The following post comes to us from Ernst & Young LLP, and is based on a publication by the EY Center for Board Matters.

Institutional investors are increasingly communicating their expectations around governance through direct engagement and letter writing campaigns. Still, some continue to rely on shareholder proposals to trigger dialogue and help ensure a topic is raised at the board level.

Investors that submit proposals generally view them as an invitation to a discussion, preferring to reach agreement with the targeted company without the proposal going to a vote. If agreement cannot be reached, they generally believe that votes on shareholder proposals provide management with valuable insights into investor views.

The EY Center for Board Matters recently had conversations with 50 institutional investors, investor associations and advisors on their corporate governance views and priorities for the 2015 proxy season.

This post is the fourth in a series of four posts based on insights gathered from those conversations and previewing the 2015 proxy season. The first post (available here) focused upon board composition; the second (available here) upon shareholder activism; and the third post (available here) on proxy communications.

Key findings

- Overall, shareholder proposal submissions remain high. Engagement continues to result in a significant portion of shareholder proposals being withdrawn as companies and proponents reach agreement prior to the proposals going to a vote.

- Environmental and social topics continue to represent the largest number of shareholder proposals submitted. These proposals reflect some investors’ heightened attention to sustainability practices and climate risk, as well as corporate political and lobbying spending.

- This year investors increased by four-fold the number of shareholder proposals seeking proxy access, which would enable shareholders meeting certain requirements to add board candidates to management’s proxy materials. The campaign for proxy access has ignited the 2015 proxy season, commanding the attention of investors and companies alike. The broad investor support for these proposals and early adoption of proxy access by some leading companies suggest that momentum for this reform is here to stay.

The overall shareholder proposal landscape so far

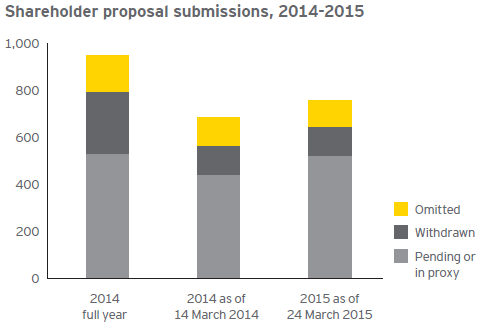

EY is tracking more than 750 shareholders proposals submitted for 2015 annual meetings, which is up from around the same time last year. The proposal withdrawal rate is on track to match last year’s, with about 17% withdrawn from 2015 meetings to date compared to 18% for around the same period last year.

At least 70% of shareholder proposal withdrawals so far this year have been made in connection with companies and investors reaching agreement. Such agreement may include implementation of the proposal in part or full, providing additional disclosure or a commitment to ongoing dialogue on the topic.

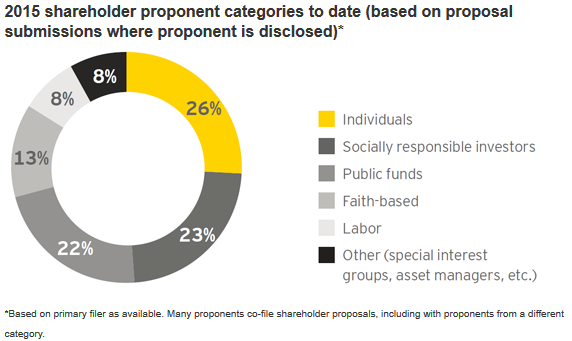

Among the various proponent types, individual investors continue to file the most shareholder proposals, consistent with 2014.

Most common shareholder proposals to date in 2015 (based on proposal submissions)

- Adopt proxy access

- Disclosure and oversight of lobbying spending

- Disclosure and oversight of political spending

- Appoint independent board chair

- Report on sustainability

- Set and report on GHG emissions reduction targets

- Increase diversity on the board

- Review and report on global labor practices/human rights

- Allow shareholders to call special meeting

- Amend Equal Employment Opportunity (EEO) policy to include sexual orientation and gender identity

Environmental and social topics continue to lead

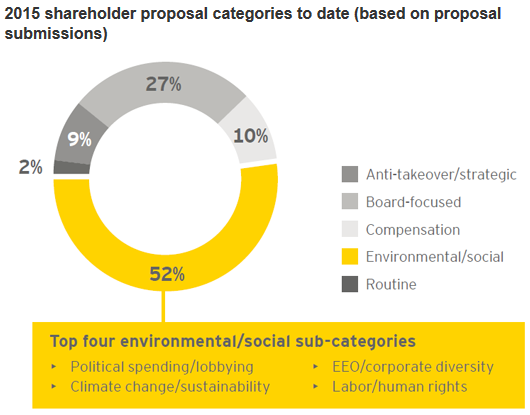

Proxy access (a board-focused topic) may be the most commonly submitted shareholder proposal this year, however, when considered by category, environmental and social topics represent the largest proposal category by the overall number of proposals submitted.

To date, shareholder proposals on environmental and social topics represent 52% of all shareholder proposal submissions so far in 2015, compared to 46% in 2014 and 39% in 2013. Environmental and social proposals are also most likely to be withdrawn because of companies and proponents reaching agreement: 17% of proposals on environmental and social topics have been withdrawn so far this year due to agreements compared to 5% to 14% for other categories.

Some commonly withdrawn environmental and social shareholder proposal topics address corporate diversity and equal employment opportunity (EEO) policies, greenhouse gas emissions reduction, sustainability reporting and disclosure and oversight of political and lobbying spending.

Shareholder proposals to watch

Based on insights from institutional investors, shareholder proposals to watch this season include:

- Adopt proxy access—While in recent years shareholders have been sparing in their submissions of proxy access shareholder proposals, that has changed in 2015: around 100 companies this year are facing shareholder proposals seeking implementation of proxy access procedures—more than four times the total submitted for 2014.

- All of the current proposals suggest either the same, or close to the same, ownership requirements used in the Securities and Exchange Commission’s (SEC) now-vacated proxy access rule. [1] Proxy access shareholder proposals using these terms that went to a vote in 2014 averaged support from a majority of votes cast.

- Proxy access has been embraced by a handful of leading companies. At least 13 companies have adopted proxy access bylaws in recent years, including at least seven companies so far this season—five of which are Fortune 500 companies.

- Increase diversity on the board—A broad group of investors working with the Thirty Percent Coalition have submitted proposals asking for a report on the board’s plans to increase diverse representation, as well as an assessment of the effectiveness of these efforts, or adoption of a policy that the board will seek to enhance board diversity beyond current levels to ensure that a wide range of female and minority candidates are included in the pool of candidates nominated. [2]

- Nearly 60% of S&P 500 companies specifically identify gender and ethnicity as a consideration when identifying director nominees. [3] However, that is not always represented in board composition: at S&P 500 companies only 19% of board seats are held by women, and women represent only 28% of new board members [4]

- Proposals related to climate risk—A number of different shareholder proposals address climate change and related risks and opportunities. These proposals aim to reduce reliance on fossil fuels, accelerate investment in renewable energy and reduce overall carbon emissions. Some emerging proposals are asking companies to address carbon asset risk (i.e., the potential for a low carbon, low demand scenario in which high cost projects may not be monetized) in their dividend policies or through their executive compensation plans. All of these proposals reflect a continued sense of urgency around climate change by many investors.

What we’re hearing from directors, executives and investors on proxy access

Some directors and executives:

- Are weighing whether fighting proxy access shareholder proposals is worth the risk of potentially straining relationships with key long-term institutional investors who support proxy access—and whether adopting proxy access could build goodwill and trust with those same investors

- Ultimately determined that proxy access was the right thing to do—regardless of the impact on relationships with investors

- Are continuing to resist proxy access altogether

Some investors:

- Believe proxy access is a fundamental shareholder right and a valuable director accountability mechanism to be used sparingly. In fact, many believe this sort of access will promote a level of director accountability that will generally negate the need to use it

- Prefer a federal proxy access rule, but without it, will pursue or support the adoption of proxy access on a company-by-company basis

- Are closely watching how companies respond to proxy access shareholder proposals

Conclusion

Despite increased engagement among large companies and their key institutional shareholders, shareholder proposals remain a primary engagement trigger for many smaller investors who may not be a part of companies’ typical outreach efforts.

Such proposals should be viewed as an invitation to engage and present companies with the opportunity to learn more about the perspectives and priorities of specific investors. Institutional investors generally prefer to find common ground and reach agreement.

Endnotes:

[1] The shareholder, or group of shareholders, must own at least 3% of company stock for at least three years to nominate directors (up to a limit of 25% of the board) on the company’s proxy card. Some proposals suggest a limit of up to 20% of the board, instead of up to 25% of the board.

(go back)

[2] Institutional Investors Working with Thirty Percent Coalition Continue to Push for Increased Gender Diversity in the Boardroom, Thirty Percent Coalition, http://www.30percentcoalition.org/news/105-institutional-investors-working-with-thirty-percent-coalition-continue-to-push-for-increased-gender-diversity-in-the-boardroom.

(go back)

[3] Let’s talk: governance—Companies respond to calls for more meaningful governance disclosure, EY Center for Board Matters, May 2014.

(go back)

[4] For more information on gender diversity in the boardroom, see Women on US boards: what are we seeing? (discussed on the Forum here), EY, 2015.

(go back)

Print

Print