The following post comes to us from Robert E. Hallagan and Dennis Carey, both Vice Chairmen at Korn Ferry, and is based on portions of a survey conducted by the Korn Ferry Institute. The complete publication is available here.

This is our second annual report on board leadership.

The numbers and trends are interesting but the subtleties and substance behind them are extremely valuable as the National Association of Corporate Directors (NACD) and Korn Ferry continue their study of high-performing boards. The thoughtful selection and performance of board leaders is one of two pillars of leadership that drive long-term shareholder value—the other being the CEO of the company.

There is universal agreement that each board must have an independent leader but how each company has achieved this takes many shapes.

In this year’s report, we see continued evidence of a slow and deliberate trend toward separation of the roles, higher in mid-cap companies than the large-cap S&P 500. Key catalysts included activism, and a transition of CEO leadership that prompted the board to elect to separate the roles. Between this report and the next, Korn Ferry and NACD will be in active discussion with companies that have changed leadership structures in the last several years and will ask the following questions to uncover what is driving long-term shareholder value:

- What has changed from the perspectives of the board, CEO, shareholders, and leadership team? We hope to understand both the positive and negative changes.

- How have you defined the board leadership role and how would you evaluate success?

- Are there best practices in selecting a board leader and, most importantly, are there unique leadership characteristics among board leaders?

- Do you think you will combine roles in the future and under what circumstances?

- In cases where there is both a non-executive chairman and lead director, how do boards clearly delineate the different roles?

In our first report we stated our commitment to remaining an honest broker of facts in the performance debate. Many proponents of separation claim it will enhance long-term shareholder value, yet no study to date has rendered conclusive evidence in either direction. We have now isolated companies that have made the change, documented their performance before and after, and will soon be comfortable debating the results. While we clearly understand the danger in relying solely on numbers and acknowledge that there are many potential ways to slice the data, we believe our attempt to get at the “facts” will generate engaged, healthy debate among our members and clients. We look forward to a rich dialogue at NACD conferences to come.

Methodology and approach

This study examined changes to and trends in board leadership structure for 900 US companies, namely the constituents of Standard & Poor’s Large Cap 500 Index (S&P 500) and the Mid-Cap Index (the S&P 400) as of December 31, 2012. Companies are added to the S&P 500 if they have unadjusted market capitalization of $4.6 billion or more, and to the S&P 400 if they have unadjusted market capitalization of between $1.2 billion and $5.1 billion. The S&P 500 Index represents a barometer of the state of the largest publicly traded US corporations, and the majority of the research and analysis in this study focuses on this group. To expand the scope beyond large-cap companies, and thus broaden the findings of the research, the constituents of the S&P 400 were also examined in detail.

For each company, we looked at the type of board leadership structure in place at the time of its proxy filing for each year between 2008 and 2012. This report focuses primarily on the leadership structure in place as of year-end 2012, and examines each company’s overall leadership approach as it pertains to the roles of chairman, CEO, and lead director (if at all). Proxy filings, annual reports, and the corporate governance section of company websites comprise the source documents for these determinations. Please note that numbers shown in this report reflect actual statistics and not data projected from a random sampling of companies.

In addition, each company that had a change in its leadership structure since January 1, 2003 (by replacing either the CEO or chairman) was investigated to understand the reason for the change, and additional details—such as tenure, age, education, committee responsibilities—were sought for the incoming chairman. Company and outside press reports and news articles were used to determine the reason for an executive’s departure, and executive biographical and company data were culled from secondary sources, including Reuters, Businessweek, MarketWatch, and Morningstar.

The trend to separate roles continues to move steadily forward.

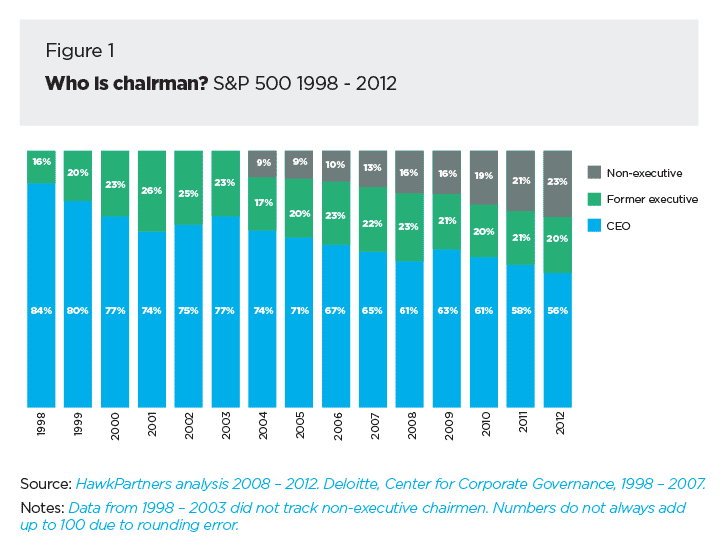

Though board composition is not likely to be an area marked by rapid, significant change, the slow and steady trend to separate chairman and CEO roles continued in 2012. By the end of 2012, 56% of S&P 500 chairmen also held the position of CEO. This marks a significant departure from 2009, when 63% of all chairmen also held the company’s highest executive office. The change comes almost equally from increases in non-executive chairmen and chairmen who have some past affiliation with the company; additional analysis in this report will examine what types of companies are likely to favor the different approaches.

While it is reasonable to expect this gradual trend to continue, particularly as activist shareholders keep pushing for separation, some large companies, including IBM, Disney, and Urban Outfitters, are moving in the opposite direction and are recombining roles. In the case of IBM and Disney, the recombinations are part of longterm succession, though IBM Chairman-CEO Ginny Rometty added the Chairman role just 10 months after becoming CEO—faster than many expected. In the case of Urban Outfitters, founder Richard Hayne reclaimed the CEO role after his successor had difficulty maintaining the main brand’s appeal to young people. Our continued perspective is that there is no one-size-fits-all approach to board leadership and that careful analysis and trusted advisors should be leveraged to find the appropriate structure for each organization.

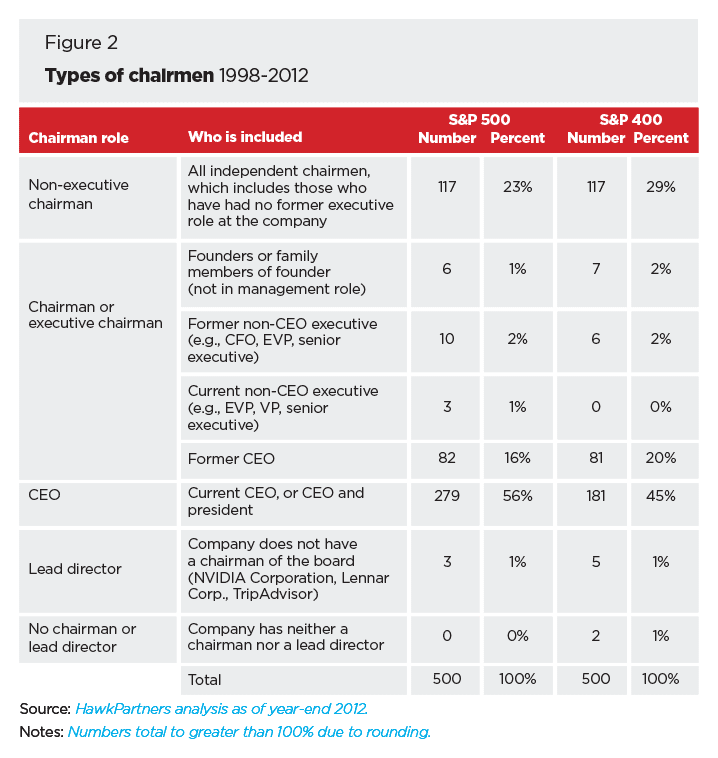

In our opinion, chairmen must meet several criteria to qualify as truly “non-executive” or independent. They must not currently hold an executive role (CEO or other), must not be former executives, and must not be founders or family members of founders. From time to time, companies may characterize these types of chairmen as “non-executive” in the language of their proxy reports or even in the chairman’s title, but our analysis re-characterizes them per the criteria above. The idea of an independent chairman is that he or she can bring an impartial and objective perspective to the board, and our experience finds that founders, family members of founders, and former executives tend not to possess that objectivity. This particular debate on nomenclature is a classic case of saying it doesn’t make it so. Being independent in title is not necessarily a reflection of reality. An analysis of the types of chairmen found in the S&P 500 in 2012 is described in Figure 2.

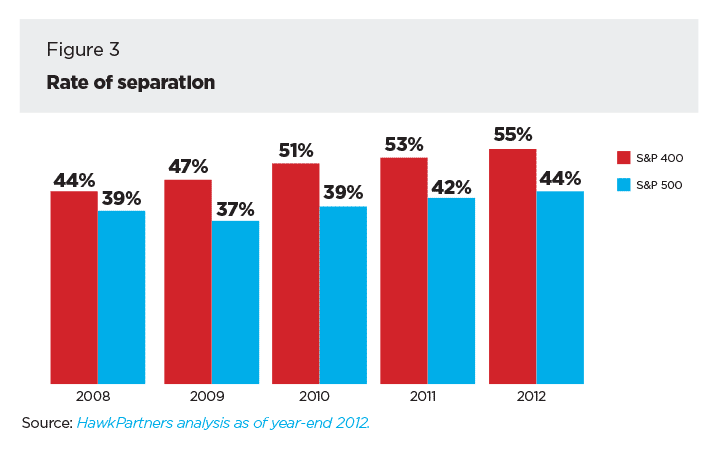

The trend toward separation of the chairman and CEO has been more pronounced over time within the mid-cap companies in the S&P 400 than it has been in the S&P 500. Separation rates in both groups rose by two points in 2012, to 44% in the S&P 500 and 55% in the S&P 400.

Larger companies have been less likely to separate CEO and chairman roles.

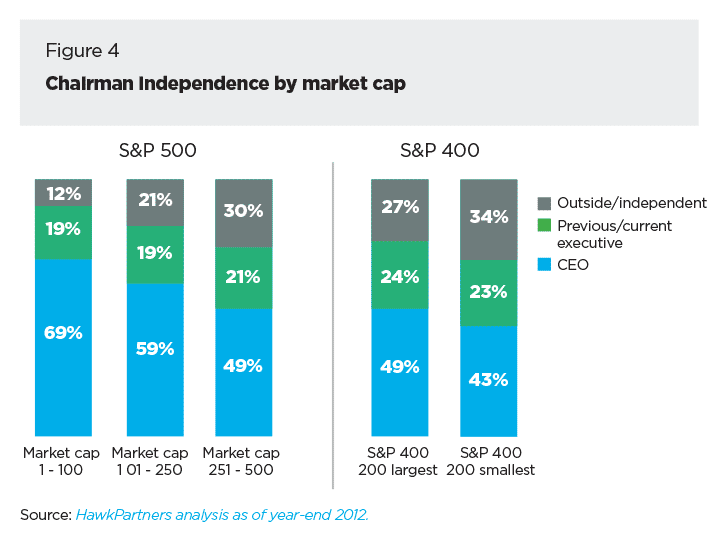

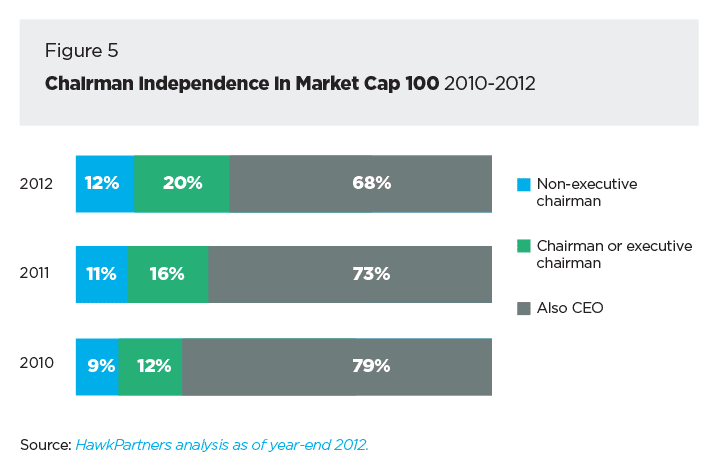

While we see the trend toward separation across the S&P 500, closer inspection reveals that rates of separation vary significantly by market capitalization. The smaller the company, the more likely it is to separate the CEO and chairman roles. While almost 70% of the largest 100 companies in the S&P 500 have combined CEO and chairman roles, just 49% of the smallest 150 companies do. Stepping down to mid-cap companies, those in the S&P 400 are even more likely to separate roles, and follow a similar pattern: 49% of the largest 200 companies have combined CEO and chairman roles, while just 43% of the smallest 200 companies do.

Even in the largest S&P 500 companies, however, the number of non-executive chairmen is rising slowly over time. The number of Market Cap 100 chairmen fitting that description in 2012 is 12%, up from 9% in 2010. It appears that while companies are motivated to shift away from a combined CEO-chairman model, these largest companies are more likely to choose an intermediate strategy—to retain current or former executives as chairmen. Twenty percent of Market Cap 100 companies took such an approach in 2012, as compared with 12% in 2010. The difference in board leadership structure by size may be explained in part by the fact that the global nature of larger companies makes it more important for a company’s leader to be seen as a strong and standalone leader due to differing cultural norms around the world. In most of these larger companies, an independent lead director can provide an outside perspective when the CEO and chairman roles are combined, but the question of how to help a non-executive chairman get up to speed on a complex business is a question deserving of further study.

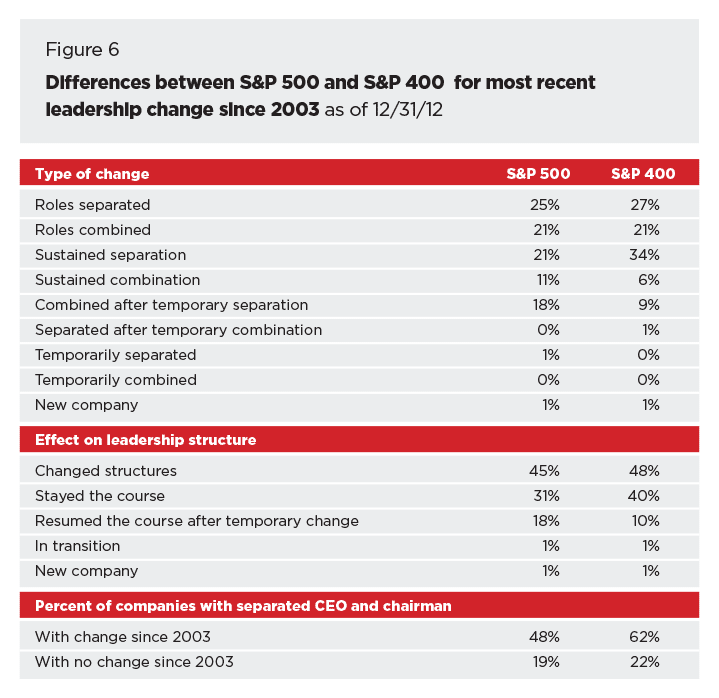

S&P 400 companies are more likely to have a separated structure in general, which leads to a higher rate of sustained separation since 2003. S&P 500 companies, which are more likely to have combined structures, are also more likely to have temporary (generally one year or less) separations but eventually recombine.

The complete publication is available here.

Print

Print Click image to enlarge

Click image to enlarge Click image to enlarge

Click image to enlarge Click image to enlarge

Click image to enlarge Click image to enlarge

Click image to enlarge Click image to enlarge

Click image to enlarge Click image to enlarge

Click image to enlarge