relationship between them.

Key Participants, Roles and Relevant Documentation

Derivatives Clearing Organization

DCO Functions

A DCO performs several different functions, which include:

- Acceptance of transactions for clearing. DCO clearing members may submit swaps for clearing from time to time. If the swaps are eligible for trading and the clearing member has satisfied the DCO’s clearing rules, the DCO accepts the transaction and enters it onto its clearing platform. Thereafter, the DCO is the counterparty to the transactions and payments and margin calls are administered in accordance with the DCO’s rules and procedures.

- Daily reconciliation of transactions. DCO clearing members deliver daily reports containing details of all swap transactions submitted for clearing by those members. This information is matched with the data supplied by all other clearing members, and any discrepancies are communicated to the affected clearing members.

- Daily settlements. Based upon a predetermined observable price source (normally the relevant exchange’s daily settlement price), a DCO marks to market on a daily basis all open positions of its clearing members. The amount of net loss is then collected by the DCO and is paid over to clearing members with a net gain for the day.

- Guaranty of financial obligations. A DCO guaranties the financial integrity of all transactions that it has accepted. In the event that a clearing member’s customer defaults on its obligation to answer margin calls, it is the duty of that clearing member to satisfy its customer’s obligation, with a DCO satisfying any part of the default that exceeds the clearing member’s resources. To protect itself against the risk of default, each DCO demands an initial collateral deposit and daily variation margin from its clearing members and, in most instances, maintains a guaranty fund and has the right to assess members for certain additional contributions. A DCO also determines the types of eligible collateral that may be posted in satisfaction of customer obligations.

Registration Requirement

Any clearinghouse that seeks to provide clearing services with respect to swaps must register with the CFTC as a derivatives clearing organization (“DCO”). To obtain and maintain registration, a DCO must comply with certain core principles, which include, among other things, (i) maintenance of adequate financial, operational, and managerial resources, (ii) standards for participant and product eligibility, (iii) risk management capabilities and disaster recovery procedures, (iv) procedures for protecting customer and member funds; (v) default, enforcement and dispute resolution procedures; (vi) reporting and recordkeeping procedures; (vii) settlement capabilities and (viii) governance standards. Dodd-Frank also imposes significant restrictions on the ownership and conduct of business by DCOs in order to reduce the risk of conflicts of interest arising in its dealings with customers.

Swap Execution Facility

SEF Functions

- Trade execution. A swap trading facility that registers as a SEF will be required to provide market participants with a trading facility, system or platform in which all market participants in the trading system or platform can post and view both firm and indicative quotes on a centralized electronic screen accessible to all market participants who have access to the SEF.SEFs would be required to provide market participants with the ability to make or accept a bid or an offer, and may provide the ability for a market participant to request a bid and request an offer.

SEFs would also be permitted to provide two methods for trading outside the formal auction platform. First, under a “request for quote” method, as presently proposed by the CFTC, a market participant would be able to select a minimum of five specific potential counterparties in the trading system or platform and send a request for quote directly to them.

Secondly, SEFs would be permitted to establish rules providing for block trades which would not be subject to the proposed “many-to-many” and timing restrictions for trading systems. Block trades are privately negotiated swaps of a large notional or principal amount (the “block size”) that is greater than the minimum block trade size set by the SEF. Under the current proposed rules, a SEF’s minimum block size for a particular swap contract must be set in accordance with the CFTC guidelines.

- Real-time reporting. A SEF will be required to deliver trade data to swap data repositories regarding all trades executed on or pursuant to the rules of that SEF, including block trades within specified time frames set by the CFTC. In addition, SEFs will be subject to certain reporting requirements to the CFTC.

Registration Requirement

Unless it is registered as a designated contract market (“DCM”), any trading system or platform in which multiple participants have the ability to execute or trade swaps by accepting bids and offers made by multiple participants in the facility or system, including any trading facility, is required under Dodd-Frank to register as a swap execution facility (“SEF”) with the CFTC. The proposed rules require all SEF applications, reinstatements of registrations and requests for transfer or withdrawal of registration to be filed electronically with the CFTC. Each applicant would be required to provide documents and descriptions pertaining to its (i) business organization, (ii) financial resources, (iii) compliance programs and (iv) technological capabilities. SEFs will also be subject to Core Principles similar to those applicable to DCOs. Other than the specific requirements related to Core Principles, this information is similar to that which the CFTC staff currently requires in considering applications for new DCMs.

Clearing Requirement

Absent an end-user exemption, any swap that becomes “available for trading” on a SEF would be required to be cleared on a DCO.

Access to SEF

A market participant is likely to have three means of accessing a SEF’s trading platform. First, it could become a member of the SEF directly and submit to all of the SEF’s rules; in practice, most swap dealers are likely to be members of multiple SEFs, but very few end-users are likely to become SEF members. Secondly, it could access the SEF through a registered broker, which may be a member of a DCO (a “Futures Commission Merchant” or “FCM”) or which may perform a more limited function as an introducing- or executing broker. Thirdly, the market participant could use a registered swap dealer to execute the trade on its behalf.

Designated Contract Market

Under the pre-Dodd-Frank regime, a DCM was a regulated market for trading futures, options or futures or options on commodities. Dodd-Frank has expanded the scope of products that can be traded on a DCM to include swaps. The regulations that would apply to swap trading on a DCM are similar to those applicable to a SEF, including compliance with similar core principles. The proposed core principles applicable to SEFs generally track core principles applicable to DCMs, except that SEFs, unlike DCMs, are not required to establish rules regarding protection of customer funds.

Futures Commission Merchant

FCM Functions

An FCM may be registered to perform any of these brokerage functions: (a) it may be a “clearing broker” that is a member of a DCO which accepts swap trades on behalf of customers and elevates them to the DCO for clearing, in which capacity it acts, as the customer’s agent, as party to the trade with the DCO; (b) it may be a “carrying broker,” which holds the customer’s account’s with the DCO; and (c) it may be the customer’s “executing broker” taking the customer’s swap orders and executing them on a SFF or DCM.

DCO Membership

While an SEF or a DCM may be integrated with a DCO, membership of the DCO is a separate status from membership of a SEF or a DCM. As a rule, membership of a DCO is available only to registered FCMs that meet minimum financial requirements set by the DCO, which are materially higher than statutory financial requirements applicable to FCMs. To become a clearing member of a DCO, an FCM is typically required to purchase or lease a specified number of membership privileges, enter into a Clearing Membership Agreement, demonstrate appropriate technical and operational systems and controls, and contribute to the DCO’s guaranty fund.

Registration Requirement

Any individual or organization which seeks to both solicit or accept orders for swaps and accept money or other assets from customers to support such orders must register as a Futures Commission Merchant through the administrative facilities of the National Futures Association (“NFA”). To obtain and maintain registration, an FCM must comply with the minimum financial requirements established by the NFA and the CFTC and, if they are clearing members, the relevant DCOs, ensure protection and proper segregation of customer funds, provide personal background information of its principals, and comply with recordkeeping and reporting requirements.

Customer Protection Duties

- Segregation of customer funds. Under the CFTC’s current proposed rules, customer funds may be pooled by an FCM in a single account clearly identified as belonging to customers, but the FCM may not use the funds, property, or account equity of one customer to cover the financial needs of another customer. In addition, the FCM may not comingle customer funds with the FCM’s proprietary funds, but is allowed to deposit its own funds in the customer-segregated account to ensure that the account as a whole does not become undermargined. The FCM is required, under current CFTC rules, to maintain ledgers showing each of its customer’s margin and trade positions.

- Customer first. FCM must ensure that customer orders are transmitted for execution ahead of orders of the FCM itself or its affiliates.

Customer Agreement

A formal relationship between a swap customer and an FCM would likely be established through a Futures Customer Agreement similar to the agreement currently used by FCM’s futures and options customers. Typically, a Futures Customer Agreement sets out provisions relating to margin and other payment obligations, customer default, the FCM’s security interest in any posted margin, liability standards and the FCM’s reporting obligations. As a general rule, a Futures Customer Agreement provides for a wide discretion in favor of the FCM, but certain provisions may be subject to negotiation. The Futures Industry Association is working with market participants on the preparation of a standard Addendum to the Customer Agreement to address issues specific to CFTC Derivatives.

Introducing Broker (also known as an Executing Broker)

Introducing Broker Functions

As an alternative to placing an order directly with an FCM that is both a member of a SEF or DCM and a clearing member of a DCO, a customer may also place an order for a swap with an introducing broker. Unlike a clearing broker, or any other FCM, an introducing broker may not: (a) accept money, securities, or other property from a swap customer for the purpose of margining, guaranteeing, or securing trades until they are offset or settled; (b) maintain records of, and have the ability to monitor on a daily basis, all of the swap customer’s transactions that are cleared by the clearing broker; or (c) issue confirmations and monthly statements.

In the event a swap order is placed with an introducing broker, the introducing broker will be responsible for executing the order on a DCM or a SEF on behalf of the customer and then, pursuant to a give-up arrangement, direct the trade for clearing to the customer’s account at an FCM that is a clearing broker. If the trade is not accepted by the clearing broker, it may be directed to another clearing broker.

Registration Requirement

Any individual or organization which solicits or accepts orders for swaps but does not accept money or other assets from customers to support such orders must register as an introducing broker through the NFA administrative facilities. IBs are subject to financial, recordkeeping and reporting requirements.

Brokerage Agreement and Give-up Agreement

The relationship between a swap customer and an introducing broker is typically set out in a brokerage agreement, which is generally based on a form provided by the introducing broker.

Separately, a give-up agreement between a swap customer and an introducing broker typically provides that a trade executed through the introducing broker is not effected until it is accepted by a clearing broker. In the event that the clearing broker does not, for any reason, accept a trade transmitted to it by the introducing broker, a give-up agreement typically gives the introducing broker a right to close out swap customer’s trade at its discretion or transfer it to another clearing broker as instructed by the customer. For purposes of cleared swaps the Futures Industry Association is promoting an effort by dealers and by-side firms to agree and adopt standard give-up terms under an agreement known as an “Execution Agreement”.

Swap Dealer

Swap Dealer Functions

A swap dealer acts as an intermediary and, in many cases, market maker, in the swap markets. The swap dealer will typically take swap orders from clients and, if they are required to be exchange-traded, facilitate the execution on a SEF. Where a swap is not required to be cleared, the swap dealer may act as the client’s counterparty.

Registration Requirement

Any entity that (i) holds itself out as a dealer in swaps, (ii) is a swap market maker, or (iii) regularly enters into swaps with counterparties in the ordinary course of business for its own account would be required to register as a swap dealer with the CFTC. In order to obtain and maintain registration, each swap dealer would be required to demonstrate compliance with all regulations adopted by the CFTC regarding capital and margin requirements, reporting and recordkeeping, daily trading records, business conduct standards, documentation standards, risk management and conflict of interest standards. In addition, each swap dealer would be required to designate a chief compliance officer and become a member of the NFA. All principals (including directors, president, certain officers, heads of swap business units or functions, and individual owners of 10% or more of the swap dealer’s outstanding stock) of a registered swap dealer would also be required to submit fingerprint cards and submit to background checks.

SEF Membership

It is expected that many swap dealers will become members of various SEFs in order to execute both proprietary trades as well as trades on behalf of customers.

Print

Print