James R. Copland is the director of the Manhattan Institute’s Center for Legal Policy. The following post is based on a memorandum from the Proxy Monitor project, available here.

As we near the close of corporate America’s “proxy season”—the period between mid-April and mid-June when most large, publicly traded corporations in the United States hold annual meetings to vote on company business, including resolutions introduced by shareholders—a clear picture has begun to emerge. By May 27, 2015, 211 of the nation’s 250 largest companies by revenues, as listed by Fortune magazine and in the Manhattan Institute’s ProxyMonitor.org database, had filed proxy documents with the Securities and Exchange Commission. This post bases its analysis on those companies’ filings, as well as voting results for 186 of those companies that had held their annual meetings by May 22.

Companies are facing more shareholder proposals in 2015. A principal driver of the increase in the number of shareholder proposals is the aggressive campaign being led by New York City Comptroller Scott Stringer, elected in 2013, on behalf of the city’s large pension funds, which control some $160 billion in assets. [1] As a part of what he calls his Boardroom Accountability Project, Stringer has introduced numerous shareholder proposals seeking to grant shareholders with a certain percentage of a company’s outstanding shares the right to nominate directors to the board, with such nominees listed as a voting option on the company’s own proxy statement—i.e., proxy access. [2] In addition, 2015 has witnessed an increase in shareholder proposals, relating to environmental issues, sponsored by social-investing funds.

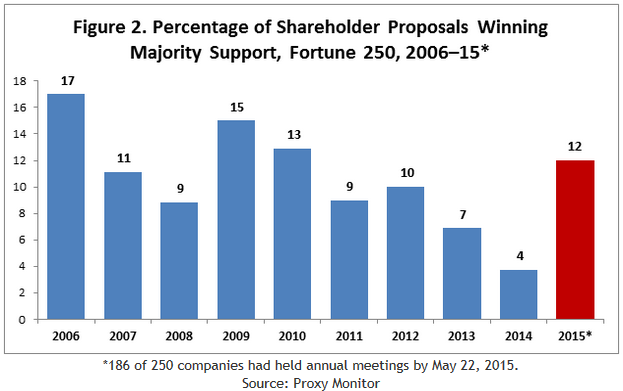

Comptroller Stringer’s proxy access effort has won substantial shareholder support—72 percent of such shareholder proposals coming to a vote by the end of May won the support of a majority of shareholders—such that the percentage of shareholder proposals to win majority backing in 2015 is the highest since 2010. Excluding proxy-access proposals, however, shareholder support for shareholder proposals remains scant: only 3.5 percent of all other shareholder proposals have received majority support, less than in any other year in the ProxyMonitor.org database, dating back to 2006.

This finding examines these trends in more detail. Section I examines overall shareholder proposal filing and voting results, including the most frequent subjects and sponsors of proposals. Section II looks at voting on the proxy-access proposals. Section III discusses proposals related to companies’ political spending or lobbying, which remain the second-most-common class of proposal in 2015 (behind those involving the environment), even though they have been introduced less often than in recent years.

I. Shareholder Proposal Filings

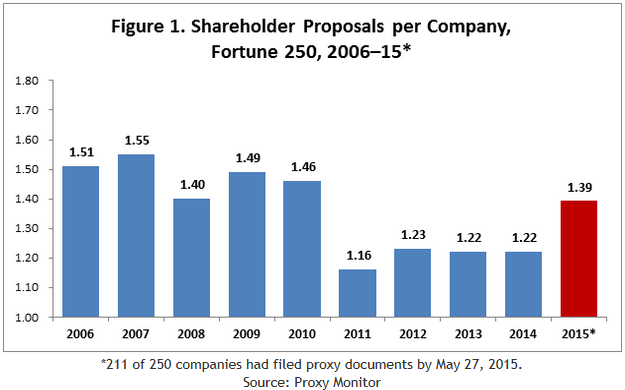

The average Fortune 250 company to have filed its proxy statement in 2015 has faced 1.39 shareholder proposals. As shown in Figure 1, the overall level at which shareholder proposals have been introduced is the highest since 2010, when Congress passed the Dodd-Frank financial reform legislation, [3] which obviated shareholder proposals seeking advisory voting rights on executive compensation packages by mandating that publicly traded U.S. companies hold such votes on an annual, biennial, or triennial basis. This overall increase has been driven principally by a marked increase in the number of shareholder proposals seeking proxy access: 32 such proposals have been introduced to date, as compared with only ten in all of 2014. 21 of these were introduced by the New York City pension funds, which are introducing 75 proxy-access proposals overall as part of the funds’ “Boardroom Accountability Project.” [4]

Shareholder proposals are not only more numerous in 2015; such proposals have been more likely to attract the support of a majority of shareholders. As shown in Figure 2, 12 percent of all shareholder proposals voted upon at Fortune 250 companies to date have received majority support—the highest percentage since 2010. This increase is also due to the prevalence of proxy-access proposals: although such proposals showed mixed support in the early and pre-proxy-season period, [5] they were substantially more likely to receive majority support in May (see Section II). Excluding proxy-access proposals, only 3.5 percent of shareholder proposals have received majority support—below the support level seen in 2014, and lower than any of the ten years tracked in the ProxyMonitor.org database. Apart from the proxy-access proposals, only seven shareholder proposals have received majority support to date: two seeking to “declassify” the board of directors and elect all directors annually, two seeking to remove all supermajority voting requirements from the company bylaws, two seeking to empower shareholders to call special meetings outside the annual meeting schedule, and one seeking to separate the company’s chairman and chief executive officer roles.

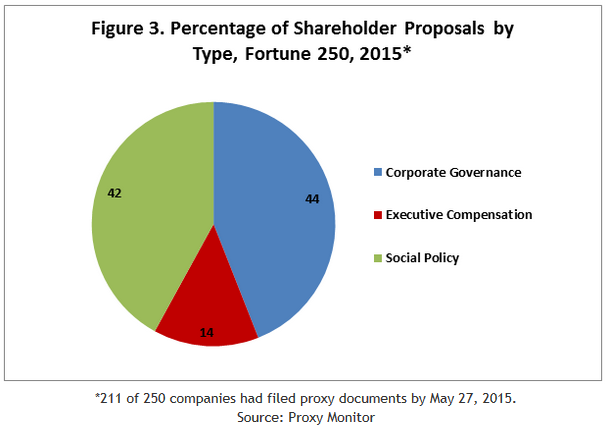

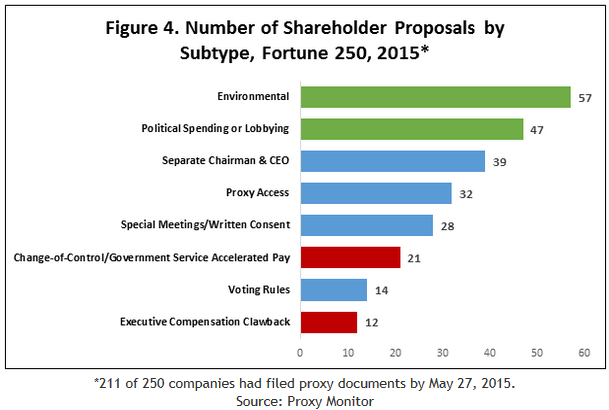

To date in 2015, 44 percent of shareholder proposals have involved corporate-governance issues like separating the board chairman and chief executive officer roles, proxy access, special meetings, voting rules, or empowering shareholders to act through written consent (Figure 3). Social or policy issues have been the subject of 42 percent of 2015 shareholder proposals and executive compensation, 14 percent. Overall, the most frequently introduced subclass of proposals has involved environmental concerns (Figure 4)—after three consecutive years in which proposals related to corporate political spending or lobbying had been most numerous (see Section III).

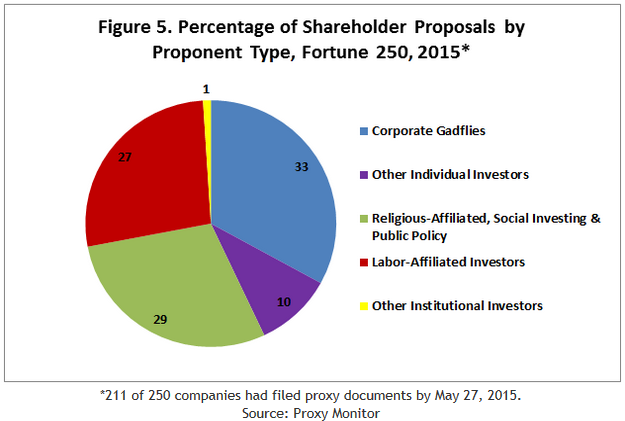

One-third of shareholder proposals introduced to date in 2015 have been sponsored by one of three individuals and their family members who repeatedly file common shareholder proposals at multiple companies, commonly called “corporate gadflies” [6] (Figure 5). 29 percent of all proposals have been sponsored by institutional investors with a social, religious, or policy purpose; a majority of these were sponsored by social-investing funds; and 24 percent by pension funds affiliated with public or private labor unions, chiefly state or municipal public employee funds or private “multiemployer” funds for labor unions, such as the American Federation of Labor/Congress of Industrial Organizations (AFL-CIO). 10 percent of all 2015 shareholder proposals have been sponsored by shareholders other than the three most-active gadflies—though many of the other individual investors are, likewise, repeat filers. Consistent with historical trends, only one percent of shareholder proposals have been sponsored by institutional investors without a labor affiliation or social, policy, or religious purpose.

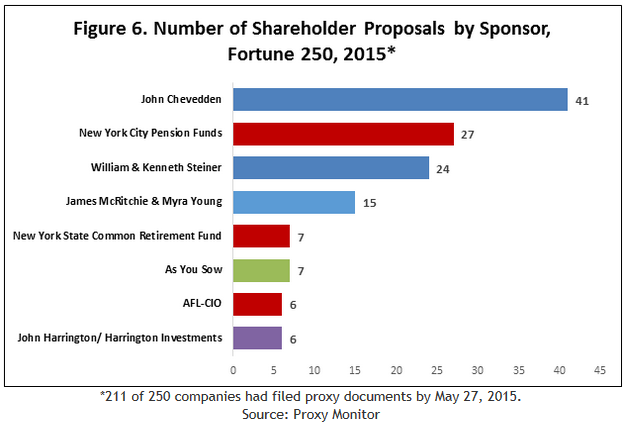

Corporate gadfly John Chevedden has been the most active sponsor of shareholder proposals in 2015, consistent with each of the last five years; to date, he has introduced 41 shareholder proposals on Fortune 250 proxy ballots (Figure 6). The New York City pension funds have been second most active, with 27 proposals—21 of which seek proxy access. The third and fourth most active sponsors of 2015 shareholder proposals are the corporate gadfly family teams of William and Kenneth Steiner (father and son) and James McRitchie and Myra Young (husband and wife).

II. Proxy Access

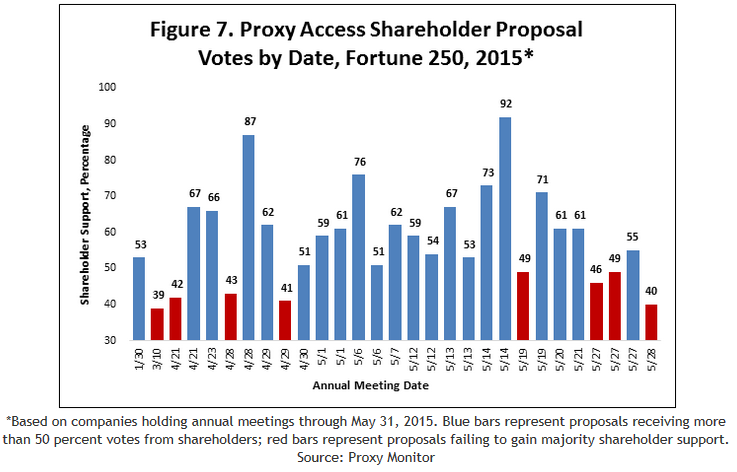

In my first finding of the proxy season, reporting on pre-season and early voting results, shareholder support for proxy-access proposals looked like a decidedly mixed bag. Indeed, as shown in Figure 7, among the ten shareholder proposals on this subject that came to a vote by the end of April, four failed to receive majority shareholder support. (One of the six companies in which the proposal had received majority backing, Citigroup, had seen its board support the proposal—which in turn was backed by 87 percent of shareholders.) In May, however, things looked very different: 15 of the first 16 companies facing proxy-access shareholder proposals saw those proposals supported by a shareholder majority. (The exception, Community Health Systems, narrowly avoided a majority vote, with 49.58 percent of shareholders supporting the proposal. A shareholder proposal on proxy access was also defeated at three more companies that held annual meetings after the overall data cutoff date for this report: Exxon Mobil (49.4 percent), Southern Company (46.2 percent), and Walgreens Boots Alliance (39.8 percent). The third of these has 21 percent insider ownership after the Walgreens-Boots Alliance merger.)

The significantly higher rate at which shareholder proposals have attracted majority support in May is likely due to the fact that most of the proposals coming to a vote over this time period were sponsored by the New York City pension funds and other public employee or union-affiliated funds; and that those funds made a coordinated effort to recruit support for their proposals. The New York City pension funds, the California Public Employee Retirement System (CalPERS), and other labor-affiliated investors have filed an SEC Form PX14A6G, permitting oral and written communication in support of the proposal, exempt from proxy solicitation rules as long as the investor does not collect actual voting proxies. [7] None of the labor-affiliated funds filed these forms for individual-sponsored proxy access proposals, even when the proposals’ terms were substantially similar to those sponsored by the New York City and other labor-affiliated pension funds.

This difference helps to explain the lower support proxy access proposals received earlier in the proxy season. Four of the proxy access proposals that were introduced through the end of April—and two of those that failed to pass—were introduced by individual investors James McRitchie or John Harrington. One of the two others in which the proposal failed to attract majority support, Exelon, notably advanced its own proxy access proposal and, based on its proxy communication, discussed the issue directly with shareholders representing 39 percent of the outstanding equity ownership. [8] Moreover, it is possible that some of the other companies at which proxy access failed earlier in the year—Apple, Coca-Cola, and PACCAR—may have made assurances that they would be formulating their own proxy access proposals in the near future.

Notwithstanding the fact that most proxy access proposals have received majority support from shareholders, shareholder opinion on the question remains divided: most proposals, if opposed by the board, have seen support range from 40 to 62 percent. The two largest mutual fund groups, Fidelity and Vanguard, have largely opposed these proposals. [9] Although pension funds argue that proxy access is important in empowering them—as long-term, diversified shareholders—with a say in corporate management, other investors may share the worry of the U.S. Court of Appeals for the D.C. Circuit, which in 2011 threw out the SEC’s promulgated proxy access rule based on the concern that “unions and state and local governments whose interests in jobs may well be greater than their interest in share value, can be expected to pursue self-interested objectives rather than the goal of maximizing shareholder value.” [10]

The Office of the Inspector General of the U.S. Department of Labor in 2011 questioned whether pension plans under its purview—including private labor-union plans but not state and municipal public-employee plans that are exempt from the federal Employee Retirement Income Security Act (ERISA)—were using “plan assets to support or pursue proxy proposals for personal, social, legislative, regulatory, or public policy agendas.” [11] The press release issued by Scott Stringer’s office announcing its proxy access push declared that two of the three “priority issues” the Comptroller was focusing on in determining which companies to target with its proposals were “climate change” and “board diversity” [12]—issues many diversified shareholders likely view as irrelevant to their investments’ share value.

III. Political Spending or Lobbying Proposals

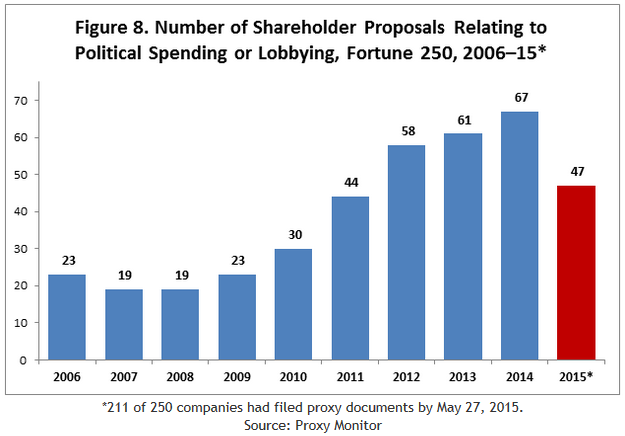

In 2012, 2013, and 2014, a plurality of all shareholder proposals involved corporate political spending or lobbying. In 2015, there have been significantly fewer such proposals introduced: 47 to date, compared with 67 in 2014 (Figure 8). So far this year, more investors have sponsored shareholder proposals related to environmental concerns (57 proposals) than corporate political spending.

The decrease in the filing of political-spending-related shareholder proposals is not due to a decline in interest among social-investing funds and other socially oriented investors: such investors have already introduced 23 such proposals in 2015, as many as in all of 2014. Labor-affiliated pension funds, however, have significantly reduced the number of such proposals introduced: only 15 to date in 2015, compared with 32 in all of 2014. The New York State Common Retirement Fund [13] introduced 14 shareholder proposals related to corporate political spending or lobbying in 2014 but only four thus far in 2015, among Fortune 250 companies.

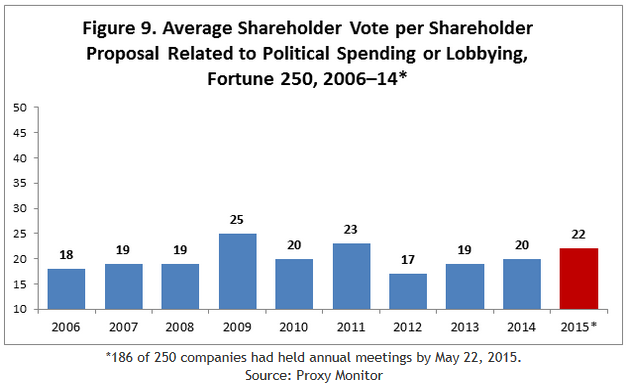

Whatever the reason for the drop in the number of shareholder proposals related to political spending, support for these proposals remains tepid. No such proposal has received majority shareholder support over board opposition in the ten years covered in the ProxyMonitor.org database. To date in 2015, shareholder support for these proposals has averaged 22 percent, in line with historical trends (Figure 9). Although this percentage is up marginally from 2014, when such proposals received just over 20 percent support, the variation is largely attributable to a different mix of proposal types and sponsors than to a shift in shareholder support. In 2014, six proposals called for either a prohibition on corporate political spending or a 75-percent shareholder vote to authorize corporate political spending—proposals which, in contrast to proposals oriented only around disclosure, receive low-single-digit support. No such proposals have been introduced in 2015. In addition, in 2014, seven shareholder proposals were sponsored by individuals, with varying provisions; these individual-sponsored proposals received, on average, the support of less than 10 percent of shareholders. To date, there have been no individual-backed shareholder proposals relating to political spending or lobbying introduced at a Fortune 250 company in 2015.

Endnotes:

[1] The elected New York City comptroller manages the City’s pension funds, which serve to provide retirement benefits for the City’s public employees. See Office of the State Comptroller, Fiduciary Responsibilities of the Comptroller, http://www.osc.state.ny.us/pension/fiduciary.htm (last visited Sept. 9, 2014). Full fiduciary authority over the funds rests with various boards composed of political and union delegates. For example, the board of the $46 billion Teachers’ Retirement System (TRS) includes the comptroller, two mayoral delegates, a delegate from the education chancellor, and three teacher delegates. See TRSNYC, Our Retirement Board, https://www.trsnyc.org/trsweb/aboutUs/ourRetirementBoard.html (last visited Sept. 9, 2014). The board of the $43 billion New York City Employees’ Retirement System (NYCERS) includes the comptroller, the public advocate, a mayoral representative, each of the five New York City borough presidents, and three union delegates. See NYCERS, Board of Trustees, http://www.nycers.org/(S(azvv04mpy1qd2j5515dyny55))/about/Board.aspx (last visited Sept. 9, 2014).

(go back)

[2] See New York City Comptroller, Boardroom Accountability Project, http://comptroller.nyc.gov/boardroom-accountability/ (last visited Apr. 14, 2015); see also Press Release, Comptroller Stringer, NYC Pensions Funds Launch National Campaign To Give Shareowners A True Voice In How Corporate Boards Are Elected: New York City Pension Funds File 75 Proxy Access Shareowner Proposals to Kick Off the Boardroom Accountability Project, https://comptroller.nyc.gov/newsroom/comptroller-stringer-nyc-pension-funds-launch-national- campaign-to-give-shareowners-a-true-voice-in-how-corporate-boards-are-elected/ [hereinafter “Stringer Press Release”].

(go back)

[3] See Dodd-Frank, supra note 1, at § 951.

(go back)

[4] See Stringer Press Release, supra note 4.

(go back)

[5] See James R. Copland, Proxy Monitor 2015 Finding 1: Proxy Season Early Report (Manhattan Inst. for Pol’y Res.), http://proxymonitor.org/Forms/2015Finding1.aspx.

(go back)

[6] “Corporate gadflies,” as commonly used in Charles M. Yablon, Overcompensating: The Corporate Lawyer and Executive Pay, 92 Colum. L. Rev. 1867, 1895 (1992); and Jessica Holzer, Firms Try New Tack Against Gadflies, Wall St. J. (June 6, 2011), http://online.wsj.com/article/SB10001424052702304906004576367133865305262.html.

(go back)

[7] See 17 C.F.R. § 240.14a-6(g) (2007) (requiring investors engaging in exempt solicitations to file materials with the SEC).

(go back)

[8] See Exelon Corp., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, proposals no. 5, 6 (Mar. 19, 2015), http://www.sec.gov/Archives/edgar/data/1109357/000119312515098237/d876808ddef14a.htm#rom876808_18.

(go back)

[9] See Gretchen Morgenson, Mutual Fund Giants Vote to Keep the Insiders In, N.Y. Times, May 31, 2015, at BU1, available at http://www.nytimes.com/2015/05/31/business/fund-giants-resist-proxy-access-board-shake-ups.html.

(go back)

[10] Business Roundtable & Chamber of Commerce of the U.S. v. SEC, 647 F.3d 1144, 1152 (D.C. Cir. 2011).

(go back)

[11] OIG Department of Labor Report, Proxy-Voting May Not Be Solely for the Economic Benefit of Retirement Plans, Rpt. No. 09-11-001-12-121, intro (March 31, 2011), http://www.oig.dol.gov/public/reports/oa/2011/09-11-001-12-121.pdf.

(go back)

[12] See Stringer Press Release, supra note 4.

(go back)

[13] The New York State Common Retirement Fund holds assets in trust for the New York State & Local Retirement System (NYSLRS), which includes the Police and Fire Retirement System (PFRS) and the Employees’ Retirement System (ERS). The fund does not provide for teacher pensions, which are separately managed by the New York State Teachers’ Retirement System (NYSTRS).

(go back)

Print

Print