The following post comes to us from Michael Klausner, Nancy and Charles Munger Professor of Business and Professor of Law at Stanford Law School, and Jason Hegland, Project Manager for Stanford Securities Litigation Analytics.

In a recent article in the PLUS Journal, we presented some simple statistics on settlement timing in securities class actions. The data cover cases filed between 2006 and 2010 and settled between 2006 and 2012. They come from a database we recently completed and will keep current. The article can be found on the PLUS website through their search bar, or here. Our plan is to follow up with a more detailed econometric analysis. In this post, we summarize some of the descriptive statistics included in that article, and we invite comment, interpretation and other reactions.

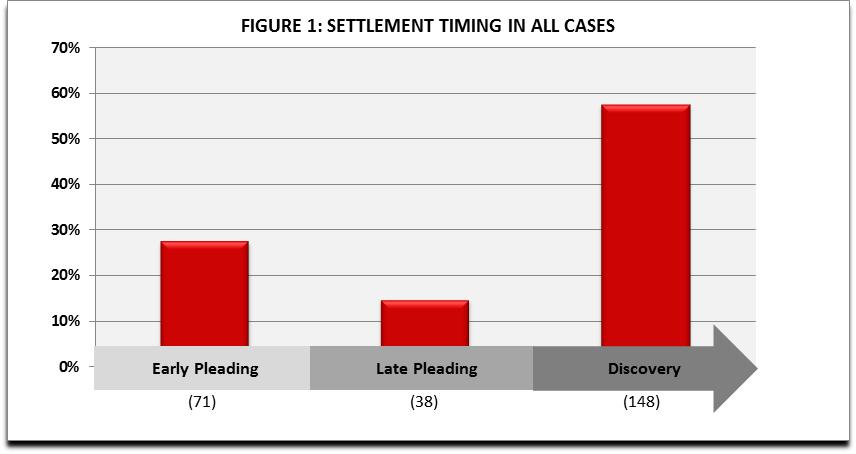

In order to summarize data on settlement timing, we divide a case into three phases:

- Early Pleading—the period before the first motion to dismiss is ruled on. A settlement during this phase of a case reflects the parties’ decision not to risk a ruling on a motion to dismiss.

- Late Pleading—the period after the first consolidated complaint has been dismissed without prejudice but before a motion to dismiss a later consolidated complaint has been denied. Parties who settle during this stage of the litigation have risked a ruling on at least one motion to dismiss but choose to settle before the judge has finally ruled on dismissal.

- Discovery—the period after a motion to dismiss has been denied and a case heads toward discovery and potentially to trial. These cases settle sometime between the day the motion to dismiss is denied (in which case discovery has not actually begun) and the end of a trial.

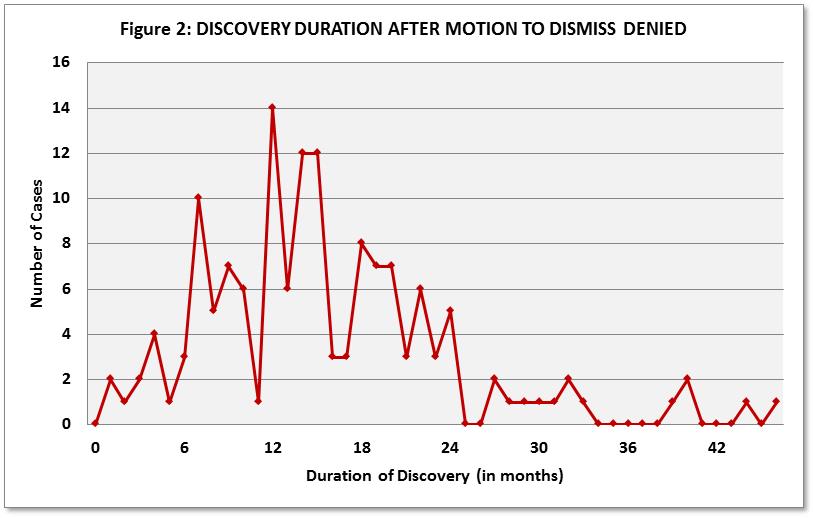

Figures 1 and 2 summarize our findings with respect to settlement timing. Figure 1 shows that roughly 42% of all settlements occur before the pleading stage of a case ends—that is, in Phase 1 or 2. Figure 2 shows the distribution of settlements across the period of discovery. There are a total of 148 cases that settled during discovery. Among these cases, the median amount of time from the denial of the motion to dismiss to settlement was 14 months. Over the first month following the denial of the motion, two cases settled and, over the first six months, 13 cases settled. The longest duration until settlement is 46 months, but some cases in our sample period have still not settled, so that number may turn out to be larger. Going back in our database to cases that were filed beginning in 2000, a few cases took five to seven years to settle following the denial of the motion to dismiss.

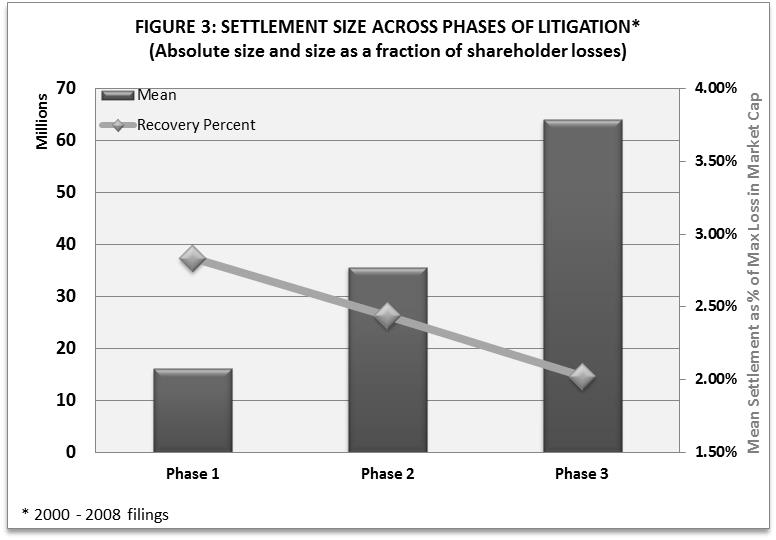

Figure 3 shows the relationship between settlement timing and the amount paid in settlement. Settlements in later stages of the litigation are larger in terms of dollar figures. But they are lower in terms of the percentage of shareholder losses, measured crudely by the maximum market capitalization of the company during the class period minus its market cap the day after the class period.

What explains this inverse relationship? Shareholder losses are a function of company size and the size of the stock drop, measured in percentage terms, when a misstatement is disclosed. We compared each of these factors across cases that settled in each phase and found that company size is the explanation. Large companies (measured by market capitalization) tend to settle later than smaller companies and, not surprisingly, large company settlements tend to be larger in absolute terms than small company settlements. On the other hand, small companies tend to settle for a larger fraction of shareholder losses than do larger companies. The relationship between company size and settlement timing appears as well when we look at settlement timing within the discovery phase. Large companies tend to settle later in discovery than do small companies.

The full article is available for download here.

Print

Print