Ann Yerger is an executive director at the EY Center for Board Matters at Ernst & Young LLP. The following post is based on a report from the EY Center for Board Matters.

As the 2015 proxy season concludes, some key developments stand out. Most significantly, a widespread investor campaign for proxy access ignited the season, making proxy access the defining governance topic of 2015.

The campaign for proxy access is closely tied to the increasing investor scrutiny of board composition and accountability, and yet—at the same time—the number of votes opposing director nominees is the lowest in recent years.

Also, the number of shareholder proposal submissions remains high, despite the fact that ongoing dialogue between large companies and their shareholders on governance topics is now mainstream. These developments are occurring against a backdrop of increased hedge fund activism, which continues to keep boards on alert.

This post is based on EY Center for Board Matters’ proprietary corporate governance database, ongoing conversations with investors, and insights from EY’s Corporate Governance Dialogue Dinner series, which convenes institutional investors, directors, corporate secretaries, academics and corporate governance advisors to discuss key developments impacting the governance landscape.

Proxy access gains momentum amid increased scrutiny of boards—but opposition to director nominees remains low

Around 100 high-profile companies faced proxy access shareholder proposals this year—more than four times the total submitted for 2014. Even more companies are discussing the topic internally and with key shareholders, in part due to a letter-writing campaign in support of proxy access launched by one of the largest US asset managers prior to the 2015 proxy season.

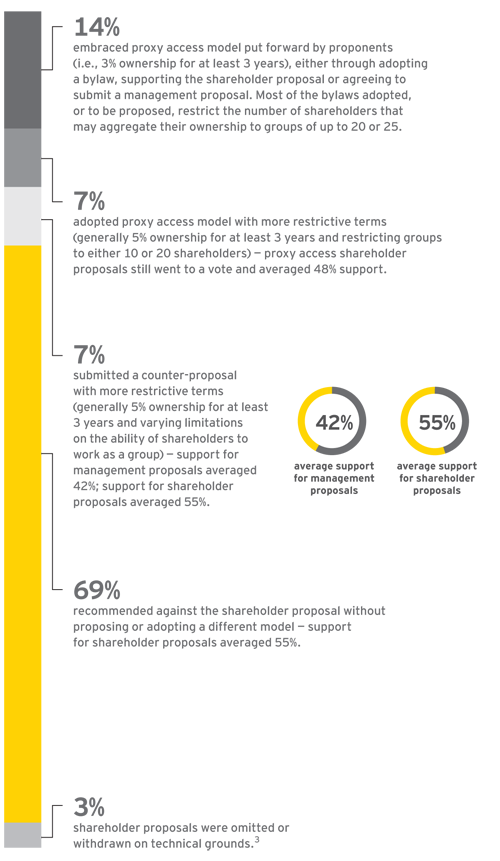

The proxy access shareholder proposals have been highly successful: around 60% of the proposals that have gone to a vote so far secured majority support, and those that did not secure majority support averaged 42% support. The proposals generally suggest a proxy access model with the same key ownership terms (i.e., 3% ownership for at least three years) set forth in the SEC’s now-vacated proxy access rule.

At least 22 companies have adopted proxy access bylaws in recent years, and 15 of these (nearly 70%) have applied these terms. This year’s proxy access campaign reveals strong support for this model even when alternative terms are proposed by management.

Based on what the EY Center for Board Matters is hearing, some directors believe that widespread adoption of proxy access across the US market is now a matter of time. These directors say proxy access is likely to follow in the path of de-staggered boards and majority voting for director elections, which have become standard practice among large companies as a result of investors pushing for these changes company-by-company through shareholder proposals, letter-writing campaigns and dialogue.

Notwithstanding, most companies continue to take a wait-and-see approach as this year’s proxy access developments play out. Long-term institutional investors who support proxy access maintain that the right should be in place at all companies—regardless of corporate performance or record on governance—so that it is there if needed, but anticipate that proxy access will be used in rare cases as a last resort.

In many ways, this year’s proxy access campaign seems like a culmination of investors’ growing focus on board composition and accountability. In recent years, investors have increasingly sought confirmation that boards have the skill sets and expertise needed to provide strategic counsel and oversee key risks facing the company, including environmental and social risks.

Many investors have also raised concerns regarding the lack of turnover on boards, pushed for increased gender and racial diversity on boards, sought greater disclosure around director qualifications and continued long-standing campaigns to make annual director elections under a majority vote standard common practice among S&P 1500 companies.

And yet, just as board composition is under increasing scrutiny, opposition to director nominees continues to decline—in 2015 reaching its lowest level in seven years.

For now, it appears that long-term institutional investors’ concerns around board composition and accountability are playing out primarily through the support of structural governance changes (e.g., majority voting and proxy access) and behind the scenes through engagement discussions—and not through voting against director nominees.

This approach is in direct contrast to activist hedge fund investors, who may push for changes in the board slate as part of efforts to seek greater control.

Company-investor engagement is now mainstream and continuing to evolve

Company-investor engagement on governance topics—and disclosure of these efforts in the proxy statement—continues to grow, jumping from just 6% of S&P 500 companies five years ago to more than half of those companies in 2015.

S&P 500 companies disclosing engaging with investors

While executive compensation remains a primary engagement driver, a variety of other governance topics—board and executive leadership, board composition and diversity, sustainability practices, audit committee reporting and other proxy disclosures, to name a few—are a growing part of those conversations.

In addition, this year’s proxy access shareholder campaign and the persistent challenge of activist hedge funds are also driving increased company-shareholder engagement as companies seek to understand key shareholders’ views on proxy access and other governance interests.

Based on what the Center for Board Matters is hearing from institutional investors, many investors remain wary of engagement-for-engagement’s sake. They generally prefer to direct time and resources toward companies where engagement may be necessary for the investor to reach a fully informed voting decision or where they have governance concerns—and prefer discussions outside of proxy season.

Companies initiating engagement efforts should do so with a clear agenda and purpose. Most investors are fine with engaging with management but may request to speak to a director if the subject under discussion is a board matter (e.g., executive compensation) or if they feel the need to escalate the dialogue.

In those cases, the director’s ability to speak to the substance of the issue at hand, demonstrate expertise, and listen to the investors’ point of view is critical.

The challenge from activist hedge funds persists

Activist hedge funds may offer fresh perspectives on how a company may enhance its operations or market valuation—and some campaigns have helped to improve shareholder value. But activists are also often seen by management and boards as a disruptive influence—and their influence is rising.

As of the end of the first quarter of 2015, there were already 71 shareholder activist hedge fund campaigns underway, compared to about 250 for all of last year, suggesting that 2015 will be another big year for hedge fund activism. Some companies are taking proactive measures to prepare for—and potentially offset the influence of—activist investors.

These include:

- Building early warning triggers (e.g., tracking unusual stock trading patterns and monitoring participation in earnings calls)

- Preparing a team of internal executives and external advisors

- Assessing vulnerabilities around capital structure, business portfolio, operational improvements, a potential sale of the company, and governance practices

- Actively engaging with institutional shareholders to build relationships and understand their governance interests and views of the company

As recent high-profile proxy contests have demonstrated, institutional investors can be a vocal and prominent ally for the company—or for the activist—in an activist campaign. When companies engage with long-term institutional investors and demonstrate responsiveness to their concerns, those same investors are better positioned to support the company in an activist situation.

Some observers believe that activism plays a positive disciplinary role in the market and cite the benefits of activism on shareholder value. For example, the Florida State Board of Administration (SBA) recently released a report which found that SBA votes supporting dissident nominees where the dissident won were associated with economic portfolio gains.

On the other hand, concerns have been raised by others that certain changes often advocated by activists (e.g., spin-offs, cost-cutting measures that impact research and development) may create short-term benefits at the expense of long-term value and the broader health of the market and the economy.

Companies making changes to reach a settlement with activists—or that could be perceived as pre-empting an activist campaign—may consider communications that explain why the board determined such changes are in the best long-term interest of the company.

Shareholder proposal submissions remain high, driven largely by environmental and social topics

Following a peak in 2013, shareholder proposal submissions remain high this year despite the sustained increase in company-shareholder engagement. This is because institutional shareholders that submit proposals view them as an invitation to a discussion and a practical way to trigger substantive engagement.

The EY Center for Board Matters is tracking more than 900 shareholder proposals submitted for meetings through June 30, 2015, which is around 50 more shareholder proposals than we tracked over the same period last year.

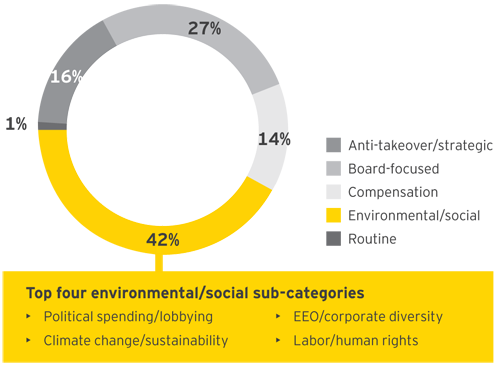

- Proxy access (a board-focus topic) may be the most commonly submitted shareholder proposal this year; however, when considered by category, environmental and social topics continue to dominate the shareholder proposal landscape in terms of overall number of proposals submitted. Shareholder proposals on environmental and social topics represent 42% of all shareholder proposals submissions in 2015, compared to 46% in 2014 and 39% in 2013.

- In recent years, the shareholder proposal withdrawal rate has hovered at around 30%, but that has dipped to 26% so far this year. This decrease is due, in part, to the fact that proxy access shareholder proposals, which have a low withdrawal rate, top the list of most commonly submitted shareholder proposals this year. Also, 2015 has seen a major decrease in the submission of proposals seeking the elimination of classified boards (down from 100 submissions in 2013 to only 20 this year), which typically have a high withdrawal rate.

- Similar to 2014, around half of shareholder proposals voted on were supported by 30% or more of votes cast (the level at which most boards take notice), and around 15% of the proposals received majority support. Failure to implement a majority-supported shareholder proposal can lead to votes against incumbent nominees in the following year.

Large investors paying closer attention to environmental- and social-related value and risk drivers

How companies are managing risks and opportunities related to the environmental and social impacts of their operations is increasingly part of the factors assessed by mainstream investors. For example:

- Nearly 200 US asset owners and investment managers are signatories to the United Nations-supported Principles for Responsible Investment (PRI) Initiative. Through PRI, investors are working to incorporate sustainability considerations into their investment decision making and ownership practices.

- While BlackRock prefers not to publicly disclose details of engagement with specific companies, this institutional investor recently teamed with Ceres, a nonprofit sustainability advocacy group, to create guidance for US institutional investors on engaging with companies and policymakers on sustainability issues. The guide includes tools and case studies geared toward broadening and deepening company-investor dialogue on environmental, social and governance factors impacting value creation.

- State Street’s 2015 Stewardship Report discloses its voting and engagement priorities on key governance topics, including environmental and social matters (e.g., climate change and conflict minerals), and includes voting and engagement results from the past year.

Shareholder proposal submissions by proposal category, 2015

Most common shareholder proposals submitted in 2015

|

Average support |

Proposals submitted |

Proposals withdrawn |

|

|---|---|---|---|

| Adopt proxy access |

55% |

106 |

12% |

| Appoint independent board chair |

29% |

77 |

6% |

| Disclosure and oversight of lobbying spending |

25% |

61 |

46% |

| Disclosure and oversight of political spending |

30% |

49 |

33% |

| Report on sustainability |

28% |

47 |

45% |

| Allow shareholders to act by written consent |

39% |

43 |

0% |

| Set and report on GHG emissions reduction targets |

23% |

37 |

38% |

| Limit accelerated vesting of equity awards |

33% |

35 |

17% |

Shareholder proposals receiving highest average vote support in 2015

|

2010 average support |

2015 average support |

|

|---|---|---|

| Eliminate classified board |

62% |

73% |

| Adopt majority vote to elect directors |

56% |

68% |

| Adopt proxy access |

n/a |

55% |

| Eliminate supermajority vote |

74% |

55% |

| Allow shareholders to call special meeting |

43% |

44% |

Support for say-on-pay proposals holds strong

In the fourth year of mandatory say-on-pay (SOP) proposals, support for corporate executive compensation policies and practices remains high, averaging around 92%. The number of SOP proposals with less than 50% of votes cast continues to be low, consistent with earlier years. So far, only 2% of all SOP proposals voted this year (30 SOP proposals) have received less than 50% support. In all of 2014, 59 proposals failed. Most companies respond quickly to low SOP votes. For meetings in 2011 through May 2015, only 29 companies failed to secure majority support for their SOP votes two or more times. Only five companies saw their proposals fail three or more times.

Opposition to compensation committee members in conjunction with some negative SOP votes is evident

At the start of mandatory SOP, many investors appeared to express pay-related concerns primarily through negative SOP votes (versus directly opposing the re-election of compensation committee members). But 2015 vote results at companies with less than 70% SOP support show that compensation committee members averaged two to three times greater opposition votes than fellow board members—and four times greater opposition than compensation committees at companies with greater SOP support.

Conclusion

Communicating and building relationships with key investors is increasingly important, both for gaining valuable investor insights that may inform company decision-making and for helping to secure support for the board. As company engagement programs become more sophisticated, and as proxy statements continue to evolve, the bar for effective communication continues to be raised.

From what we’re hearing from investors, the key to effective engagement is quality—not quantity. There is increasing pressure on companies to make engagement meaningful and purpose driven. Timing can also be key: given the extensive holdings of many institutional investors, often the best time to lay the groundwork for engagement is outside of proxy season.

Print

Print