Ruby Sharma is a principal with the EY Center for Board Matters. The following post is based on a report from the EY Center for Board Matters, available here.

The role of the board has always been an important and demanding one, but today’s board members face increasingly complex challenges in overseeing an organization’s risk management, including:

- Demands for greater accountability from investors

- Increasingly complex regulatory oversight

- Sluggish economic growth

- The convergence of industries

- Disruptive new technologies

- Scarcity of resources and the effects of a changing climate

- Human capital and talent management challenges

In the aftermath of the global financial crisis, stakeholders and regulators intensified their focus on the board’s risk management oversight role. Directors are not expected to take a more proactive role in understanding the company’s risk appetite, its risk culture, and risk management policies and procedures. And more than ever, boards must understand the risks their organization faces.

Those risks are many. Organizations are pressed to meet quarterly financial targets, while complying with accounting standards and new reporting requirements (e.g. new revenue recognition standards). On the operational side, increased outsourcing of major elements of manufacturing processes in emerging markets and countries can increase risks.

Meanwhile the regulatory environment has grown more active, with fines and sanctions on the rise. And the recurring front-page headlines about cyber-attacks and data breaches at companies across the world make it clear that cybersecurity has become a primary concern. Finally, the immense impact of social media means that any misstep in dealing with these challenges can feed into reputational risk.

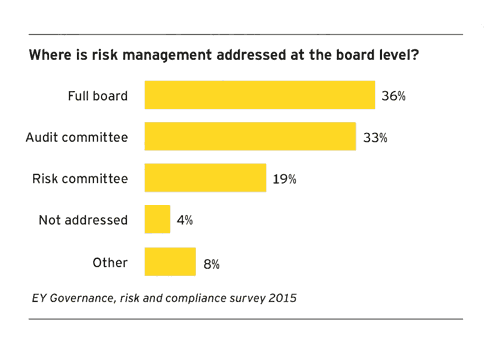

Boards recognize the significance of risk management and some have created stand-alone committees to address the changing risk climate. See below for more on how boards are addressing risk management.

Survey Findings

What organizations are telling us

In this year’s Governance, Risk, and Compliance (GRC) survey, we focused on an array of topics (e.g., risk strategy, coordination of functions, internal audit, technology) to gain a better understanding of how well organizations are managing risk today.

While organizations demonstrated they are making progress, they indicated that further opportunities exist to improve the way that they identify, manage and respond to risk.

Framing the board’s oversight of risk

Boards of directors need to know where to focus when surveying this changing risk landscape. Although risks historically have been categorized in different ways, it helps to consider risks in the context of an organization and how best to respond to those risks. Many organizations categorize risk into three categories according to their impact:

- Strategic risks that must be accepted because they offer benefits. Examples include risks related to user adoption, return on assets, market penetration, and talent management.

- Preventable risks that should be avoided or mitigated because they would have a negative impact. Examples include employee fraud and risks related to information security, financial integration, and regulatory compliance.

- External Risks that the organization cannot control. These can have positive or negative effects. Examples include competitive shifts, geopolitical risks, and natural disasters.

Looking at the risk landscape through the lens of strategic, preventable and external risks can help sharpen the boards’ focus to build a risk-aware organization, as can frequent and regular updates of the organization’s risk profile.

When it comes to identifying, understanding and linking risks to strategic objectives, the three lines of defense model offers significant advantages. The model is based on the premise that risk management is everyone’s job, which is the most appropriate approach given today’s risk landscape. Accordingly, the Institute of Internal Auditors recently issued a report formally linking the Committee of Sponsoring Organizations of the Treadway Commission (COSO) framework and the three lines of defense. The three lines of defense include:

- First line (operations and business units): This group comprises the line management directly responsible for identifying and managing risks. This group must consider risk management as a crucial element of its everyday job.

- Second line (management assurance): This group is responsible for ongoing monitoring of the design and operation of controls in the first line, as well as advising and facilitating risk management activities.

- Third line (independent assurance): The groups responsible for independent assurance over managing of risks. Internal Audit (IA) plays the leading role.

Not all companies have the resources to develop and sustain three distinct lines of defense, but every organization should make sure that its risk coverage mitigates gaps and avoids unnecessary duplication.

In the three lines of defense model, the first line usually reports to senior management and is typically responsible for management controls and internal control measures. The second line is typically responsible for the effective management and oversight of risk and control. The third line, which includes IA, is independent of the first two and usually reports to the board as well as management. IA is the impartial conduit between business and the board. To make sure the organization appropriately deals with the risks it faces, the board and audit committee should work with IA, which has a wide line of sight into the business.

Regardless of the framework it adopts, be it the COSO framework—the most widely used framework in the US and adopted or adapted by numerous businesses and countries around the world—or the principles-based, “comply or explain” approaches used in the UK and the EU, the board should make sure as it works its way through the strategic, preventable and external risks that it has sufficient knowledge to gain comfort that each risk area is covered. The board needs to be sure that it has been effectively informed about governance policies procedures.

Global approaches to managing risk

Countries around the world have taken varying approaches to corporate governance and risk management. Some examples:

- In the US, the COSO framework lists 17 principles that organizations should follow.

- Companies with a premium listing on the London Stock Exchange must report how they have applied the UL Corporate Governance Code. In general, listed companies must “comply or explain”—in other words, they must clearly and meaningfully explain why they have chosen not to apply the code in a given area.

- The European Commission has recommended a similar “comply or explain” regime across the EU.

- In Hong Kong, issuers are expected to comply with the Corporate Governance Code. Companies that deviate from the Code must give “considered reasons” in their annual report.

The evolving role of internal audit in risk management

A proactive and involved IA function can play an important role in the three lines of defense model: auditing governance process and procedures; validating the monitoring being performed by second-line functions; and evaluating incentive metrics put in place across the business. IA also plays a key role in verifying that the efforts of the first and second lines are meeting the expectations of management and the board. Among other items, leading organizations should have IA evaluate:

- The alignment of risk management with the organization’s strategic objectives

- The view the organization is taking toward the nature and origin of risks—strategic, external or preventable

- Whether the organization has the means to identify and appropriately respond to emerging risks

- The organization’s governance processes

As the risk landscape changes and boards grapple with increasingly complex business environments, there is further opportunity for IA to better assist the board in its oversight role. Leading organizations and boards are asking IA to focus on key business processes and deliver more beyond enhancing internal controls and compliance and validation efforts. As leading boards increase their focus on monitoring company performance and creating more shareholder value, they are starting to better leverage the knowledge and expertise of the IA function to glean business and strategic insights to drive value creation.

According to Harvard Business Review, 86% of significant losses in market value are a result of strategic risk. IA should take this into account as they select their areas of focus and priorities.

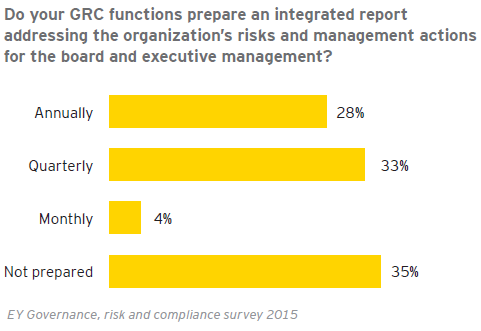

By providing insights above and beyond the control environment, IA also can provide consolidated and comprehensive risk and management response reporting; uses its knowledge of the organization to identify and report areas of potential operational improvement and upside risk potential, and provide insight on strategic priorities and risks on the front end. Boards can use the IA function to improve the linkage between risk and business performance, making sure that the organization accepts the appropriate level of risk to achieve its strategy.

As IA’s mandate expands and its scope shits, the function may need to address the need for additional skills and adjust training to ensure it has the right competencies to meet changing expectations.

Conclusion

Now more than ever before, today’s complex, evolving risk landscape requires boards to focus on the risks that matter to the organization. Leading organizations have adopted the three lines of defense model, or a suitable variant, to make sure that risks are appropriately covered and that the board has the necessary transparency into risk management across the organization.

IA plays a key role in the three lines model, and in verifying and validating that risks are appropriately and correctly categorized as strategic, preventable or external risks. IA can make sure the board is effectively informed about governance policies and procedures and regularly updated on the organization’s risk profile.

That puts the board in position to help create a risk-aware organization—one that advances strategic thinking, optimizes functions and processes and embeds solutions. By moving beyond its traditional role as a best-in-class assurance function, IA can serve the board’s needs as a trusted advisor, providing insights that give the organization the competitive edge.

Questions for the board to consider

- How aligned are your organization’s risk management activities to its strategic objectives?

- Has the organization correctly identified and assessed its strategic risks in the context of its risk appetite?

- What role do risk management professionals (e.g., chief risk officer, risk management staff, internal audit, compliance) play in the organization’s strategic planning process?

- Are IA activities aligned with the strategic objectives of the business?

- How can IA help the board understand the overall health of the internal control environment in the organization?

- Has the organization correctly identified and assessed the external risk landscape, and does it have appropriate mitigation plans in place?

- Is IA providing the board with a comprehensive, balanced assessment of the organization’s governance processes, including risk management?

- How are the company’s IA and risk functions leveraging big data and analytics to help the organization achieve its objectives?

- Does IA have the skill set to deal with the increased complexity presented by emerging risks?

Print

Print