Holly J. Gregory is a corporate partner specializing in corporate governance at Weil, Gotshal & Manges LLP. This post is based on a Weil alert by Ms. Gregory and Rebecca Grapsas; the full document, including footnotes and appendix, is available here.

Institutional Shareholder Services Inc. (ISS) and Glass Lewis & Co. have each made several important revisions to their proxy voting policies for the 2013 proxy season. ISS released new and updated FAQs relating to application of ISS proxy voting policies to compensation (including peer groups and realizable pay), board responsiveness to shareholder proposals, hedging and pledging of company stock, and other matters. This post provides guidance to US companies on how to address these policy changes.

Overview of Key Changes in Proxy Voting Policies

- Effective Dates: Proxy voting policy changes are applicable to shareholder meetings held on or after:

- January 1, 2013 — Glass Lewis

- February 1, 2013 — ISS

- Board Responsiveness:

- Beginning 2014, ISS will recommend a negative vote against directors if the board “failed to act” on a shareholder proposal supported by a majority of votes cast in the previous year.

- Glass Lewis will scrutinize the board’s responsiveness where 25 percent or more of shareholders vote against the recommendation of management on any proposal (not just say-on-pay).

- Pay-for-Performance:

- ISS will consider a company’s self-selected peers when constructing the peer group that ISS will use to evaluate pay-for-performance.

- ISS will also incorporate a comparison of “realizable pay” to grant date pay into the qualitative portion of its pay-for-performance evaluation.

- Say-on-Golden Parachutes:

- ISS will no longer grandfather existing change-in-control severance agreements.

- Hedging and Pledging of Company Stock:

- ISS will recommend a negative vote on directors if directors and/or executive officers have hedged any amount or pledged a significant amount of company stock.

- “Overboarded” Directors:

- ISS will count the boards of publicly-traded subsidiaries as separate from the parent board.

- Other Changes:

- ISS has adopted policy changes relating to board and committee meeting attendance, social and environmental shareholder proposals, sustainability metrics for compensation and lobbying disclosure.

- Glass Lewis has adopted policy changes relating to equity compensation plan proposals and exclusive forum provisions.

- Note that for the 2013 proxy season, ISS has identified more than 40 circumstances that may support a negative vote recommendation (either “against” or “withhold”) in uncontested director elections (see Appendix, available here).

- For a comparison of ISS’ policies (as updated) against suggestions for board structure and practice by influential members of the corporate, institutional investor and legal communities, see our “Comparison of Corporate Governance Principles & Guidelines: United States,” available at http://www.weil.com/news/pubdetail.aspx?pub=11385.

1. Board Responsiveness

ISS

ISS’ policy has been to recommend a negative vote against the entire board (except new nominees, who are considered case-by-case) where the board “failed to act” on a proposal that received either support of (a) the majority of shares cast the previous year and also one of the two years prior to that, or (b) the majority of shares outstanding the previous year.

ISS has changed this approach in two important respects. First, effective for the 2013 proxy season, rather than board non-responsiveness triggering a negative recommendation for the entire board, ISS will recommend against individual directors, committees or the entire board as it deems appropriate. Second, beginning in 2014, ISS will broaden its view of board non-responsiveness. If a shareholder proposal receives a majority of shares cast at a single shareholder meeting, ISS will evaluate how the company responded.

Under this revised policy, to be judged “responsive” will generally mean “full implementation” of the shareholder proposal. If implementation of the shareholder proposal requires a shareholder vote, ISS will expect a management proposal designed to implement the earlier shareholder proposal on the next annual meeting ballot. If the board’s response to the proposal involves less than full implementation, ISS will consider the following factors in determining its recommendation:

- Subject matter of the proposal

- Shareholder support and opposition to the proposal at prior meetings

- Board outreach to shareholders after the vote (as disclosed)

- Board actions in response to engagement with shareholders

- Continuation of the underlying issue as a voting item on the ballot (as either a shareholder or management proposal)

- Other factors as appropriate

ISS FAQs include examples of how ISS would treat certain actions taken in response to shareholder proposals on particular topics:

- Board declassification:

- Responsive — declassification, which may be phased in

- Not responsive — all other actions

- Independent chair:

- Responsive — separating chairman and CEO positions, with an independent director elected chairman. Adopting a policy to separate the positions upon the resignation of the current CEO would also be “highly responsive”

- Case-by-case — for other actions, will depend on the responses of shareholders obtained by the company’s outreach, the company’s disclosure of those responses and the facts and circumstances (e.g., strengthening the lead director role may be sufficient where shareholders are concerned about weaknesses in the lead director’s responsibilities)

- Majority voting in director elections:

- Responsive — adoption of true majority vote standard in charter or bylaws

- Not responsive — adoption of director resignation policy alone (without a true majority vote standard)

- Shareholder right to call a special meeting:

- Not responsive — giving shareholders the right to call a special meeting at a higher threshold than that specified in the proposal (e.g., adopting a 25 percent threshold when the shareholder proposal sought a 10 percent threshold), requiring that only one shareholder meet the threshold or restricting allowable agenda items at special meetings called by shareholders

- Case-by-case — if the company discloses outreach efforts to shareholders on the issue and has an equity structure that indicates that a higher threshold is reasonable

- Shareholder right to act by written consent:

- Responsive— granting ability to act by written consent, which may include reasonable restrictions such as:

- Ownership threshold of no greater than 10 percent

- No restrictions on agenda items

- Total review and solicitation period of no more than 90 days

- Limits on when written consent may be used of no more than 30 days after a meeting already held or 90 days before a meeting already scheduled

- Requirement that the solicitor must use best efforts to solicit consents from all shareholders

- Case-by-case — restrictions that go beyond those listed above will be considered in light of the company’s disclosure of outreach to shareholders on what they consider reasonable and the equity structure of the company

- Responsive— granting ability to act by written consent, which may include reasonable restrictions such as:

- Reducing supermajority voting requirements:

- Responsive — reducing all voting requirements to a majority of shares cast

- Shareholder proposals that are antithetical to shareholder rights

- Responsive — companies are not expected to act on proposals that are contrary to the interests of all shareholders and/or proposals that have been invalidated by court rulings or state law

Glass Lewis

Currently, Glass Lewis scrutinizes board responsiveness, including efforts to engage with shareholders, where 25 percent or more of shareholders (excluding abstentions and broker non-votes) vote against management’s say-on-pay proposal. Beginning in January of 2013, Glass Lewis will extend this same approach to situations where 25 percent or more of shareholders vote:

- Against management’s recommendation on any proposal — not just say-on-pay — including votes against directors or

- In favor of any shareholder proposal

This scrutiny will involve a review of the underlying issues, whether the board “responded appropriately” based on publicly available information (such as SEC filings, press releases, the company website and other public communications) and the disclosure in the proxy statement in the year following the vote. In assessing board responsiveness, Glass Lewis will undertake a case-by-case assessment, focusing on:

- Changes in board and committee composition, related person transaction disclosure, meeting attendance and director responsibilities

- Amendments to governance documents

- Changes in company policies, business practices or special reports

- Modifications to the design and structure of the company’s compensation program

What To Do Now?

- The ISS and Glass Lewis policy changes will add significant pressure on boards to act in line with shareholder viewpoints, even where the vote result is non-binding and, in the case of Glass Lewis, even where the vote result that triggers the scrutiny represents a minority of shareholders. In this environment, it is important for boards and their counsel to apply the engagement techniques honed in the context of say-on-pay to shareholder proposals generally. In particular, boards should:

- Engage with their largest shareholders to seek support

- Consider ways of addressing shareholders’ expressed views that the board believes may be acceptable from the company’s perspective

- Be prepared to negotiate with shareholder proposal proponents

- Consider enhanced solicitation efforts with respect to management proposals and director nominees, particularly where there may be circumstances or reasons to believe that a proposal and/or one or more directors may receive a significant negative vote.

- Boards will need to be especially careful to ensure that they continue to apply fiduciary judgment with respect to matters that receive a majority of votes cast on issues for which shareholders do not have decision rights. Directors retain legal responsibility as fiduciaries for those decisions. Communicating to shareholders about how the board is responding and why the board’s viewpoint may be different will become increasingly important.

2. Pay-for-Performance Evaluation

Peer Group Composition: More Attention to Self-Selected Peers

In making say-on-pay vote recommendations, ISS starts with an analysis of a company’s pay practices and performance relative to an ISS-selected peer group. ISS’ construction of peer groups has been a source of concern for many companies as its reliance on the company’s six-digit Global Industry Classification Standard (GICS) industry group can result in a peer group that is not wholly reflective of a company’s multiple business lines (e.g., by omitting key competitors or including companies with very little relevance).

According to its revised methodology, ISS’ selected peer group will continue to be comprised of 14 to 24 companies, based on the following factors:

- GICS industry classification of the subject company (8-digit, 6-digit and 4-digit)

- GICS industry classification of the company’s disclosed peer group used for CEO pay benchmarking purposes (8-digit, 6-digit and 4-digit)

- Size constraints for both revenue (or assets for certain financial companies) and market value

ISS will prioritize peers that:

- Are in the company’s peer group

- Have chosen the company as a peer

- Are closer in size to the company

- Maintain the company size at or near the median of its peer group

This new approach is broadly similar to the Glass Lewis approach (effective July 2012), which considers a company’s self-selected peers and the peers disclosed by the company’s self-selected peers.

Even though ISS has said that it will take into consideration a company’s self-selected peers, ISS FAQs clarify that a company’s self-selected peers may not always appear in the ISS peer group, even if they meet ISS’ size constraints (for example, if inclusion would lead to over-representation of a particular industry in the ISS peer group). In addition, ISS peer groups will not include privately-held or foreign-domiciled companies that are not domestic issuers for SEC filing purposes (i.e., Form 10-K filers). Likewise, ISS will not incorporate market indices and broad benchmarking surveys in its peer group, even if a company uses such benchmarking tools.

Realizable Pay

Under its revised policy, ISS will compare CEO “realizable pay” with grant date pay in its payfor- performance analysis, to reflect final payouts of performance-based awards or changes in value due to stock price movements. Realizable pay will be comprised of cash paid, equity-based grants made, changes in pension value and nonqualified deferred compensation earnings and “all other compensation” (such as perquisites) paid during a particular performance period. Realizable pay will be calculated using stock price at the end of the period, and will be based on equity award values for earned awards or target values for ongoing awards.

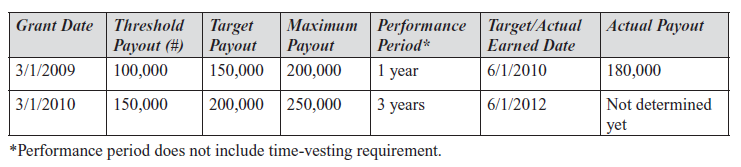

ISS has suggested in FAQs that companies include disclosure of ongoing or completed performancebased equity awards to facilitate ISS’ calculation of realizable pay, for example:

According to ISS FAQs, ISS’ research reports for S&P 500 companies will include a chart comparing realizable pay to granted pay over a three-year period (which for 2013 will consist of fiscal years 2010 through 2012). ISS may explore the underlying reasons behind why realizable pay is lower or higher than granted pay. Moreover, ISS will consider realizable pay for all companies in determining whether the company demonstrates a strong commitment to a pay-for-performance philosophy.

What To Do Now?

- Review the peer companies used for CEO benchmarking purposes in light of the increased weight that such companies will have in ISS’ peer group methodology.

- ISS will construct peer groups using the new methodology in early January 2013. Companies that changed their self-selected peer companies with respect to 2012 compensation decisions from those disclosed in the most recent proxy statement were requested by ISS to notify it by December 21, 2012 to ensure that ISS’ analysis considers the company’s current and most relevant peers. Peer groups will be updated again by ISS during July and August 2013. ISS has indicated in FAQs that companies with later fiscal year ends will be given an opportunity after the 2013 proxy season to communicate changes to peer groups.

- Companies should be aware that ISS may adjust peer groups by applying “manual judgment” where the standard methodology would produce “inappropriate” peers, so it will still not be possible for companies to predict with any certainty what peer group ISS will use.

- Review existing compensation disclosures and include realizable pay disclosure where appropriate, particularly if the company is in the S&P 500.

3. Say-on-Golden Parachutes

Say-on-golden parachute votes will continue to be analyzed by ISS on a case-by-case basis, but legacy change-in-control severance agreements will no longer be treated as grandfathered (and therefore not subject to scrutiny). Under its revised policy, ISS will focus on existing change of control arrangements with named executive officers, as well as recently adopted or amended agreements that are the focus of the current policy. Recent amendments to agreements that incorporate problematic features would carry greater weight in ISS’ analysis and the existence of multiple legacy problematic features in change of control agreements (such as cash severance that is more than three times salary and bonus, excise tax gross-ups and single or modified-single trigger cash severance) will be more closely scrutinized.

What To Do Now?

- Review change-in-control arrangements — including legacy arrangements — to ascertain the company’s vulnerability under ISS’ revised policy.

- Consider omitting provisions that ISS views as problematic from new or renewed employment agreements and consider negotiating with executive officers to amend agreements that are currently in effect.

4. Hedging and Pledging of Company Stock

ISS has revised its policy on voting on director nominees in uncontested elections to clarify that a “material failure of risk oversight” includes “any amount” of hedging of company stock or “significant pledging” of company stock, in addition to bribery, large or serial regulatory fines or sanctions and significant adverse legal judgments or settlements. The rationale accompanying the change in policy and ISS FAQs explain that the focus is on hedging and pledging by company executives and directors. Moreover, ISS FAQs indicate that ISS appears to be concerned about company stock purchased on the open market, as well as equity compensation. According to FAQs, ISS will determine on a caseby- case basis whether a “significant” amount of company stock has been pledged by “measuring the aggregate pledged shares in terms of common shares outstanding or market value or trading volume.”

ISS has indicated that at companies where executives and/or directors currently have pledged company stock, the following factors will be considered when determining the voting recommendation:

- Proxy statement disclosure of a policy prohibiting future pledging activity

- Aggregate pledged shares in terms of total common shares outstanding, market value or trading volume

- Disclosure of progress in reducing the magnitude of aggregate pledged shares over time

- Proxy statement disclosure that shares subject to stock ownership and holding requirements do not include pledged company stock

- Other relevant factors

What To Do Now?

- Determine whether executives and/or directors have hedged and/or pledged company stock, and ensure that appropriate disclosure is included in the proxy statement.

- Review insider trading and other relevant policies and consider whether such policies should be amended to include provisions prohibiting pledging (and perhaps, more broadly, hedging) of company stock by executives and directors.

- Note that the SEC has not yet begun rulemaking required by the Dodd-Frank Act with respect to disclosure as to whether any employee or director is permitted to hedge against losses on their company stock.

5. “Overboarded” Directors

ISS

ISS will recommend a vote against a director who sits on more than six public company boards or who is a public company CEO sitting on the board of more than two public companies besides their own. Under its current policy, ISS counts the boards of a parent company and a publicly-traded subsidiary as a single board. The revised policy will count the parent company board and the board of a subsidiary with publicly-traded stock owned 20 percent or more by the parent as two separate boards. Subsidiaries that only issue debt will still be counted as one board along with the parent company board under the new policy.

If a public company CEO is “overboarded,” he or she will receive a negative vote recommendation with respect to outside boards, which as of next year, will include subsidiaries that are less than 50 percent controlled.

Glass Lewis

Under its 2013 guidelines, if an executive officer serves on more than two other boards, Glass Lewis has stated that it will recommend a vote against the director at the public companies where he or she serves as an outside director, but not at the company where he or she is an executive officer.

What To Do Now?

- Given that “overboarding” results in an automatic negative vote recommendation from ISS, directors should consider whether it is worthwhile to sit on the boards of subsidiary companies.

- Review D&O questionnaires to ensure that relationships between boards on which directors serve are clear.

6. Attendance at Board and Committee Meetings

Under its existing policy, ISS issues negative voting recommendations against the entire board (except new nominees, who are considered case-by-case) where the company’s proxy statement disclosure indicates that not all directors attended at least 75 percent of the aggregate board and committee meetings, but does not disclose which directors are involved. Beginning in 2013, ISS will recommend that shareholders vote against an individual director where it is unclear whether the director attended at least 75 percent of board and committee meetings held during that director’s period of service.

What To Do Now?

- Review proxy statement disclosure relating to director attendance to ensure that directors who did not attend 75 percent of board and committee meetings are identified and consider disclosing the reasons for any non-attendance.

- For example, ISS considers it acceptable to miss meetings because of medical issues/illness or family emergencies, or where the director missed only one meeting (when the total of all meetings is three or fewer).

7. Evaluating Social and Environmental Shareholder Proposals

ISS’ revised policy establishes enhancement or protection of shareholder value as the overarching principle for evaluating social and environmental shareholder proposals. ISS will continue to consider other factors, including the cost and benefits of implementing the proposal, the scope of information already available, and the company’s response to the issue raised in the proposal.

What To Do Now?

- Address the likely impact of the proposal on shareholder value when drafting proxy statement disclosure in opposition to a social or environmental shareholder proposal.

8. Sustainability Metrics for Compensation

ISS’ current policy is to recommend that shareholders vote “against” proposals to link, or report on linking, executive compensation to environmental and social criteria issues (e.g., environmental performance, human rights and community involvement). Beginning in 2013, ISS will make recommendations on such proposals on a case-by-case basis, taking into account:

- Factors relating to the history of sustainability issues at the company

- Relevant management systems and oversight mechanisms

- Incorporation of sustainability metrics in executive compensation practices at peer companies

- Disclosure regarding environmental and social performance

What To Do Now?

- Review peer company use of sustainability metrics and consider whether it would be appropriate to implement such metrics at the company.

- Consider providing voluntary disclosure relating to environmental and social performance, for example, by publishing a sustainability report.

9. Lobbying Disclosure

Under its existing policy, ISS will make case-by-case recommendations on proposals requesting information on a company’s direct and grassroots lobbying activities. ISS has expanded the scope of its policy to include indirect lobbying, as well as application of the policy to proposals seeking disclosure of a company’s lobbying policies and procedures.

What To Do Now?

- Consider disclosing information about the company’s political activities, which is an emerging best practice, particularly since the recent surge in popularity of shareholder proposals targeting political contributions and lobbying.

10. Equity-based Compensation Plan Proposals

Glass Lewis will examine equity compensation plans that are presented for shareholder approval for share-counting provisions that understate the potential dilution or cost to common shareholders. For example, Glass Lewis’ 2013 abridged guidelines state that “plans should not count shares in ways that understate the potential dilution, or cost, to common shareholders. This refers to ‘inverse’ full value award multipliers.”

What To Do Now?

- Review methodology for counting shares as set forth in equity compensation plans presented to shareholders for approval.

- Provide proxy statement disclosure explaining how shares are counted pursuant to the terms of the equity compensation plan.

11. Exclusive Forum Provisions

Glass Lewis will continue to oppose exclusive forum provisions, but beginning in 2013 may consider recommending in favor of exclusive forum proposals if the company:

- Has a compelling reason why the provision would benefit shareholders

- Provides evidence of abuse of legal process in non-favored jurisdictions

- Demonstrates a record of good corporate governance

What To Do Now?

- Review proxy statement disclosure accompanying management proposals to adopt exclusive forum provisions to address Glass Lewis’ concerns.

What You Should Do Now

ISS typically provides companies that are in the S&P 500 with prior warning if it intends to issue a negative vote recommendation. Companies then have a very narrow time window (48 hours) in which to engage with ISS on the issue. Companies that are not in the S&P 500 generally do not receive such prior warning. We encourage all companies to become familiar with the circumstances in which ISS may recommended a negative vote regarding director re-election (set forth in the Appendix, available here), or on other proposals that may be included in their proxy statement. Companies may also wish to contact their analyst at ISS in anticipation of or shortly after proxy statement filing to talk through any issues that could cause ISS to issue a negative vote recommendation.

In addition to the steps discussed above relating to each policy change, we recommend that counsel:

- Review the company’s corporate governance and compensation practices for potential vulnerabilities under ISS’ and Glass Lewis’ policy updates (for example, how shareholder proposals fared at the previous annual meeting and whether executive officers or directors have pledged company stock for margin accounts or other loans)

- Assist the company in developing outreach tactics to engage with key institutional investors on governance-related matters, especially if the company had a majority-supported shareholder proposal at its last annual meeting that has not been implemented

- Review the company’s existing compensation and governance disclosure and plan to make improvements where appropriate

Print

Print