The following post comes to us from Maureen Errity, Director, Center for Corporate Governance at Deloitte LLP, and is based on the introduction and key findings of a Deloitte and Society of Corporate Secretaries and Governance Professionals’ report, titled “2012 Board Practices Report;” the full text, including survey results, figures, and appendices, is available here.

The 2012 Board Practices Report (the “Report”) is the eighth edition published by the Society of Corporate Secretaries and Governance Professionals. The Report presents findings from a survey conducted in July and August 2012 of the Society’s membership, which includes 3,000 individuals from more than 1,600 companies of varying sizes, industries, and organizational structures. The questions cover 16 board governance areas, including both established board practices and new trends in board activity.

The Report and its accompanying questionnaire were developed with Deloitte LLP’s Center for Corporate Governance.

Methodology

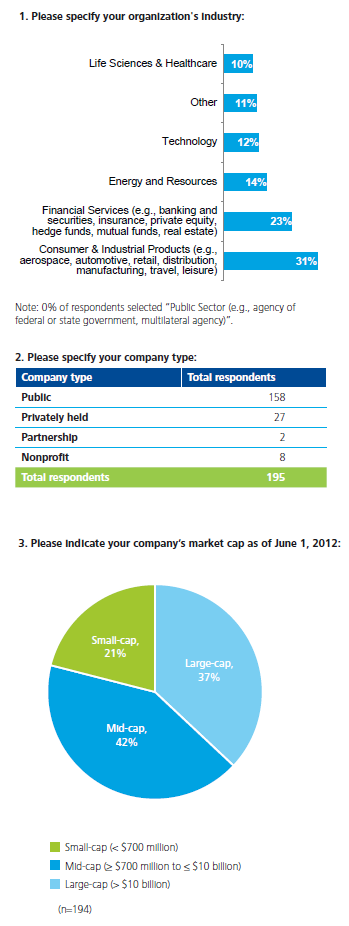

The survey, administered via an online application, contained a total of 78 questions, not including the sub-questions applicable to questions 16, 17, 19, 37, 50, and 74. A total of 195 individuals participated in the survey, although not all questions were answered by all respondents. In such cases, an “n” value is included with the result. Results from the 2011 Board Practices Report are included where available to show trends in various sections of the Report.

Percentages are based on the number of respondents to a particular question, and in some instances, percentages that should together form a whole may not add up to 100% (e.g., 28% “Yes,” 73% “No”), due to rounding to the nearest whole digit.

Participation in the survey was confidential, and the results provided cannot be attributed to a specific company.

Contents

Survey responses were analyzed in three categories: all participating companies, public companies, and nonpublic entities. Public company results are presented by market capitalization (small, mid, and large) and by broad industry sectors (financial and nonfinancial). The results correspond with the Report sections to follow.

Participant overview

The responses to the survey’s first three questions provide detail on the industry, type, and size of participating companies.

2012 Key findings and common practices

Key findings of the 2012 survey:

Room for improvement in board diversity

More than 80% of respondents say that the percentage of women and minorities on their boards is at most 25%, and less than 15% say that the percentage has increased since last year.

Industry knowledge tops list of desired director experience

The type of skill and experience most desired for board success in the next two years is industry knowledge, followed by C-level experience, international business exposure, technology/IT, and operations.

Classified boards declining

Compared to the results from last year’s report, 4% fewer public companies report a classified, also known as “staggered”, board structure. The most significant change in this area is with small-cap company boards, 46% of which had a staggered election of directors in 2012, down from 52% in 2011.

Separate CEO and chairman roles: a split outcome

Just over half of respondents, 51%, currently separate the role of the chairman and CEO, about the same as last year.

Increased special meeting rights

The proportion of public companies with special meeting rights for shareholders increased among large- and mid-cap companies (71% of large-caps now have such rights, compared with 61% among 2011 respondents). However, findings do not show that companies have lowered their thresholds for calling such meetings, despite shareholder pressure to do so.

Directors are receiving meeting information earlier

Compared to last year’s study, there is a 10% decline in directors receiving board meeting information five or fewer days in advance of the meeting. Instead, more directors report getting information six or more days in advance of meetings. This could be attributed to an increase in board usage of technology, such as tablet devices and board portals.

Variation in risk oversight practices

How boards are assigning risk oversight for the organization’s risk management program varies. Only 7% say they have a board risk committee, and the remaining responses display little variation in those saying the responsibility is spread across all board committees; to the audit committee; and to the full board.

Increases in shareholder engagement

More directors report having direct contact with shareholders or shareholder groups — 42% this year compared to 36% in the 2011 survey.

Greater use of technology by boards

Eighty-three percent (83%) of boards say that their use of technology for board matters has increased year-over-year; this is in line with trends from the 2011 report. Compared to last year, more boards are using tablets and board portals, and fewer are distributing materials in hard-copy format.

More company involvement in ethical matters

Compared to last year’s results, 5% more companies report taking steps to create or enhance a culture of candid and open communication, and 4% more say they conduct cultural surveys on an annual basis. Further, there has been a significant increase in companies that have management review cultural survey findings with the board.

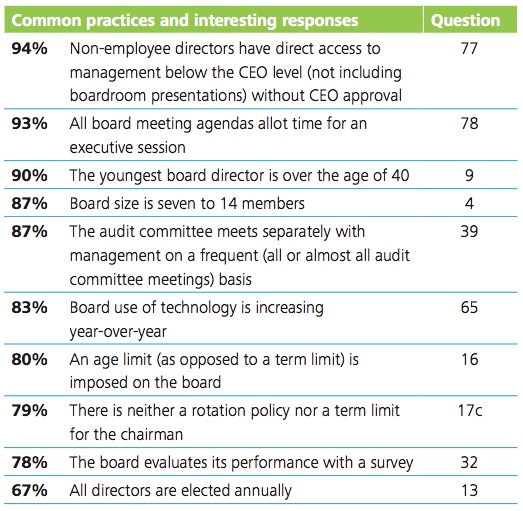

Presented in the following table are some of the most common practices and interesting responses derived from the survey’s results.

The full report, including survey results, figures, and appendices, is available here.

Print

Print