Mark Schonfeld is a litigation partner at Gibson, Dunn & Crutcher LLP and co-chair of the firm’s Securities Enforcement Practice Group. This post is based on a Gibson Dunn client alert by Mr. Schonfeld and Kenneth J. Burke; the full version, including footnotes, is available here.

In many respects, 2012 was another year of aggressive SEC enforcement. The SEC’s Division of Enforcement again logged a near record number of enforcement actions. More important, the cases reflected a marked increase in the number and proportion of actions against registered investment advisers and broker-dealers, and their associated persons. This increased focus derives from a culmination of factors, including Enforcement’s creation of specialized units for the asset management industry and for structured products, the hiring of industry experts, and the close collaboration between staff from Enforcement and the SEC’s Office of Compliance Inspections and Examinations (“OCIE”). With the expansion of the registered private fund adviser population under financial reform legislation, and the launch of an initiative to conduct focused, risk-based examinations of these new registrants, this trend will likely continue for the foreseeable future.

At the same time, in the latter half of 2012 the SEC confronted significant challenges in litigating previously filed enforcement actions against individuals in cases related to the financial crisis. Whether these cases will cause the SEC to reevaluate its approach with respect to charging decisions in the future is unknown. However, in the short term, Enforcement seems undeterred by individual litigation results in its pursuit of continued enforcement actions.

The last six months of 2012 mark the beginning of another transition for the SEC generally, and for Enforcement in particular. As the year drew to a close, Mary Schapiro announced her departure as Chairman, followed by several division directors. Most notably, on January 9, 2013, the SEC announced that Robert Khuzami would step down as Director of Enforcement. As we look ahead to 2013, a new leadership team at the SEC and in Enforcement will seek to make their own imprint on the SEC’s priorities and processes. In addition, as more time has passed since the depth of the financial crisis, Enforcement’s priorities will shift to more recent conduct and emerging industry risks.

A. By the Numbers: 2012 Enforcement Statistics and Trends

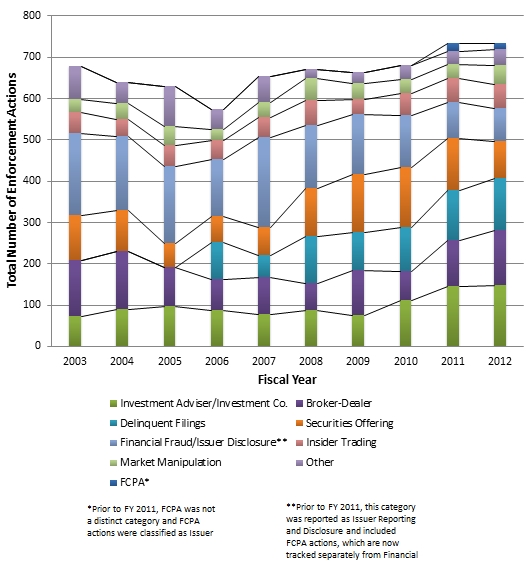

In FY 2012, the SEC filed a total of 734 enforcement actions, just one action shy of last year’s record of 735. The SEC also obtained orders in FY 2012 requiring the payment of more than $3 billion in penalties and disgorgement, an 11% increase over the amount ordered in FY 2011.

As in prior years, the SEC continued to emphasize its record in bringing cases related to the financial crisis, making particular note of the number of cases against individuals. In FY 2012, the SEC counted 29 cases, naming 38 individuals, relating to the financial crisis.

Figure 1 – Enforcement Actions Filed by Fiscal Year, 2003-2012

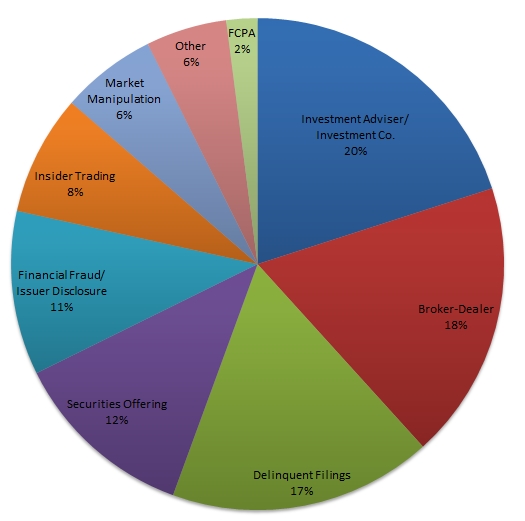

More notable than the total number of enforcement actions, however, is the increasing number and proportion of actions against investment advisers and broker-dealers. In FY 2012, the SEC filed a record 147 cases against investment advisers, representing 20% of the total number of enforcement actions during the year. This number, which is one more than last year’s record total, is nearly 30% higher than the number of similar actions brought in FY 2010, and nearly 48% higher than the SEC’s average over the last 10 years. In announcing these results, the SEC emphasized that a significant number of the investment adviser cases resulted from initiatives of Enforcement’s Asset Management Unit (“AMU”), such as the unit’s Compliance Initiative and the Aberrational Performance Inquiry Initiative. With more than 1,500 private fund advisers having registered with the SEC as a result of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), Enforcement’s focus on investment advisers will undoubtedly continue in the future.

Similarly, this past year we saw a significant increase over recent years in the number of actions against broker-dealers. In FY 2012, the SEC brought 134 cases against broker-dealers, representing approximately 18% of total enforcement actions. This number is approximately 20% higher than last year, and nearly 30% higher than the SEC’s average over the last 10 years. In announcing these results, the SEC emphasized a number of actions involving compliance issues relating to stock exchanges, alternative trading platforms, such as dark pools, and other market structure participants.

Other notable trends involve insider trading and market manipulation cases. The agency filed 58 insider trading cases in FY 2012, constituting approximately 8% of the total number of enforcement actions during the year. In the last three years, the SEC has filed 168 insider trading cases – a record for any three-year period in the agency’s history. The SEC also brought 46 cases involving market manipulation, constituting approximately 6% of the total. The FY 2012 results in this area were nearly 24% higher than FY 2011’s, and nearly 19% higher than the SEC’s average over the last 10 years.

Figure 2 – Breakdown of Enforcement Cases Filed in FY 2012

B. Litigation Challenges

Of course, statistics alone do not tell the full story of the SEC’s enforcement program. In the latter half of 2012 in particular, the SEC confronted significant challenges in litigating cases to judgment. In the wake of the financial crisis, the SEC pursued an aggressive strategy of bringing cases against individuals. As we have noted in prior alerts, individual defendants more frequently litigate enforcement actions than entity defendants, leaving Enforcement staff with a significant litigation docket. The latter half of 2012 saw several cases brought against individual defendants reach resolution, often with adverse results for the SEC. A few notable decisions are discussed below.

- SEC v. Stoker: In July, a federal jury found a former mid-level Citigroup Global Markets executive not liable for civil negligence charges in connection with allegedly misleading disclosures concerning a collateralized debt obligation (“CDO”). The executive had been charged by the SEC as part of a broader civil lawsuit against Citigroup. After a two-week trial, a jury absolved the defendant of all liability.

- SEC v. Perry: In October, the SEC announced an $80,000 settlement with the former CEO of IndyMac Bancorp, resolving claims that the CEO misled investors shortly before the bank’s closure. The settlement was reached shortly after the judge presiding over the case dismissed all but one of the SEC’s claims.

- SEC v. Reserve Management Co. Inc.: In November, a federal jury absolved two former money-market mutual fund managers of civil fraud charges. In 2009, the SEC sued Bruce Bent Sr., and his son Bruce Bent II, who were co-managers of the $62 billion Reserve Primary Fund. The SEC alleged that the managers misled investors and others about their intentions to support the Reserve Primary Fund after the fund “broke-the-buck” in September 2008 in the wake of the Lehman Brothers bankruptcy filing. After a four-week trial, the jury found both defendants not liable for civil fraud. The jury did, however, find Mr. Bent II liable on one claim of negligence for his role in communicating with investors, and also found Reserve Management Co. Inc. liable for a fraud violation. The SEC recently announced its intention to seek a new trial against the defendants.

- SEC v. Steffelin: Also in November, the SEC filed a voluntary dismissal of its claims against a former executive of GSC Capital Corp. The executive had worked on a CDO deal that later defaulted. The SEC’s lawsuit, filed in June 2011, alleged that the executive was negligent in failing to make disclosures that a hedge fund allegedly had a role in selecting assets that were referenced in the CDO’s portfolio.

- In re Premo: In December, Chief Administrative Law Judge Brenda Murray issued an initial decision finding that Lisa Premo, a senior portfolio manager at Evergreen Management LLC, had failed to inform a fund valuation committee of adverse information regarding the deterioration of a $13 million asset-backed security position held by an ultra-short mutual fund, and thereby aided and abetted and caused violations of the Investment Advisers Act of 1940 (the “Advisers Act”) and the Investment Company Act of 1940 (the “IC Act”). Noting that Premo had a distinguished career and received no personal financial benefit from the alleged violations, Chief Judge Murray declined to impose a civil money penalty, but did issue a cease-and-desist order and barred Premo from association with an investment adviser for five years.

Notwithstanding Premo, the SEC’s litigation results over the past six months suggest that the agency faces challenges in proving the elements of a violation by an isolated individual, particularly in cases involving large organizations, complex financial instruments, and the unforeseen turmoil of the financial crisis.

C. Further Use of New Enforcement Tools

During the latter half of 2012, Enforcement also made use of new tools that have been implemented both through legislation and internal process.

In August, the SEC announced the first award made under the whistleblower program implemented pursuant to the Dodd-Frank Act. Although the SEC did not identify the whistleblower or the case in question, it did disclose that the whistleblower helped stop a multimillion dollar fraud, and would receive a nearly $50,000 award. The award represented 30% of the amount collected in the related enforcement action, the maximum percentage award allowed pursuant to the Dodd-Frank Act. This award illustrates that the SEC’s whistleblower program provides a concrete monetary incentive to would-be whistleblowers to come forward with tips and information about possible fraud and wrongdoing.

More broadly, the SEC’s Office of the Whistleblower reported that it received over 3,000 tips in FY 2012, with the most common complaints relating to corporate disclosures (18%), offering fraud (15%), and manipulation (15%).

In July, the SEC made use of a deferred prosecution agreement (“DPA”) to resolve an investigation. This represented only the second time a DPA has been used by the SEC. Moreover, the circumstances of the matter were somewhat unique, suggesting it had limited value as a template for the resolution of other investigations. Specifically, this DPA was entered into with the Amish Helping Fund (“AHF”), a nonprofit corporation that was formed in 1995 by Amish elders to help those in the Amish community. AHF’s business operations involved selling securities in the form of investment contracts to help fund mortgage and construction loans for Amish families in Ohio. AHF operated from 1995 through 2010 without ever updating its offering memorandum, which rendered the document stale and allegedly misleading. According to the SEC’s announcement, upon learning of the issue, AHF immediately cooperated, updated its circular, offered all investors the right of recission, and took other remedial actions. No AHF investors suffered losses as a result of the outdated circular.

D. Continued Judicial Scrutiny of SEC Settlements

In prior alerts, we have discussed the heightened scrutiny that certain federal judges have applied to SEC settlements when presented for their approval. In particular, we have reviewed the criticism by District Judge Jed Rakoff of the SEC’s long-standing policy of settling cases on a “neither admit nor deny” basis in rejecting a settlement between the SEC and Citigroup, as well as the Second Circuit’s interim order staying the district court decision. The Second Circuit is scheduled to hear oral argument on the merits of the appeal by the SEC and Citigroup during the week of February 4, 2013. In the meantime, the Second Circuit’s interim decision staying the district court decision suggests that the SEC’s “neither admit nor deny” settlement format will remain safely in place.

Nevertheless, judicial challenges to the terms of SEC settlements continue. Most recently, in December, District Judge Richard Leon in Washington, D.C. raised concerns over the terms of a settlement between the SEC and IBM relating to alleged violations of the Foreign Corrupt Practices Act. In particular, Judge Leon raised concerns regarding the absence of additional future reporting requirements in the settlement, and gave the parties the opportunity to respond.

E. Looking Ahead in 2013: Leadership in Transition

In December, Mary Schapiro stepped down as Chairman of the SEC. Within short order, other senior officials announced their intentions to leave as well, including Marc Cahn, the General Counsel; Meredith Cross, the Director of the Division of Corporation Finance; and Robert Cook, the Director of the Division of Trading and Markets. On January 7, 2013, the SEC announced the appointment of Geoffrey Aronow as the agency’s new General Counsel. Mr. Aronow had at one time served as the Director of the Division of Enforcement at the Commodity Futures Trading Commission. Most recently, on January 9, 2013, the SEC announced that Robert Khuzami would step down from his post as Enforcement Director. A successor has not been named for Director Khuzami.

Former Chairman Schapiro, and the division directors she appointed, joined the SEC in the wake of the financial crisis, and served during one of the most challenging periods in the agency’s history. As a result of the Dodd-Frank Act, Schapiro oversaw one of the busiest rulemaking periods in decades. With respect to Enforcement, Director Robert Khuzami implemented significant organizational and operational changes to streamline Enforcement’s investigative process, reduce levels of management, and increase the level of specialization and expertise of the staff. He also oversaw record levels of enforcement activity and devoted substantial resources to addressing cases related to the financial crisis.

Despite the significant turnover, the change in Chairman and senior staff will not diminish the SEC’s aggressive enforcement posture in the immediate future. Shortly after Schapiro announced her resignation, President Barack Obama appointed Commissioner Elisse Walter as the agency’s new Chairman. Chairman Walter has had a distinguished career at several financial regulatory organizations, and worked closely with former Chairman Schapiro in many of those capacities. Furthermore, Chairman Walter and former Chairman Schapiro were aligned on most regulatory issues during Schapiro’s tenure, thus we do not anticipate immediate changes in the agency’s enforcement program. Over a longer period, however, we do anticipate that the arrival of a new leadership team will usher in new perspectives, priorities, and strategies at the agency.

With nearly five years having passed since the advent of the financial crisis, we anticipate that 2013 will be the year that Enforcement begins to turn the page on this subject. Nevertheless, with the financial crisis behind it, Enforcement will soon have capacity that can shift elsewhere. One area that is ripe for consideration is the asset management area. As a result of the Dodd-Frank Act, over 1,500 private fund advisers registered with the SEC, subjecting the new registrants for the first time to periodic examination by OCIE. As we discussed in a prior alert, “SEC Announces New Three-Part Examination Strategy for Newly Registered Private Fund Advisers,” OCIE has already developed a strategy for dealing with this new pool for registrants. Furthermore, Bruce Karpati, Chief of the AMU, recently commented on the close collaboration between his unit and OCIE, and noted that hedge fund oversight will be a priority for the AMU in 2013. As a result of these considerations, we anticipate additional private fund adviser enforcement actions in the future.

Furthermore, in 2013 the Supreme Court will address an issue with broad implications for SEC enforcement actions in Gabelli v. SEC. At issue in the case is whether, for purposes of applying the five-year statute of limitations for penalty actions, the SEC’s claim first accrues when the underlying violation occurs (as the petitioner-defendants contend), or when the SEC discovers, or in the exercise of reasonable diligence should have discovered, the violation (as the SEC contends). During oral arguments held on January 8, 2013, several justices appeared to express skepticism regarding the SEC’s position, and suggested that the five-year statute of limitations for penalty actions should begin to run from accrual, not from discovery of the violation. A final decision in the case is expected by the end of June 2013.

II. Investment Advisers

A. Regulatory Updates

1. JOBS Act

In April, President Obama signed into law the Jumpstart Our Business Startups Act (the “JOBS Act”). The stated purpose of this law is to increase “American job creation and economic growth by improving access to the public capital markets for emerging growth companies.”

There are several relevant provisions in the JOBS Act for private funds and their advisers. First, the JOBS Act removes Regulation D’s prohibition on general solicitation and advertising for issuers relying on Rule 506, which is the most common exemption from the Securities Act of 1933 utilized by private funds. Specifically, the JOBS Act requires the SEC to amend Rule 506 so that the general advertising and solicitation prohibitions in Rule 502(c) of Regulation D will not apply to the offer and sale of securities pursuant to Rule 506. Accordingly, once the SEC amends Rule 506 in accordance with the JOBS Act, it appears that private funds relying on either Section 3(c)(1) or Section 3(c)(7) of the IC Act will be able to engage in general solicitation and advertising without violating the provisions contained in those sections regulating “public offerings” of securities.

Although the SEC missed the JOBS Act’s July 4, 2012 deadline for eliminating Rule 506’s general solicitation and advertising ban, it proposed an amendment to Rule 506 on August 29th that would permit “advertising and solicitation as long as all purchasers are accredited investors and the issuer has taken reasonable steps to verify their accredited status.” On December 6th, the Director of the SEC’s Division of Investment Management (“IM”), Norm Champ, reported that the SEC had received over 160 comments during the comment period, and that SEC staff is “carefully reviewing those comments and considering what recommendations to make to the Commission.”

Secondly, the JOBS Act increases the thresholds that trigger registration and reporting requirements under the Securities Exchange Act of 1934 (the “Exchange Act”). Generally, Section 12(g) of the Exchange Act requires an issuer to register its securities with the SEC and file periodic reports if the issuer exceeds certain asset and investor thresholds. The JOBS Act increased Section 12(g)’s thresholds from 500 shareholders of record to 2,000, and from $1 million to $10 million in assets. Consequently, a private fund can now have 1,999 “record investors” without triggering Exchange Act public company reporting obligations.

2. Dodd-Frank Registration and the Investment Advisers Act

As we recently discussed at length in an alert, “SEC Announces New Three-Part Examination Strategy for Newly Registered Private Fund Advisers,” Title IV of the Dodd-Frank Act required the vast majority of private fund advisers with $150 million or more in assets under management in the U.S. to register with the SEC by March 30, 2012. In October, the SEC announced that 1,504 new advisers had registered with the agency as a result of the Dodd-Frank Act, bringing the total number of registered private fund advisers to 4,061. Private fund advisers now comprise nearly 40% of the SEC’s total registered investment adviser universe.

As a result of this considerable increase in private fund adviser registrants, IM Director Norm Champ said that a potential priority for his division moving forward is to review how the Advisers Act applies to private fund advisers. Specifically, Champ stated that the SEC has “pretty much a vastly different registration base than we’ve had in the past, and so we have received a number of questions and comments from newly registered advisers to private funds about how certain provisions of the Advisers Act relate to them.” Furthermore, Champ noted that private fund advisers have inquired about the Advisers Act’s books and records and advertising provisions. Champ explained that, because private fund advisers now make up such a large percentage of the SEC’s registrant population, the SEC “think[s] it’s important that we . . . take a broad look at our regulatory framework and how that fits with private [fund] advisers.” If the IM Division pursues this initiative, it could potentially result in a significant revision of Advisers Act requirements as applied to private fund advisers.

The Dodd-Frank Act also required midsized advisers to move from federal to state registration by June 28, 2012. On October 19th, the SEC issued a notice that it intended to de-register 293 advisers who either failed to comply with SEC filing requirements, or managed less than $100 million in assets.

3. Proposed Legislative Reform of Investment Adviser Examinations

In the wake of the substantial expansion of the SEC’s adviser registrant population as a result of the Dodd-Frank Act, during 2012, Members of Congress proposed legislative alternatives to overhaul SEC oversight of registered investment advisers.

As we reported in our Mid-Year Update, House Financial Services Committee Chairman Spencer Bachus (R-Ala.) in April introduced the Investment Adviser Oversight Act (the “IAOA”), a bill that would require many investment advisers to join a self-regulatory organization (an “SRO”). Since its introduction, critics have faulted the bill for imposing higher costs and a redundant regulatory burden on small advisory firms, as the bill would mandate that they join an SRO in addition to current SEC oversight.

In response to criticism concerning the IAOA, Representative Maxine Waters (D-Cal.) in July introduced the Investment Adviser Examination Improvement Act of 2012 (the “IAEIA”), which would provide the SEC with authority to impose and collect user fees from investment advisers. According to Waters, the SEC would use fees collected pursuant to the IAEIA to increase the number and frequency of SEC examinations. Waters has stated that the IAEIA’s fee approach is a simpler solution than the IAOA, which calls for the creation of a new SRO.

As of the date of this publication, the status of both bills in the House of Representatives remains “introduced.”

B. Enforcement Priorities

1. Asset Management Unit Activities

In the latter half of 2012, the AMU continued to focus heavily on its risk-based investigative initiatives. In a speech in December, AMU Chief Bruce Karpati explained that the registration rule under the Dodd-Frank Act has provided the AMU with a more robust source of data from newly registered private fund advisers to analyze as part of its risk-analytic initiatives.

For example, during 2012 the AMU continued to focus on its Aberrational Performance Inquiry Initiative, which it originally launched in March 2011. Under this initiative, the AMU, along with the SEC’s Division of Risk, Strategy, and Financial Innovation (“RiskFin”) and OCIE, analyzes performance data on hedge fund advisers and targets suspicious candidates–those who have a high incidence of aberrationally high returns–for examination or investigation. The SEC has brought a total of seven enforcement actions against hedge fund advisers as a result of this initiative, including the recent Yorkville Advisors case, discussed below.

In addition, the AMU, again in coordination with RiskFin and OCIE, recently launched the Private Equity Initiative. Through this initiative, the SEC seeks to identify private equity fund advisers that are at risk for certain types of conflicts that could lead to potential securities law violations. For example, the staff has been using the initiative to identify private equity fund advisers managing so-called “zombie funds”– funds that linger beyond their set life span by not liquidating certain illiquid assets–or advisers that may be at risk for overstating the value of fund assets to investors.

Finally, the AMU implemented “Operation ADV” last year, pursuant to which the unit reviews certain advisers’ Forms ADV in search of red flags that can be indicative of securities law violations.

As a final consideration, and from a more general standpoint, Karpati categorized the AMU’s biggest areas of concern in FY 2012 as: (1) conflicts of interest, (2) fee arrangements, (3) valuation and performance, and (4) compliance and controls. We anticipate that these areas will continue to be focal points for Enforcement in the upcoming year.

2. Conflicts of Interest

In an October speech, OCIE Director Carlo V. di Florio highlighted conflicts of interest as a key focus area for OCIE’s National Examination Program. Mr. di Florio also noted several conflicts of interest that OCIE considers high priority in its examinations, including:

- Compensation-related conflicts and incentives–including “incentives to place investors in accounts with fee structures that are high relative to the services provided”;

- Portfolio management-related conflicts–including (1) “investment advisers that prefer one client over another when managing multiple accounts side-by-side, due to financial incentives or personal relationships,” and (2) advisers’ portfolio-management activities that involve risks “beyond risk-tolerance levels or stated objectives in the prospectus, such as overconcentration in a single issuer or sector” or a “mismatch of fund liquidity to an expectation of fund redemptions”;

- Affiliations between investment advisers and broker-dealers–including an investment adviser’s incentives to use an affiliated broker-dealer for a client’s trade when the terms of the execution are substandard; and

- Valuation–including an adviser’s incentive “to provide high marks in pricing relatively illiquid positions” and inflating valuations to charge more fees and attract more investors.

As the cases below illustrate, many of the SEC’s enforcement actions last year stemmed from alleged adviser misconduct in the aforementioned areas, and we anticipate that conflict of interest-related cases will continue to be a priority for Enforcement in 2013.

C. Notable Investment Adviser Cases

The SEC again filed a record number of enforcement actions against investment advisers in FY 2012–it filed 147 actions, one more than last year’s record. This number is likely to rise again in 2013 as Enforcement continues to focus on investment advisers and as the number of registered investment advisers continues to grow.

Detailed below are notable actions brought by Enforcement against investment advisers in FY 2012, organized categorically.

1. Valuation

In December, AMU Chief Bruce Karpati reaffirmed the unit’s focus on detecting fraudulent or weak valuation practices–especially lax valuation committees or a fund’s use of a “side pocket” to conceal losing illiquid positions. The volume of notable cases and enforcement actions from the latter half of last year involving valuation issues demonstrates the SEC’s intense focus on this area.

- It is not often that the SEC brings an enforcement action against independent directors for acts solely in their capacity as directors. So it was a notable event when, in December, the SEC instituted an administrative proceeding against eight former independent directors of mutual funds managed by Morgan Asset Management, Inc., alleging that the respondents caused the funds to violate various provisions of the IC Act in connection with the funds’ fair valuation of securities backed by subprime mortgages in early 2007. The SEC alleged that, as directors of the funds, the respondents were responsible for determining the fair value of securities held by the funds and, as permitted, the directors delegated their fair valuation responsibility to a management valuation committee. However, the SEC alleged that the directors did not provide the committee with “meaningful substantive guidance” on how fair valuation determinations should be made, or make sufficient efforts to learn how the committee made such determinations, in the particular circumstances of the funds, which had invested in mortgage-related securities. Accordingly, the SEC alleged that the directors caused the funds’ violations of Rules 22c-1, 30a-3(a) and 38a-1 under the IC Act. This action follows a related $200 million settlement in 2011 with the funds’ managers, and sanctions against two former employees of the manager, who, among other things, were alleged to have fraudulently misled the independent directors on valuation issues.For their part, the directors issued a statement vigorously denying the SEC’s allegations and noting several issues that will be subject to further litigation in the proceeding, including: the absence of any issues having been raised by the funds’ independent auditors, compliance officer, and even the SEC’s examination staff, in reviewing the funds’ valuations and procedures; the absence of regulatory guidance on fair valuation procedures; and the unforeseen impact of the financial crisis.

- As discussed above, the AMU’s Aberrational Performance Inquiry Initiative seeks to target for investigation or examination fund managers with a high incidence of aberrationally high returns. In October, the SEC filed it seventh case resulting from this initiative, in this case an action against Yorkville Advisors LLC, as well as its president and its CFO. The SEC alleged that the defendants overstated the performance and value of the hedge funds they managed, charged excessive fees based on the overstated asset values, failed to adhere to the funds’ stated valuation procedures, withheld adverse valuation information from the funds’ auditors, and misrepresented the liquidity and safety of the funds’ investments. The defendants are contesting the SEC’s allegations, and have issued a statement in which they referred to the SEC’s case as a “free money shakedown.”

- Finally, on November 28th, the SEC brought a settled action against three executives at KCAP Financial Inc. (“KCAP”), a New York-based, publicly traded fund regulated as a business development company, alleging that the executives overstated the fund’s assets during the financial crisis. Specifically, the SEC alleged that: (1) KCAP did not account for certain market-based activity when determining the fair value of certain collateralized loan obligations (“CLOs”) and debt securities, and (2) KCAP failed to disclose the fact that its fund had valued its two largest CLOs at cost. Notably, this action was the first SEC enforcement action against a public company fund for failing to properly fair value its assets according to its applicable financial accounting standard–FAS 157. KCAP and the three executives, without admitting or denying the SEC’s findings, consented to a cease-and-desist order, and the three executives paid an aggregate fine of $125,000.

2. Allocation of Trades: “Cherry-Picking”

The procedures by which investment advisers allocate trades among clients is a perennial focus for the SEC, particularly when a potential conflict of interest exists, such as when the adviser or its principals have an investment interest in one or more investment vehicles but not in others. In December, the SEC filed an action against investment adviser Aletheia Research and Management, Inc. (“Aletheia”) and its CEO alleging that the defendants breached their fiduciary duties by engaging in “cherry-picking”: unfairly allocating trades that had appreciated in value to trading accounts in which Aletheia employees, the CEO, and favored clients had interests to the detriment of trading accounts in which other investors had interests. The SEC also alleged that the defendants failed to timely disclose to clients Aletheia’s precarious financial condition. The defendants are contesting the SEC’s allegations, though the CEO has said he is cooperating with the SEC and that Aletheia “did not intentionally or otherwise harm any of its investment products or its clients.”

3. Conflicts of Interest

In September, the SEC instituted an administrative proceeding against Meditron Asset Management, LLC, Meditron Management Group, LLC, and their principal, alleging that the respondents diverted approximately $2.65 million from a fund they managed into a private contracting company that the principal owned. The respondents allegedly failed to inform investors of the fund’s investment in the company, or of the principal’s interest in the company. The contract company ultimately filed for bankruptcy. The respondents are contesting the SEC’s allegations.

4. Excessive Fees

In October, the SEC filed a complaint against two hedge fund managers, Norman Goldstein and Laurie Gatherum, and their firm, GEI Financial Services, alleging that the defendants withdrew excessive fees and made capital withdrawals of at least $147,000 from the hedge fund that they managed. According to the SEC, the defendants did not tell investors that the adviser removed various performance hurdles when calculating fees, making the fee calculations vastly different from what they had originally told investors. Further, the SEC alleged that Goldstein failed to inform his clients that the state of Illinois–where the fund was based–had barred him from providing investment advisory services in 2011. The defendants are contesting the SEC’s allegations.

5. “Skin in the Game” Representations

The SEC also focused on “skin in the game” representations by investment advisers last year, bringing two notable cases in which advisers allegedly misstated the extent of their personal co-investment alongside outside investors. First, as we reported in our Mid-Year Update, the SEC alleged in May that Quantek Asset Management LLC, two of its executives, and its former parent company misrepresented the extent to which fund managers co-invested in the Quantek Opportunity Fund. Secondly, in December, the SEC instituted settled administrative proceedings against Aladdin Capital Management LLC (“Aladdin”), Aladdin Capital, and former executive Joseph Schlim for allegedly representing that Aladdin was co-investing alongside clients in two CDOs, when, in fact, Aladdin did not make such investments. The SEC alleged that Aladdin’s representation concerning co-investment was a “key feature and selling point” to investors in its marketing message that the adviser’s interests were aligned with those of investors. As part of their settlement, Aladdin and Aladdin Capital agreed to pay $900,000 in disgorgement and a $450,000 penalty, and Schlim agreed to pay a $50,000 penalty.

6. Style Drift

Another risk that the SEC focused on in 2012 was “style drift,” or the risk that a manager will diverge from its stated investment style or objective. For example, in December, the SEC instituted settled administrative proceedings against Top Fund Management (“TFM”) and its principal, Barry Ziskin, for allegedly failing to adhere to the stated investment objectives of a mutual fund they managed. The fund’s prospectus allegedly restricted the fund’s use of options and stated that the fund’s objective was long-term capital appreciation; however, the SEC alleged that the respondents instead invested the fund in put options for speculative purposes. Due to losses from options trading and investor redemptions, the fund ultimately collapsed. Without admitting or denying the SEC’s allegations, the respondents agreed to settle the SEC’s action. The settlement included cease-and-desist orders, a censure against TFM, and an order barring Ziskin from the securities industry.

III. Broker-Dealer Developments

In FY 2012, the SEC brought 134 enforcement actions related to broker-dealers, marking a 19% increase from the previous year. Consistent with former Chairman Schapiro’s comments about FY 2012’s enforcement actions as a whole, the SEC’s actions against broker-dealers represent a “docket distinctive not just for volume[,] but for the importance, complexity and sheer variety of the cases involved.” In particular, recent broker-dealer actions demonstrate the SEC’s attention to foreign, as well as domestic, misconduct. We anticipate that the SEC will continue to seek to cast its jurisdictional net widely in the future.

A. OCIE Report on Controls to Protect Confidential Information

On September 27, 2012, OCIE issued a report detailing the strengths and weaknesses of broker-dealer controls to protect confidential information. The report discussed a number of potential conflicts of interest, including interactions between personnel with access to material nonpublic information and colleagues responsible for sales and trading. The report also noted the risk that senior executives with access to material nonpublic information oversee trading units that could benefit from the misuse of this information. OCIE went on to describe best practices observed at certain broker-dealers that would help to manage these and other conflicts of interest. These practices included the adoption of processes that identify the sensitive nature of certain documents based on the nature of the information or where it originated. OCIE similarly recommended conducting expansive post-trade reviews for potential misuse of confidential information, and to review trading in credit default swaps, equity or total return swaps, loans, components of pooled securities such as unit investment trusts and exchange-traded funds, warrants, and bond options. Overall, the SEC observed that “broker-dealers were enhancing their controls in response to developments in business activities, technologies and business structures [but] also identified gaps in controls, which were raised with the broker-dealers.”

B. Registration

The SEC continues to emphasize the importance of broker-dealer registration as a threshold requirement for the protection of domestic investors. The particular issue of registration of foreign broker-dealers came to the fore in November when the SEC instituted settled administrative proceedings against four India-based brokerage firms for providing services to institutional investors in the U.S. without registering with the SEC. According to the SEC’s orders, the four foreign brokerage firms interacted with U.S. investors in a variety of ways without registering with the SEC. The interactions included sponsoring conferences in the U.S., traveling to the U.S. to meet with investors, trading securities of India-based issuers on behalf of U.S. investors, and participating in securities offerings from India-based issuers to U.S. investors. Recognizing the prompt cooperation and remedial efforts of these firms, the SEC declined to impose cease-and-desist orders or civil money penalties in the case. Nevertheless, the four firms were required to pay over $1.8 million in disgorgement collectively to settle the charges.

C. Market Manipulation and Supervision

In FY 2012 the SEC brought a number of cases against broker-dealers and trading firms for alleged failures to detect and address suspect trading by customers trading through those firms. Collectively, these cases highlight the need for broker-dealers to be vigilant in their efforts to monitor questionable trading by their customers. Notable cases concerning this topic are discussed below.

In January, the SEC charged a Latvian trader for an online scheme that allowed him to manipulate the prices of more than 100 securities listed on the New York Stock Exchange (“NYSE”) and NASDAQ exchanges. The SEC alleged that on more than 150 occasions over a period of 14 months, Igors Nagaicevs broke into online brokerage accounts of the customers of U.S. broker-dealers and made unauthorized purchases and sales. According to the complaint, Nagaicevs then generated profits by trading in those securities anonymously at manipulated prices through electronic trading firms. In addition to the case against Nagaicevs, the SEC also instituted administrative proceedings against the four electronic trading firms and eight executives of those firms for allowing Nagaicevs to trade through their platforms without first registering as a broker. According to the SEC, the absence of registration permitted Nagaicevs direct access to the U.S. markets while bypassing the protections of the federal securities laws, including requirements for brokers to maintain and follow adequate procedures to gather information about customers and their trading. One of the firms and two of the executives agreed to a consent order finding that they committed or aided and abetted and caused broker registration violations and, as to the individuals, penalties of $35,000 each.

In September, the SEC instituted settled administrative proceedings against Hold Brothers On-Line Investment Services (“Hold Brothers”) and three of its executives for their alleged role in facilitating a trading scheme perpetrated by overseas traders. The traders allegedly used Hold Brothers accounts to engage in “layering” or “spoofing,” a process by which a trader places and cancels orders without any intention of having them executed, but rather to move the market and thereby cause other market participants to enter into trades at prices caused by the canceled orders. The SEC alleged that the three Hold Brothers executives were aware of several e-mails regarding manipulative trading through Hold Brothers customer accounts, but failed to properly investigate the conduct. The two Hold Brothers customers whose accounts were used for the trading, Trade Alpha Corporate Ltd. (“Trade Alpha”) and Demonstrate LLC (“Demonstrate”), were also charged. All of the defendants settled the charges without admitting or denying the findings. Hold Brothers agreed to pay $635,000 in disgorgement and interest and nearly $1.9 million in penalties. The firm further agreed to a censure and to cease and desist from committing or causing any violations of Sections 9(a)(2) and 17(a) of the Exchange Act, and Rules 17a-4 and 17a-8 promulgated thereunder. Trade Alpha and Demonstrate agreed to pay over $1.25 million in disgorgement and to cease and desist from committing or causing any violations of Sections 9(a)(2) and 17(a) of the Exchange Act. Finally, three Hold Brothers executives, including the company’s founder, entered into settlements with the SEC, which included industry bars, cease-and-desist orders, and individual penalties of $75,000.

In December, the SEC instituted settled administrative proceedings against Biremis Corp. (“Biremis”), a Toronto-based brokerage firm, and two of its executives for an alleged failure to supervise overseas day traders who used the firm’s order management system for layering. According to the SEC’s order, the respondents failed to address numerous instances of layering by many of the overseas day traders using the system. Biremis and the executives agreed to settlements in which the company’s registration as a U.S. broker-dealer was revoked, and the executives agreed to be permanently barred from the securities industry and to each pay a penalty of $250,000.

D. Sales Practices

In August, the SEC instituted settled administrative proceedings against Wells Fargo Brokerage Services (“Wells Fargo”) and a former Vice President of the firm for allegedly selling investments tied to mortgage-backed securities without fully understanding their complexity or adequately communicating the risks to investors. According to the SEC’s order, the firm sold asset-backed commercial paper structured with high-risk mortgage-backed securities and CDOs to municipalities, nonprofit institutions, and other customers. The SEC alleged that the firm did not obtain sufficient information about the investments and relied primarily on their favorable credit ratings, and did not fully appreciate the risks and volatility of the investments before recommending them to investors with generally conservative investment objectives. As part of its settlement, Wells Fargo agreed to pay $65,000 in disgorgement and $6.5 million in penalties, and the former Vice President agreed to a $25,000 penalty and a six-month suspension from the securities industry. The SEC noted that since 2007, the firm has taken a number of remedial measures to ensure that its registered representatives have adequate information about the nature and risk of investments recommended to customers, and that relevant information about those investments are communicated to investors.

In September, the SEC charged three former JP Turner & Company (“JP Turner”) brokers with “churning.” The SEC alleged that the brokers’ churning activities generated commissions, fees, and margin interest of approximately $845,000, while also causing client losses of approximately $2.7 million. The SEC also charged the former head supervisor at JP Turner, Michael Bresner, firm President William Mello, and the firm itself with compliance violations and failure to supervise. JP Turner and Mello have agreed to settle with the SEC, but administrative proceedings remain pending against the three former brokers and Bresner. As part of the settlement, Mello consented to a $45,000 penalty and a five-month bar from acting in a supervisory capacity with a broker, dealer or investment adviser. Regarding the entity’s settlement, JP Turner agreed to hire an independent consultant to review its supervisory procedures, and pay $200,000 in ill-gotten commissions and fees, a $200,000 penalty, and $16,051 in prejudgment interest.

E. Exchanges and High-Frequency Trading

High-frequency trading was an area of renewed SEC attention last year. The agency has gone to great lengths to ensure that market participants do not receive informational advantages, even when those advantages can only be measured in fractions of a second. For example, in September, the SEC instituted a settled administrative proceeding against the parent company of the NYSE alleging violation of Regulation NMS as a result of data transmission disparities. According to the SEC’s order, the exchange violated Regulation NMS by sending data through two of its proprietary feeds before sending that data to be included in what are known as consolidated feeds, which broadly distribute trade and quote data to the public. The transmission disparities apparently had several causes, including a software issue that caused delays for certain consolidated feeds, and a system design flaw that allowed one of the proprietary feeds to bypass an internal distribution system, thus creating a faster path to select clients. According to the settlement, the NYSE’s parent company paid a $5 million civil penalty, marking the first time the SEC imposed a fine on an exchange. In announcing the case, Enforcement Director Khuzami emphasized the importance of simultaneous delivery of market information to all market participants, noting that “early access to market data, even measured in milliseconds, can in today’s markets be a real and substantial advantage that disproportionately disadvantages retail and long-term investors.”

Former Chairman Schapiro subsequently highlighted the risks of technological errors in the ever-changing securities markets. Schapiro noted at the SEC’s Market Technology Roundtable in October that “[t]o an extraordinary extent, the stability of our securities markets is tied to the technological infrastructure of those markets. . . . Thanks to technology, our securities markets are more efficient and accessible than ever before. But we also know that technology has pitfalls. And when it doesn’t work quite right, the consequences can be severe.” Schapiro went on to say that, just as technological errors can cause traffic, plane, or train accidents, so too can they harm the securities markets. “[T]rading can be disrupted, investors can suffer financial loss, firms can be imperiled, and confidence in our markets broadly can erode.” Erozan Kurtas, an Assistant Director in OCIE’s Quantitative Analytics Unit, echoed Chairman Schapiro’s sentiment in a speech in December by calling for greater oversight from investment and trading firms over quantitative trading models. Kurtas emphasized that asset managers who employ quantitative strategies must conduct thorough testing of their systems and models to ensure that their strategies operate in a manner consistent with representations that were made to investors.

Because technological problems in the securities markets have caused significant losses in recent years, the SEC will likely continue to focus intensely on this area in 2013.

IV. Insider Trading

Insider trading remains a high priority for the SEC, as well as federal criminal prosecutors. Since 2009, the Unites States Attorney’s Office in Manhattan (“SDNY”) has charged 75 individuals with insider trading crimes. Of those charged, the government has obtained 71 guilty pleas or verdicts. Of the 11 defendants who have taken their cases to trial, all have been found guilty by juries. For FY 2012, the SEC brought a total of 58 insider trading actions against 131 individuals and entities, a 56% increase from the 37 cases brought by the Commission in 2009. The major developments in the last half of 2012 are set forth below.

A. Criminal Prosecutions

As noted above, the government continues to have a high level of success at prosecuting insider trading cases. In December, two former hedge fund managers – Anthony Chiasson of Level Global Investors and Todd Newman of Diamondback Capital Management – were found guilty after trial on charges of insider trading allegedly resulting in more than $70 million in profits from trades in technology stocks, including Dell Inc. and Nvidia Corp. While seven people were originally named in the indictment, only Chiasson and Newman chose to stand trial, while the other five defendants pleaded guilty and agreed to cooperate with prosecutors.

This past year, one of the government’s most highly publicized insider trading cases, against Rajat Gupta, reached a resolution at the district court level. The case alleged that, while serving as a director of Goldman Sachs and Proctor & Gamble, Gupta provided confidential financial information concerning those companies to Galleon Group hedge fund manager Raj Rajaratnam. Gupta was found guilty by a jury in June, and in October was sentenced to two years in prison. Gupta remains free on a $10 million bond and has appealed his conviction. The Second Circuit has agreed to expedite the appeal, which will be heard as soon as April 2013.

B. Continued Focus on Alleged Insider Trading at Hedge Funds

Over the past few years, the SEC’s focus on alleged insider trading by hedge funds has shown no sign of wavering. In November, the SEC and the SDNY filed parallel civil and criminal insider trading charges against Matthew Martoma, a former portfolio manager of hedge fund advisory firm CR Intrinsic Investors, which is a whollyowned division of S.A.C. Capital Advisors, LP. The government alleged that Martoma received confidential information from medical consultant Dr. Sidney Gilman on negative results from testing of an Alzheimer drug being jointly developed by two pharmaceutical companies. Dr. Gilman served as Chairman of the safety monitoring committee overseeing the drug trials. The government alleged that Martoma caused several hedge funds to sell the securities they held in the pharmaceutical companies and establish short positions that resulted in approximately $276 million in profits and avoided losses. Martoma has pleaded not guilty to the criminal charges. Dr. Gilman has entered into a non-prosecution agreement with the government and has agreed to repay the benefits he received from Martoma, and to cooperate with the government.

The SEC also brought cases against individuals associated with broker-dealers who allegedly misused confidential information. In December, the SEC amended a previously filed complaint to include charges against Trent Martin, a research analyst at a brokerage firm in Connecticut. The complaint alleged that Martin used material nonpublic information regarding IBM’s acquisition of SPSS Inc. for his own benefit, and also disclosed this information to his roommate and a fellow retail broker–resulting in more than $1 million in unlawful profits.

The SEC has also extended its pursuit of insider trading claims to foreign private issuers. In December, the SEC filed a settled insider trading action against Sung Kook Hwang, founder and portfolio manager of two New York-based hedge fund advisory firms, Tiger Asia Management and Tiger Asia Partners, alleging unlawful trading in Chinese bank stocks that generated $16.7 million in profits. The complaint alleged that the defendants committed insider trading by short selling three Chinese bank stocks on the basis of confidential information, and then covered the short positions with private placement shares purchased at significant discounts. In settlement, Hwang and the advisory firms agreed to pay approximately $19 million in disgorgement and interest, and approximately $8 million each in penalties. Hwang and the firms also agreed to plead guilty to parallel criminal charges in New Jersey.

Significant insider trading cases were not limited to the financial center of the New York area. For example, in December, federal prosecutors unsealed an indictment charging a former Wells Fargo Securities investment banker, John Femeni, and two other individuals with insider trading. The indictment alleged that Femeni provided tips to a network of close friends and family regarding four pending mergers involving Wells Fargo Securities’ clients. The case is notable for its geographic breadth: prosecutors confirmed that six individuals in North Carolina, South Carolina, Florida, California and New York have already pleaded guilty. Similarly, in November, California prosecutors charged former Major League Baseball player Doug DeCinces and three others for allegedly illegal trading based on confidential information concerning a California medical device company. Also in November, New Jersey prosecutors charged three individuals for insider trading at three health care companies.

C. Developments in the Law of Insider Trading

In a recent and notable Second Circuit opinion, the court wrote at length regarding standards governing liability under the misappropriation theory of insider trading. By way of background, on April 25, 2006, after a four-year investigation, the SEC charged Nelson Obus and Peter Black of Wynnefield Capital, a New York-based hedge fund, and Thomas Strickland, a former employee of GE Capital, under both the classical and misappropriation theories of insider trading, alleging that Obus and Black illegally traded shares of SunSource stock after receiving material nonpublic information from Strickland. District Judge George B. Daniels granted summary judgment for all three defendants under both theories and dismissed the case. Among other things, Judge Daniels held that the SEC failed to establish that Strickland had breached a fiduciary duty to his former employer, GE Capital, and, accordingly, neither Obus nor Black could have inherited this breach.

The SEC appealed the lower court’s decision only with respect to the misappropriation theory, and on September 6, 2012, the Second Circuit reversed. In particular, the appellate court found that the SEC had sufficiently established genuine issues of material fact as to whether Strickland breached a fiduciary duty to his former employer, which included an obligation to GE Capital to keep SunSource’s information confidential. The court noted that in order to establish “tipper” liability, the government must prove, among other things, that Strickland received a personal benefit from the disclosure. Obuspermits this prong to be satisfied merely by establishing that the tipper “ma[de] a gift of information to a friend.” The most notable aspect of the Second Circuit’s decision, however, is the court’s expansion of “tipper-tippee” liability. Obus suggests that “actual knowledge” of the fiduciary breach is not required, and that tippee liability may be established where the tippee, as a sophisticated investor, knew or should have known that the information was improperly disclosed.

V. Public Company Accounting and Financial Reporting

A. U.S.-Traded Chinese Companies

As we noted in our Mid-Year Update, the SEC and the Public Company Accounting Oversight Board (“PCAOB”) have spent significant resources pursuing accounting fraud actions against China-based foreign private issuers. Enforcement has also established a “Cross Border Working Group” to concentrate on foreign-based issuers. This trend continued through year-end. With access to corporate data at overseas firms limited, the SEC and the PCAOB have concentrated on “access” persons–accountants and intermediaries who have a role in the public offering or reporting process.

1. Actions Against Issuers and Executives

Chinese companies and executives faced a year of heightened SEC scrutiny over alleged accounting irregularities. The SEC initiated a number of cases against Chinese issuers in the first half of 2012, and that trend continued unabated in the second half of the year. The SEC aggressively pursued de-registration proceedings against Chinese issuers for failing to provide timely financial reports, and in December alone instituted revocation proceedings against three Chinese issuers and revoked the registration of one Chinese issuer.

In addition to the de-registration proceedings, the SEC filed an action against China Sky One Medical, Inc. (“CSKI”) and its CEO Yan-qing Liu in September, alleging corporate reporting, recordkeeping, internal controls, and false statement violations. The SEC alleged that CSKI, a weight-loss company, falsely reported in annual and quarterly reports that it had entered into a distribution agreement with a Malaysian company resulting in the recognition of $19.8 million of false export revenue. The complaint seeks financial penalties against CSKI, disgorgement from Liu, and the clawback of incentive-based compensation that Liu received.

In November, the SEC filed an action against China North East Petroleum Holdings (“CNEP”) and various executives. The SEC alleged that the defendants misrepresented how CNEP would use offering proceeds, and that the executives then diverted millions of dollars in proceeds to their personal accounts. During 2009, CNEP and its executives allegedly engaged in at least 176 undisclosed, related-party transactions totaling approximately $59 million.

In December, the SEC filed an action against Huakang “David” Zhou for allegedly defrauding investors while helping over 20 Chinese companies gain access to U.S. capital markets through reverse mergers. Among other things, the complaint alleges that Zhou–through his company, Warner Technology and Investment Corporation–used proceeds from investors to pay $271,500 toward his mortgage and to “refund” his wife $40,000. Additionally, the SEC alleges that several of the Chinese issuers that Zhou assisted later failed. Zhou allegedly acted as an unregistered securities broker, made material misrepresentations and omissions to investors, and committed securities fraud. The defendant is contesting the SEC’s allegations.

2. Actions as to Audit Firms

The SEC has sought documents from the overseas member firms of the large international accounting firms, even though the Chinese authorities have not allowed these firms to produce the documents. In connection with this impasse, last year, the SEC filed an action against Deloitte Touche Tohmatsu CPA Ltd., a Chinese audit firm, in U.S. District Court seeking production of documents. That action remained pending as U.S. and Chinese authorities discussed a possible solution to the issue of audit firm oversight. From published reports, however, it appears that governmental discussions have not yet resulted in an agreement.

In December, the SEC initiated administrative proceedings against Chinese members of each of the “Big Four” accounting firms, as well as against a BDO Seidman Chinese member firm, alleging that each firm failed to produce audit workpapers as to certain audit clients that are the subject of enforcement investigations as required by Section 106 of the Sarbanes-Oxley Act of 2002 (“SOX”). Under the SEC’s Rules of Practice, an initial decision of the administrative law judge must be filed within 300 days, putting a tight time limit on this ongoing process.

This standoff has not halted all enforcement investigations of auditors of foreign private issuers. In September, the PCAOB instituted settled disciplinary proceedings against Michael T. Studer, CPA, and his accounting firm. Studer allegedly hired a Canadian consulting firm to assist with his audit of two Chinese-based issuers. According to the PCAOB’s order, the Canadian firm prepared deficient audit documentation in multiple audit areas, and Studer maintained insufficient quality control practices to prevent the documentation errors. Nonetheless, Studer and his firm issued unqualified audit reports for the issuers from 2006–2008. The PCAOB censured Studer, required 60 hours of continuing professional education, imposed an independent third-party monitorship over his firm, and banned Studer and his firm from preparing an audit report subject to the PCAOB’s jurisdiction until the monitor issues a Certificate of Compliance.

B. Financial Crisis-Related Cases

Several financial crisis cases entail alleged financial reporting violations. In July, the SEC brought another enforcement action concerning the structuring and marketing of a CDO backed by subprime residential mortgage-backed securities. The SEC brought settled actions against Mizuho Securities USA and three former employees, as well as the CDO collateral management firm and its portfolio manager. The SEC alleged that the defendants and respondents obtained a more favorable rating on the CDO from a rating agency by including in the portfolio submitted to the rating agency assets of higher credit quality that were not included in the final CDO portfolio. In settlement, Mizuho agreed to pay $10 million in disgorgement and a $115 million civil penalty. The collateral management firm agreed to a settlement including approximately $4.5 million in disgorgement and penalties. The individual respondents agreed to settlement including penalties and industry suspensions of varying durations.

In September, the SEC brought an action against former TierOne Bank (“TierOne”) CEO Gilbert G. Lundstrom, COO James Laphen, and Chief Credit Officer Don A. Langford, alleging that the defendants understated the losses incurred on impaired loans and real estate repossessed by the bank. The SEC alleges that the executives disregarded information that TierOne had overvalued certain assets and relied on “stale and inadequately discounted appraisals,” notwithstanding an Office of Thrift Supervision direction to maintain a higher capital ratio as a result of an increase in high-risk loans. Lundstrom and Laphen agreed to final judgments barring them from serving as an officer or director of a public company, and imposing civil penalties of $500,921 and $225,000, respectively. Langford did not join the settlement, and his case continues in the District of Nebraska.

Also, as previously discussed, in November the SEC instituted its first enforcement action involving FAS 157 in settled administrative proceedings against KCAP, a business development company registered under the IC Act, and certain of its executives. The SEC alleged that KCAP and the charged executives did not consider market activity in estimating the fair value of debt securities in its portfolio, and also overstated the value of CLOs in its portfolio because it carried them at cost. KCAP allegedly violated disclosure, books and records, and internal reporting provisions. The company agreed to cease-and-desist from future violations of Section l3; the CEO and Chief Investment Officer each agreed to pay a $50,000 civil penalty; and the CFO agreed to pay a $25,000 penalty.

C. Executive Compensation Clawbacks

Since our Mid-Year Update, the SEC’s effort to obtain “clawback” relief from corporate executives under SOX Section 304 has proliferated. In addition to the pending action against the CEO of Chinese-issuer CSKI, the SEC also filed an action against three former executives of Electronic Game Card, Inc., as well as the company’s independent auditor. The SEC complaint alleges that the defendants reported false revenue, provided falsified documents to outside auditors, misrepresented business operations, and failed to disclose related-party transactions. Among other relief, the SEC seeks to clawback compensation received by the former CEO and CFO.

In December, the SEC brought an action against TheStreet, Inc. (“TheStreet”), and three of its former executives, alleging misstated revenues and operating income. Greg Alwine and David Barnett, former Co-Presidents of a subsidiary that TheStreet had recently acquired, allegedly fabricated documents and conducted sham transactions to improve revenue numbers. The SEC also alleged that the former CFO of TheStreet, Eric Ashman, failed to implement adequate internal controls after acquiring the subsidiary, thus causing TheStreet to overstate its income. Ashman agreed to a five-year officer and director bar, a $125,000 civil penalty, and to repay TheStreet $34,240 under SOX Section 304. Barnett and Alwine agreed to 10-year officer and director bars, and to pay civil penalties of $130,000 and $120,000, respectively. TheStreet agreed to be permanently enjoined from future violations of the federal securities laws, but was not required to pay any penalty.

D. Municipal Securities

Enforcement’s Municipal Securities Unit has also recently brought several noteworthy matters regarding “pay-to-play” conflict of interest claims. In May, the SEC filed an action against former Detroit Mayor Kwame M. Kilpatrick; former City Treasurer Jeffrey W. Beasley; MayfieldGentry Realty Advisors LLC (“MayfieldGentry”), which served as the investment adviser to Detroit’s public pension funds; and Chauncey Mayfield, who is the founder, President, CEO, and majority owner of MayfieldGentry. The SEC’s complaint alleged that Kilpatrick and Beasley, trustees of the pension funds, engaged in a pay-to-play scheme involving kickbacks in exchange for influence over the funds’ investments. Kilpatrick and Beasley allegedly received more than $125,000 in private jet travel and entertainment while MayfieldGentry concurrently sought the funds’ approval for over $115 million in investments. Kilpatrick and Beasley have defaulted, but the litigation against Mayfield and his investment advisory firm continues in the Eastern District of Michigan.

In September, the SEC brought an action against Goldman Sachs and former executive Neil Morrison alleging a violation of the pay-to-play rules relating to municipal securities underwriting. This marked the first enforcement action in which the SEC alleged violations based on “in-kind” noncash contributions to a political campaign. In this case, Morrison allegedly conducted campaign activities on behalf of the then Massachusetts state treasurer and gubernatorial candidate, Timothy Cahill. According to the SEC, those activities should have disqualified Goldman from engaging in municipal underwriting business with certain municipal issuers for two years. However, Goldman subsequently participated in a number of municipal underwritings. Without admitting or denying the SEC’s allegations, Goldman settled the claim, paying $7.5 million in disgorgement and a $3.75 million civil penalty. This case highlights the need for those firms engaged in municipal underwriting to monitor not only campaign contributions by their employees, but also the use of the firm’s resources to conduct campaign activities.

Print

Print