Martin Lipton is a founding partner of Wachtell, Lipton, Rosen & Katz, specializing in mergers and acquisitions and matters affecting corporate policy and strategy. This post is based on a Wachtell Lipton memorandum by Mr. Lipton and Sabastian V. Niles.

On October 22, 2014, Institutional Shareholder Services issued a note to clients entitled “The IRR of ‘No’.” The note argues that shareholders of companies that have successfully “just said no” to hostile takeover bids have incurred “profoundly negative” returns. In a note we issued the same day, we called attention to critical methodological and analytical flaws that completely undermine the ISS conclusion. Others have also rejected the ISS methodology and conclusions; see, for example, the November analysis by Dr. Yvan Allaire’s Institute for Governance of Public and Private Organizations entitled “The Value of ‘Just Say No’” and, more generally, a December paper by James Montier entitled “The World’s Dumbest Idea.” Of course, even putting aside analytical flaws, statistical studies do not provide a basis in individual cases to attack informed board discretion in the face of a dynamic business environment. The debate about “just say no” has been raging for the 35 years since Lipton published “Takeover Bids in the Target’s Boardroom,” 35 Business Lawyer p.101 (1979). This prompts looking at the most prominent 1979 “just say no” rejection of a takeover.

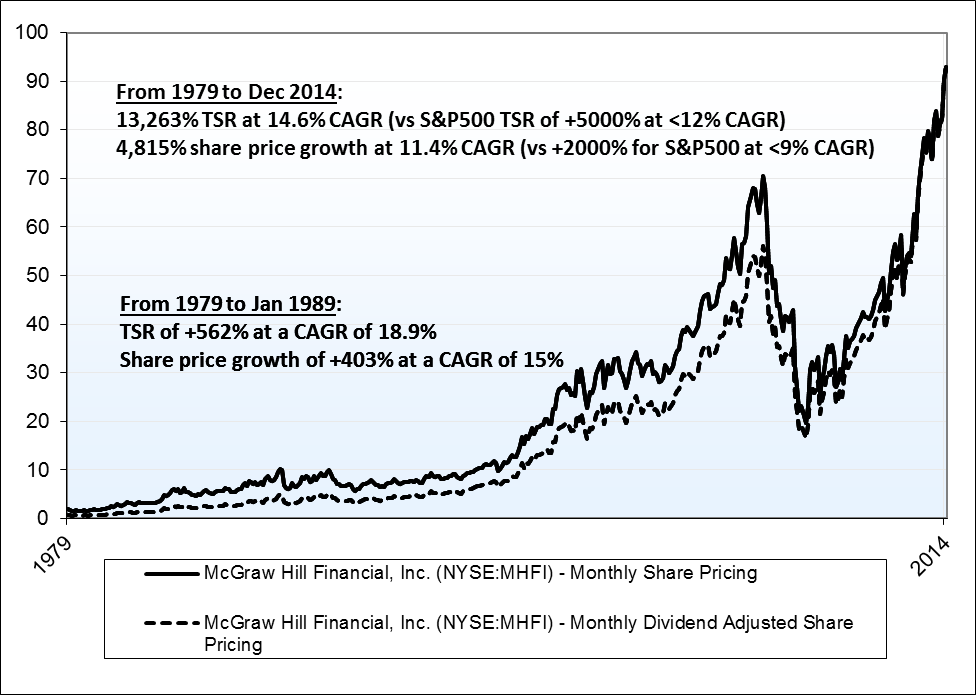

In January 1979, McGraw-Hill rejected a $34 per share offer (later raised to $40) by American Express (which represented a 50% premium over the pre-offer market price). Within less than two years, the decision was completely vindicated with the shares selling in the market for more than the $40 offer price. The graph below, showing McGraw-Hill’s stock price appreciation through December 2014, further shows how right that rejection was.

While McGraw-Hill’s success from saying no to American Express (and other such successful examples) does not mean that saying no is always the right answer to every unsolicited takeover bid, it does show that the points Lipton has been making since 1979 remain true today: (1) statistical studies do not prove that board discretion in any individual situation leads to the wrong outcome for shareholders and (2) because each context is different, it is wrong to adopt one-size-fits-all policies that restrict or undermine the ability of a board to “just say no” (or that attack a board merely for doing so) in a situation where the board, exercising its fiduciary duties, determines the bid is not in the best interest of the shareholders.

McGraw-Hill Stock Price Performance (1979 to 2014)

Sources: S&P Capital IQ, adjusted and non-adjusted share pricing and total shareholder return; Bloomberg; Shiller dataset

Print

Print